Tale of the Tape

Happy Monday everyone. 🙏

Markets snapped their 3-day losing streak. Nifty and Sensex recovered sharply in the final hour of trade to end in the green. Midcaps (-0.2%) and Smallcaps (-0.1%) closed with minor losses. 📈

Most sectors closed lower. Energy (-3%) stocks dropped the most. IT (+1.1%) and PSU Banks (+0.6%) took a break from the beating. 👍

Adani Enterprises FPO faces a serious risk after the Hindenburg report. Read our detailed analysis below. ⚔️

Bajaj Finance (+5%) was the top gainer on Nifty. More details below. 🚀

Tata Motors will increase car prices from Feb 1. 🚘

Hinduja Global will buyback 60 lakh shares at Rs 1,700 apiece; +30% from current levels. 💸

Dilip Buildcon won a Rs 1,370 cr order from the National Highway Authority of India (NHAI). 🚧

Earnings reaction. BEL hit a 6-month low. Seshasayee Paper & Boards (+6%) snapped its 4-day losing streak. 📊

Cryptos continued to climb higher. Bitcoin and Ethereum rose 2%. Solana bounced +5%. 🔥

Here are the closing prints:

| Nifty | 17,649 | +0.3% |

| Sensex | 59,500 | +0.3% |

| Bank Nifty | 40,387 | +0.1% |

Adani FPO At Risk?

The Adani-Hindenburg drama has turned into a full-blown war (of words). The Adani Group released a 413-page report in retaliation against the American research firm over the weekend. 🤼

Adani called the Hindenburg report a “malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive”. Basically, just a corporate way of saying F&*# off! 🤬

Adani took matters to another level calling the whole episode “a calculated attack on India, the independence, integrity and quality of Indian institutions, and the growth story and ambition of India”. On the other hand, Hindenburg blamed Adani for resorting to nationalism to avoid their questions (88 to be precise). 🤯

The Adani clarification aimed to not only address investor fears but also ring the cash registers for their record Rs 20,000 cr follow-on public offer (FPO). PS – The sharp sell-off in Adani Group stocks (particularly Adani Enterprises) has seen the company’s stock price drop below the FPO price band. As a result of this, their FPO was subscribed to only 2% on day 2. If it fails to get the minimum 90% subscription, then the FPO will be deemed unsuccessful. 🚨

However, Adani Group CFO Jugeshinder Singh remains confident that the FPO will sail through on strong institutional demand. He explains that due to a low free float, big investors like mutual funds may not be able to buy a large number of shares from the open market. Hence, he’s hopeful that higher institutional demand may drive the FPO subscription. Grab your popcorn guys, this one’s gonna be crazy! 🍿

Big, Bigger, Biggest!!!

Bajaj Finance rallied +5% intraday after unveiling their 5-year roadmap named “Long Range Strategy” (LRS) framework. Here are the top takeaways: 💯

- Bajaj Finance aims to become India’s largest payments and financial services company with a 4%-5% market share in retail lending. As part of the strategy, they have recently expanded into Loan against property (LAP) business for MSME customers. Bajaj Finance will also enter the new auto loans and microfinance in FY24. They will also open 100 retail touchpoints in Uttar Pradesh, Bihar and North-East during this period. 📈

- Bajaj Finance said they aim to build these businesses with a long-term approach that focuses on risk management. Their goal is to become a “top 5 player” as per market share in each of these businesses and achieve a consistent 19-21% ROI over 10 years. 💰

- Bajaj Finance’s omnichannel strategy will receive a big boost as their super app goes fully live by March end. They aim to leverage their huge customer franchise and cross-sell other products and services using their digital app. Of all service requests raised, 22% are coming through the app, which could increase to 40-45% within the next few quarters, as per experts. 👍

Bajaj Finance’s Q3 results were also decent. Asset quality or the % of bad loans continues to remain one of the lowest in the industry. This in turn boosted their profitability which hit an all-time high. The big question now is – can this be the start of a new bull for India’s favourite NBFC? Watch out for this one. 🙏

