Tale of the Tape

Good evening, everyone. Happy Hump Day!

Markets edged lower. Nifty and Sensex closed with minor cuts amidst global weakness. Midcaps (+0.5%) and Smallcaps (+0.7%) outperformed. The advance-decline ratio was evenly split. 😏

Most sectors were down. IT (-0.8%) and Auto (-0.5%) were the top losers. Banks (+0.8%) and NBFCs (+0.6%) offered support. 💪

Vodafone Idea dropped 11% from its intraday high. The Union Cabinet decided not to offer a relief package for the telecom sector in this particular meeting. 👎

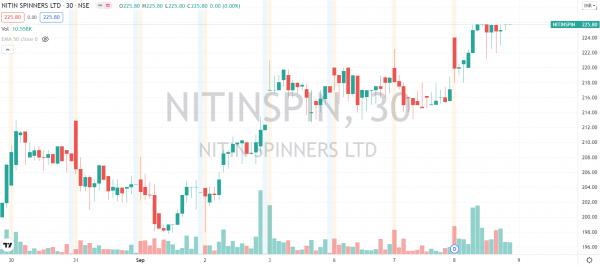

Textile stocks were the stars today. Arvind Ltd rallied ~6%, Nitin Spinners and Trident gained 5% each. Check out their charts below. 📈

Info Edge (+9%) hit a new all-time high. Improving growth outlook and the upcoming Policybazaar IPO got investors excited. 🤗

Zen Technologies (+5%) was locked in an upper circuit for a 6th straight day. They are the only listed drone manufacturer and should benefit big time from the new relaxed Drone Rules 2021. ✅

Godawari Power was locked in a 5% upper circuit. The company will consider the proposal of a stock split and bonus issue on September 14. 🤑

Vijaya Diagnostics and Ami Organics IPOs allotment details are out. Check out if you’re one of the lucky few here. 👍

Crypto got wrecked today. El Salvador’s patchy rollout of BTC as a legal tender was the cause. Bitcoin and Ethereum were down ~10%. Doge crashed 13%. 😢

Here are the closing prints:

| Nifty | 17,353 | -0.1% |

| Sensex | 58,250 | -0.1% |

| Nifty Bank | 36,768 | +0.8% |

Top Gear

The global chip shortage isn’t ending anytime soon. Dealers have limited inventory and demand is far greater than supply. With waiting periods as high as six months, buyers are moving to a quicker and cheaper alternative – used cars. 🚘

Vikram Chopra, Co-Founder & CEO at Cars24 told Bloomberg:

New car production will be cut dramatically and that will definitely result in high demand for used cars. In the next six months, we are going to see a pretty big impact.

Second-hand car sales are shooting up. Major markets like Maharashtra, Karnataka, and Delhi-NCR are seeing rapid growth, per media reports. Recent IPO CarTrade Tech should benefit big time. CarTrade is a leading online marketplace for used automobiles. 📊

The pre-owned car market is estimated to be 1.5x bigger than the new car market. Preference for personal mobility, lower cost, and cheap financing options are long-term positives. ✅

One man’s loss is another man’s gain. 💪

Big Fat Cheque

Textile stocks were in focus today. The Government announced a Rs 10,683 cr incentive scheme for the industry. The output linked scheme is set to boost manufacturing and create 7.5 lakh new jobs. 💸

Arvind Ltd rallied 6%, Nitin Spinners and Trident gained 5% each. Check out their charts below. 📈

Exports have also started to gain traction. Availability of cheap labor, an abundance of raw material, and diverse offerings will enable Indian players to take share from China. Watch out for this space. 🔥

Amazon’s New Friend

Amazon will soon allow customers to invest in mutual funds and fixed deposits! 🤯

Yeah, you read it right. Amazon, the e-commerce giant, is partnering with online investing platform Kuvera to provide wealth management services in India. This is the first such tie-up for Amazon anywhere in the world! So why Kuvera and what’s Amazon’s scene here? 🤔

Founded by ex-investment bankers Gaurav Rastogi and Neelabh Sanyal, Kuvera is an online investment platform. The company offers a wide variety of products from mutual funds, insurance, digital gold to crypto and US ETFs. Kuvera is one of the fastest-growing wealth-tech companies in India with +1 million users and Rs 28,000 cr in assets under advice. 💰

Vikas Bansal, Director at Amazon Pay India explains:

At Amazon Pay, our vision is to simplify lives and fulfil aspirations by solving payment and financial needs of every Indian. For our most engaged customers, growing their wealth and investments is a large need. Here is where we think Kuvera can help our customers with their unique offering.

Fintech and WealthTech are clearly important to Amazon. Don’t forget, Amazon recently led Smallcase’s Series C financing round. Let’s see how this goes. ✌

Crypto 101

Hello and welcome to “Crypto 101”, our weekly feature where we explain complicated crypto terms in simple language. In today’s class, we’ll discuss the highly anticipated crypto bill and its impact. 🤓

Up to now, there has been no clarity on whether cryptocurrencies should be treated as a currency (i.e. FX), a commodity, a service, or a stock (for tax purposes). The Indian government totally gets the issue and is close to an answer. Per a recent ET report, the government is working on a new bill to define cryptos as an asset class. 🥳

ET reports that cryptos would be categorized based on the use case of the underlying technology. However, for regulations, the government would be focusing on the end-use of the asset. For example, if you were a crypto trader, you may see a security transaction tax (STT). But remember, there’s over 5,000 cryptocurrencies and each has different technological use cases such as smart contracts, file storage, KYC, security, gaming tokens.

Hopefully we’re closer to knowing how crypto will be taxed in India and can plan accordingly. Overall, a bullish development for crypto bulls. 🚀

In case you missed it, India now ranks second on the list of 20 countries with the highest cryptocurrency adoption rate, as per Chainalysis. Many people will watching the crypto bill carefully 👀

Links That Don’t Suck

👩⚖️ Cairn Energy To Drop Cases Against India, Accepts $1-billion Offer

💰 Indian Crypto Exchange Coinswitch Kuber In Talks To Raise Funds At Unicorn Valuation

💃 Deepika Padukone Set To Launch A Lifestyle Brand Rooted In India

📱 Apple’s iPhone 13 Event Will Take Place On September 14th

⛵ This App Lets You Rent A Yacht For A Day Or Weekend

🐢 Meet The Oldest Known Living Animal On Earth

👨💻 What Is ‘Metaverse’ And How Does It Work?

😓 Fancy Some Dry Fruit Dosa? Purists Are Already Throwing Up At Just The Sight Of New Food Trend