Good evening, everyone. The market got hit on hump day. 🥊

Each index lost over a percent. The Russell 2000 retreated 1.73% and the Nasdaq dipped 1.32%.

AAR Corp ascended 7.5% today to two-year highs after smashing third quarter earnings and sales estimates. $AIR is now up 29% YTD. Here’s the daily chart:

9 out of 11 sectors closed negative. 💔 Energy was the only sector to gain over a percent at 1.72%. Financials flopped 1.85% and healthcare bled 1.8%.

Ethereum and Bitcoin both gained less than a percent. Maybe we’ll see some movement tonight… 🤞

Memestocks are still hot. 🔥 $GME gained 14.5% and $AMC ascended 13.58%.

Zinc futures zipped 6.3% to all-time highs. Crude oil cruised 5.21% to $114.36 and steel futures flew 2.3%.

$BTU blasted 10.4%, $GNK gained 9.42%, and $AXS.X accelerated 10.15%.

Here are the closing prices:

| S&P 500 | 4,456 | -1.23% |

| Nasdaq | 13,922 | -1.32% |

| Russell 2000 | 2,052 | -1.73% |

| Dow Jones | 34,358 | -1.29% |

Trending on Stocktwits 🔥

$ALLG, $KRL.X, and $LRC-X trended on Stocktwits today with some pretty impressive price gains. Here’s a breakdown of these tickers’ moves:

Spartan Acquisition Corp / Allego ($ALLG):

$ALLG, aka Spartan Acquisition Corp., skyrocketed 114% today on news that the company Allego would go public through a “business combination” with Spartan Acquisition Corp. III (managed by Apollo Global Management.) Allego is a top EV charging company in Europe. ⚡ The $720 million deal will help fund Allego’s expansion plans, according to a Businesswire press release. Allego currently hosts 26,000 charging stations in 12 different European countries. Check out the intraday chart:

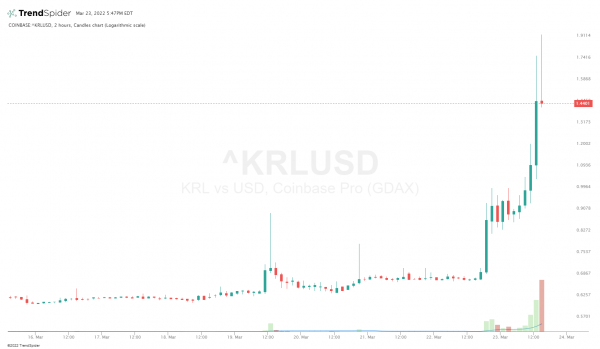

Kryll ($KRL.X):

$KRL.X saw +142.93% price gains, trending #118 on Coinbase today. $KRL.X is the Ethereum token of the Kryll crypto project’s platform, which is designed to facilitate automated crypto trading strategies — especially among less tech-savvy crypto traders. The coin is up 206.4% over the last week, currently trading at $1.60. Here’s the weekly chart:

Loopring ($LRC.X):

The LRC token ($LRC-X) experienced double-digit gains today while trending on Stocktwits. The crypto saw price hikes after GameStop’s announcement that the company would partner with Loopring to launch $GME‘s NFT marketplace. Specifically, GameStop is launching the NFT marketplace on loopring’s layer-2. 🎮 $LRC-X trading volume blasted to $1.9 billion on the news. $GME also trended on Stocktwits, gaining +14.50%. Here’s the intraday chart:

Curious about what else trended today? 🤔 Check out Stocktwits Rankings to see which streams got attention.

Sponsored

Introducing 01, protecting your assets has never been more important.

What value do you place on your data? We think your data is the most valuable asset you will ever own. 01 watch is a new type of asset, protecting your data in a brand new era, and its value is backed by a formula, not hype.

Earnings

Earnings Today

Winnebago Industries crushed earnings and sales expectations during the second quarter, but still fell 11.77% to fifteen-month lows. $WGO grew revenue by 39% YoY to $1.2 billion.

$WGO | EPS: $3.14 (vs. $3.06 expected) | Revenue: $1.2 billion (vs. $1.09 billion expected) | Link to Report

Clear Secure soared 16.83% after beating on the top and bottom lines. Total books surged 99% to $109.6 million. $YOU is still down 19% in 2022.

$YOU | EPS: ($0.09) (vs. ($0.24) expected) | Revenue: $80.7 million (vs. $78.1 million expected) | Link to Report

Traeger Grills sat out too long and sizzled 16.66% to all-time lows. Accessories revenues increased 424.5% to $48.1 million thanks to the acquisition of Apption Labs.

$COOK | EPS: ($0.29) (vs. ($0.17) expected) | Revenue: $174.9 million (vs. $158.5 million expected) | Link to Report

Bullets

Bullets from the Day

🆔 Arizona adds driver’s license and state ID support in Apple Wallet. The state of Arizona became the first U.S. state to offer residents the option to digitally store their driver’s licenses or state IDs in Apple Wallet. Users who take advantage of the “digital ID” will be able to tap their iPhone or Apple Watch to speed through TSA security checkpoints at Phoenix Sky Harbor, among other expected airports. Apple plans to roll the digital ID feature out in other states, including Colorado, Hawaii, Georgia, and others. Read more in Techcrunch.

📈 Terra-based DeFi app Anchor Protocol turns heads. In our crypto newsletter, The Litepaper, we reflected on the growth of the Terra blockchain. Almost all of that growth has come because of one decentralized app: Anchor Protocol, which offers $UST depositors an interest rate unlike any other at 19.4%. That figure changes day-to-day and hour-to-hour, but it turns heads nonetheless. A new Bloomberg piece says that investors see only one of two outcomes: success or collapse.

🧾 Judge is “prepared to approve” Activision misconduct settlement. A Federal Judge is “prepared to approve” an Activision misconduct settlement which would provide $18 million in restitution to victims. The ruling would come with three years of oversight, according to Stephen Totilo (the author of the Axios Gaming newsletter.) The state of California attempted to intervene in the settlement, but was denied. In the grand scheme of things, the punishment is a speeding ticket for alleged misconduct at the company. Microsoft is expected to acquire Activism in the next 24 months, assuming the FTC doesn’t do anything about it. Read the docs and Totilo’s take on Twitter.

Links

Links That Don’t Suck:

📈 Higher-Income Americans Are Getting Nervous about the Economy

💡 When the Optimists are Too Pessimistic

💀 Marilyn Monroe’s Final Hours: Nuke Fears, Mob Spies, and a Secret Kennedy Visitor

✈️ Rolls-Royce’s Electric Plane Shattered World Records

💰 Return of Student Loan Payments Could Spell Trouble for Borrowers