Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 37 in 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

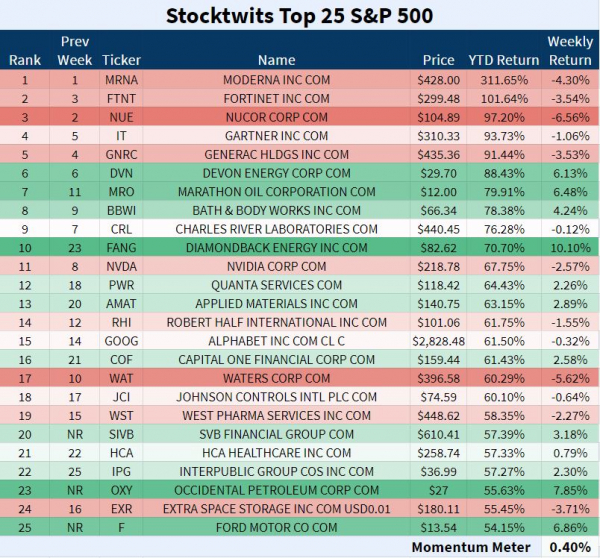

Here are your Stocktwits Top 25 Lists for Week 37:

SPY

ST Top 25 S&P 500

The ST Top 25 S&P 500 flipped the script in Week 37.

12 of 25 names closed positive.

Diamondback Energy flew 10.10% and improved 13 rankings. You can read about $FANG on the Winners list below.

Waters Corp got whacked 5.6% as the list’s second-worst performer. It’s a Sinner below.

Ford Motor Co, Occidental Petroleum, and SVB Financial are the list’s Freshmen.

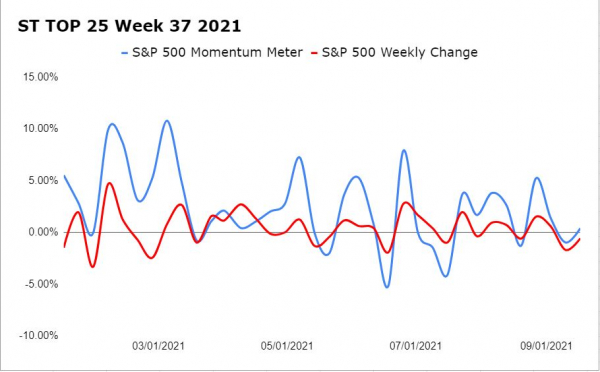

The Stocktwits Top 25 S&P 500 Momentum Meter gained 0.40% while the S&P 500 fell 0.57%. The 0.97% differential in favor of the top stocks shows the full index was far weaker.

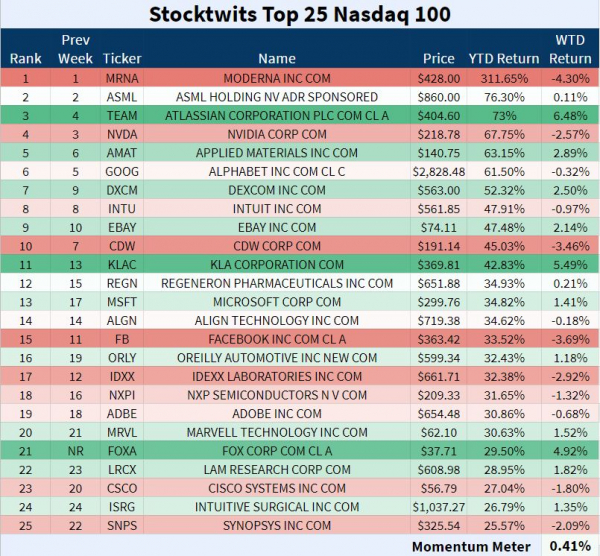

N100

The Big Cap Nasdaq 100

The ST Top 25 N100 List flexed its muscles in Week 37.

13 names traded higher.

Fox Corporation snapped back 4.92% and completed its buyout of MTZ Entertainment. $FOXA is in the Winners section below.

Atlassian Corporation marched to new highs and improved a spot on the list. $TEAM is ranked #3.

Fox Corporation was the only Freshman.

The ST Top 25 Nasdaq 100 Momentum Meter jumped 0.41% in Week 37 while the full Nasdaq 100 dipped 0.69%. The 1.10% difference shows the top stocks outperformed the full index by a fair margin.

