Tale of the Tape

Good evening everyone and Happy Friday Jr. 🤗

Markets climbed higher on monthly Futures & Options expiry. Midcaps (+0.6%) and Smallcaps (+0.8%) also saw decent gains. Two stocks advanced for every one loser. ✌

Most sectors closed in the green. Real Estate stocks topped the list of gainers. Autos (-0.4%) were down for the 4th time in the last 5 days. 👎

Reliance Industries single-handedly drove markets higher. The stock rallied +6%, its highest single-day gain since May 2021. We bring you the details below. 🤓

ITC (+1.6%) started clinical trials of its COVID-19 nasal spray. ✅

Siemens India dropped 5% after reporting weak Q2 results. The company’s net profit fell 3% over the previous year to Rs 323 cr. 📊

Paytm (+3%) extends its winning streak to day 3. Reports indicate that BlackRock and Canada Pension increased their stake in the company. 💸

Dixon Technologies (+3%) will partner with Acer to manufacture laptops. 💻

JSW Energy (+3%) approves business restructuring plans. Here’s ET with more. 👔

Latent View Analytics was locked in a 20% upper circuit for a 2nd straight day. 🤑

HUL increased soap and detergent prices, as per media reports. 🧼

Cryptos rebounded sharply after yesterday’s ugly crash. Bitcoin and Ethereum were up ~10%. BAT rallied +30%. 😍

Here are the closing prints:

| Nifty | 17,536 | +0.7% |

| Sensex | 58,795 | +0.8% |

| Bank Nifty | 37,365 | -0.2% |

Keep This Energy Going

Reliance Industries continues to make further progress on its renewable energy plans. The company will carve out its gas assets into a separate unit. ♻

Reliance seeks to produce green hydrogen from this unit. Hydrogen forms a core part of the company’s renewable energy plans. It also takes Reliance one step closer to its target of being net carbon neutral by 2035. FWIW, India consumes 6 million tonnes per annum of hydrogen. It is expected to grow five-fold by 2050. 🤯

Reliance Industries in a statement said:

India is a high-growth market and is expected to continue to see a deficit of these high-value chemicals in the foreseeable future. Further, as the hydrogen economy expands, RIL will be well-positioned to be the first mover to establish a hydrogen ecosystem.

Recently, Reliance and Saudi Aramco pulled the plug on an investment proposal estimated to be about $15 billion. Reliance’s focus on renewable energy was a key factor for the deal failing to go through. The entry of a large investor or tie-up with a leading green energy player will be crucial for the stock’s re-rating. Maybe, that’s the reason the stock rose +6%. No smoke without fire. 👀

Raising The Roof

India’s property market is rebounding after being in a down cycle for the last six years. A combination of factors like demonetization, bad loan crisis, and the Covid-19 pandemic hurt demand for new homes. 🏠

Going forward, experts are confident about the sector’s long-term outlook. As people stay indoors, who doesn’t want more space and updated homes. Rising employment and sharp salary hikes are also increasing buyers’ purchasing power. Lastly, favorable Government policies and decade-low interest rates are also key growth triggers. This in turn may drive a 75% growth in the real estate sector over the next three years, according to the latest industry report. 💰

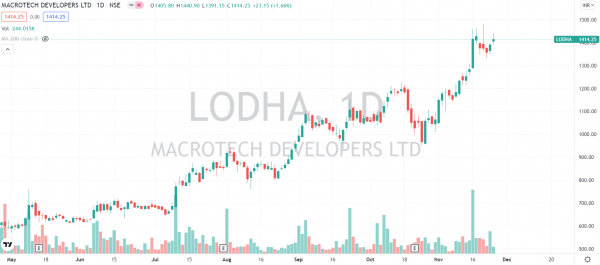

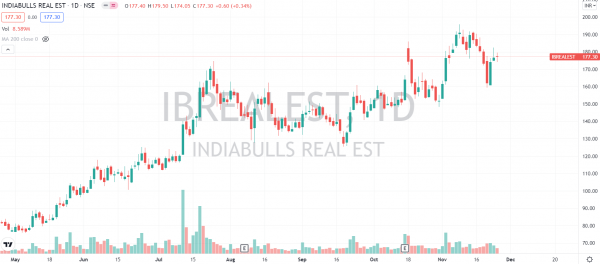

Real estate stocks have outperformed all the sectors in November. The Nifty Realty index is +5% in November vs -0.8% fall for the Nifty 50 index. Macrotech Developers is up 32% so far this month. Indiabulls Real Estate and Sobha are up between 12%-18%. Check out their charts below: 📈

On A Dream Run

Dream11 owner Dream Sports raised $840 million in the latest funding round led by Falcon Edge and Tiger Global. The new deal values the company at $8 billion. That’s a whopping 60% jump from its previous funding round in March. 🤑

Harsh Jain, CEO and co-founder, at Dream Sports said:

Our investors have deep experience in developing sports ecosystems globally, and we are fortunate to have their guidance to ‘Make Sports Better’ for 1 Billion Indian sports fans.

Founded in 2008, Dream Sports seeks to create a complete sports ecosystem beyond its Dream11 platform. Its portfolio includes hosting events, selling merchandise, payment solutions, and data analytics. Dream Sports has a user base of 140 million. Also, it recently committed $50 million to enhance its sports commerce platform, FanCode.🏑

Dream 11 also holds the distinction of being profitable. The gaming startup reported a net profit of Rs 180 cr in FY20. That’s a sharp turnaround from a net loss of Rs 88 cr in the year before that. This may be the reason for the big jump in its valuation. Meanwhile, regulatory uncertainty continues to be an overhang not just for Dream11 but the industry as a whole. 😬

On the topic of startups, Spinny became the latest entrant to the unicorn club. The company raised $285 million in the latest funding round valuing it at $1.75 billion. That’s unicorn #37 for you! 🦄

Links That Don’t Suck

💰 India’s Blume Ventures Raises $105 Million In The First Close Of Its Fourth Fund

😓 What Peloton’s Growing Pains Mean For At-Home Fitness

💯 Christie’s To Hold Ethereum NFT Auction On Opensea

🚀 NASA Just Launched A Satellite To Crash Into An Asteroid!

🤗 This Bank Has Moved To A 4-Day Work Week Without Cutting Staff Pay

🎬 Dhanush & Sara Ali Khan-Starrer ‘Atrangi Re’ Will Make A Disney+ Hotstar Debut