Markets went green this week! And no, we don’t mean ESG. 😜

U.S. and global stocks rallied across the board, snapping a 7-week losing streak.

The relief rally comes as investors digest better than expected inflation news. Today, April’s Personal Consumption Expenditures headline price index (PCE) showed inflation rose 6.3% YoY, adding to the shortlist of signs that inflation may have peaked in March. 🗻

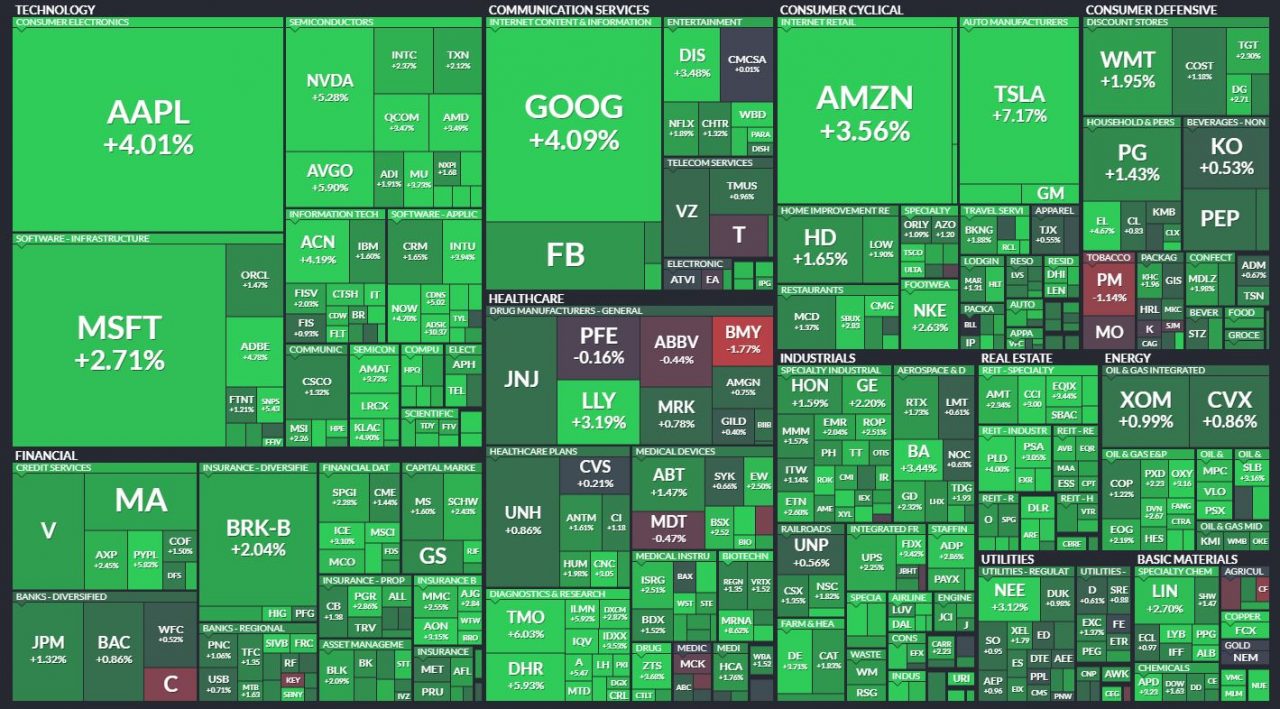

Here’s today’s heat map:

11/11 sectors closed green, led by consumer discretionary (+3.43%), real estate (+2.82%), and materials (2.38%). 💚

In what seems like a case of deja-vu, SIGA Technologies is back on the trending tab, rallying 43% as the battle against Monkeypox heats up. 🐒

The Chinese e-commerce platform Pinduoduo rose 15.19% today on better-than-expected earnings. However, like its peers $BABA, $JD, and $TCEHY, the company warned of slower growth due to the COVID-19 pandemic.

