Tale of the Tape

Hello everyone. The stock market had a rough day! 🤕

Nifty and Sensex tanked nearly 3% each, the worst single-day fall since the start of the pandemic. Midcaps and Smallcaps felt maximum pain, falling ~5% each. Almost 900 stocks were locked in a lower circuit on the BSE. More details below. 📉

It was a sea of red across the board. Real Estate (-6.5%) and Metal (-5.5%) stocks got beat up the most. 🚨

Reliance Industries cracked 4% despite healthy Q3 performance. ICICI Bank (-1%) saw limited damage after strong results. Read more below. 📊

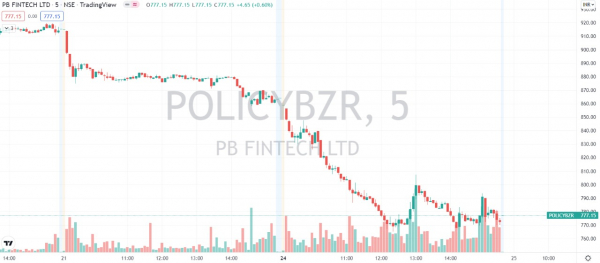

Shares of new-age tech companies like Zomato, Nykaa, and Policybazaar got KO-ed. Check out their charts below. 🔻

Cipla rose 3%. Global brokerage firm Credit Suisse sees a 33% upside in the stock from current levels. 💰

Tube Investments bought a 70% stake in electric tractor startup Cellestial E-Mobility for Rs 161 cr. ⚡ The stock closed down 4% tracking overall market weakness.

Cryptos extended their worst start to a calendar year. Bitcoin dropped 4% to trade below the $35K-mark. Ethereum slumped 8%. Solana dove 18%. 💔

Here are the closing prints:

| Nifty | 17,149 | -2.7% |

| Sensex | 57,491 | -2.6% |

| Bank Nifty | 36,947 | -1.7% |

Rush To Sell

Markets ended lower for a fifth straight day, the most in over 10 months. The Nifty is down 1,200 points, wiping out a majority of the gains from December lows. A combination of domestic and global factors are responsible for this. 😤

The most important of them all is the US Federal Reserve and its move to raise interest rates. As we all know, the post-pandemic rebound has been a bit too hot for businesses to handle. Broken supply chains only made matters worse pushing prices to record highs. All this has reduced the need for the US to print more $$$ and raise interest rates which is negative for equities. Also, rising crude oil prices and geopolitical tensions in Eastern Europe and the Middle East are making investors nervous. 👀

Back home, the earnings season hasn’t got off to a great start. Muted business outlook and concerns over the impact of the 3rd wave hurt sentiment. Lastly, volatility ahead of the upcoming Union budget and monthly F&O expiry added pressure. 📉

What next? Should you buy the dip? The answer is both Yes and No. Most experts are bullish over the long term but do not advise buying right now. The outcome of the US Federal Reserve meeting on Wednesday plus cues from the budget will be key in determining the market’s direction. Let’s hope for the best. 🤞

Chartbusters

Shares of recently listed new-age companies were brutally punished. Here’s why? The sharp sell-off in US tech companies caused a ripple effect across the globe. The Nasdaq 100 index, dropped ~8% last week as the US Fed doubles down on its plans to raise interest rates. Experts also point out that valuations turned “too good to be true” for these loss-making companies. 🙃

FYI – US growth stocks like Square, Zoom, Coinbase, and Robinhood have more than halved from their record highs.

Zomato was locked in a 20% lower circuit. Nykaa and Policybazaar fell between 11%-13%. Check out their not-so-good looking charts:

Earnings Roundup

ICICI Bank’s (-1%) beat estimates on all fronts. Strong loan growth, improvement in margins, and lower provisioning drove overall outperformance. Lower bad loans was the icing on the cake. ✔️ Here’s a quick recap:

- Net Interest Income: Rs 12,236 cr; +23% YoY vs Est: Rs 12,114 cr

- PAT: Rs 6,194 cr; +25% YoY vs Est: Rs 5,910 cr

- Gross NPA: 4.13% vs 4.82% (QoQ)

- Net NPA: 0.85% vs 0.99% (QoQ)

ICICI Bank is +47% in the past year.

Reliance Industries (-4%) Q3 results were slightly better than estimates. All three businesses: Oil to Chemical (O2C), Jio, and Retail reported healthy growth. Strong festive demand coupled with aggressive store expansion boosted Retail business. Tariff hikes made up for the weak response to JioPhone Next and the second straight quarter of fall in net subscribers. 📱 Here are the key stats:

- Revenue: Rs 1.85 lakh crore; +10% QoQ vs Est: Rs 1.76 lakh crore

- EBITDA: Rs 29,706 cr; +14% QoQ vs Est: Rs 28,700 cr

- EBITDA Margin: 16% vs Est: 15.5%

- Net Profit: Rs 15,700 cr; +15% QoQ vs Est: Rs 15,500 cr

- Jio Average Revenue Per User (ARPU): Rs 152 vs Est: Rs 149

Mukesh D. Ambani, Chairman and Managing Director at Reliance Industries Limited said:

I am happy to announce that Reliance has posted best-ever quarterly performance in 3Q FY22 with strong contribution from all our businesses. Both our consumer businesses, Retail and Digital services have recorded highest ever revenues and EBITDA. The recovery in global oil and energy markets supported strong fuel margins and helped our O2C business deliver robust earnings. We are making steady progress towards achieving our vision of Net Carbon Zero by 2035.

Reliance Industries is +23% in the past year.

Overheard on Stocktwits

Havells slumped over 5% on weak results. Seems like the worst is far from over for the stock, according to Trader Harneet. Add $HAVELLS.NSE to your watchlist and track the latest news, expert views, and more only on Stocktwits. Here’s the link: https://bit.ly/3zL3xJ9.

Earnings Highlight

- Yes Bank: Net Interest Income: Rs 1,764 cr; (-31% YoY) | Net Profit: Rs 266 cr; (+77% YoY)

- Vodafone Idea: Revenue: Rs 9,717 cr; (-11% YoY) | Net Loss: Rs 7,230 cr

- Bandhan Bank: Net Interest Income: Rs 2,125 cr; (+3% YoY) | Net Profit: Rs 859 cr; (+36% YoY)

- L&T Finance: Revenue: Rs 2,970 cr; (-12% YoY) | Net Profit: Rs 326 cr; (+12% YoY)

- Inox Leisure: Revenue: Rs 296 cr; (+19X YoY) | Net Loss: Rs 1.3 cr

Calendar

Be sure to know when your stocks report earnings. Here’s the results calendar:

Links That Don’t Suck

💸 E-Scooter Maker Ola Electric Raises $200 Million For Expansion

🙅♀️ Bitcoin Whales Stay Away Even As Technical Indicator Flashes Oversold

💯 National Girl Child Day 2022: 7 Business Leaders Every Girl Can Look Up To

🤭 Toddler Accidentally Orders Furniture Worth Rs 1.4 Lakh Online On His Mother’s Phone

🤦 Shoaib Akhtar Blames Virat Kohli’s ‘Early’ Marriage As A Reason For His Dip In Form – Watch

🔥 The Batman: Director Matt Reeves Has A Promising Update For The Fans

😇 Still Avoiding Life Admin? How To Motivate Yourself To Do Even The Dullest Of Tasks