Well…it’s Wednesday. Stocks were deep in the red as concerns about consumer health intensify. 🔻

Today’s focus was the big miss in Target’s earnings (specifically operating margins), which confirmed several trends highlighted by Walmart yesterday and Amazon a few weeks ago. Our main story breaks it down.

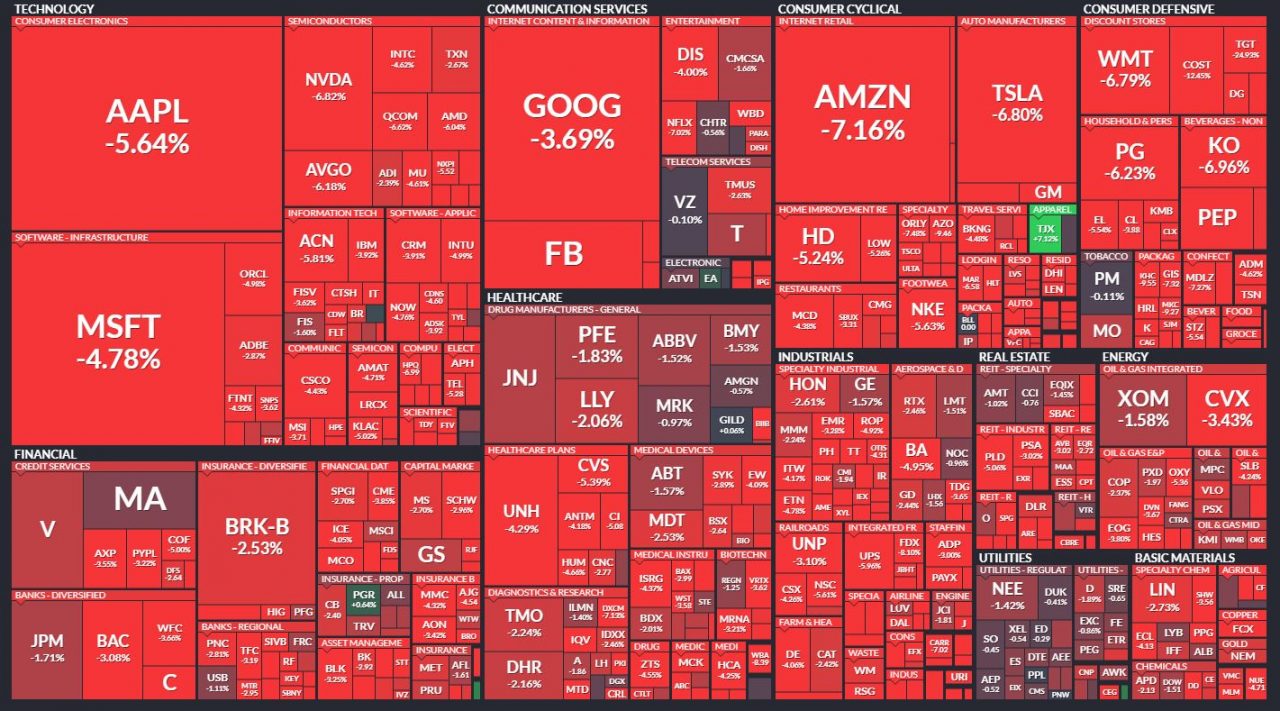

The heat map below highlights today’s carnage: 🐻

0/11 sectors closed green, with maximum pain felt in: consumer discretionary (-6.51%), consumer staples (-6.41%), and technology (-4.55%). 🔴

Other retailers and consumer-focused names like BJ’s (-16.28%), Costco (-12.45%), Bed Bath & Beyond (-8.86%), and Cheesecake Factory (-5.02%) traded down in sympathy, weighing heavily on the market. 😨

In other earnings news, TJX Companies managed to escape the bloodbath on the back of upbeat earnings. Meanwhile, Cisco is crashing in extended trading after missing revenue expectations and lowering its revenue forecast. Highlights from those and more below. 👇

Here are the closing prices:

| S&P 500 | 3,924 | -4.04% |

| Nasdaq | 11,418 | -4.73% |

| Russell 2000 | 1,775 | -3.56% |

| Dow Jones | 31,490 | -3.57% |

After investors *rolled back* the prices of Walmart shares yesterday, trouble in the Retail industry continued with Target missing forecasts in a big way.

