Happy Sunday, gang! Welcome to our last Weekend Rip of 2021.

I know what you’re thinking… “last Weekend Rip of 2021?” As hard as it is to believe… this is it! The markets will be closed this Friday in observance of Christmas Day. Our team will be taking the holiday weekend off (we’ll probably be trading crypto if I’m being honest, lol.) On the bright side, you got us here all week — and we’ll be back next Monday to wrap up 2021 with a pretty bow. 😊

That said, let’s get into it. This week was a beefy one and there’s no natural place to start except with… stocks. There were no winners. The Nasdaq Composite led the losers, down -2.89% this week. Meanwhile, the S&P, Russell 2000, and Dow Jones all dipped more than -1.5%.

The Federal Reserve decision seems to be underpinning the trial and tribulation in both the crypto and equities markets. However, it’s hard to look past the regular “end of year blues” in equities world. People are selling to buy gifts, tax loss harvesting to avoid giving Uncle Sam some extra moolah come tax season, and/or finally giving up on trades that went south (won’t name any names. 😂)

While being in the red hurts, I’m sure many long-term investors haven’t been too bothered by the dip. The S&P 500 is still up 24.8% YTD and the Nasdaq Composite isn’t too far off, up 19.5% YTD. In short: we’ll take what we can get.

Meanwhile, in crypto world: it’s unclear whether we can expect to keep going down, or to bounce from here. Peep the Crypto Total Market Cap graph from TradingView:

What is easy to garner, however, is that crypto is still doing enormously well. The Crypto Total Market Cap has more than doubled since the start of 2020, we’re well above the “China banning crypto FUD” lows, and we’ve seen higher highs in recent weeks than we saw earlier this year. For those reasons, it’s hard to feel bad about where we’re at in crypto-ville.

As far as winners go this week: yearn.finance owned the week. $YFI.X rose 53%. Trailing behind, but still evidently in the green, was Arweave (+34.3%), Avalanche (+32%), and Hedera (+24.7%). In losers: $GALA.X dove 21%, BitTorrent fell 18.5%, and NEAR Protocol (-17%) shed some of its big gains from previous weeks.

Anyway, ’nuff said. Here are the closing prices:

| S&P 500 | 4,620 | -1.90% |

| Nasdaq | 15,169 | -2.89% |

| Russell 2000 | 2,173 | -1.70% |

| Dow Jones | 35,365 | -1.65% |

Bullets

Bullets from the Week

- The taper talk: The Federal Reserve tendered one idea of a solution to sky-high inflation, stagnant economic growth, and “weaker-than-you’d-wanna-see” consumer confidence on Wednesday after the two-day Federal Open Market Committee meeting. The Fed’s plans will have it halting asset purchases by March 2022 and doing its first of many rate hikes by June 2022. Stocks and crypto jumped, then tripped up, after the announcement. Read more about the Fed’s plans (and other happenings) in the Dec. 15 edition of The Daily Rip.

- All uphill for Avalanche: Let’s face it, Ethereum is slow and expensive — and it’s going to be months until its developers start to arrest that problem. That’s one reason why new “scaling blockchains” are getting a lot of love. By now, names like Solana and Cardano are not strangers to crypto maxis, but an unexpected blockchain got a big vote of confidence from a Bank of America analyst this week: Avalanche. It rose 32% this week. Read more about why it’s rising in our Dec. 17 edition of The Litepaper.

- Dems punt social spending until 2022: The Democrats are punting President Biden’s flagship Build Back Better (BBB) legislation until next year, prioritizing voting rights legislation in lieu of the social spending bill. With BBB punted, millions of Americans expecting a change in the tax regime have been left more confused than grateful — especially scores of high net worth Americans who positioned for tax increases. Read more about what punting BBB means for your taxes and the Dems’ reelection odds.

- Omicron continues its world tour: Pfizer execs are convinced the pandemic could last until 2024, which is notably… [checks calendar] not anytime soon. However, that’s little surprise to us — especially given the global resurgence of Covid. Over 700,000 new cases were reported worldwide on Friday, which shows that a fourth wave of Covid might very well be here. Some countries, such as the Netherlands, are turning back to lockdowns. President Biden will reportedly address the nation on Tuesday, according to The New York Times.

- Billionaires bail on stock market: Remember Elon Musk’s decision to sell billions worth of Tesla? He’s not alone. Filings show that some of the richest Americans unloaded $42.9 billion worth of stock in December, which is more than double what they sold in all of 2020. According to Bloomberg, Meta’s Mark Zuckerberg, the two founders of Google, and two of the three co-founders of Airbnb are just a few names getting in on the sell-off. Do they know something we don’t? Read more about it in The Street.

Sponsored

Knightscope’s crime-fighting robots have been credited with reducing crime as reported by law enforcement agencies.

Knightscope is currently accepting investments on StartEngine for their most recent equity crowdfunding round – Learn more about how to become an investor by following the link!

Disclaimer:

Offering Circular: https://bit.ly/KnightOC

Related Risks: https://bit.ly/Knight-rr

This Reg A+ is made available through StartEngine Primary, LLC, Member of FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. Please see the Offering Circular and Related Risks before investing.

The Brief

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s your brief for the trading week starting Dec. 20.

Economic Calendar:

12/22 Consumer Confidence (10:00 AM ET)

12/22 Existing Home Sales (10:00 AM ET)

12/22 EIA Crude Oil Inventories (10:30 AM ET)

12/23 Personal Income & Spending (8:30 AM ET)

12/23 PCE Prices (8:30 AM ET)

12/23 Initial & Continuing Claims (8:30 AM ET)

12/23 New Home Sales (10:00 AM ET)

Peep the full Economic Calendar provided by Briefing for all the reports this week.

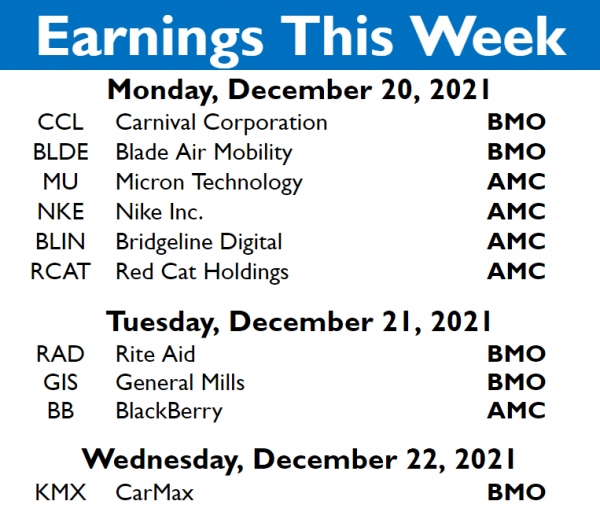

Q4 earnings are on the way out. Here’s what to expect from this shortened week:

For more information on stocks that are reporting (and what our community is watching), check out the Stocktwits earnings calendar.

Links

Links That Don’t Suck:

🗺️ See What Institutions Bought in Q3 2021 Using the 13F Heatmap on Whale Wisdom

👀 See What r/wallstreetbets Is Talking About Using Quiver Quant

🌌 Fly Around the Music Galaxy, a 3D Visualization of Relationships Between Artists

🏢 Inside the $23 Million Duplex From “Succession”

🔥 Former OSU Coach Urban Meyer Fired After Helming Losing Jacksonville Jaguars

🏈 College Quarterback’s First Career Throw Goes Unexpectedly Well

🧱 Jared Vennett’s Comical Jenga Pitch From 2015 Film, “The Big Short”

🎙️ Nardwuar, the Human Serviette Is Back: Interviewing JPEGMAFIA