Tale of the Tape

Hey guys. Markets were back in the red. 🔻

The dreaded last hour selling returned as Nifty and Sensex erased all gains to end with minor cuts. Midcaps (-0.4%) and Smallcaps (-0.8%) witnessed deep cuts. The advance-decline ratio (1:2) remained in favor of the bears. 🐻

Most sectors ended lower. Metal stocks fell the most; down 8%. Energy and Pharma slipped over 1% each 📉

Paytm rallied +8% despite losses widening in Q4. More details below. 📊

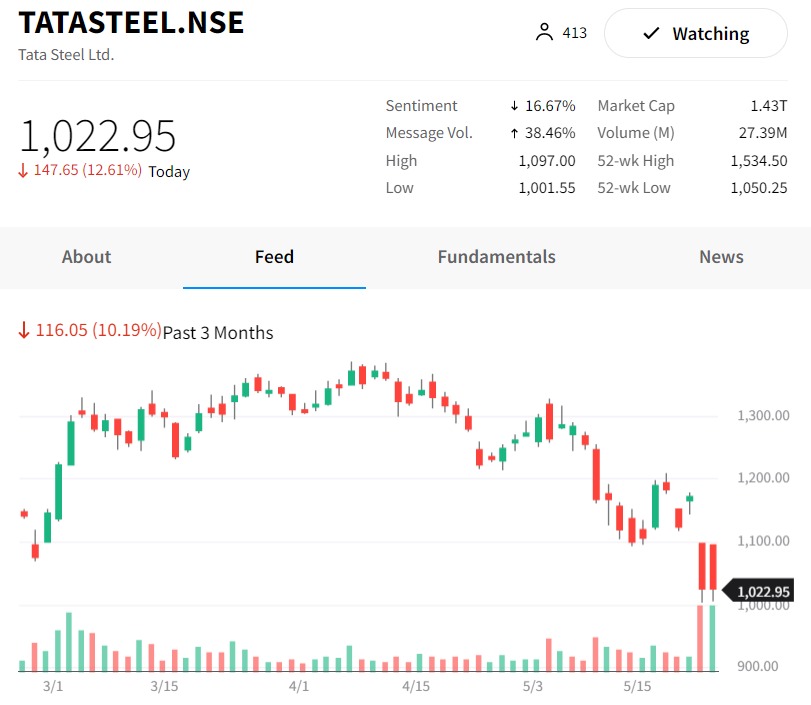

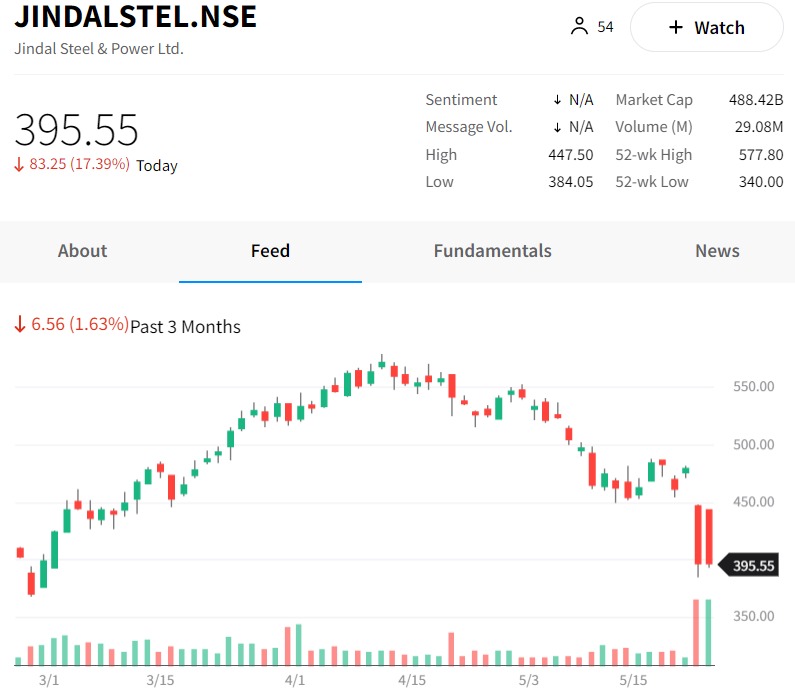

Steel stocks got smoked. Tata Steel, JSW Steel, and JSPL tanked between 12%-17% each. Read more below. 🤕

