Tale of the Tape

Welcome back, ladies and gentlemen. Markets snapped their three-day winning streak. 😓

Nifty and Sensex closed flat after opening lower. Midcaps (-0.3%) and Smallcaps (-0.1%) both moved in tandem. Market breadth was weak with two stocks declining for every one gainer. 👎

Most sectors ended in the red. Real Estate stocks (-2%) witnessed profit booking. PSU Banks and Tech stocks slipped 1% each. 🔻 FMCG was the top gainer, up +0.3%.

CLSA decided to show some love to ITC (+1.2%). The global brokerage sees a 24% upside from its current price. 🤑 Read more below.

Telecom stocks were all fired up. Vodafone Idea soared +14%. Bharti Airtel (+2.4%) hit a new all-time high. More details and charts are below. 📈

Panacea Biotech rallied +10%. The company successfully supplied 1 million doses of the Sputnik V vaccine. 💉

VST Tillers (+5.6%) will export its tractors to the South African markets. 🚜

Jindal Steel & Power gained +2% on higher production and sales in August. Additionally, JSPL received the Australian Govt’s approval to restart its New South Wales coal mine. 👍

Cryptos yanked off after a positive start. Bitcoin was down ~2%. Ethereum slumped 5%. Ripple, Cardano, and Doge were down between 7%-10%. Solana became the 7th most valuable crypto after rallying +25%. ✌

Here are the closing prints:

| Nifty | 17,362 | -0.1% |

| Sensex | 58,280 | -0.1% |

| Bank Nifty | 36,469 | -0.3% |

All Eyes On ITC

It’s ITC’s time to shine, according to CLSA. The global brokerage is bullish and sees a 24% upside from its current price. That’s a lot when you’re an ITC investor! 😱

CLSA believes ITC’s FMCG business is on track for a profitable scale-up. Strong demand for home and personal care products along with margin expansion are set to boost earnings. It estimates the division’s operating profits to grow 31% compounded annually over the next three years. 📊

ITC’s $3.7 billion in cash can also be put to good use. The company could acquire smaller regional brands with unique offerings to fill product portfolio gaps. ITC’s cheap valuation and healthy dividend payout further sweeten the deal. 💸

But, it’s not all sunshine and roses. ITC still relies heavily on its cigarette business. 85% of its profits come from this vertical alone. This is a big ‘no-no’ for large investors following socially responsible investing practices, also known as ESG. On top of that, there is uncertainty on cigarette taxes and the rising counterfeit market. Potential recipe for disaster. 🚨

Nevertheless, the stock did get excited and jump 2% before cooling off. At one point it was the top gainer on Nifty. Our take: Bring on the memes! 🤭

Govt Calling?

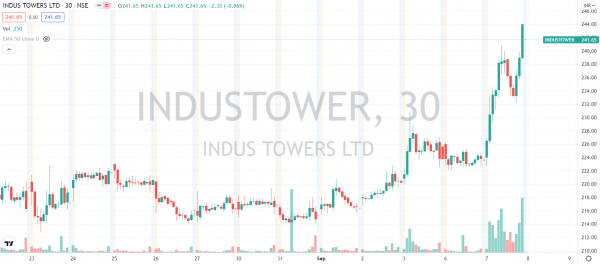

Telecom stocks were in high demand in an otherwise quiet market. Media reports of the Government announcing a telecom relief package cheered investors. Vodafone Idea ripped +14%, Indus Tower jumped 5% and Bharti Airtel (+2.4%) hit a new all-time high. 📈 Check out their charts below:

Vodafone Idea released its annual report yesterday. The telecom operator said it remains hopeful of government support to address the sector’s structural issues. Speculators got all excited. Rest as they say is history. Of course, none of this is official, but we’ll keep you posted. 😎

Bitcoin’s Moment of Truth

El Salvador became the first country to adopt Bitcoin as legal tender! 🥇

Starting Tuesday, businesses will accept Bitcoin in exchange for goods and services. Also, citizens will be able to pay taxes with crypto. El Salvador is installing hundreds of Bitcoin ATMs that can be used to exchange $BTC for U.S. dollars. Supporters of the move say it will draw more people into the financial system and save billions on remittances. ✅

In just three months, El Salvador’s bold experiment has evolved from a mere concept to reality. But not everyone is on board. 75% of Salvadorans have reservations about the law, and ~50% said they knew nothing about it. Protests have erupted in several parts of the nation with growing fears of money laundering and corruption. 😓

This is indubitably the biggest test for Bitcoin in its 12-year long history. Crypto detractors point out various adoption risks such as liquidity, volatility, etc. But if it succeeds, it would surely open a new chapter in the crypto landscape. 🤞

Links That Don’t Suck

💰 Lee Fixel’s Addition Invests Over $75 Million In Delhivery

⚡ Mercedes-Benz Reveals An Electric G-wagen Concept For The Future

😍 Inside A Super-Luxury $28.5 Million NYC Apartment

🌌I Was Hypnotised Into A Different Lifetime On A Group Video Call

🥇From 1960 To 2016, India Had 12 Paralympic Medals And Now It Has Won 19 In One Edition

🦠 Nipah Virus In Kerala: Causes, Symptoms, And All You Need To Know About The Deadly