Tale of the Tape

Good evening y’all. Markets snapped their seven-day gaining streak! 💔

Nifty and Sensex cooled off sharply after opening higher. Weak global cues and profit-booking were the key factors. Midcaps (-2.2%) and Smallcaps (-1.7%) saw steep cuts. Four stocks declined for every one gainer. 👎

IT (+2.2%) was the lone gainer today. Real Estate (-4.7%) stocks recorded their worst single-day loss in 6+ months. 📉

L&T Infotech rallied +16% on stellar earnings. HUL’s (-4%) Q2 performance and weak management commentary disappointed the Street. Read more below. 📊

IRCTC (-7%) was volatile AF. The stock tanked +15% from its intraday high. 🎢

ITC (-5%) also had an off day. The Government is likely to increase the cigarette cess in next year’s annual budget. 😓

Onto some good news then. The Maharashtra Government allowed restaurants to remain open till 12 AM. Speciality Restaurants jumped +16%. Pizza Hut chain operator Devyani International gained 6%. Check out their charts below. 💪

Indian Energy Exchange will consider the proposal of a bonus issue on October 27. The stock closed up 6%. ✅

TTK Prestige (+12%) will consider a stock split at its Board meeting on October 27. ✌

Dixon Technologies (-1%) will manufacture 5G smartphones for the US market. The stock hit before cooling off. 📱

Bharti Airtel (+0.1%) launched its video streaming platform, Airtel IQ Video. The platform will allow entertainment companies to offer over-the-top (OTT) video services. Bharti eyes $1 million in sales from the business. Here’s more details 🎥

Cryptos mostly trended lower with the exception of Bitcoin (+1.5%). Ethereum was flat. Doge dropped 6%. 🔻

Here are the closing prints:

| Nifty | 18,419 | -0.3% |

| Sensex | 61,716 | -0.1% |

| Bank Nifty | 39,541 | -0.4% |

Earnings Roundup

L&T Infotech (+16%) killed it after reporting better than expected results. Broad-based growth across geographies and industry verticals drove the outperformance. Operating margins improved 80 basis points despite higher costs. The company won new orders worth $30mn in Q2. 💰 Here are the key stats:

- Revenue: $510 million; +8.3% QoQ (vs Est: $493 million)

- PAT: Rs 552 cr; +11% QoQ (vs Est: Rs 527 cr)

Sanjay Jalona, CEO & MD at L&T Infotech said:

We are happy to report the strongest sequential revenue growth and best-ever Q2 of 8.9% in constant currency terms. As we cross the $2-billion annual revenue run rate, we continue to remain committed to growth in the future. We are witnessing strong demand and are rapidly scaling up on the supply-side with our headcount up 31% YoY.

Going forward, the company is bullish on its future outlook. Not only is it confident of sustaining these growth levels but it also forecasts higher growth in the coming quarters. That’s what you want to hear! 😎

L&T Infotech is +85% YTD.

HUL dropped -4% despite steady results. Weak Q2 volume growth and concerns over margin pressure hurt investor sentiment. 😥 HUL announced an interim dividend of Rs 15 per share. Check out its report card:

- Revenue: Rs 12,724 cr; +11% YoY (vs Est: Rs 12,570 cr)

- EBITDA: Rs 3,132 cr; +9% YoY (vs Est: Rs 3,085 cr)

- EBITDA Margin: 24.6% (vs Est: 24.5%)

- PAT: Rs 2,187 cr; +9% YoY (vs Est: Rs 2,175 cr)

Sanjiv Mehta, Chairman and MD at HUL said:

Looking forward, we remain cautiously optimistic about demand recovery. In these times of uncertainty and unprecedented input cost inflation, we continue to firmly focus in delivering consistent, competitive, profitable and responsible growth

