Tale of the Tape

Happy Wednesday everyone. We’re halfway through the week. 😇

Markets extended their recovery to a second straight day amidst positive global cues. Midcaps (+1.7%) and Smallcaps (+2.2%) outperformed. The advance-decline ratio (3:1) was firmly in favor of the bulls. 🐂

There was a green wave across the board. Real Estate stocks (+3%) topped the charts. Pharma (+2%) and Metal (+1.8%) stocks also saw healthy gains. 💪

Zee Entertainment and Sony Pictures India officially right-swiped each other. The stock was volatile but closed with minor gains. More details below. 💑

It’s been over a month since Paytm’s listing but markets continue to be split. Both Morgan Stanley and Goldman Sachs initiated coverage on the stock with varying levels of confidence. Read more below. 🤔

India Cements jumped +6% after renowned investor Radhakishan Damani bought a 2% stake in the company. 💰

Yes Bank (+5%) will raise Rs 10,000 cr. The private lender aims to reduce its bad loans to zero by the end of FY22. 📈

MapMyIndia jumped +7% after both Fidelity Funds and Goldman Sachs bought +3 lakh shares in the company. ✌️

Gujarat Fluorochemicals (+4%) will set up a unit to manufacture EV batteries. 🔋

IPO Update. Metro Brands failed to light any fireworks on its Dalal Street debut. The stock closed at Rs 493 p/sh, -2% from its IPO price. CMS Info Systems IPO was subscribed just 0.6x on day 2. 💸

Cryptos mostly traded in the green. Bitcoin and Ethereum were up 1% each. Cardano and Ripple surged between 5%-7%. ❤️

Here are the closing prints:

| Nifty | 16,955 | +1.1% |

| Sensex | 56,930 | +1.1% |

| Bank Nifty | 35,029 | +1.2% |

Tag Team Champions

The biggest marriage this wedding season has to be the Zee Entertainment and Sony Pictures India. Sorry, Vicky & Katarina. 😜

The two companies officially announced their merger after spending months finalizing every tiny detail. Deal terms remain similar as earlier reported. Most importantly, both promoters will pump in fresh funds into the combined entity. Armed with $1.5 billion in cash, the company is betting big on OTT content and sports, especially IPL. Watch out Disney! Sony will hold a 51% stake in the merged company, while Zee promoters will hold a 4% stake. But, the latter also has an option to raise their holding to 20%. 👍

Here’s the tricky part. The deal would require Zee to get approval from 75% of its shareholders. However, it is at war with its largest shareholder, Invesco Group, which owns an 18% stake in the company. 🧐

In the past, Invesco maintained that it is cool with the merger. But, it does not want Punit Goenka to lead the organization. This resulted in serious courtroom drama between the two, worthy of its own Netflix series. 🍿

If all goes well, the merged entity will become India’s largest broadcasting company with 75 channels, two OTT platforms, and two film studios. The company is estimated to report Rs 2,800 cr in profit in FY23. It will have a 26% viewership share with a potential to reach 130 cr Indians. Disney-owned Star India currently leads the pack with +18% viewership base. 📺

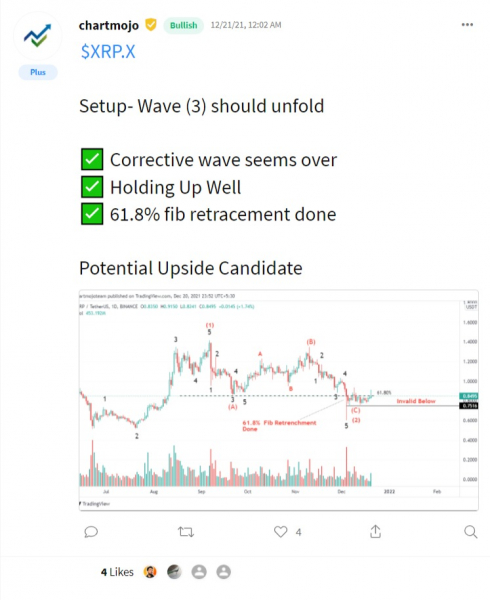

Overheard On Stocktwits

Here’s an interesting chart setup by Chart Mojo on Stocktwits that you should check out. Add $XRP.X to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3EoUpKF

In The Slow Lane

Banks play a huge role in our financial system. They aid financial activities of Government bodies and boost investment across sectors. This in turn drives our economic growth. Yet, Financials are one of the biggest underperformers in 2021, despite the sharp economic rebound. 🙃

