Tale of the Tape

Good evening, y’all! Welcome back to another week in the markets. 😎

Nifty and Sensex snapped their three-day losing streak. Cool off in oil prices and short covering pushed markets higher. Midcaps (+0.1%) and Smallcaps (-0.9%) traded mixed. The advance-decline ratio stood in favour of the bears. 🐻

Most sectors ended in the green. PSU Banks (+2%) pulled back sharply. FMCG (+1.1%) and Autos (+0.9%) also witnessed healthy gains. Real Estate (-1%) stocks ended lower for a fifth-straight day. 📉

This cement stock is up +50% in 2022. Know what’s driving the optimism below. 🔥

M&M overtook Tata Motors to become India’s 2nd largest car maker. More details below. 🥈

Oil refining companies were in focus after the GOI reduced the export tax on oil to Rs 10,500 per tonne. RIL and Chennai Petroleum gained +1%. ✅

Canfin Homes tanked 7% after the sudden resignation of Girish Kousgi, MD & CEO. 👀

Welspun Corp (+9%) received a large order to supply 100,000 MT of industrial pipes. 💰

Deep Industries (+13%) hit a new all-time high. Domestic brokerage firm InCred Equities sees a +30% upside from current levels. 🚀

South Indian Bank (+2%) aims to scale up the retail lending business. 📊

Cryptos continued to get hammered. Bitcoin was down 8%. Ethereum slipped over 10%. 🤕

Here are the closing prints:

| Nifty | 17,622 | +0.5% |

| Sensex | 59,141 | +0.5% |

| Bank Nifty | 40,904 | +0.3% |

Bhaiya, Ye Rally Rukti Kyu Nahi Hai?

Ambuja Cement gained +9% intraday to hit a new all-time high. The stock is up +50% this year vs just a 2% gain for the Nifty50 index. I know what you’re thinking: what the hell is going on here? 🤯

In May, the Adani Group reached an agreement with Switzerland-based cement giant Holcim Group to acquire both Ambuja Cements and ACC for an insane $10.5 billion. The mega deal with all the complexities of an open offer, legal and regulatory approval was eventually completed last week. Gautam Adani, the world’s 2nd richest person, took over as the chairman of Ambuja Cements and his elder son Karan was appointed as a non-executive director. 😎

The change in ownership plus the new management structure has raised hopes of the company’s turnaround, leading to its re-rating. Going forward, the Adani Group will invest Rs 20,000 cr to double its current manufacturing capacity (~66 million tons) over the next five years. Markets love when promoters are pro-growth and willing to invest thousands of crores. Rumours of further consolidation in the sector have also boosted the positive sentiment. 📈

Big Picture: The GOI will spend Rs 7.5 lakh crore to build new roads, homes, dams, and other projects. Rapid urbanization, a growing middle class, and affordable housing are expected to drive the cement sector’s growth over the next several decades. Ambuja and ACC have established brands with immense manufacturing depth and a robust pan-India distribution network. 💯

Taking The Lead

Mahindra & Mahindra overtook Tata Motors to become India’s second most valuable car maker. Hurray! 🥂

What’s the deal bro? M&M is legit killing it where it matters the most – business. For context, M&M’s latest Scorpio-N SUV registered a record-breaking 1 lakh bookings in less than 30 minutes. FYI, that equates to a total order book of $2.3 billion, a world record!!! They continue to gain market share in the lucrative SUV segment and the excitement around EV launch are key positives, said experts. Besides this, robust demand in its tractor business (thanks to healthy monsoons) has only increased its appeal. PS – In Q1, the company reported its highest ever quarterly profits. 💸

On the other hand, Tata Motors continued to disappoint. Weakness in its flagship Jaguar Land Rover (JLR) business remains a major source of headache for the company. JLR sales have been under constant pressure owing to supply constraints mainly chip shortage. Markets had anticipated these issues to resolve over time but back-to-back lockdowns in China and geopolitical tensions delayed the recovery. As a result of this, JLR continues to report MASSIVE losses and remains free cash flow negative to date. 👎

Bottomline – Markets love stocks that are cheap and profitable. *cough* tech stocks *cough*. So do not forget to check the fundamentals of the company before investing in it. You can find all the relevant information about a stock, expert views, and trading calls (for short-term traders) only on https://stocktwits.com/ 💯

Stocktwits Spotlight

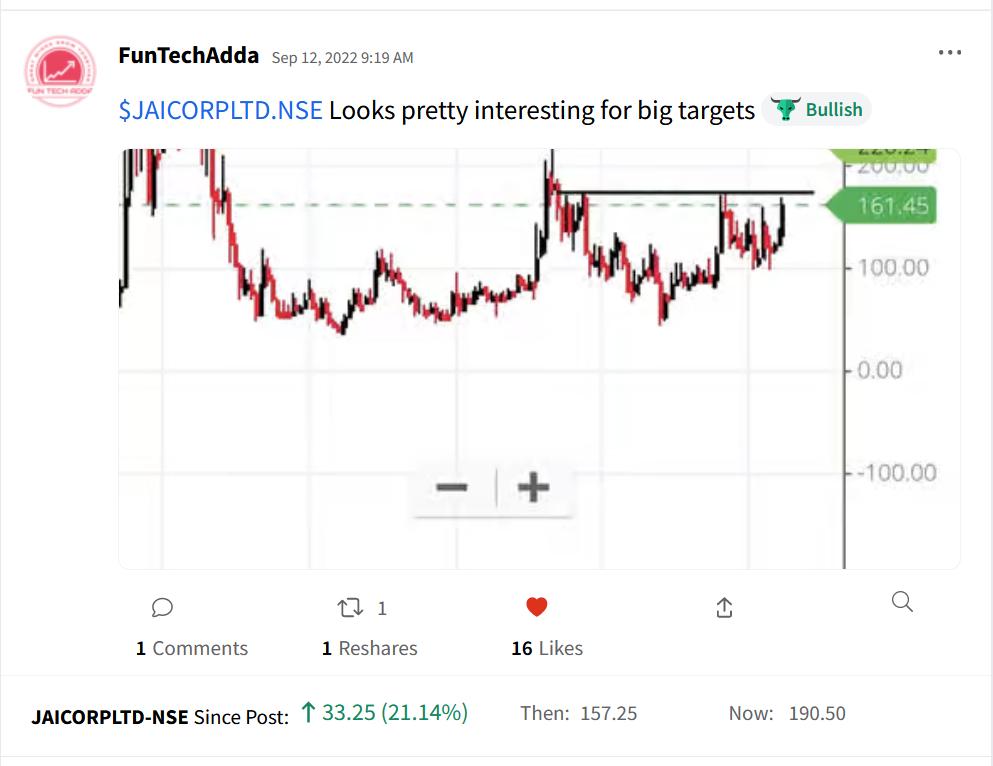

Jai Corp is up +21% since FunTechAdda shared their view on Stocktwits. Follow them for more amazing trade ideas and add $JAICORPLTD.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3qQvZFU.

Links That Don’t Suck

🔥 Can Nifty Fall Below 17,000? | Sectors to Watch Out | Stock Room Sunday

🙏🏻 How crypto billionaire Sam Bankman-Fried survived the market wreckage and still expanded his empire

😍 GTA 6 gameplay leaks online in 90 videos

👽 NASA’s Perseverance Rover Samples Indicate That Life Once Existed On Mars

🎤 Justin Bieber’s Tour To India Has Been Called Off Due To His Health Issues

🏏 KL Rahul will open in World Cup, Kohli our third opener: Rohit

🐆 7 decades after extinction, cheetahs land in India’s heart