HUL is +8% YTD. 📈

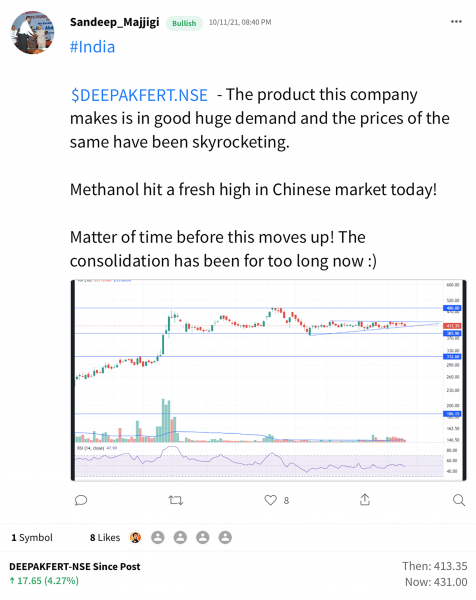

Overheard on Stocktwits

Here’s an interesting chart setup by Sandeep Majjigi on Stocktwits that might interest you. Add $DEEPAKFERT.NSE to your watchlist and track its performance. Check out our YouTube video for a 360-degree view of India’s fertilizer industry. Here’s the link- https://youtu.be/CL4zIrV6grE

Hungry For More

Restaurant and QSR stocks were buzzing in trade. The Maharashtra government extended the timing for restaurants to remain open till 12 AM. Speciality Restaurants rallied +16%. Devyani International jumped +6%. 💸 Check out their charts below:

Good To Go

Policybazaar has received the green signal from SEBI for its Rs 6,000+ cr IPO. The public offer may hit the markets before Diwali, according to media reports. Policybazaar is aiming for a $6-7 billion valuation post listing. Wow! 🍾

The company will issue Rs 3,750 cr of shares to new investors. The remaining Rs 2,267 cr shares will be sold by existing investors. Softbank, InfoEdge, and Claymore Investment are some of the marquee investors in the company. 🤑

Founded in 2008, Policybazaar is one of India’s largest insurance marketplaces. As of March 2020, it has 4.8 cr registered users. The company claims to sell 2 out of every 3 insurance policies sold online. 📊

At a time when everyone is going digital, Policybazaar is focusing on expanding its offline reach. The company aims to develop 200 physical retail outlets. It plans to spend nearly Rs 150 crore towards setting up its offline presence by the end of FY24. 📈

Financial Snapshot:

- FY21 Revenue: Rs 957 cr; +12% YoY

- FY21 Net Loss halved to Rs 150 cr vs Net Loss of Rs 304 cr YoY

India has one of the lowest insurance penetration among developing economies. Over the next decade, the insurance industry is estimated to grow 5x to $520 billion. Innovative products, wider distribution reach, and digitization boom are key growth drivers. 🔥

Crypto For All

Cryptos are going the mutual fund way! 👀

Mudrex has launched a new service called “Coin Sets” for retail investors. With Coin Sets, retail investors can buy a basket of crypto tokens based on a particular theme. For example, a “DeFi 10” Coin Set will invest in a basket of top 10 DeFi tokens. Consider Coin Sets as a fund, similar to a large-cap or midcap fund. 🤓

Mudrex says Coin Sets will make crypto investing simpler and expand retail participation. Worst case, will make it easier to diversify and let the pros decide which coins to buy. 👍

Mudrex is a crypto asset management platform. The company says it has 40,000 active users in 90 countries with an asset under management of $15 million. Mudrex recently raised $2.5 million in seed funding from Nexus Venture Partners, Village Global, and Kunal Shah. 💰

Indian’s love crypto. A recent report by Chainalysis ranked India 2nd globally for crypto adoption. Crypto investments in India have jumped from $200 million to $40 billion in the past year. Serious money is still sitting on the sidelines awaiting clarity on a plethora of issues such as taxation. ❓

We’re not completely sure about the regulatory aspect of Coin Sets. But, we hope the incoming Cryptocurrency Bill helps answer these questions. 🤞

Up Next

Be sure to know when your stocks report earnings. Here’s the earnings calendar:

Links That Don’t Suck

🔥 Indian Startups Raise $10 Billion In A Quarter For The First Time, Report Says

😍 The 8 Biggest Announcements From Apple’s Unleashed Event

😢 Disney Delays Five Marvel Movies, Other Major Releases

💰 Squid Game Season 2? Series Worth $900 Million To Netflix So Far

🚗 Most Affordable Automatic Cars, Suvs In India Under Rs 7 Lakh

💑 Kourtney Kardashian And Boyfriend Travis Barker Are Now Engaged. See Pics