The Nifty Bank Index is up just 12% YTD while Nifty50 gained +18% this year. In fact, reports suggest that Bank Nifty has underperformed the Nifty by 16% from pandemic lows. 👎

What’s going on here? A combination of factors like competition from new age fintech startups, slower digital adoption and continuous selling by foreign investors are hurting. Several new-age startups have entered the lending business. Experts say it has the potential to cause the same disruption as e-commerce has on grocery and clothes shopping. 🤯

Raamdeo Agrawal, Chairman of Motilal Oswal Financial Services, told ET:

As the internet becomes more friendly, we will see that financial services will become more digitised and in a digitally surcharged environment, one does not need many players… Customer on-boarding can happen digitally and then services can be delivered and even the customer service can be digital. The scalability of a single successful company is extremely high and one does not need 20 banks. Maybe five banks are good enough.

Foreign investors have the highest exposure to Indian banks in their portfolio. These investors have sold more than Rs 50,000 cr of Indian stocks in 2021. This has created the problem of additional supply in the market driving prices lower. 📉

Having said that, many experts remain bullish on banks. Fears over fintech’s gaining market share may be exaggerated. They point that most startups lend to high risk first-time borrowers. The bull case for banks is a higher quality loan book and attractive valuations. Also, some much needed love from foreign investors in 2022 may come in handy. We have our fingers crossed. 🤞

Mixed Fortunes

Paytm is down ~40% from its IPO price. Valuations have corrected, but the key question still remains: Is it a buy at current levels? Well, it depends on who you ask. 🤭

Morgan Stanley and Goldman Sachs, both bankers to the IPO, have initiated coverage on the stock. But, they share contrasting views. Let’s cut straight to the bull case. ✅

Morgan Stanley says Paytm has built a strong customer acquisition engine via payments. It is now expanding rapidly into financial services at a low additional cost, which in turn may boost profitability. They believe the risk to reward ratio is attractive in that context. Morgan Stanley has a Buy rating with a target price of Rs 1,875, indicating 40% upside. 📈

Goldman Sachs is bullish on the company’s long-term story. It sees gross merchandise value to grow 6x, and revenue growth at 5X by FY30. BUT, stiff competition across most of Paytm’s verticals, plus tight regulations may impact earnings in the near term. Goldman Sachs has a Neutral rating with a target price of Rs 1,630, implying 21% upside.

FWIW: The stock did get excited and jumped over 2%. The contrasting opinions mean it all lies in the hands of investors to steer the ship forward. Let’s see how this goes. 😇

Teen Titans

Inspirational stories don’t always have to start and stop with billionaires. Here are two Mumbai teens who raised $100 million for their online grocery startup. 🤑

Meet Aadit Palicha, and Kaivalya Vohra, who started Zepto, when they turned 19! They left their degrees at the prestigious Stanford to return to India with an aim to deliver groceries in 10 minutes. Starting initially in Mumbai, Zepto has quickly expanded to six cities like Bengaluru, and Delhi. 🛒

Zepto claims to add +1 lakh users every week. Its valuation has touched $570 million after the latest fundraise. That’s a massive 1.5x jump since its last funding round, which was only 45 days ago. Zepto will use the funds to scale up its operations and expand its footprint. 💸

The Covid-19 pandemic has revolutionized online shopping. Consumers are buying everything from milk, soap, hair oil to fresh meat online. Rising smartphone penetration and cheap data costs are set to drive growth. According to RedSeer, India’s online grocery market is expected to touch $24 billion by 2025. However, the segment is getting crowded. Swiggy, Grofers, BigBasket, and Dunzo are all fighting for a larger pie of users. 🥧

Honestly, we are super proud of Aadit Palicha and Kaivalya Vohra’s impressive journey. Can’t wait to see the next chapter of Zepto. 👊

Links That Don’t Suck

🥇 Anshuman Sharma discusses his favourite Tata Group stocks on Stocktwits India’s YouTube channel

💰 Oracle To Buy Cerner For $28.3 Billion In Bold Move On Health

👨💻 Scammers Steal $150k Worth Of Crypto From Nft Project With Discord Hack

🤯 “Merry Christmas” First Sms Sells For Over 100,000 Euros In Paris Auction

😋 115 Biryanis Per Minute, Samosas Equaling New Zealand Population Ordered By Desis In 2021

🏏 Timid, Predictable England Need Something, Anything To Wake Them From This Slumber