Tale of the Tape

Good evening and Happy Dussehra everyone! 😇

Markets continue to climb higher. Nifty and Sensex hit a new all-time high. Yes, again. Midcaps and Smallcaps gained 0.6%. The advance-decline ratio was split evenly. ✌

Banks and Metals were the key sources of strength, up ~2% each. Auto stocks (-0.7%) snapped their five-day gaining streak. 📉

Mindtree (+8%) hit a new all-time high on strong results. Century Textiles (+3%) returned to profitability in Q2. Read more below. 📊

Midcap IT stocks were lit after Mindtree’s standout performance. Cyient, Persistent Systems, and Mphasis surged between 5%-7%. 🤑

ITC galloped +3% amid speculation over a tie-up with Amazon. 👀

HCL Tech (-1.5%) will report its Q2 results later today. Analysts expect the company’s sales to grow in the range of 12%-13% QoQ. Net Profit is seen up 3%-6%. 💰

Westlife Development (+3%) will invest Rs 1,000 cr over the next 3-4 years to increase its retail outlets. 🍔

Apollo Pipes (+1%) will consider the proposal of a bonus issue on October 22. 👍

NLC India ramps up coal production at Talabira Mine. The stock closed up +9%. 🏭

Department of Telecom (DoT) approved proposals from 31 companies applying for Production Linked Incentive (PLI) scheme. This is positive for Dixon Technologies (+0.1%) and Tejas Networks (+5%) 📱

The global crypto market cap rose +4%. Bitcoin and Ethereum rallied ~5%. Polkadot (+19%) hit a five-month high. ❣

Here are the closing prints:

| Nifty | 18,339 | +1.0% |

| Sensex | 61,306 | +0.9% |

| Bank Nifty | 39,341 | +1.8% |

Earnings Roundup

Mindtree rallied +8% after reporting better than expected results. Broad-based growth across industry verticals coupled with record deal wins led to the outperformance. 📊 Operating margins expanded 40 basis points despite higher employee costs. Here are the key stats:

- Revenue: $350 million; +13% QoQ (Est: $333 million)

- Net Profit: Rs 399 cr; +16% QoQ (Est: Rs 332 cr)

- Orderbook: $360 million; +19% YoY

Debashis Chatterjee, CEO and MD, at Mindtree said:

The broad-based momentum and growth outlook across all verticals, service lines and geographies attest to our operational rigor and sharp focus on being a trusted business transformation partner to our clients. Thanks to the disciplined execution of our strategy, and the dedication of Mindtree Minds, we are well-positioned to capitalize on the strong demand environment and deliver profitable, industry-leading growth in FY22.

Mindtree is up +178% YTD. 📈

Century Textiles jumped +6% before cooling off. Sharp demand revival and new launches boosted the company’s topline. Increased sales of premium products and cost savings aided profits. 💸 Here’s some for the nerds:

- Revenue: Rs 1,013 cr; +67% YoY

- EBITDA: Rs 111 cr; +2x YoY

- EBITDA Margin: 11% vs 8.7%

- Net Profit: Rs 45 cr; net loss of Rs 14 cr YoY

Century Textiles is up +136% YTD. 🤑

Overheard on Stocktwits

Here’s an interesting chart setup by Kush Ghodasara on Stocktwits that might interest you. Add $ITC.NSE to your watchlist and track its performance.

Numero Uno

MX Player became the first Indian company to surpass 1 billion downloads on the Google Play Store. Congratulations guys! 🍾 PS. there are only 15 apps with +1 billion downloads that are not owned by Google.

Founded in 2011, MX player started off as a video playback app similar to VLC media player. The company was bought out by Times Group in a Rs 1,000 cr deal in 2018. Since then there has been no looking back. 😎

MX Player forayed into video streaming with a rich pipeline of local TV shows and movies. This has helped the company gain a strong foothold in the massy Tier 2 & 3 markets. Large players like Netflix and Amazon realized this later. 🎬

While India is a big market for OTT companies, it’s also one of the toughest to generate revenue from. Users are accustomed to watching content for free on YouTube or through pirated channels. MX Player’s advertisement-supported model benefits in this situation. 👍

The Indian OTT industry is estimated to hit $15 billion by 2030, as per RBSA Advisors. The Covid-19 pandemic has obviously changed the way we consume media. Affordable smartphones and cheap data prices may drive the growth. Let’s see how this goes. 🔥

New Pup On The Block?

