Tale of the Tape

Good evening everyone and Happy Republic Day! ❤️

Markets were down big today. Nifty and Sensex dropped over 1% each, the worst single-day fall in over a month. Mixed earnings, weak global cues and a sell-off in Adani Group stock made investors nervous. Midcaps (-1.5%) and Smallcaps (-1.2%) also witnessed deep cuts. The market breadth was extremely weak with 4 stocks falling for every gainer. 🚨

It was a sea of red across the board. Not a single sector closed higher. Banking (-2.5%) and Financials (-2%) were the biggest casualties. Energy (-2%) and Real Estate (-1.8%) also weren’t spared. 🤕

TVS Motor Co rallied +5% on strong Q3 results. More details below. 📊

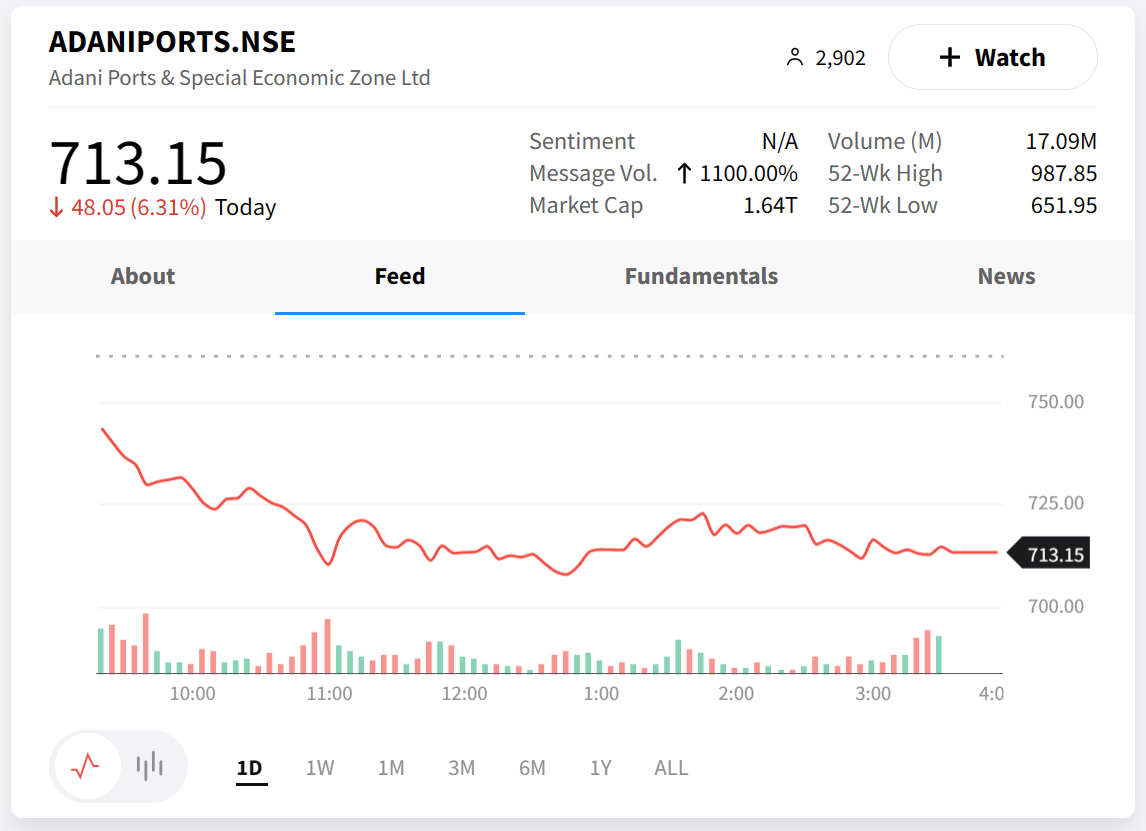

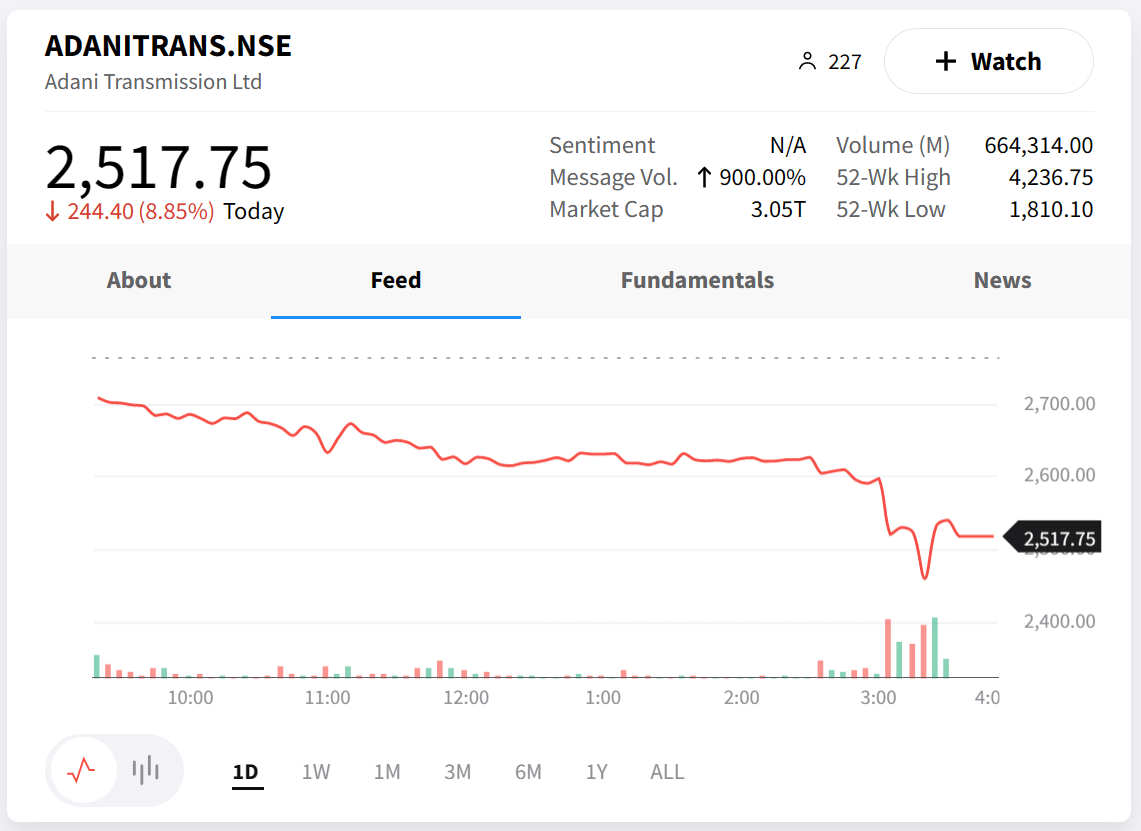

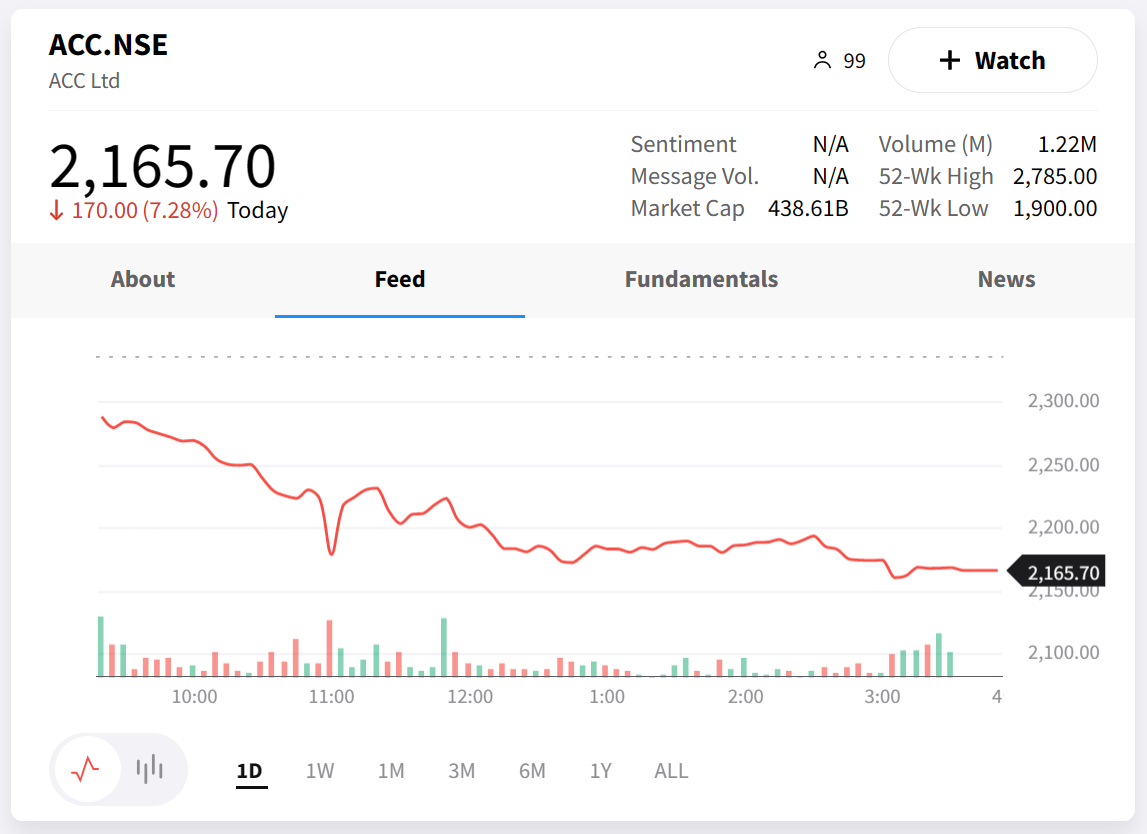

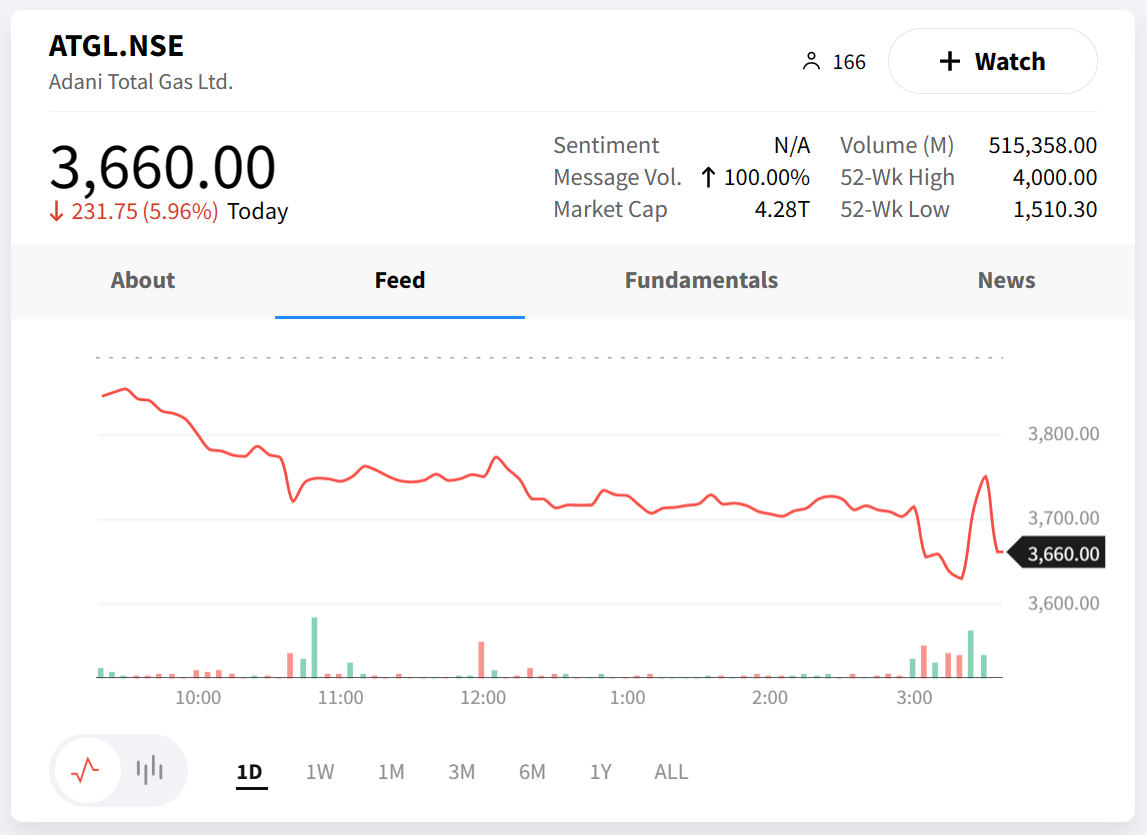

Adani Group stocks got hammered. Adani Ports (-7%) was the top loser on Nifty. Adani Transmission, ACC and Adani Total Gas were down 7%-11% each. Check out their (scary) charts below. 📉