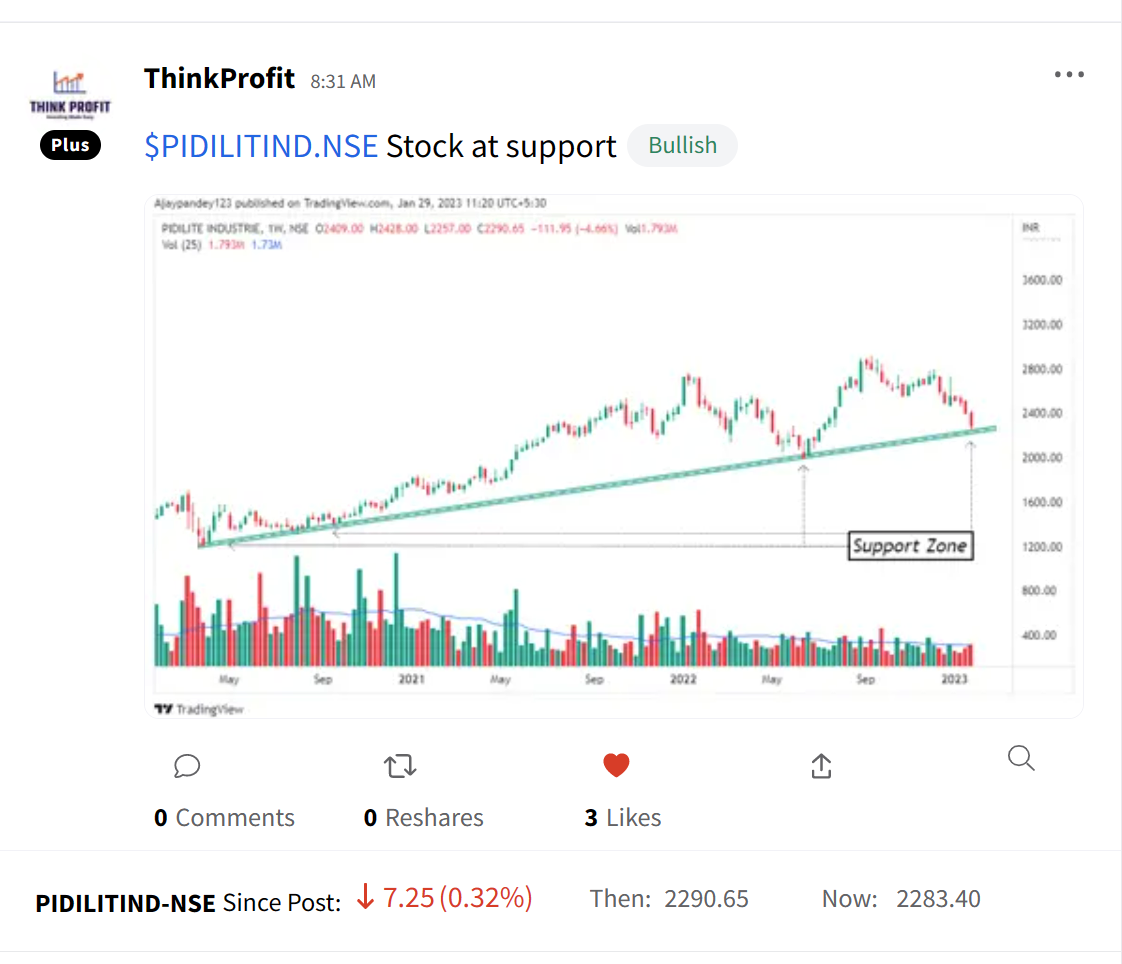

StockTwits Spotlight

ThinkProfit is betting on a reversal in Pidilite from long-term trendline support. Follow them for more awesome trading insights and add $PIDILITE.NSE to your watchlist and track the latest from our community. Here’s the link: https://bit.ly/3Y282tu.

Earnings Highlights

- Bharat Electronics: Revenue: Rs 4,131 cr; (+12% YoY) | Net Profit: Rs 599 cr; (+3% YoY)

- Kajaria Ceramics: Revenue: Rs 1,091 cr; (+2% YoY) | Net Profit: Rs 74 cr; (-39% YoY)

- Laurus Labs: Revenue: Rs 1,545 cr; (+50% YoY) | Net Profit: Rs 203 cr; (+32% YoY)

- Seshasayee Paper & Boards: Revenue: Rs 556 cr; (+66% YoY) | Net Profit: Rs 112 cr; (+17X YoY)

- Gail: Revenue: Rs 35,365 cr; (+37% YoY) | Net Profit: Rs 246 cr; (-93% YoY)

Calendar

Links That Don’t Suck

🎶 Google’s New AI Turns Text Into Music

🪙 Bitcoin Mining Is Booming Despite Market Headwinds

😎 Self-Made Millionaire: Here Are 8 Things Rich People Do Differently That Make Them ‘Ultra Wealthy’

🔥 ‘Pathaan’ SHATTERS Box Office Record; Enters Rs 200 Cr Club In Just 4 Days

⚽ Transfer News And Rumours LIVE: Brighton Turn Down £70m Arsenal Bid For Caicedo