The company’s adjusted earnings per share missed the $3.07 expected by analysts, coming in at $2.19. Revenues did beat expectations at $25.17 billion vs. $24.49 billion.

The numbers came as a surprise to investors given the company’s upbeat 2022 guidance in March, where it forecasted adjusted profit in the high single-digits and suggested supply chain constraints were steadily working out. 🤯

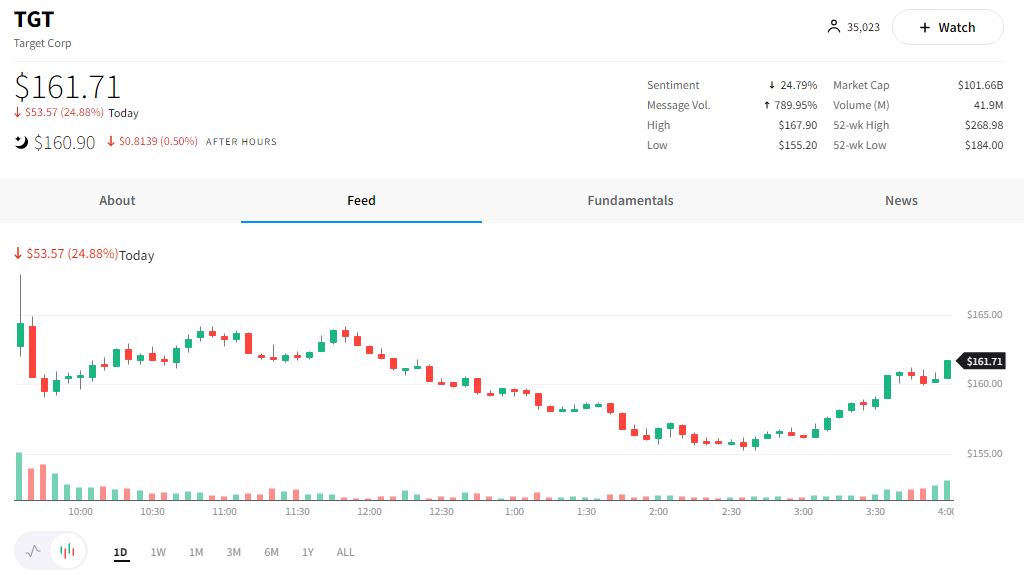

Investors quickly sent $TGT shares to the clearance shelves, knocking it down ~25%. 👎

Operating income margin was a significant focus, falling to 5.3% compared with 9.8% in the same period last year.

The company noted various factors that drove this decline in margins, including supply chain constraints, excess inventory, and a shift in product mix to lower-margin items. As a result, the company now expects an operating income margin rate “in a range centered around 6%” for the year.

CEO Brian Cornell stated, “Things have changed significantly from even 13 weeks ago… We did not project, I did not project, the kind of significant increases we would see in freight and transportation costs.”

The company now expects about a billion dollars of incremental freight costs this year, even compared to expectations outlined three months ago. 🚚

These comments echo much of what we saw from Walmart yesterday and Amazon a few weeks back when both companies highlighted that increased costs were eating into profits.

Despite the short-term hit to profitability, the company remains focused on its long-term trajectory and gaining market share.

Target noted that passing rising costs onto its customers via broader price increases is the last lever it would pull to improve profit. The company is also not changing its planned annual capital expenditures of $4-$5 billion.

Despite significant issues on the expense side of the equation, revenue numbers did offer a few bright spots: ☀️

- Comparable sales grew 3.3% YoY, reflecting traffic growth of 3.9% YoY

- Store comparable sales increased 3.4% YoY

- Digital comparable sales grew 3.2%YoY

- Same-day services grew 8% YoY

With inflation sitting near 40-year highs, it’s clear that these issues are not going away anytime soon. In this environment, the major challenge for the retail sector is going to be balancing its long-term focus on the customer and the often short-term demands of Wall Street investors. ⚖️

For now, retail investors’ eyes shift to $BJ, $ROST, and $DECK which report tomorrow. 👀

Sponsored

How Many Markets Can This Tech Penetrate?

