Tale of the Tape

Good evening y’all. Markets had the best day in +3 months! 🚀

Nifty and Sensex rallied ~3% each. Midcaps (+2.7%) and Smallcaps (+3.4%) were equally enthusiastic. 🔥

Not a single sector closed in the red. Metals stocks gained ~7% on hopes of improved demand. Energy (+3%) and IT (+2.8%) also witnessed healthy gains. 💪

LIC had a wobbly listing. The stock ended 8% lower from its issue price on its Dalal Street debut. 😓 More details below.

Dmart (+3%) extended its winning streak to day 2. What’s fuelling the rally? Read more below 📈

Paytm’s (-1%) early investors Alibaba and Ant Group sold their entire stake in Paytm Mall. 💸

BEL (+3%) will manufacture battery packs for Triton electric trucks. 🔋

KEC International (-1%) won multiple orders worth Rs 1,150 cr. 📊

Aditya Birla Capital (+7%) denied reports of insider trading and frontrunning at Aditya Birla Sun Life AMC. 🚫

Cryptos continued to climb higher. Bitcoin and Ethereum rose 3%. Solana was up 5%. 🤑

Here are the closing prints:

| Nifty | 16,259 | +2.6% |

| Sensex | 54,318 | +2.5% |

| Bank Nifty | 34,301 | +2.1% |

Disappointing Start

LIC’s big date with Dalal Street ended with disappointment for investors. The stock closed down 8% from its issue price to close at Rs 875 p/sh. FYI – this is less than retail and policyholders cost price post discount. 😓

Despite a weak listing, LIC is still valued at Rs 5.5 lakh cr. That makes the insurance giant India’s fifth-largest listed company. 💪

Earlier this day, global brokerage firm Macquarie pulled off yet another Paytm. They assigned LIC a “neutral” rating with a target price of Rs 1,000 p/sh. That’s barely +5% from its IPO price. Macquarie believes volatile earnings, low share of high margin products, and increased competition from private players are key concerns. 👀

Big Picture: India has one of the lowest insurance penetration among developing economies. Over the next decade, the insurance industry is estimated to grow 5x to $520 billion. For LIC, improving the product mix and scaling up its tech capabilities would be key triggers. Let’s see how this one goes. 🔥

Has Dmart Bottomed?

Avenue Supermarts finally woke up after doing nothing for +7 months. The stock rallied over 10% on Monday despite okay-ish Q4 results. What’s going on? 🤷

Avenue Supermarts is one of the biggest wealth creators of the past 5 years. The stock is up +12x since listing in March 2017. Its strong parentage, industry-leading financials, and immense growth potential always gave it a premium valuation. In fact, at its peak, the stock traded at over 100x price-to-earnings. 🤯

However, the recent correction has been absolutely brutal. Avenue Supermarts nearly halved from its all-time high in Oct last year. This turned valuations slightly more attractive said, experts. ✅

Also, robust demand and aggressive store addition are expected to boost earnings going forward. Dmart is also gradually expanding its e-commerce business and is now present in 12 cities. But, stiff competition from Swiggy, Zomato, and Reliance plus the impact of rising inflation on consumer sentiment remain top concerns. 🛒

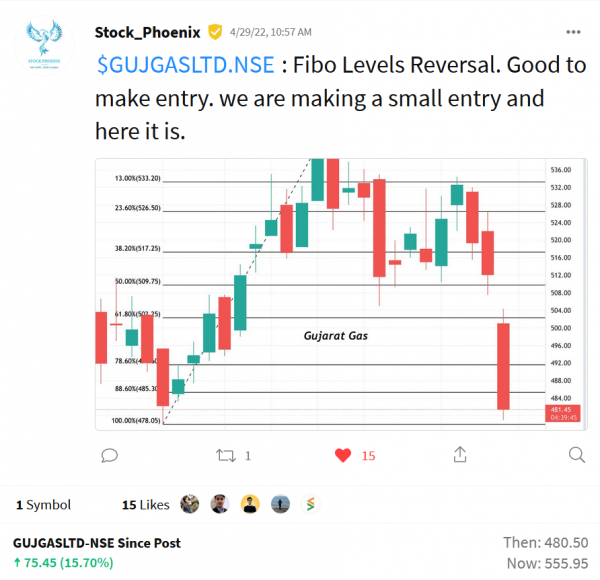

Stocktwits Spotlight

Gujarat Gas has come out on top amidst the recent spike in volatility. The stock is +16% since Stock Phoenix shared his view on Stocktwits. That deserves a big round of applause. Follow Stock Phoenix for more amazing trade ideas and add $GUJGASLTD.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3zL3xJ9.

Earnings Highlights

- Raymond: Revenue: Rs 1,958 cr; (+43% YoY) | Net Profit: Rs 263 cr; (+3.6X YoY)

- Indoco Remedies: Revenue: Rs 409 cr; (+34% YoY) | Net Profit: Rs 40 cr; (+62% YoY)

- Rategain: Revenue: Rs 108 cr; (+51% YoY) | Net Profit: Rs 12 cr;

- Dodla Dairy: Revenue: Rs 590 cr; (+11% YoY) | Net Profit: Rs 40 cr; (+3.2X YoY)

- Kajaria Ceramics: Revenue: Rs 1,102 cr; (+16% YoY) | Net Profit: Rs 96 cr; (-25% YoY)

Calendar

We’re in the thick of the earnings season. Here’s all the companies that will announce their Q4 results tomorrow:

Links That Don’t Suck

💯 Chris Wood On Why This Decade Can Belong To India

🍿 Twitter’s CEO And Elon Musk Are Beefing Over Bot Counts

😬 $1.2 Billion In Bitcoin Was Liquidated During Last Week’s Crypto Crash

💪 Byju’s Isn’t Looking To Slow Down On Shopping Despite The Downturn In Global Markets

🌋 Largest Volcanic Eruption In Over A Century Took Place In January; Study Claims

😔 Gunners’ Champions League Chances Fading After Defeat At Inspired Magpies