Tale of the Tape

Good evening everyone and welcome to the new trading week. 🎲

Markets were super volatile as the second and final phase of voting in Gujarat began today. Nifty and Sensex closed flat. The Midcap Index (+0.3%) hit a new high and Smallcaps (0.4%) also outperformed. 📈

Most sectors closed higher. Metals (+1.9%) and PSU Banks (+1.2%) were the stars of the day. IT stocks (-0.5%) witnessed profit booking. 💸

ICICI Bank closed up for the first time in three days as investors cheered the private lender’s growth plans. Read more below. 💯

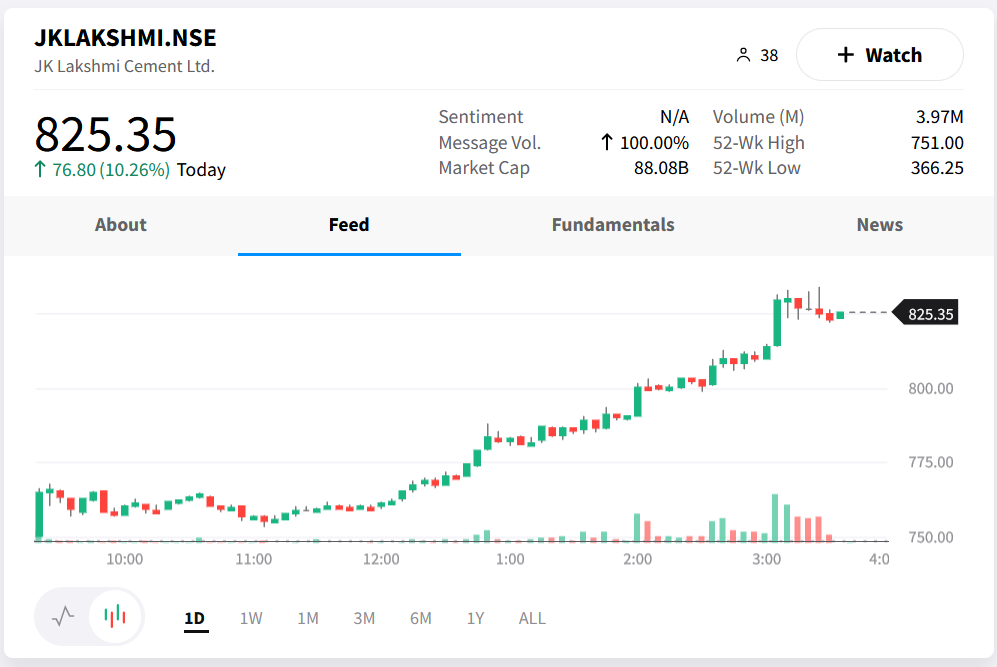

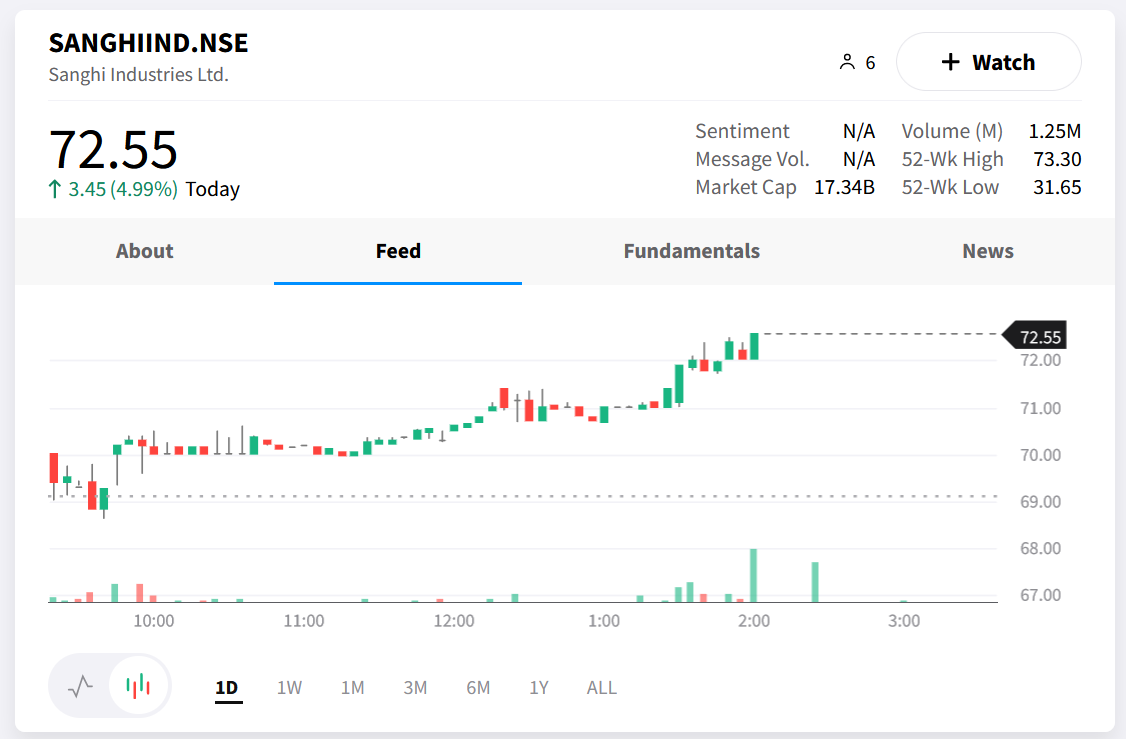

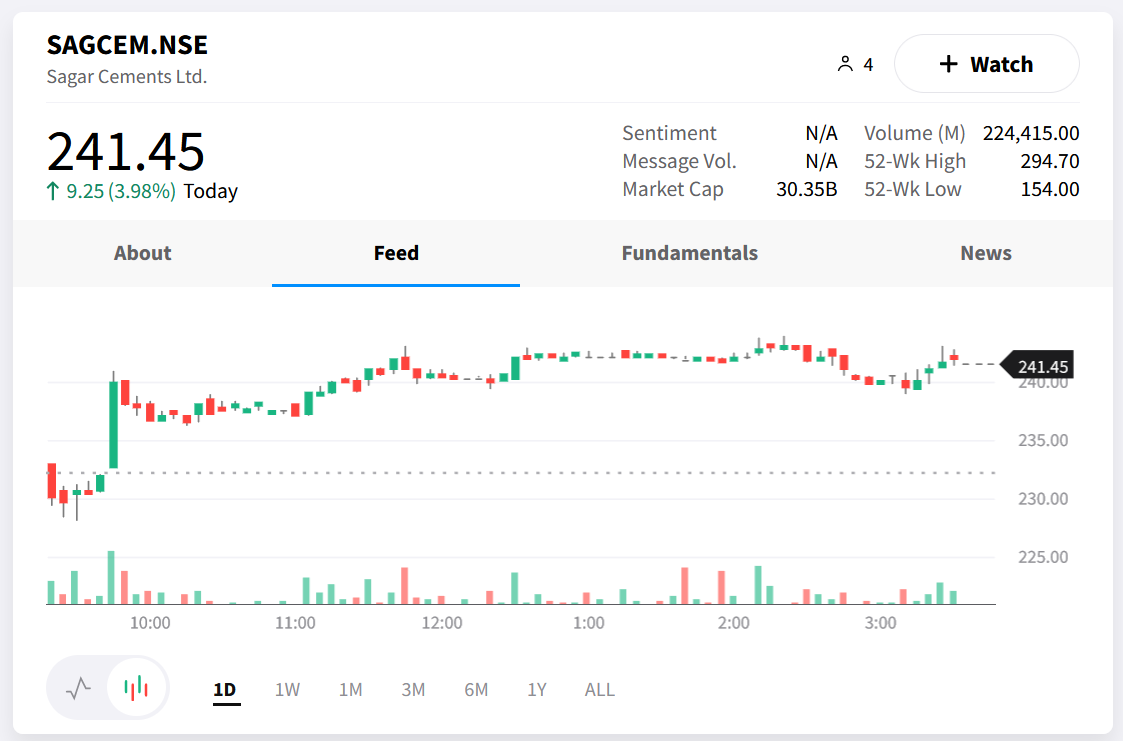

Cement stocks were in high demand. JK Lakshmi Cement rallied by +10%. Sanghi Industries and Sagar Cements rose by +5% each. Check out their charts below. 🚀