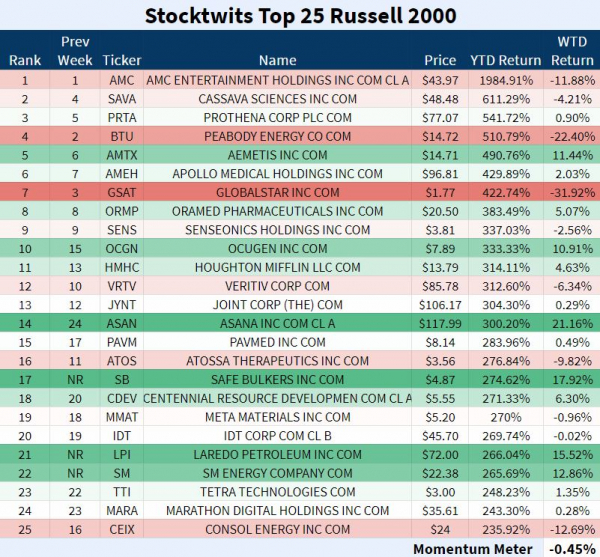

R2K

Small-Cap Russell 2000

The ST Top 25 R2K List was the weakest performing list in Week 37.

14 of 25 stock closed green.

$GSAT gave up 32% and was the worst-performing stock. Globalstar is a Sinner below.

$ASAN took off 21.16% this week to close at all-time highs. Read about the catalyst in the Top Dawg section.

This week’s Freshmen are Safe Bulkers, Laredo Petroleum, and SM Energy.

The ST Top 25 R2K Momentum Meter flopped 0.45% while the Russell 2000 index expanded 0.42%. The 0.97% differential shows the top stocks performed a bit worse than the full index.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 37, 2021 is #14 R2K – Asana Inc.

Asana ascended 21.16% in Week 37 as the biggest Winner on all three lists. The web and mobile app company improved ten spots on the ST Top 25 R2K List from #24 to #14.

$ASAN registered gains every day of the week and closed at all-time highs.

Its most impressive day came on Thursday after the company was awarded one of the Best Workplaces for Women in the United States by Great Place to Work and Fortune. Asana ranked #9, making it the second top ten finish in a row.

Here’s the weekly chart:

$ASAN is up 300.2% YTD.

📈📈📈

The Winners 📈

△ #17 R2K – Safe Bulkers soared onto the ST Top 25 R2K List as a Freshman in Week 37. $SB spiked 18% and earned the seventeenth ranking.

The marine dry bulk transportation company sprang to six-year highs on Monday after being issued a buy rating and a $6.50 per share price target by investment bank H.C. Wainwright.

The Baltic Exchange Dry Index rose 6.8% late last week and is trending towards the high of 4,235 from last month.

Here’s the daily chart:

$SB is up 274.6% YTD.

△ #21 N100 – Fox Entertainment flew 4.92% and debuted on the ST Top 25 N100 List as a Freshman.

Fox Entertainment completed its acquisition of TMZ entertainment platform from WarnerMedia on Monday for a projected $50 million.

Fox CEO Lachlan Murdoch said:

“The unique and powerful brand Harvey has created in TMZ has forever changed the entertainment industry and we’re excited to welcome them to Fox. TMZ has been an impactful program for our Fox television stations and broadcast partners for many years and I know Jack Abernathy and Charlie Collier will find creative ways to utilize and expand this content in effective and compelling ways for our audiences.”

Here’s the daily chart:

$FOXA is up 29.5% YTD.

△ #10 S&P 500 – Diamondback Energy covered some ground in Week 37, moving from #23 to #10. The energy company climbed 10.10% as the top stock on the ST Top 25 S&P 500 List.

$FANG kicked it into gear thanks to Crude oil prices cruising higher. The energy company traded positive ⅗ days this week and closed at its highest price since mid-July.

On Thursday the company said it expedited its intentions to return 50% of free cash flow to stockholders until the fourth quarter of 2021, and that the Board of Directors has approved a $2.0 billion share repurchase program to supplement this commitment.

Here’s the full press release.

📉📉📉

The Sinners 📉

▼ #7 R2K – Globalstar got slammed 32% in Week 37 and fell four spots from number three to seven on the ST Top 25 R2K List.

$GSAT sank 12.3% Monday and plummeted 23.25% Tuesday after Apple announced its new iPhone does not enable satellite communications.

$GSAT is still up 422.75% YTD.

▼ #17 S&P 500 – Waters Corp was the biggest loser on the ST Top 25 S&P 500 List, moving from #10 to #17.

$WAT was a weakling – the Analytical Laboratory instrument and software company sold off 4% on Monday and softened up again on Thursday and Friday.

Despite the weak performance, Waters introduced the Waters™ BioAccord™ System with ACQUITY™ Premier, a combination of the Waters BioAccord System and the ACQUITY Premier UPLC™ with MaxPeak™ High Performance Surface (HPS) technology.

By increasing analyte recovery and assay-to-assay repeatability, the integrated high-resolution LC-MS system streamlines multi-attribute monitoring of biotherapeutics, allowing regulated laboratories to provide essential medications to patients faster.

$WAT is up 60.3% YTD.

See Y’all Next Week 🤙