Tale of the Tape

Happy Monday everyone. We hope you enjoyed the long weekend! 😇

Markets continued where they left off. Both Nifty and Sensex climbed higher for a 7th straight day. Midcaps (+1.2%) and Smallcaps (+0.7%) moved in sync. 😍

Metals and State-owned banks rallied ~4% each. Pharma (-0.9%) was the only sector to close lower. 👎

Earnings Galore. HCL Tech’s (-3%) weak numbers pressured the stock. Indiabulls Real Estate (+6%) soars after a turnaround quarter. Ultratech Cement (+0.1%) eyes improved growth after a mixed Q2. Read more below. 📊

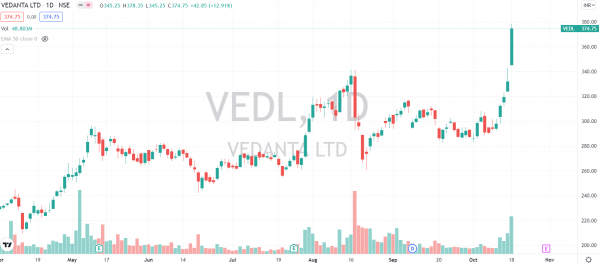

Metal stocks shined today. National Aluminium Co., Vedanta, and Hindustan Copper gained between 12%-13%. Check out their charts below. 💸

Tata Power rallied +16%. Chatter over the listing of its renewables biz drove investors nuts. The stock is +41% in the last 5 days. 🤯

Tata Motors (+3%) unveiled the pricing of its sub-compact SUV, Tata Punch. The brand new set of wheels will cost you Rs 5.5 lakh ex-showroom. The company aims to capture 10% of the SUV market share with the new launch. 🚘

SML Isuzu was locked in a 20% upper circuit. Sachin Bansal and a clutch of investors picked up a 3% stake in the company. 📈

Paras Defence and Space Technologies celebrated moving out of the Trade-to-Trade (T2T) segment with a 20% jump. In the T2T segment, stocks can only be bought and sold on a delivery basis. In other words, intraday trading is not allowed. ✅

Cryptos cooled off after a big weekend. Bitcoin was flat. Ethereum dropped 3%. Solana tripped 5%. Elon Musk’s cryptic tweet sent Dogecoin flying +8%. 🐕🦺

Here are the closing prints:

| Nifty | 18,477 | +0.8% |

| Sensex | 61,766 | +0.8% |

| Bank Nifty | 39,684 | +0.9% |

Earnings Roundup

HCL Technologies (-3%) hit a one-month low after earnings missed Street estimates. Weakness in its Platforms business played spoilsport. Margins also fell more than expected to 19% due to higher costs. A healthy 38% YoY growth in deal wins was the only silver lining. 👍 Here are the key stats:

- Revenue: $2.8 billion; +2.6% QoQ (vs Est: $2.9 bn)

- PAT: Rs 3,264 cr; +1.5% QoQ (vs Est: Rs 3,368 cr)

C Vijayakumar, CEO & MD at HCL Technologies Ltd said:

We signed 14 large new deals which helped us to record net new booking of $2.3 B, a growth of 38% YoY. Our net employee addition hit an all-time high of 11,135 this quarter. Our robust pipeline and continued strong employee ramp up augurs well for our business momentum going forward.

Despite concerns over slowing growth, HCL Technologies maintained its FY22 revenue and margin guidance. The company also increased its dividend payout to shareholders. Nice touch!

HCL Technologies is +28% YTD. 📈

Indiabulls Real Estate (+6%) hit a new all-time high after turning profitable in Q2. Strong real estate demand and lower debt boosted overall performance. Also, merger talks with Embassy Group have reached the final stages. The combined entity will be renamed Embassy Developments Ltd. 🤝 Check out its report card:

- Revenue: Rs 349 cr; vs Rs 20 cr YoY

- PAT: Rs 5.5 cr vs Net loss of Rs 56 cr YoY

Indiabulls Real Estate is +128% YTD. 🤑

Ultratech Cement’s (+0.1%) results were mixed. The company’s topline beat estimates. But, higher raw material costs plus lower other income hurt the bottomline. 📊 Here’s how it fared:

- Revenue: Rs 12,016 cr; +2% QoQ (vs Est: Rs 11,759 cr)

- EBITDA: Rs 2,715 cr; -18% QoQ (vs Est: Rs 2,807 cr)

- EBITDA Margin: 22.6% (vs Est: 23.9%)

- PAT: Rs 1,314 cr; -23% QoQ (vs Est: Rs 1,378 cr)

Going forward, the company expects cement demand to increase. Higher infrastructure spending, pickup in real estate demand, and a healthy rural economy are key drivers.