Bharti Airtel will increase the prices of entry-level plans by 57% in 7 states. 💸

Zomato tanked over 9% to hit the lowest level since July last year. They recently announced that they will stop the 10-minute delivery service due to operational challenges. 🚫

Star Health Insurance is in talks to enter the life insurance business, according to media reports. ✌️

Teamlease Services will consider the proposal of a share buyback on Feb 3. 💰

Earnings Reaction. United Spirits dropped 6% intraday, the worst single-day fall since July 27. Home First Finance (+6%) closed up for a fifth straight day. 😎

The global crypto market cap slipped by 3%. Bitcoin was down 2%. Ethereum slipped over 5%. Cardano, Doge, and Solana crashed by 6% each. 👎

Here are the closing prints:

| Nifty | 17,892 | -1.3% |

| Sensex | 60,205 | -1.3% |

| Bank Nifty | 41,647 | -2.5% |

Earnings Roundup

TVS Motor Co jumped +5% on outstanding Q3 results. Topline beat Street estimates driven by bumper demand and market share gains. Average realizations jumped 15% YoY thanks to price hikes and higher sales of top-end bikes. This in turn boosted their overall profitability, which is a positive. Here’s its report card: 📊

- Revenue: Rs 6,545 cr; +15% YoY (vs Est: Rs 6,345 cr)

- EBITDA: Rs 659 cr; +16% YoY (vs Est: Rs 651 cr)

- EBITDA Margin: 10.1%; (vs Est: 10.3%)

- Net Profit: Rs 353 cr; +22% YoY (vs Est: Rs 352 cr)

TVS is also betting big on the EV business which has paid off as they achieved a 14% market share in Q3. That’s insane considering they have only one product in this category which they launched just three years back!!! 💯

Going forward, TVS will invest north of Rs 1,000 cr to extend its family of electric scooters and also launch an electric 3-wheeler. They are confident of selling more than 1 lakh units in FY23 and aim to sell 25,000 EVs per month by March next year. 💸

TVS Motor is +72% in the past year. 📈

Chartbusters

Adani Group stocks took a major L today after Hindenburg Research raised concerns over stock price manipulation and the financial health of the conglomerate. 🔍

Hindenburg Research, a US-based forensic financial research firm, released a super detailed report titled “Adani Group: How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History”. In this report, they raised serious questions about the Group’s shareholding structure, related-party transactions and massive debt. Moreover, Hindenburg even disclosed that they have a short position in Adani Group stocks through US-traded bonds and non-Indian-traded derivative instruments. 🚨

FWIW, this isn’t the first time the Adani Group has run into trouble with a foreign research firm. In September 2022, CreditSights, a subsidiary of global credit rating firm Fitch, raised doubts over the Group’s debt levels. Next month, S&P Global Ratings withdrew their credit rating for Adani Transmission at the company’s request. 🫢

What’s more interesting is the timing of the Hindenburg report. As we all know, Adani Enterprises’ Rs 20,000 cr follow-on public offer (FPO), the largest ever in Indian history, opens for subscription on Jan 27. The Adani Group released a statement denying any wrongdoing and called the whole episode an attempt to undermine the Group’s reputation and damage the FPO. ⚔️

Meanwhile, panicked investors rushed for the exit door. Adani Ports (-7%) was the top loser on Nifty. Adani Transmission, ACC and Adani Total Gas were down 7%-11% each. Check out their (scary) charts below: 📉

