Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 48 of 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 48:

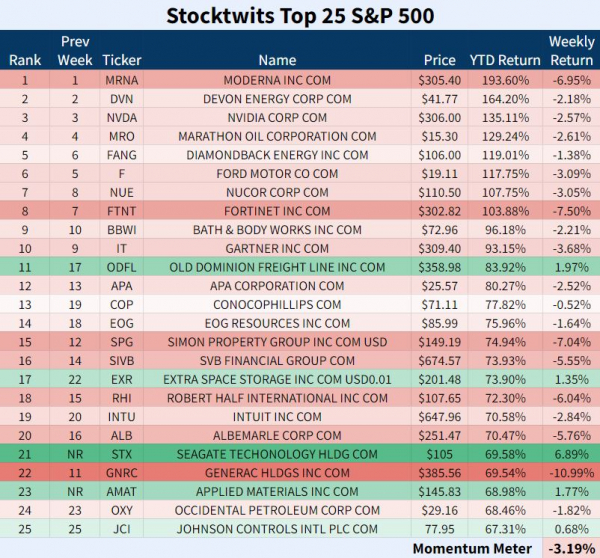

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 list trended lower. 📉

20 names of 25 finished red. 7 names lost more than 5%.

$STX spiked 6.9% and earned a spot as a freshman. It’s a Winner below.

Generac dove 11% as the list’s biggest loser.

The list’s Freshmen are Seagate Technology and Applied Materials.

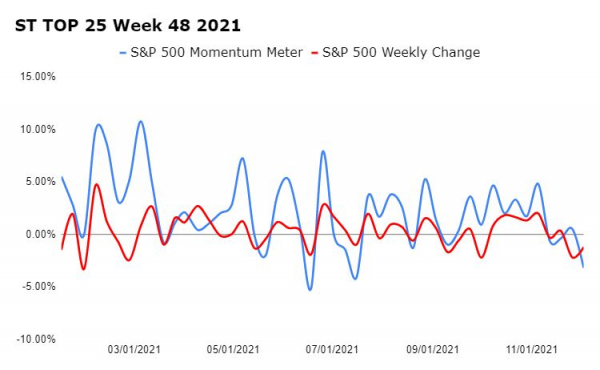

The Stocktwits Top 25 S&P 500 Momentum Meter erased 3.19% while the full-index decreased 1.22%. The 1.97% difference indicates that the index as a whole outperformed the top stocks.

Sponsored

StartEngine’s Current Funding Round Ends 12/19/2021

With a goal to help raise $10 billion by 2029, StartEngine has big plans… and they’re already gaining momentum:

- 146% revenue growth YoY in the first half of 2021.

- 500,000 prospective investors on the platform

- Led by Howard Marks, co-founder of Activision (NASDAQ:ATVI).

- Launched a first-of-its-kind trading platform

- $400M raised for more than 500 companies.

- Moving into wine collections, real estate, and more

Until December 19th, you can join over 30,000 other people and invest in StartEngine itself.

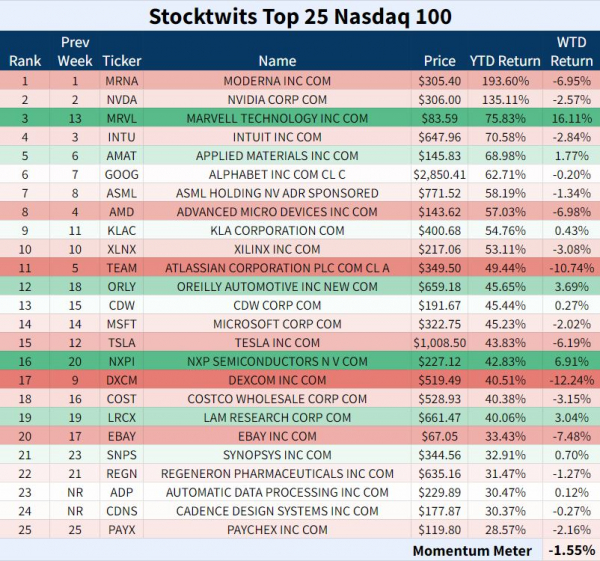

Nasdaq-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List held up the best throughout the first week of December.

16 stocks finished lower.

Marvell Technology marched 16.11% and the earned Top Dawg honor. 👑

DexCom rode the elevator down, losing 12.25%. $DXCM is a Sinner below.

This week’s Freshmen are Automatic Data Processing and Cadence Design Systems.

The ST Top 25 Nasdaq 100 Momentum Meter decreased 1.55% while the full Nasdaq 100 fell 1.96%. The 0.41% difference shows that the full index was a bit stronger than the top stocks.

