The M&A rumor mill was heavy at work, moving several stocks throughout the day.

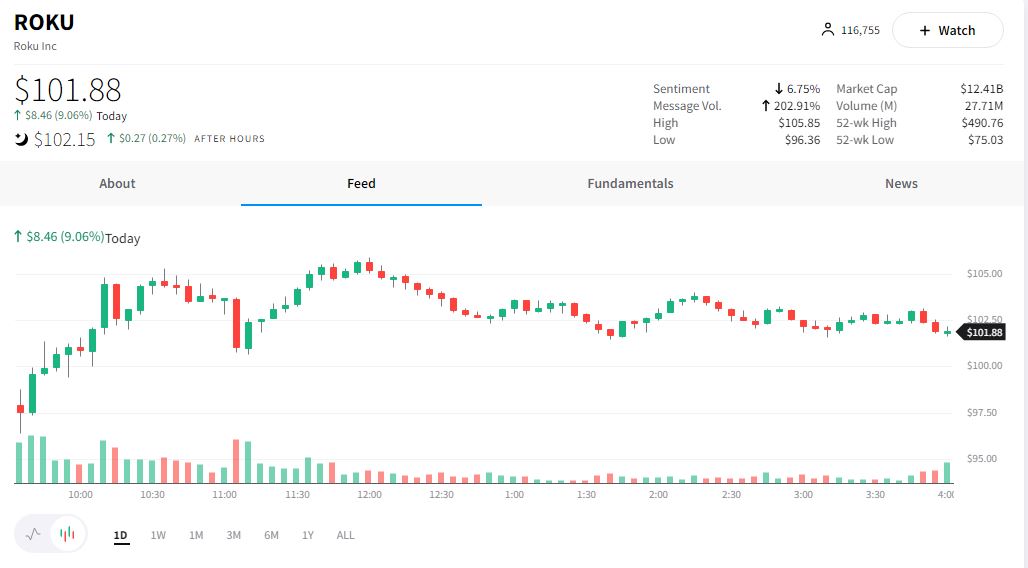

First, $ROKU spiked 9.06% today on a rumor that Netflix may be looking to buy the company.

With Roku shares down roughly 80% from their all-time highs and Netflix struggling to grow in a competitive streaming landscape, some market participants think this could be a smart move. Skeptics point to Netflix’s CEO’s past disinterest in owning any hardware and that this would essentially have Netflix competing on two fronts of the streaming wars.

We’ll have to see how it develops in the weeks ahead.

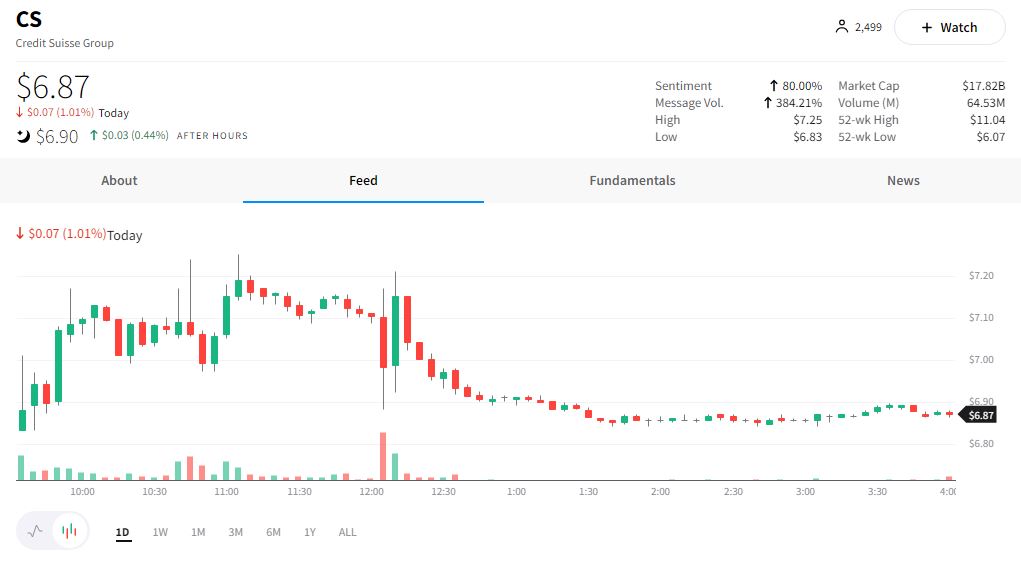

Credit Suisse also turned higher throughout the day after a report that U.S.-based State Street is planning a takeover bid for the troubled lender.

As a reminder, the second-largest bank in Switzerland is going through a rough transition this year as it tries to put several costly scandals and management changes behind it.

Credit Suisse shares ended up 3.8% in Zurich but continued lower in U.S. trading, with its ADR closing down 1.01% on the day, suggesting there’s still a lot of doubt that this rumor has any validity.

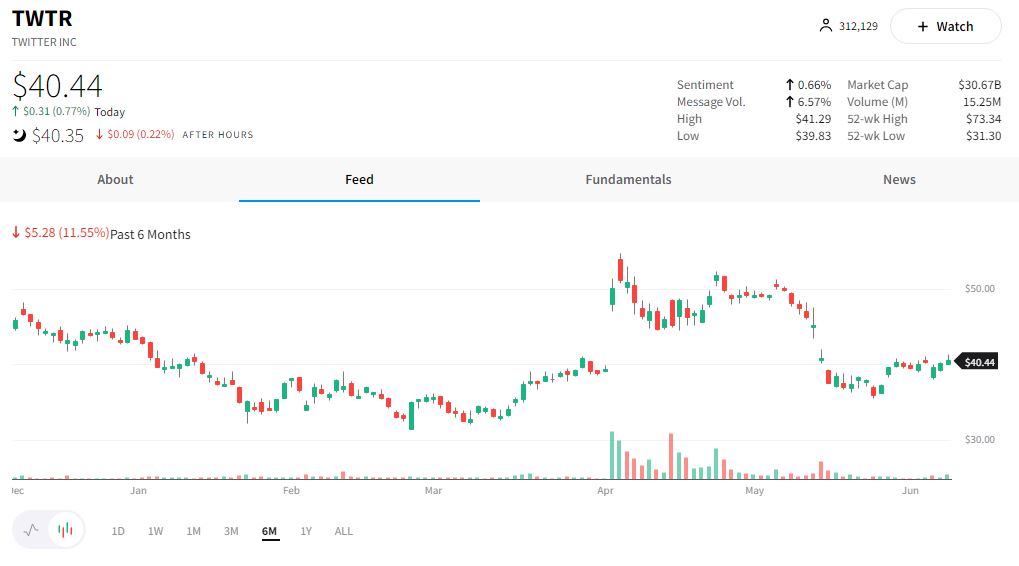

Meanwhile, Elon Musk and Twitter are back in the news again.

On Monday, Elon Musk accused the company of refusing to give him information about its fake accounts.

In response to Musk’s SEC filing, Twitter released a statement trying to reassure employees, shareholders, and the public that this deal will continue, stating, “Twitter has and will continue to cooperatively share information with Mr. Musk to consummate the transaction in accordance with the terms of the merger agreement.”

Today’s reports say that Twitter is preparing to grant him unprecedented access to platform data to address his concerns about automated accounts.

With $TWTR shares still 25% below the deal price of $54.20, there’s still a lot of skepticism that this will actually go through.

Lastly, this isn’t quite M&A news, but the big four accounting firm Deloitte is considering splitting its audit and consulting businesses.

This headline comes just weeks after initial reports that its competitor, EY, was considering such a move in what would be the most significant shakeup of the accounting industry in decades.