M&M Financial Services (+5%) closed up for a fourth straight day on a solid November business update. 📊

Gujarat Fluorochemicals tanked 6% after 20 lakh shares (1.8% equity) changed hands in a large block deal. 🤝

MTAR Technologies (+2%) hit a new all-time high. The company is confident of achieving 55%-60% topline growth in FY23. 💯

Angel One (-4%) added 3.2 lakh new customers in November, down 7% over the previous month. 👎

Persistent Systems dropped 2% after JP Morgan downgraded the stock. They see an additional 4% downside from current levels. 😶

SJVN (+5%) bagged a 200 MW solar project worth ₹1,200 cr from Maharashtra State Electricity Distribution Company Ltd (MSEDCL). ⚡

Cryptos extended their gains. Bitcoin and Ethereum rose 2%-3% each. Solana, Shiba Inu and Litecoin rallied between 4%-8%. ❣️

Here are the closing prints:

| Nifty | 18,701 | +0.1% |

| Sensex | 62,834 | -0.1% |

| Bank Nifty | 43,332 | +0.5% |

Making The Big Bucks

ICICI Bank held its 2022 Analyst Day meeting over the weekend. They highlighted their go-to-market strategy and gave investors an update on their digital initiatives and future growth roadmap. Here are the top takeaways: 💯

– ICICI Bank has adopted a micro-market-based approach for determining growth and market share targets in different regions. The business centre manager can assess the opportunity better rather than having targets dictated by the Head Office. The private lender will delegate more powers to the regional teams to understand the local markets better and capitalize on the business opportunities. 📈

– Investors are also excited about their Corporate 360 strategy. As part of it, they’ll provide corporate customers, their vendors and dealers with a one-stop solution to efficiently manage working capital requirements. This platform helps in engaging the entire ecosystem at scale and generates revenue opportunities across different levels. 💰

– ICICI Bank has invested heavily over the past few years to build tech stacks across its business verticals. Digital has emerged as a force multiplier driving 1.5-2x growth across key segments at a far lower customer acquisition/servicing cost. They have also partnered with multiple fintechs/start-ups to acquire customers, manage credit risk and improve RoE. Using the insights gained from its digital initiatives, ICICI Bank aims to provide a complete suite of banking and financial services instead of specific products. 🏦

ICICI Bank is +26% so far this year. Domestic brokerage firm Emkay has a target price of Rs 1,225 p/sh (+30% from current levels.) 🤑

Off The Charts

Cement stocks were in high demand. JK Lakshmi Cement rallied by +10%. Sanghi Industries and Sagar Cements rose by +5% each. What’s the deal bro? 🧐

Cement demand is expected to pick up big time in the next six months. Robust housing market and GOI’s infrastructure push are key growth drivers. Cement makers citing this increased demand have increased prices by Rs 15-30 per bag, according to reports. 💸

Additionally, raw material prices have cooled off sharply in recent months. For instance, petcoke prices are down 25%. This in turn is expected to boost margins and profitability. Reports of further consolidation in the cement sector have also sent the share prices of several regional/smaller players through the roof. 🚀

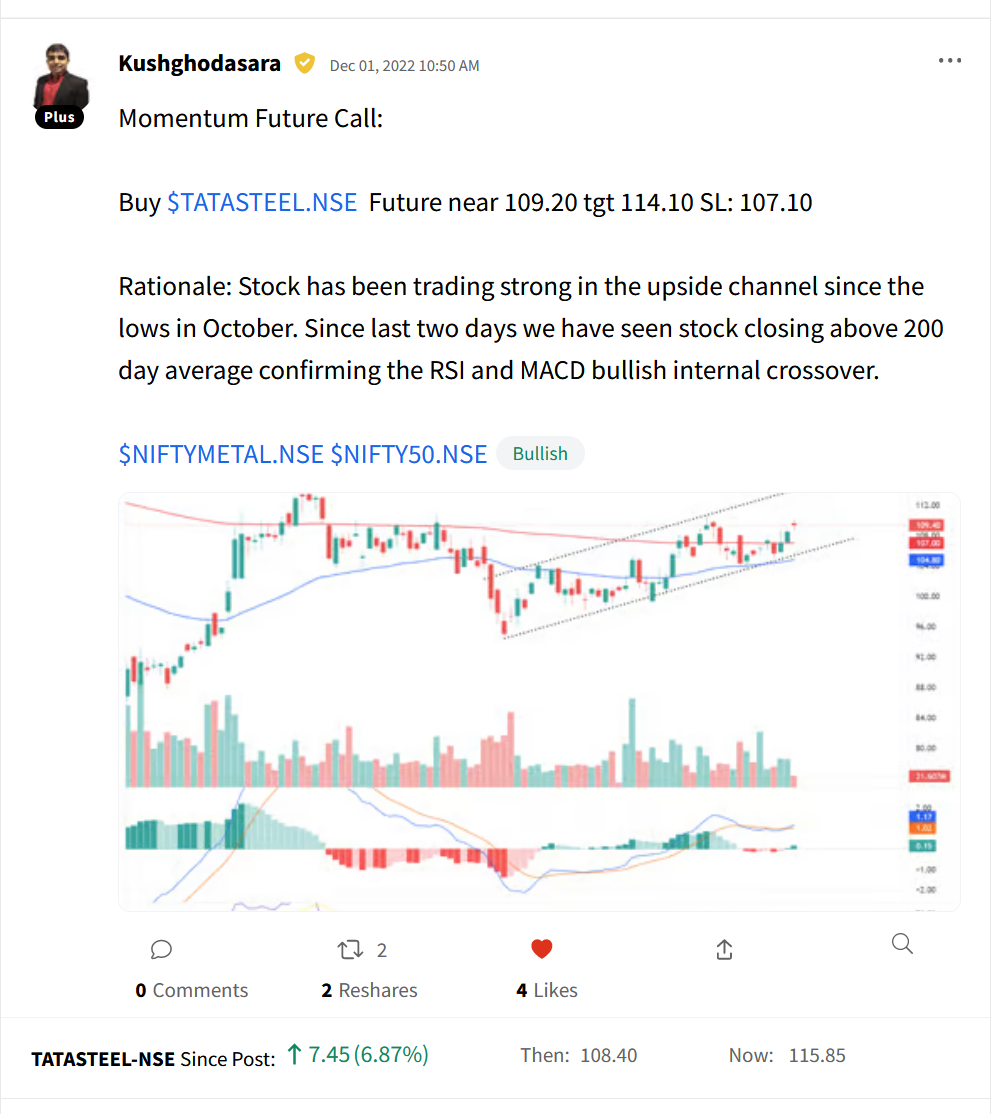

Stocktwits Spotlight

Here’s an interesting chart setup by Kush Ghodasara on Stocktwits. Follow Kush for more awesome trading insights and add $TATASTEEL.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3F1ZTh0.

Links That Don’t Suck

🤖 Everything You Need To Know About AI Bot ChatGPT

👻 The Metaverse Is A New Frontier For Earning Passive Income

🙏 MBA Grad Turns 5 Tonnes of Banana Waste/Month into Eco-Friendly Crafts, Earns Lakhs

🙈 Watch: Twin Sisters, Both IT Professionals, Marry Same Man In Mumbai. Case Filed

🔥 Kylian Mbappe Overtakes Legendary Pele To Break 60-Year Old FIFA World Cup Record