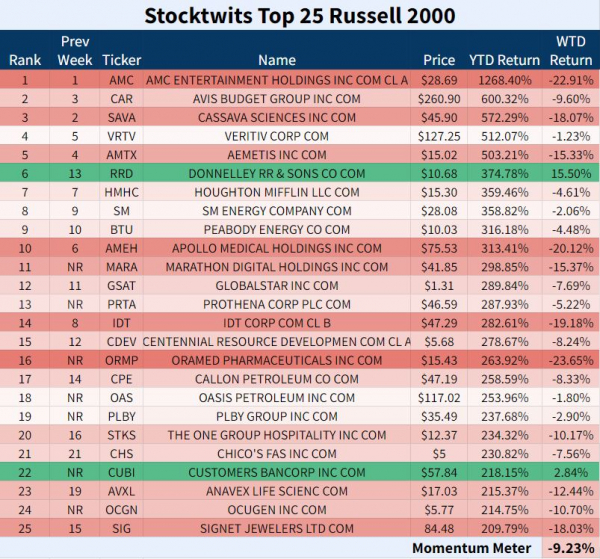

Russell 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was a bloodbath in Week 48.

23 of 25 names closed negative.

Donnelley RR & Sons surged 15.5% on buyout news. Check out the full story in the Winners section below.

$AMC faded 22.9% but is moving into the NFT game. Will NFTs be $AMC‘s night in shining armor?

$OCGN, $CUBI, $PLBY, $OAS, $ORMP, $PRTA, and $MARA were this week’s Freshmen.

The ST Top 25 R2K Momentum Meter plummeted 9.23% and the Russell 2000 index lost 3.86%. The 5.37% differential favors the full index by a large amount in Week 48.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 48, 2021 is #3 N100 – Marvell Technology.

Marvell scaled the ST Top 25 N100 list this week, vaulting ten spots higher from #13 to #3. The tech stock was the largest gainer on all three lists.

$MRVL marched 17.7% on Friday to record highs after reporting record revenue while exceeding earnings and revenue expectations.

$MRVL | EPS: $0.43 (vs. $0.38 expected) | Revenue: $1.21 billion (vs. $1.15 billion expected) | Link to Report

Here’s the daily chart:

$MRVL is up 75.83% YTD.

📈📈📈

The Winners 📈

△ #6 R2K – Donnelley RR & Sons was the strongest stock on the ST Top 25 R2K List in Week 48. $RRD surged 15.5% to 4-year highs.

Shares of the printer maker climbed 10% on Monday after Chatham Asset Management upped its offer to purchase $RRD for $10.25/share.

Previously in November, RR Donnelley agreed to be acquired by Atlas Holdings for $8.52/share.

In what seems like a no-brainer deal, RR Donnelly accepted Chatham’s offer before its negotiation period with Atlas expires on Dec 7.

$RRD is up 374.8% YTD.

△ #21 S&P 500 – Seagate Technology jumped onto the ST Top 25 S&P 500 list this week as a freshman. The data storage company zipped 6.9% and took the 21st ranking on the list.

$STX registered gains on four days this week while the full-index closed negative three days, a considerable outperformance. The stock also reclaimed the $100-level and now sits near prior highs from late-May.

$STX is up 6.6% YTD.

📉📉📉

The Sinners 📉

▼ #22 S&P 500 – Generac surrendered 11 spots on the ST Top 25 S&P 500 List thanks to an 11% loss in Week 48. The power equipment maker is now ranked twenty-second on the list.

Generac announced on Wednesday that it has completed its purchase of ecobee, Inc, a pioneer in sustainable smart home solutions.

Aaron Jagdfeld, CEO of Generac stated: “With the addition of ecobee and its energy management products focused on conservation, convenience, peace of mind and comfort, we will be able to further build out Generac’s suite of offerings around an intelligent home energy ecosystem”.

Still, $GNRC received no love as it closed lower four days this week and settled at five-month lows.

$GNRC is still up 69.55% YTD.

▼ #1 R2K – AMC Entertainment sank 22.91% this week as the second-biggest loser on the ST Top 25 R2K List. $AMC still holds a 668% lead ahead of $CAR.

On Monday, AMC announced it’s entering the NFT game as it offered 86,000 NFTs to members who ordered tickets for the debut of Spider-Man: No Way Home in advance.

And just like that, $AMC set its second-biggest ticket sales day for a single movie in the company’s history. The sales for Spider-Man were just 1.5% off of Avengers: Endgame’s single day record in 2019!

Here’s the weekly chart of $AMC:

$AMC is up 1,268.4% YTD.

▼ #17 N100 – DexCom, Inc was the ST Top 25 N100 List’s biggest loser, dropping 12.25%. The medical device company worsened eight rankings, dipping from #9 to #17.

$DXCM traded lower four days this week and managed its worst weekly-performance since the week of Oct 26, 2020. Yikes.

Here’s the weekly chart:

$DXCM is still up 40.5% YTD.

See Y’all Next Week 🤙