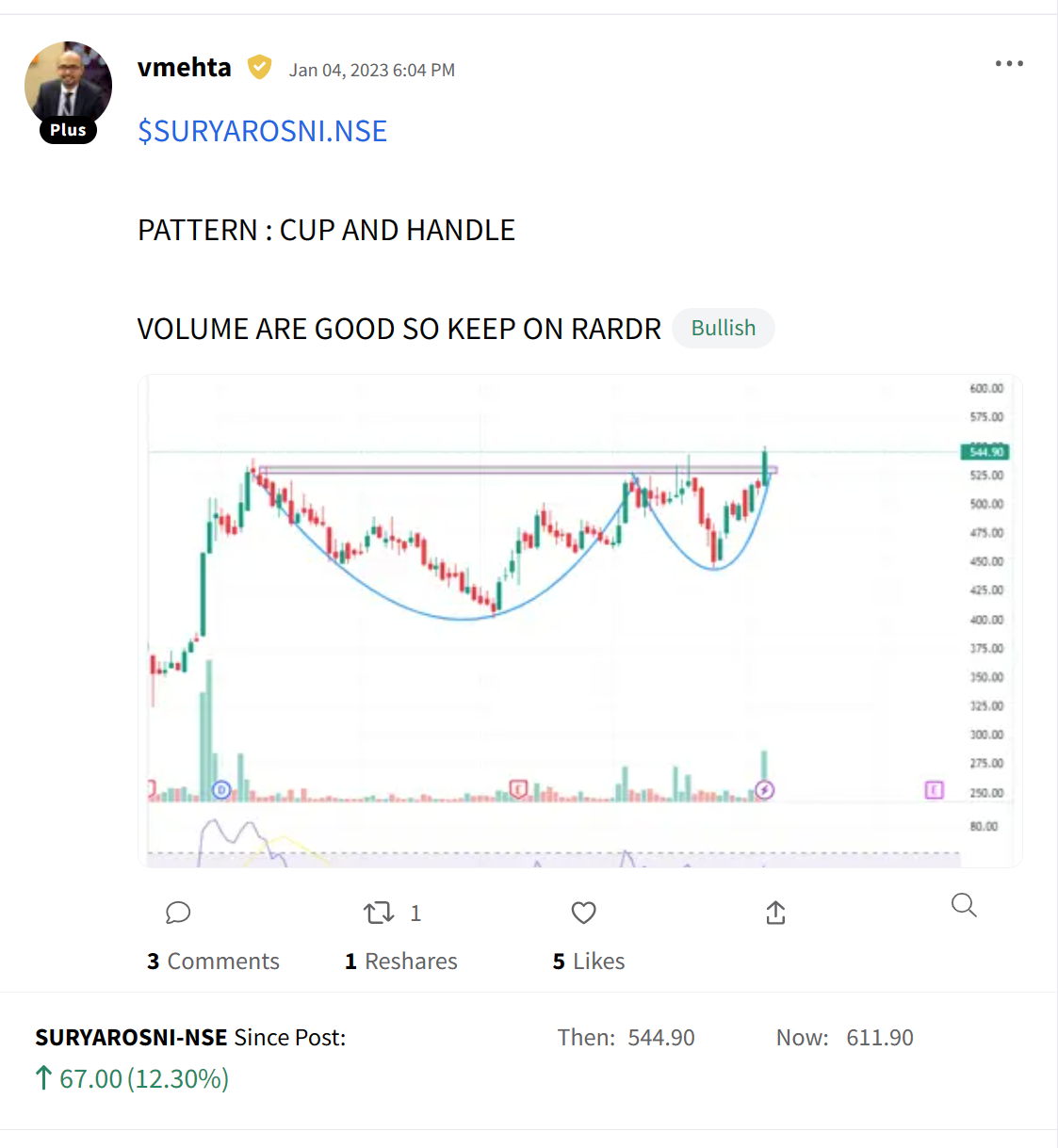

Stocktwits Spotlight

CMT chart guru Vishal Mehta gets it right again! Surya Roshni is up +12% in January. That deserves a huge round of applause! Follow Vishal for more awesome trading insights and add $SURYAROSHNI.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3JadHtz.

Earnings Highlights

- Cipla: Revenue: Rs 5,810 cr; (+6% YoY) | Net Profit: Rs 801 cr; (+10% YoY)

- United Spirits: Revenue: Rs 2,781 cr; (-4% YoY) | Net Profit: Rs 111 cr; (-64% YoY)

- Home First Finance Company: Net Interest Income: Rs 126 cr; (+30% YoY) | Net Profit: Rs 59 cr; (+28% YoY)

- Nazara Technologies: Revenue: Rs 315 cr; (+69% YoY) | Net Profit: Rs 18 cr; (+1.1X YoY)

- Indus Towers: Revenue: Rs 6,765 cr; (-2% YoY) | Net Loss: Rs 708 cr;

Calendar