Tale of the Tape

Good evening, everyone. Happy Hump Day!

Markets were flattish after yesterday’s big move. Nifty and Sensex closed with minor cuts ahead of the US Federal Reserve meet. Midcaps (1.7%) and Smallcaps (+1.4%) were lit. 🔥

Most sectors ended higher. Media (+13.6%) and Real Estate (+8.5%) stocks were up huge. Banks and NBFCs closed down -0.8% each. 👎

Zee Entertainment rallied +32% after announcing its merger with Sony. Read more below. 🤝

Media stocks were ablaze on this development. Tv18Broadcast, SunTv, and Jagran Prakashan soared between 4%-7%. 🥳

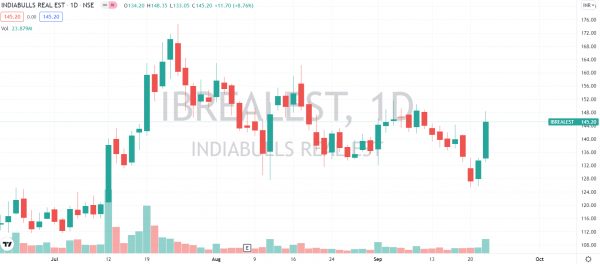

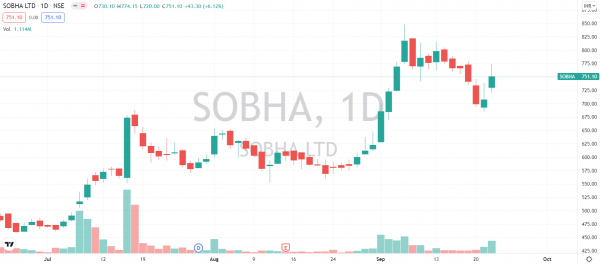

Real Estate (+8.5%) stocks were also in high demand. Reduction in stamp duty by the Karnataka Government plus strong industry outlook excited investors. Check out their charts below. 📈

KPIT Technologies will acquire Germany’s Future Mobility Solutions for 15.6mn euros. The stock jumped +6%. 👨💻

Indiabulls Housing Finance (+5%) raised Rs 808 cr. 💸

Nucleus Software dashed up +13%. The company will consider the proposal of a share buyback on September 24. ✌

Movie Time! Reports suggest the Maharashtra Government is planning to reopen theatres and multiplexes from Oct 1. PVR jumped +4%. Inox Leisure closed up +11%. 🎥

No kidding. ITC (+0.6%) crossed the Rs 3 lakh crore market cap figure. The stock is up +19% in the last month. 💪

Paras Defence and Space Technologies IPO was oversubscribed 40.5x on Day 2. 🤯

Cryptos slide further. Bitcoin (-2.5%) cracked below the $40K mark. Ethereum tanked ~5%. Solana fell 7%. 😓

Here are the closing prints:

| Nifty | 17,547 | -0.1% |

| Sensex | 58,927 | -0.1% |

| Bank Nifty | 36,995 | -0.8% |

Tag Team Champions

Zee Entertainment has joined hands with Sony Pictures India. The two entities will merge together to form India’s #1 broadcasting company! The stock jumped +32%. 🤑

Post-merger, Sony will become the main promoter of the combined entity. It will also invest $1.6 billion to drive growth. (Interestingly) Punit Goenka will continue to be the Managing Director & CEO of the merged entity. 🧐

Big Picture: The merger will help both companies fix gaps in their entertainment portfolio. Zee is dominant in regional channels. Sony, on the other hand, has a strong presence in the sports and general entertainment categories. The two companies also have a robust pipeline of OTT content catering to different audiences. Post-merger, the combined entity will become the 3rd largest OTT player with ~13% market share. 👑

Power Struggle: The Sony-Zee merger couldn’t have come at a better time. Last week, Zee’s largest shareholders had sought to remove Punit Goenka, son of founder Subhash Chandra. Dissatisfaction over the company’s performance and corporate governance were the key reasons. 🙅♂️

The merger with Sony will allow Goenka to retain his role, but the new board will be appointed by Sony. That means no more dishing out fat salary hikes for top management. The drastic improvement in corporate governance standards along with the synergy benefits will drive the stock’s re-rating. ✅

Chart Busters

Real Estate stocks were in high demand. The Karnataka Government cut stamp duty on new property from 5% to 3%. The move only applies to houses costing less than Rs 45 lakh. The stamp duty reduction will help boost sales in the region, said experts.📊

That’s not all. Godrej Properties (+13%) said it clocked record sales of Rs 575 cr in a single day. This has investors hyped about the sector’s strong demand-pull. We’ve discussed key triggers for the Real Estate market in the past. Here’s the link. 😎

Dreaming Big

Dream11 is bringing in cold hard cash. That’s right, it’s one of the few unicorns to report a profit! 🍾

In FY20, the start-up posted a net profit of Rs 180 cr. That’s a sharp turnaround from a net loss of Rs 88 cr in the year before that. Its topline grew 2.7x YoY to Rs 2070 cr. Advertisements and promotions continue to be the biggest source of cash burn. Dream11 spent Rs 1328 cr on ads, up 69% over the previous year. 😶

Founded in 2008, Dream11 is an online fantasy gaming platform. The company claims it has over 100 million registered users playing fantasy cricket, football, and hockey on its app. Earlier this year, Dream11 raised $400 million, the largest investment in the Indian sports tech industry, at a valuation of $5 billion. TCV, Falcon Edge, and TigerGlobal are some marquee investors in the company. ✌

The company’s turnaround is set to attract more investors. Dream11 is reportedly in talks to raise another funding round and planning a US IPO next year. Worth noting that online gaming regulation is a risk to watch. 👀

Links That Don’t Suck

💸 Indian Buy Now, Pay Later Startup Zestmoney Raises $50 Million From Australia’s Zip

🤯 Bitcoin Crashed To $5,402 In Error On Network Backed By Quants

📵 Oneplus 9T Won’t Be Happening This Year, Cancellation Confirmed By Company

🙌 How Fuck You Pay Me Is Empowering Creators

👨🔬 Scientists Promise Virtual Teleportation With 6G

🤑 This Is The World’s Most Valuable Parasite

⚽ Carabao Cup Highlights: 41 Goals, Two Shocks, Three Shootouts!