Vodafone Idea (-1%) is in talks to raise Rs 20,000 cr. 💸

IGL (-2%) increased CNG prices in Delhi by Rs 2.50 to Rs 75.61/kg. 😓

Jet Airways was locked in a 5% upper circuit after the Directorate General of Civil Aviation (DGCA) allowed the airline to resume operations. ✈️

eMudhra IPO got fully subscribed on day 2. 👍

Cryptos traded higher. Bitcoin (+3.5%) stabilized above $30,000. Ethereum jumped ~5%. Solana, Matic, and Shiba Inu gained between 6%-7% each. 😇

Here are the closing prints:

| Nifty | 16,214 | -0.3% |

| Sensex | 54,288 | -0.1% |

| Bank Nifty | 34,247 | -0.1% |

Steal-ing Those Gains

Steel stocks got beat up after the GOI decided to impose hefty duties on steel products and their raw materials. 🤕

What’s the matter, bro? The Government announced a 15% tariff on steel exports vs 0% earlier. Export duty on iron ore was hiked to 50% from 30% and pellets to 45% vs 0% earlier. 🔼

What does this mean? Higher taxes would discourage steel companies to export more and increase domestic supplies. Experts believe this would result in an 8%-10% fall in domestic steel prices. Lower prices may impact profitability and steel companies may be forced to postpone their expansion plans. This is a huge negative. 🚨

This set the alarm bells ringing and investors pressed the sell button immediately as the markets opened. Tata Steel, JSW Steel, and JSPL tanked between 12%-17% each. Check out their charts below: 📉

Earnings Roundup

Paytm’s (+8%) Q4 results were alright to be fair. Topline rose 89% YoY led by solid growth in the lending business. Paytm gave out fresh loans to 65 lakh customers, up ~5x YoY. However, this was driven by 83% growth in its Buy Now Pay Later (BNPL) segment. 💸

Gross Merchandise Value (GMV) more than doubled to Rs 2.6 lakh cr but was slightly lower than the Street’s expectation. Average monthly transacting users (MTU), which is the number of unique users with at least one successful payments transaction in a month, grew 41% over the previous year to 7.1 cr. But, higher salaries and advertisement expenses widened the net loss. Check out its key stats: 📊

- Revenue: Rs 1,541 cr; +89% YoY

- Net Loss: Rs 761 cr; vs Net Loss: Rs 444 cr YoY

So, what explains the massive 8% rally? For starters, Paytm remains confident of turning breakeven aka no profit no loss on an operational level by September 2023. The company believes it can achieve this feat without compromising any of its growth plans. 😎

Secondly, Paytm has more than halved since listing. The sell-off in global tech stocks plus regulatory headwinds eliminated the possibility of any gains. Having said that, the risk-reward ratio has turned extremely attractive making a bunch of Dalal Street analysts bullish on the stock. PS, global brokerage firm Goldman Sachs sees a 86% from current levels! 🤑