Ultratech Cement is +40% YTD. ✌

PS. HDFC Bank (-1%) and Avenue Supermarts (-8%) posted results over the weekend. The private lender reported steady earnings growth. D-Mart reported better expected operational performance. 💪

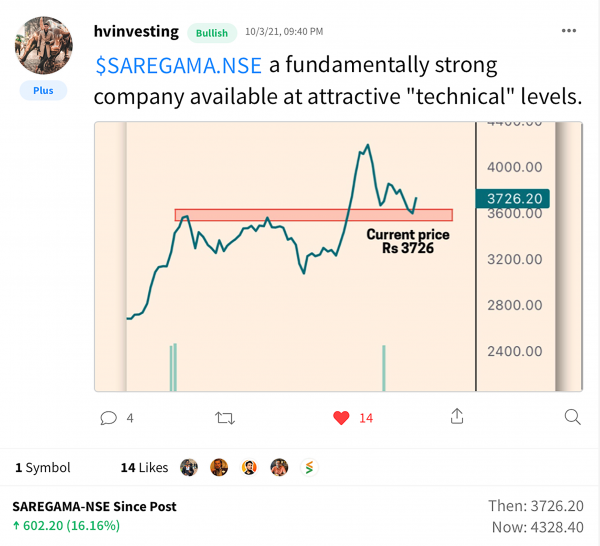

Overheard on Stocktwits

Here’s an interesting chart setup by Harsh Vora on Stocktwits that might interest you. Add $SAREGAMA.NSE to your watchlist and track its performance. We’ve also covered Saregama in detail on our weekly show, Stock Room Sunday. Here’s all you need to know about the music industry, the company fundamentals, and its growth outlook – https://youtu.be/vXB9ydRO2dQ

System Check

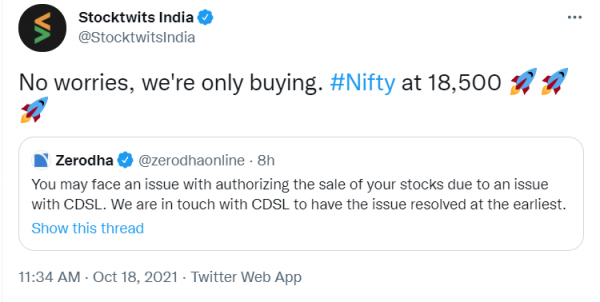

Investors were faced with an unusual problem today. A handful of brokerages were unable to process sell orders due to a technical glitch at CDSL. The likes of Zerodha, Upstox, and Groww faced outages. 👨💻

Zerodha took to Twitter to clarify this issue. “You may face an issue with authorizing the sale of your stocks due to an issue with CDSL. We are in touch with CDSL to have the issue resolved at the earliest,” they said.

CDSL is one of the two depositories in India. It facilitates holding and transacting in securities in electronic form. It also facilitates the settlement of trades on stock exchanges. ✅

Here’s what we think about the whole episode:

Chartbusters

Metal stocks topped the list of gainers today. Media reports of price hikes and record quarterly results by US aluminum giant Alcoa Corporation drove the bullish sentiment. National Aluminium Co., Vedanta, and Hindustan Copper gained between 12%-13%. Check out their charts below: 📈

Big Money Moves

PharmEasy raised $350 million in its latest funding round. Of this, nearly 60% or $200 million is fresh capital raise. The balance is sold by existing investors, mainly API Holdings. 💰

The pre-IPO fundraise values the startup at $5.6 billion. Amansa Capital, Steadview Capital, and Abu Dhabi’s sovereign wealth fund ADQ are some of the new investors. Founders Dharmil Sheth, Dhaval Shah, and 20 senior employees also participated in the fundraise. 😎

PharmEasy delivers medicines and healthcare products in +1,000 cities in India. As part of its growth plans, the company aims to position itself as a broader digital healthcare platform. It recently acquired Thyrocare Technologies for $600 million and cloud-based hospital supply chain management startup Aknamed for ~$200 million. 💪

PharmEasy is part of a growing list of consumer internet firms that are eyeing stock market debuts this year. It has received board approval to convert into a public company and added five new independent directors. Roll the red carpet. 🥳

Coming Soon

We’re in the thick of the earnings season. Here are all the companies that will announce their results tomorrow:

Links That Don’t Suck

💯 Markets At All-Time High: Right Time To Initiate Fresh Positions? (Marketsmithindia)

🥻 Reliance To Acquire 40% Stake In Manish Malhotra Brand Company

🎮 Steam Bans Crypto Games While Epic Games Welcomes Them

🤗 First Zero-Covid-Death Day In Mumbai Since March 26, 2020

🚀 China Tested Hypersonic Nuke That Circled Globe Before Speeding Towards Target, Report Says

🎬 The Latest Trailer For The Batman Sees Robert Pattinson’s Dark Knight Face Off Against The Riddler

🧳 This Hotel In Mumbai Is Letting You Pay What You Want, Or Stay For Free For A Day