Tale of the Tape

Hey, guys. Markets inched higher ahead of the Union Budget announcement. 📈

Nifty and Sensex pulled back after opening lower as investors bought the morning dip. Midcaps (+1.8%) and Smallcaps (+3%) were up big time. The market breadth was extremely positive with nearly four stocks gaining for every loser. 🚀

Except for IT (-1.2%) and Pharma (-1%), all the other sectors ended in the green. PSU Banks bounced +4%. Autos (+1.9%) and Metals (+1.5%) also witnessed healthy gains. 💪

Adani Enterprises’ Rs 20,000 cr FPO got fully subscribed on the final day! 💰

Tech Mahindra was the top loser on Nifty on weak Q3 results. Read more below. 📊

This recently listed microfinance company can give +30% returns. More details below. 😇

Vedanta (+4%) is in talks to restart the Sterlite copper plant in Tamil Nadu, according to media reports. 🏭

Ultratech Cement will buy a 70% stake in Oman’s DUQM Cement for $2.25 million. ✅

Earnings reaction. REC jumped +5% intraday. L&T closed down for the 7th straight day. 📉

Kansai Nerolac will sell a 24-acre plot to the Hiranandani Group for Rs 655 cr. 💸

KEC International won multiple new orders worth Rs 1,131 cr. 🚧

Cryptos trended lower on renewed fears of further rate hikes. Bitcoin and Ethereum slipped over 3% each. Ripple, Matic and Solana are down 4%-5% each. 🤕

Here are the closing prints:

| Nifty | 17,662 | +0.1% |

| Sensex | 59,549 | +0.1% |

| Bank Nifty | 40,655 | +0.7% |

Earnings Roundup

Tech Mahindra was the top loser on Nifty after falling over 4% intraday on weak Q3 results. The company reported the slowest growth amongst all the Tier 1 IT services companies. Key verticals like BFSI (-0.5%) and manufacturing (flat) witnessed a demand slowdown. North America, which accounts for nearly 50% of overall sales, was down -0.4% over the previous quarter! Tech Mahindra signed new deals worth $795 million in Q3; up 11% during the same period. Here are its key stats: 📊

- Revenue: $1.7 billion; +2% QoQ (vs Est: $1.7 billion)

- Net Profit: Rs 1,297 cr; +1% QoQ (vs Est: Rs 1,300 cr)

Going forward, Tech Mahindra is seeing signs of cost-cutting and vendor consolidation, which is a negative. PS- revenue from their top-5 clients declined 5% QoQ. They did not share any guidance for the rest of the year! 👎

Tech Mahindra is down 33% in the past year. 📉

Smart Money

Fusion Microfinance is in red hot form. The stock is +20% in the past month vs a -5% drop for the Nifty Financial Services Index during the same period. 🔥

What’s the deal bro? Founded in 1994, Fusion Microfinance provides small ticket loans mainly to women and female entrepreneurs living in rural and semi-urban areas. They have a robust pan-India network of 966 branches in 19 states and union territories across India serving nearly 3 million active borrowers. 🏦

Fun fact: It is one of the youngest companies amongst India’s top 10 NBFC-MFIs with Assets Under Management (AUM) of Rs 7,000 cr. They have a unique business model wherein a small number of women form a group (5 to 7) and guarantee one another’s loans. 📈

Going forward, they aim to scale up their MSME lending business and leverage tech to offer personalized finance solutions. Fusion’s decade-long experience in the high-growth microfinance segment, robust asset quality and strong parentage are key positives, said experts. At 1.4x price-to-book (P/B), the stock is undervalued compared to larger peers. PS – global brokerage firm CLSA has a target of Rs 550 per share; +35% from current levels! 🤑