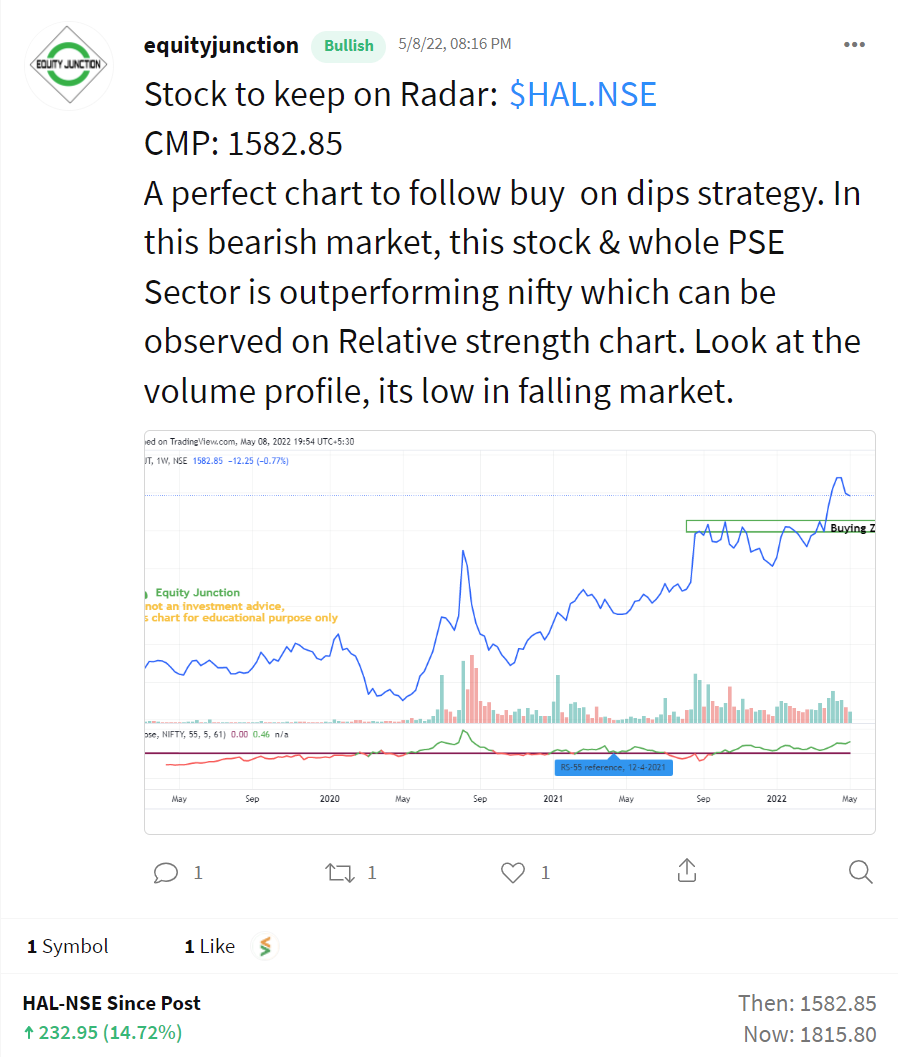

Stocktwits Spotlight

Hindustan Aeronautics hit a new all-time high!!! Super call (as always) by Equity Junction. Follow them now on Stocktwits for more amazing trade ideas and add $HAL.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3aaaKJP.

Earnings Highlights

- Metro Brands: Revenue: Rs 403 cr; (+26% YoY) | Net Profit: Rs 69 cr; (+60% YoY)

- Divis Lab: Revenue: Rs 2,518 cr; (+41% YoY) | Net Profit: Rs 895 cr; (+78% YoY)

- Bharat Heavy Electricals: Revenue: Rs 8,062 cr; (+12% YoY) | Net Profit: Rs 909 cr;

- Thermax: Revenue: Rs 1,992 cr; (+27% YoY) | Net Profit: Rs 103 cr; (-5% YoY)

Calendar

A ton of companies will post their Q4 results tomorrow… Here are all the important earnings you don’t want to miss:

Links That Don’t Suck

🤓 Nifty In A Rally Attempt; What’s A Follow-Through Day And How It Influences Market Status

💰 General Atlantic Plans $2 Billion Investment In India, Southeast Asia

💪 Apple Looking To India, Not China, To Produce iPhones And More: Report

💯 From Ambani To Damani, Here Are 8 Of The Richest Indian Families

😂 Elon Musk’s Job Application Post On Twitter Gets Hilarious Responses From The Users

🔥 From Control To Chaos: How Manchester City Beat Liverpool To The Premier League Title Again