Earnings

Earnings Highlights

TJX Companies ($TJX) | EPS: $0.68 vs. $0.61 expected | Revenue: $11.41 billion vs. $11.61 billion expected | Link to Report

TJX (parent company of T.J. Maxx) joined the small group of retailers who have been able to defend their margins amid rising inflation pressures. Pretax margins for Q1 were 7.5% (and 9.4% on an adjusted basis). The company believes it is well-positioned for the current environment, as inflation-pinched consumers gravitate more toward discounted merchandise.

Investors cheered the results, with the stock closing up (7.12%) amid a sea of red. 📈

Cisco Systems ($CSCO) | Adjusted EPS: $0.87 vs. $0.86 expected | Revenue: $12.84 billion vs. $13.34 billion expected | Link to Report

The company noted the Russia/Ukraine war reduced revenue by ~$200 million and Covid-19 lockdowns in China exacerbated supply chain issues. For the fiscal fourth quarter, the company forecasted $0.76 – $0.84 adjusted EPS and a YoY revenue decline of 1% – 5.5%. The wider-than-usual guidance range reflects an “increasingly complex environment,” CEO Chuck Robbins says.

The stock is down 13% after hours, adding to its losses in the regular session.

Lowe’s ($LOW) | EPS: $3.51 vs. $3.22 expected | Revenue: $23.66 billion vs. $23.76 billion expected | Link to Report

The Container Store ($TCS) | EPS: $0.46 vs. $0.20 expected | Revenue: $305.55 million vs. $279.82 million expected | Link to Report

Tencent Holdings Ltd. ($TCEHY) | EPS: CN¥ 2.62 vs. CN¥ 2.81 expected | Revenue: CN¥ 135.5 billion vs. CN¥ 141 billion | Link to Report

Lowe’s lost 5.24% today, the Container Store Group gained 7.07% on news of EPS, and Tencent Holdings Ltd. dumped 6.97% at the close. 💰

Want more EPS?? Check out Stocktwits’ earnings calendar! 📅

Bullets

Bullets from the Day

🏘️ Housing market cools as affordability drops and supply constraints limit building. U.S. homebuilding permits, often seen as a leading indicator for the sector, fell to a five-month low in April. Meanwhile, the Mortgage Bankers Association report showed applications for loans to buy a home dropped 12% WoW and 15% YoY, as rising interest rates and record-high median home prices reduce affordability. Weakness in single-family housing was the focus of today’s reports, but there remains a record construction backlog at a macro level. Reuters has more.

❌ Tesla was removed from S&P 500’s ESG index, and Musk responds via Tweet. S&P’s blog post on the annual rebalancing noted that Tesla did not make the cut for various reasons, including its “lack of a low-carbon strategy” and “codes of business conduct.” Musk, who has been critical of the role/methodology of ESG funds, wrote in a tweet exchange this morning, “I am increasingly convinced that corporate ESG is the Devil Incarnate.” Those are some choice words, but given companies like Exxon Mobil are included in the index, he may have a point about how these indexes are constructed… Read more via CNBC.

💸 Meet the insiders whose stock you bought during last year’s tech IPO bonanza. Insiders at popular companies like FIGS, Coinbase, Coupang, and Robinhood all sold heavily after going public, leaving public investors holding the bag as prices plunged. Insiders sold $35.5 billion in shares of companies that went public in 2021, only purchasing a fraction of that amount at $7.6 billion. Perhaps among the pain, there’s a lesson here for investors about approaching high-flying names in a frothy market. Marketwatch shares the numbers.

Links

Links That Don’t Suck:

⛏️ Caterpillar eyes energy transition as growth driver for mining business

🗳️ JPMorgan shareholders vote disapproval of CEO Dimon’s special payout

🐘 Illegally jailed at the Bronx Zoo? Court to weigh Happy the elephant’s rights

⚽ U.S. Soccer announces equal pay agreement between USMNT and USWNT

🎪 Ringling Bros. circus returns — without animals — five years after closing

🖥️ Acer’s new portable monitors can make 2D look like 3D

💊 ‘Pharma bro’ Martin Shkreli released from prison early

👶 Indian couple sue their only son for not giving them grandchildren

🎧 The NFT gaming podcast: featuring Alchemon (ep04)

*this is a sponsored post