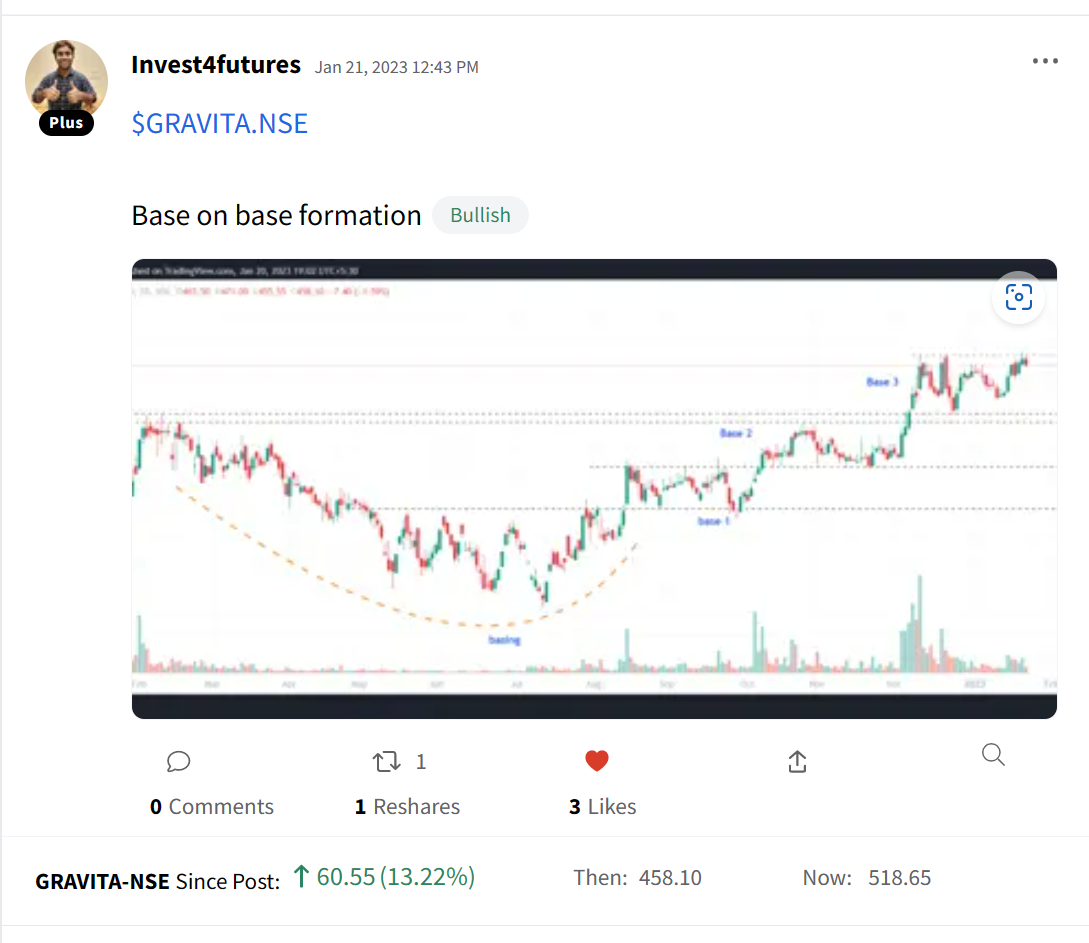

Stocktwits Spotlight

Gravita India hit a new all-time high. Huge shoutout to Chintan Jain aka Invest4futures for catching the move early (as always). Follow him for more awesome trading insights and add $GRAVITA.NSE to your watchlist and track its performance. Here’s the link: https://bit.ly/40eSg0o.

Disclaimer: All ideas shared by Invest4futures are for educational purposes. Invest4futures is neither SEBI-registered nor an investment advisor.

Earnings Highlights

- Larsen & Toubro: Revenue: Rs 46,390 cr; (+17% YoY) | Net Profit: Rs 2,553 cr; (+24% YoY)

- Bharat Petroleum Corporation: Revenue: Rs 1,19,158 cr; (+18% YoY) | Net Profit: Rs 1,960 cr; (-20% YoY)

- REC Ltd: Revenue: Rs 9,782 cr; (-3% YoY) | Net Profit: Rs 2,915 cr; (+5% YoY)

- Sun Pharmaceutical Industries: Revenue: Rs 11,241 cr; (+14% YoY) | Net Profit: Rs 2,166 cr; (+5% YoY)

- Indian Oil Corporation: Revenue: Rs 2,04,740 cr; (+23% YoY) | Net Profit: Rs 448 cr; (-92% YoY)

Calendar

A ton of companies will post their Q3 results tomorrow… Here are all the important earnings you don’t want to miss: