Tale of the Tape

Good evening everyone and welcome to the new trading week. 🎲

Nifty and Sensex closed up for a sixth straight day. Midcaps (+1.5%) and Smallcaps (+1%) also witnessed healthy gains. The market breadth was extremely positive with nearly 2 stocks gaining for every 1 loser. ✌️

Most sectors closed in the green. Auto (+2.5%) and Real Estate (+2%) were the key sources of strength. FMC and Energy stocks also gained over 1% each. 📈

Hero MotoCorp’s (+2%) Q1 results were way below Street expectations. More details below. 💰

Singer Ltd was locked in a 20% upper circuit after “Big Bull” Rakesh Jhunjhunwala’s RARE Enterprises acquired a 10% stake. 💯

HDFC Life rallied +10% intraday after 1.3 cr shares (6% equity) changed hands in multiple block deals. 📊

Samvardhana Motherson (+5%) approved a 1:2 bonus issue. ✅

UTI AMC surged +15%. Tata Mutual Fund may acquire the company, according to media reports. 🤝

DFM Foods was locked in a 20% upper circuit after the Board of Directors approved delisting plans. 💸

Cryptos were quiet. Bitcoin and Ethereum traded flat. Meme coins were on fire. Doge rallied +12%. Shiba Inu was up +4%. 🚀

Here are the closing prints:

| Nifty | 17,825 | +0.7% |

| Sensex | 59,842 | +0.6% |

| Bank Nifty | 39,239 | +0.5% |

Gone Too Soon

Billionaire investor, trader, entrepreneur, philanthropist, and the “Big Bull” of Indian markets Rakesh Jhunjhunwala died of cardiac arrest on Sunday, August 14. 😞

RJ started his investing journey with a few thousand rupees back in 1985. He enjoyed a decent run in the initial years before hitting the jackpot in the 1992 Harshad Mehta crash. Jhunjhunwala earned the tag of “Big Bull” for his undying faith in the India story. He successfully identified Titan, CRISIL, and Lupin before anyone else in the market. Fun Fact: his 5% stake in Titan is estimated to be worth over Rs 11,000 cr and made up nearly a third of his portfolio. 💰

Jhjunjhunwala will forever remain the beacon of hope for millions of newbie investors. His story, a lot like the Drake song: started from the bottom now we’re here is a huge source of motivation. Humble, yet feisty, the firm believer in – “the mother of all bull markets is coming” would be deeply missed. Long live the Big Bull. 🙏🏻

Gearing Up For A Big Run?

Hero MotoCorp’s Q1 results missed Street estimates on all counts. Lower than expected sales, steep raw material costs, and higher other expenses dragged overall performance. Yet, the stock closed up +2%, why so? 🤔

For starters, Hero MotoCorp is confident of a strong demand recovery in FY23. As employees return to offices and college kids make plans for their next road trip demand for bikes and scooters is set to rise. The availability of parts has also improved drastically as compared to last year. Pick up in rural sales (55% of total sales) and attractive discounts ahead of the all-important festive season may drive volume growth. 📈

India’s largest two-wheeler maker expects margins to improve led by price hikes and a cool-off in raw material prices. PS, Hero MotoCorp increased prices by up to Rs 3,000 in July. Hero is also entering the rapidly-growing EV space with its first offering under the Hero brand expected to launch around Diwali. FYI – Hero is the largest shareholder in Ather. Here’s its Q1 report card for those who care: 📊

- Revenue: Rs 8,393 cr; +53% YoY (vs Est: Rs 8,600 cr)

- EBITDA: Rs 941 cr; +83% YoY (vs Est: Rs 1,042 cr)

- EBITDA Margin: 11.2% (vs Est: 12.1%)

- Net Profit: Rs 625 cr;+71% YoY (vs Est: Rs 771 cr)

Hero MotoCorp is +14% YTD.

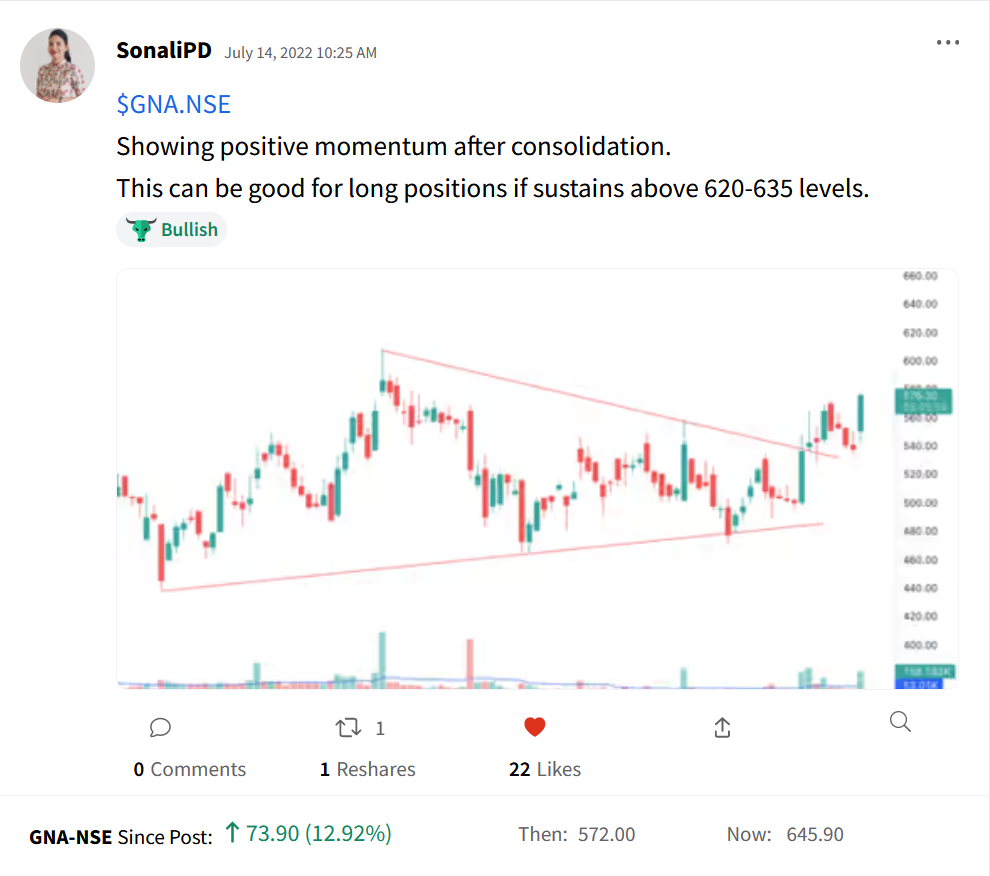

Stocktwits Spotlight

GNA Axles is up 13% in the past month! Awesome call (as always) by Sonali on Stocktwits. FYI – she is one of the sharpest breakout traders, so follow her for more awesome trading ideas like this and add $GNA.NSE to your watchlist. Here’s the link: https://bit.ly/3PpR3g7.

Earnings Highlights

- Muthoot Finance: Net Interest Income: Rs 2,482 cr; (-8% YoY) | Net Profit: Rs 802 cr; (-17% YoY)

- Indiabulls Real Estate: Revenue: Rs 272 cr; (-64% YoY) | Net Loss: Rs 60 cr;

- Life Insurance Corporation of India: Revenue: Rs 98,352 cr; (+20% YoY) | Net Profit: Rs 683 cr;

- Apollo Tyres: Revenue: Rs 5,942 cr; (+30% YoY) | Net Profit: Rs 191 cr; (+58% YoY)

- Zee Entertainment Enterprises: Revenue: Rs 1,775 cr; (+4% YoY) | Net Profit: Rs 106 cr; (-50% YoY)

Links That Don’t Suck

🙏🏻 ‘Tu Dar Mat’ Was Rakesh Jhunjhunwala’s Mantra And He Himself Was Truly Fearless: Rashesh Shah

🕺 Apple Is Allegedly Threatening To Fire An Employee Over A Viral Tiktok Video

🤐 A Lebanese Man Robbed A Bank Of His Own Money & People Are Hailing Him As A ‘National Hero’

❌ FIFA Suspends All India Football Federation Due To “Undue Influence From Third Parties”