Tesla CEO Elon Musk is obsessed with dogs… and crypto lovers are obsessed with Musk. You’ve probably heard of Dogecoin and Shiba Inu, but another one is making a break for the crypto zeitgeist: Floki Inu. 🐕🦺

Floki Inu ($FLOKI.X), named after Musk’s pet, came into existence in June. The project’s website says that the cryptocurrency was born by fans and members of the Shiba Inu community. Almost every time Musk mentions his pup, $FLOKI.X surges. For instance, last month, he tweeted a picture of his new furry friend with the caption, “Floki has arrived.” The tweet sent $FLOKI.X soaring +300%. 📈

But, that’s nothing when you compare it with the returns in the last two months. $FLOKI.X is up 343,769% from its August lows. That means if you invested Rs 10,000 the value of your investment would be a mouth-watering Rs 3.4 cr. 🤯

The connection between Musk and the price surge is insane. But, that’s just how meme coins work. Besides, $FLOKI.X is not just limited to mind-blowing price hikes. The crypto project has partnered with Elon’s brother Kimbal Musk’s ‘Million Gardens Movement’ that works for food security. Last month, Floki Inu raised $1.4 million in just 35 minutes in a donation drive for this movement. 🤗

Movers and Shakers

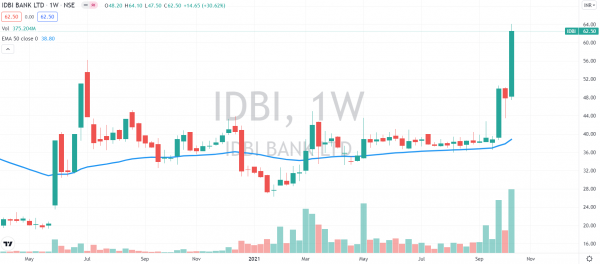

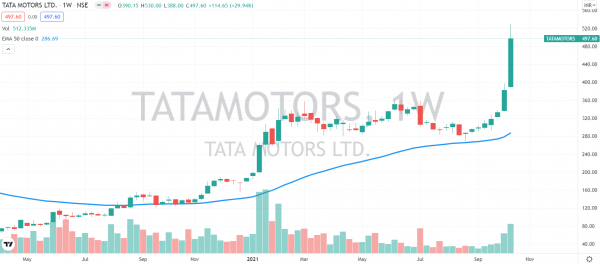

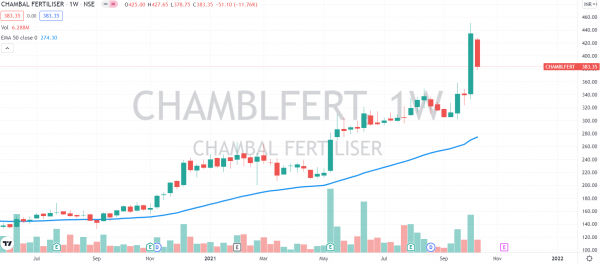

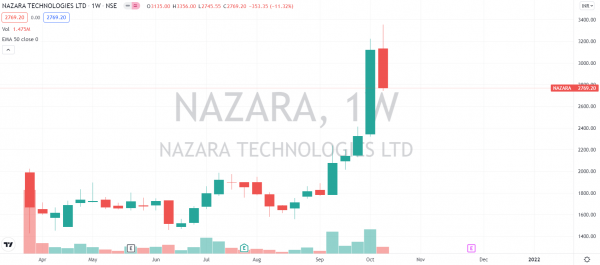

Here’s a look at this week’s top movers from the Nifty 500. IDBI Bank took the pole position after rallying +31%. 🥇 Privatization buzz, ICRA’s rating upgrade, and ace investor Rakesh Jhunjhunwala picking up stake in the lender fuelled the rally. Tata Motors (+30%) posted its best weekly return since January. Chambal Fertilizer (-12%) saw profit booking after last week’s big move. Nazara Technologies (-11%) snapped its four-week gaining streak. 📉 Check out their charts below:

Links That Don’t Suck

🔮 Astrology Startups Launch Apps Amid Pandemic Uncertainty

🥇 U.S. Becomes Largest Bitcoin Mining Center

😍 Google’s Latest Virtual Tour Lets You Walk The Great Wall Of China

💯 Apple’s Secret Keynote Formula, Explained

🚘 This Bentley Is $2 Million, Roof Not Included