Tale of the Tape

Happy Monday everyone, and welcome back to The Daily Rip! 🤗

Nifty and Sensex snapped their six-day losing streak. On the other hand, Midcaps (-2.3%) and Smallcaps (-3.2%) continued to underperform. 👎

Most sectors ended lower. Metals (-4%) and PSU Banks (-2.5%) got beat up the most. FMCG (+1.8%) had the best day in over a month. 📈

Vedanta crashed 13% on reports that they’ll sell their Tuticorin plant. More details below. 🚨

Sun Pharma rose 2% after a double upgrade by Jefferies. The global brokerage has a “buy” rating on the stock and sees a 15% upside from current levels. 🚀

Delta Corp tanked 5% after ace investor Rakesh Jhunjhunwala sold 57.5 lakh shares. 💸

Shree Cement (+2%) will invest Rs 2,500 cr to set up a new plant in Andhra Pradesh. 🏭

Maruti Suzuki (-0.5%) opened bookings for the 2022 Brezza today. PS. The Maruti Brezza is India’s highest-selling SUV. 🚗

Cryptos rebounded after a bloody weekend. Bitcoin jumped 8%. Ethereum rallied +12%. 🔥

Here are the closing prints:

| Nifty | 15,350 | +0.4% |

| Sensex | 51,597 | +0.5% |

| Bank Nifty | 32,684 | -0.2% |

Deep F*#&ing Value?

LIC’s disappointing start to life on Dalal Street has raised a few eyebrows. The stock is down over 30% from its IPO price wiping out nearly Rs 2 lakh cr of investor wealth in just a month! 😥

Experts say LIC’s volatile earnings, low share of high margin products, and increased competition from private players pose key concerns. Weak investor sentiment amidst fears of a global recession only made matters worse. ⛔

But, JP Morgan believes these concerns may be overblown and the Street is seriously “mispricing” the insurance giant. With 99% of value from old policies, we see the 0.75x P/EV as unduly harsh, even assuming no growth, said JP Morgan. They believe valuations more than capture all the negative, making it a compelling value buy at current levels. However, IPO investors may find it difficult to rejoice – JP Morgan’s Rs 840 target price is 12% below the issue price. 🙃

Big Picture: India has one of the lowest insurance penetrations among developing economies. Over the next decade, the insurance industry is estimated to grow 5x to $520 billion. 💰

For Sale

Vedanta (-13%) hit a new 52-week low after the Tamil Nadu government ordered the company to sell its Tuticorin plant. 📉

What’s the deal bro? Vedanta’s Sterlite copper plant in Tuticorin is India’s largest and state-of-the-art copper smelter. It accounts for 40% of India’s total copper output and employs ~30,000 people. But, legal and political hurdles forced Vedanta Group to shut operations back in 2018. 😵

Here’s a quick recap: The plant was closed in May 2018 following an order by the Tamil Nadu Pollution Control Board. Days later, 13 agitators were killed in police firing during a violent anti-Sterlite protest. The State Government intervened and sealed the plant for good. Vedanta challenged the decision in the Madras High Court but their appeal was rejected. Eventually, Vedanta moved to the Supreme Court where the case is still pending. 👨⚖️

Vedanta is estimated to lose Rs 4,000 cr from the plant’s closure. Going forward, they plan to shift the unit to another state, according to media reports. Let’s see how that goes. 🏭

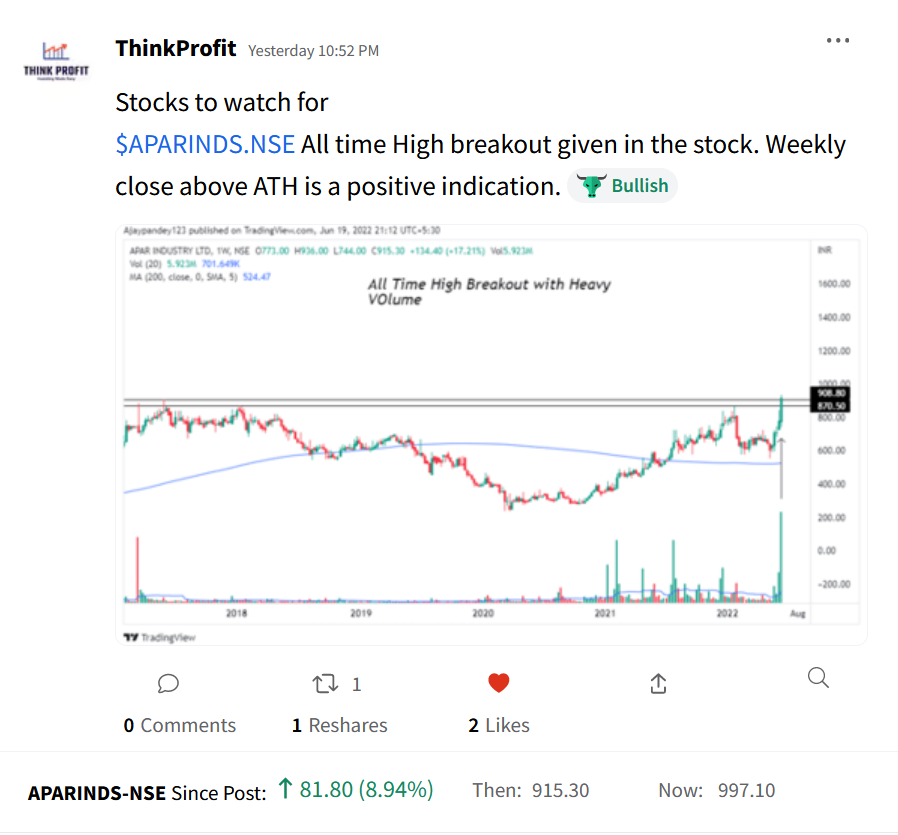

Stocktwits Spotlight

Fast and Furious! Apar Industries rallied ~10% in a single day. That deserves a big round of applause. Follow ThinkProfit for more amazing trade ideas and add $APARINDS.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3HzQ1fk.

Links That Don’t Suck

💯 Watch: Should You Buy This Dip? Nifty Bottomed Out? | Stock Room Sunday

🤦 Here Are The Three Things The Fed Has Done Wrong, And What It Still Isn’t Getting Right

🐕 Dogecoin Pumps 8% After Elon Musk Says He’s Still Buying

😇 This Sikh Man In The US Sells Petrol At A Loss Because He Truly Believes In Kindness

😆 “No One Informed Me”: Case Against Odisha Mla For Missing His Own Wedding

🔭 You Can Now Go For Stargazing In Rajasthan; It’s The 1st Indian State To Launch Astro-Tourism

⚽ Raheem Sterling: Chelsea Confident Of Signing Man City And England Forward