Tale of the Tape

Good evening everyone. Markets continued to slip. 😥

Nifty and Sensex ended lower after a late rebound from key support levels. Midcaps (-0.4%) and Smallcaps (-0.8%) moved in sync. 📉

Banks (+1.3%) and NBFCs (+1.2%) rose to the occasion and provided support. IT (-2.5%), Metals (-1.7%), and Real Estate (-1.4%) were the top losers. 👎

Havells dipped -9% despite positive management on the demand outlook. Asian Paints (-5%) gross margins hit an 8-year low in Q2. JSW Steel (-1.3%) reported better than expected results post-market hours. Read more below. 📊

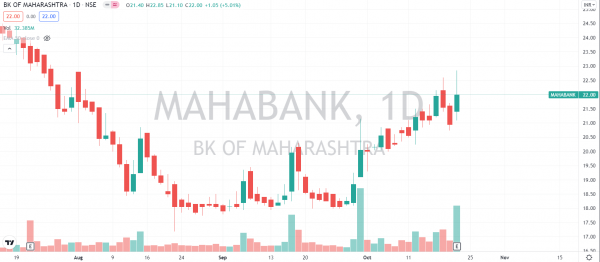

State-owned banks are on a tear. The Nifty PSU Bank Index (+2.7%) rose for a second straight day despite broader market weakness. Indian Bank, Union Bank, and Maharashtra Bank jumped between 5%-7% each. Check out their charts below. 🤑

Ace investor Rakesh Jhunjhunwala doubled his holding in Tata Motors DVR (+10%) in Q2. He now holds ~4% stake in the company. 💸

Deepak Nitrite dropped 5%. The Government revoked the anti-dumping duty on Phenol imports. Analysts estimate this could have a 7%-10% negative impact on its bottomline. 💔

Bandhan Bank (-0.3%) is in talks to acquire a majority stake in Future Generali Life Insurance. Here’s ET with more. 💰

ITC said reports of a tie-up with Amazon are speculative. The stock closed down 1%. 🤷♂️

UPL (+1%) acquired an 80% stake in Indonesian agrochemical company PT Excel Meg for $25 million. 💪

Cryptos broke out to new all-time highs. Bitcoin (+3%) cooled off after cruising past the $67,000-mark. Ethereum soared +11%. Solana rallied +20%. 😍

Here are the closing prints:

| Nifty | 18,178 | -0.5% |

| Sensex | 60,924 | -0.6% |

| Bank Nifty | 40,030 | +1.3% |

Earnings Roundup

Havells tanked 9% after mediocre Q2 performance. Topline met estimates but higher costs hurt the bottomline. Concerns over losses in its subsidiary Lloyds and its steep valuations dented sentiment. 👎 Here are the key stats:

- Revenue: Rs 3,238 cr; +32% YoY (vs Est: Rs 3,150 cr)

- EBITDA: Rs 440 cr; +5% YoY (vs Est: Rs 490 cr)

- EBITDA Margin: 13.8% (vs Est: 15.5%)

- PAT: Rs 300 cr; -7% YoY (vs Est: Rs 340 cr)

Going forward, Havells is positive on the demand outlook. The company said that it added new customers and is witnessing healthy demand across all verticals. ✌But, the sharp increase in raw material prices will have an impact on margins. How many times have we heard that already?

Havells is +41% YTD.

Asian Paints (-5%) weak Q2 results disappointed the Street. High raw material prices, mainly crude oil, left a hole in the company’s operating profits. Gross margins hit an 8-year low of 34.7% even after increasing prices. 📉 Healthy 34% YoY volume growth was the only silver lining. Check out its report card:

- Revenue: Rs 7,096 cr; +33% YoY (vs Est: Rs 6,750 cr)

- EBITDA: Rs 904 cr; -29% YoY (vs Est: Rs 1,350 cr)

- EBITDA Margin: 12.8% (vs Est: 20%)

- PAT: Rs 605 cr; -29% YoY (vs Est: Rs 895 cr)

Asian paints has increased prices thrice in past six months. And, it’s not done yet. The company said that it will take further price hikes to offset rising input costs. Not so good for the consumer’s pockets. 🙈

Asian Paints is +8% YTD.

JSW Steel’s (-1.3%) Q2 results beat Street estimates. The company reported the highest-ever Revenue and Net Profit in a quarter. 💪 Higher fuel costs restricted margin growth. The company spent Rs 3,639 cr on capacity expansion. Here’s the fine print:

- Revenue: Rs 32,503 cr; +69% YoY (vs Est: Rs 32,109 cr)

- EBITDA: Rs 10,417 cr; +2.4x YoY (vs Est: Rs 10,452 cr)

- EBITDA Margin: 32% (vs Est: 32.6%)

- PAT: Rs 7,170 cr; +4.5x YoY (vs Est: Rs 5,850 cr)

The company will host its analyst call later today. We will watch out for updates on future price hikes, demand outlook, and debt reduction.

JSW Steel is +73% YTD. 📈

Overheard on Stocktwits

Here’s a sick trade idea by Sanket Thakar on Stocktwits. Add $BTC.X to your watchlist and track its performance. Curious about investing in cryptos but don’t know where to begin? Here’s a quick primer on Bitcoin – https://youtu.be/d9fCQug8EHM

Chartbusters

State-owned banks have been completely immune to the recent market weakness. The Nifty PSU Bank Index is +4% in the last two days vs -2% for the broader Nifty500 Index. Attractive valuations, easing NPA problems, and privatization buzz has boosted investor sentiment. ✅ Indian Bank, Union Bank, and Maharashtra Bank jumped between 5%-7% each. Check out their charts below:

Let Me In

The Indian EV industry is quickly hotting up and Tesla wants to get some of that action. Media reports suggest that Tesla executives met with Government officials last month to discuss the one thing holding them back. TAXES! 🚗

India currently applies a 40% import tax on EVs priced at $40,000 and below. That number bumps up to a full 100% for anything more than that. Insane, right? 🤯 This isn’t the first time Tesla has complained about steep taxes. Back in July, Elon Musk tweeted about how India’s high taxes were not conducive to business.

India is home to the fifth-largest auto market in the world. But, EV’s form only a fraction of it. India has set an ambitious target of achieving 100% electrification by 2030. This translates into a $200+ billion market opportunity, according to the CEEW Centre for Energy Finance. 💰

Tesla’s entry into India will most certainly drive EV adoption. But, industry experts fear that local manufacturing may take a hit as Tesla sticks to its made-in-China cars. Reports indicate that Government may give some relief if Tesla were to set up production in India. The ball is in Tesla’s court now. 😎

On a side note, Tesla came out with strong Q3 earnings. The automaker posted record revenues and profits in the quarter. Here’s more details. 📊

Calendar

Here are all the key earnings lined up for the rest of the week.

Links That Don’t Suck

💪 India Crosses Historic 100 Crore Covid-19 Vaccine Doses Mark

💰 Jio To Join Dunzo’s Fund-Raising Party

📈 Pepperfry May File For IPO By Next June

💸 Paypal Is Exploring A Purchase Of Pinterest

😎 Jack Dorsey Nearly Predicted Which Bitcoin Block Would Include All-Time High

🤳 Trump Announces Plans To Launch New Social Media Platform Called TRUTH Social In 2022

🤯 Apple Is Charging ₹1900 For A Cleaning Cloth, And It’s Already Sold Out