Tale of the Tape

Happy weekend everyone. Markets closed down. 😓

Nifty and Sensex fell 0.7% each tracking the weakness in global markets. Hints of an early withdrawal of economic stimulus by the US Federal Reserve spoiled the mood. Midcaps and Smallcaps closed down 2%. 💔

Except for FMCG (2%), all other sectors closed in the red. Metals crashed 6% following the rout in the commodities market. 📉

Ujjivan Small Finance Bank tanked 19% after the company’s MD & CEO Nitin Chugh resigned. 👎

Aurobindo Pharma (-6%) received 7 negative observations from the US FDA (United States Food and Drug Administration) for its key API unit. 🚨

Hindustan Unilever (+5%) hit a new all-time high. The company’s market cap crossed Rs 6 lakh crore mark. 🤑

Natco Pharma fell 4% after a US district court ruled against the company in a patent infringement case. 👩⚖️

CarTrade Tech had a dull start to life as a listed company. The stock closed at Rs 1,501 per share, down 7% from its issue price. 😪

Crypto surged in trade. Bitcoin (+5%) rallied past $47,000 mark. Ethereum and Doge jumped +6%. Cardano (+18%) became the third most valuable crypto after hitting a new all-time high. 💸

Here are the closing prints:

| Nifty | 16,450 | -0.7% |

| Sensex | 55,329 | -0.5% |

| Nifty Bank | 35,034 | -1.5% |

Motion Denied

Eicher Motors’ (+0.5%) shareholders rejected the re-appointment of Siddhartha Lal as managing director of the company. Why so? 🤔

The resolution to re-appoint Lal, son of Eicher Motors founder Vikram Lal, also included a 10% hike in his salary. While most investors were fine with him continuing in the role, it is the salary bit that didn’t sit well. 😏 Lal’s salary in the past three years has risen at a compounded rate of 28% to Rs 21.1 cr. For comparison, Eicher Motors’ net profits are down 8% during the same period. ❌

Lal has been instrumental in turning around the brand and forging a tie-up with Swedish giant Volvo. However, growth in recent years (even pre-pandemic) has been hard to come. 📊 Weak near-term outlook due to the global semiconductor shortage plus no immediate EV plans has left investors disgruntled.

In that context, asking for a raise was always going to be a hard sell. Anyways big ups to the shareholders for holding the top management accountable. More power to you guys! 💪

Eicher Motors is up 2% YTD

Can’t Spell Credit without CRED

Cred is launching peer-to-peer (P2P) lending for members on its platform. 💸

The new feature, called CRED Mint, enables members to earn interest on idle money by lending to other high-trust members. Cred will allow users to invest between Rs 1-10 lakh. Members who participate can earn up to 9% interest per annum. 😎

Kunal Shah, Founder of CRED said:

The power of CRED is our high-trust community. With CRED Mint, we are enabling members to leverage this trusted community to help one another in their journey of financial progress. The product democratises access to inflation-beating interest rates, and a frictionless, transparent, and delightful financial experience for CRED’s high-trust members.

P2P lending is a challenging business. According to reports, +20% of individuals default on their loans. But, Cred is uniquely positioned because of its large credit-worthy customer base. On CRED, a user must have a credit score of +750 to join the app. This significantly reduces the risk of non-payment. CRED has a loan book of Rs 2,000 cr with less than 1% NPA. Now that’s impressive. ✌

Also, in a separate development, Facebook announced that it is entering the lending business. Zuckerberg will give out loans of Rs 5-50 lakh to small businesses in India. 💰 This is the first time Facebook has launched a program of this kind in any market. Here’s TechCrunch with more.

Movers and Shakers

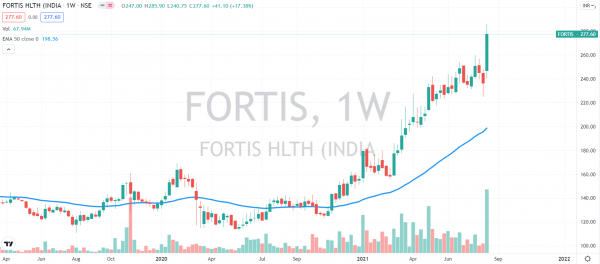

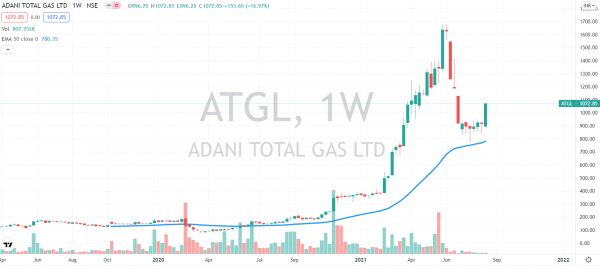

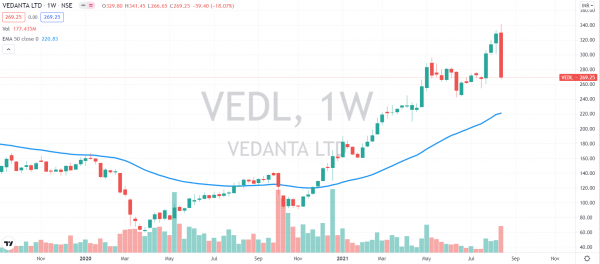

Here’s a look at this week’s top movers. Fortis Healthcare took the pole position with a 17.4% gain. Adani Total Gas (+17%) posted its best weekly gain since May 31. 🤑 Ujjivan Small Finance Bank (-23%) was the top loser. Vedanta (-18%) fell the most in a week since the outbreak of Covid last year. 🤕 Check out their charts below:

We ❤ Crypto

No legal status? Who cares. Potential ban? Bring it on. Indian’s love crypto. ❤

A recent report by Chainalysis ranked India 2nd globally for crypto adoption. 🥈Crypto investments in India have jumped from $200 million to $40 billion in the past year. India, with its 15 million crypto traders/investors is on course to become the largest market ahead of the USA (23 million). 💯

A majority of this growth is driven by young millennials (sub-35 years old) living outside the large cities. India’s largest crypto exchange WazirX recorded a 2,648% growth in user sign-ups from Tier-II/III cities. 📈 However, you need to take these numbers with a pinch of salt.

Don’t get us wrong, India’s crypto growth is encouraging, but it comes off a low base. Serious money is still sitting on the sidelines awaiting clarity on a plethora of issues such as taxation. The incoming Cryptocurrency Bill should help answer those questions. Let’s go! 🤗

Links That Don’t Suck

📈 Exposure Management Using Canslim (Marketsmith India)

🤑 Cars24 To Raise $350 Million, Aims To Float IPO In 18 To 24 Months

😇 Onlyfans To Prohibit Sexually Explicit Content Beginning In October

🤖 Elon Musk Unveils Humanoid Robot To Take Over ‘Boring’ Work

🍨 Singapore Gets Sweet Pandemic Distraction As Museum Of Ice Cream Opens

🎬 Bellbottom Review: Akshay Kumar’s Film Is A High-jacked Flight From Start