Other big movers/trending names from the day included $AMC (+19.03%), $BB (+7.93%), $RDBX (+1.86%), and $IOVA (-53.43%). 🔥

A quick reminder that U.S. markets are closed on Monday for Memorial Day.

As we relax and spend time with loved ones, may we remember those who courageously gave their lives and made the ultimate sacrifice to protect our freedoms. 🙏

And if you need something to listen to over the long weekend, our CEO Rishi Khanna was on “The Compound and Friends” podcast to chat about the state of retail trading, economic outlook, and much more! 🎧

Here are the closing prices:

| S&P 500 | 4,158 | +2.47% |

| Nasdaq | 12,131 | +3.33% |

| Russell 2000 | 1,888 | +2.70% |

| Dow Jones | 33,213 | +1.76% |

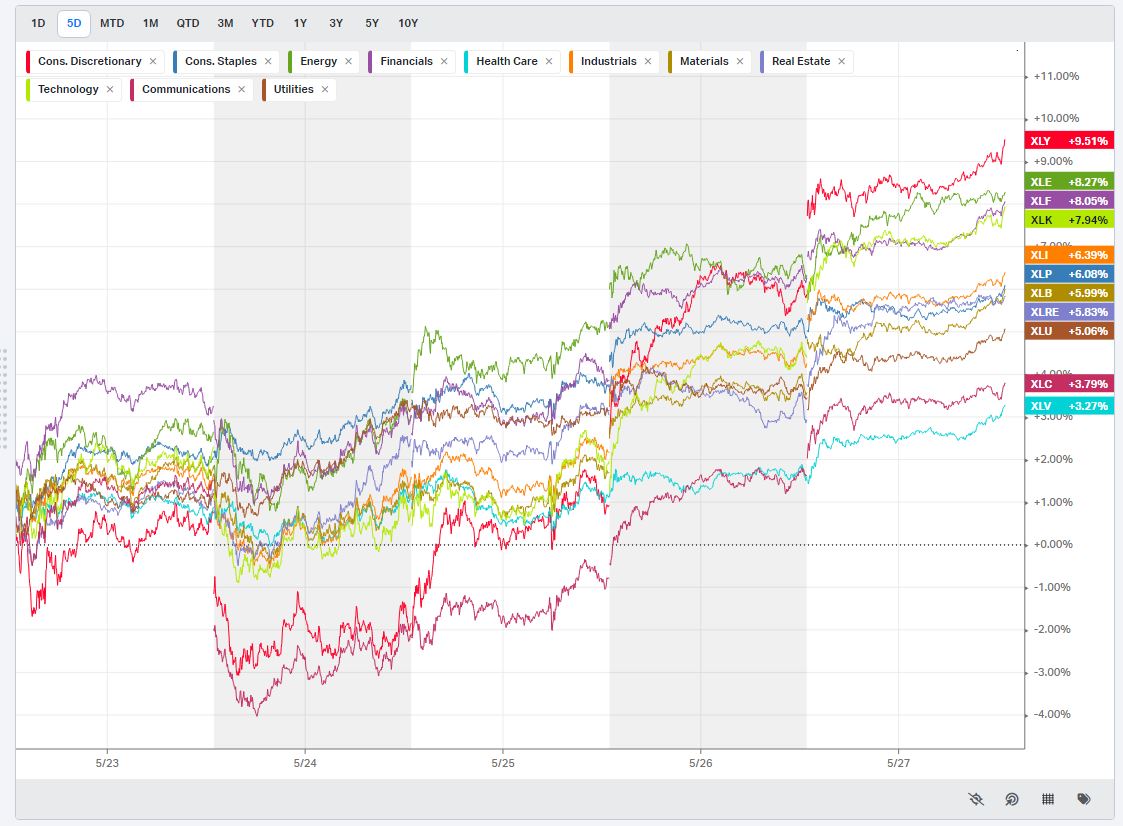

Optimism reigned supreme this week as investors continue to form their opinion about the economy’s future. ⏳

We saw macro data like the Purchasing Manager’s Index and New Home Sales plummet early in the week. But since Wednesday’s Fed Minutes, which were mainly in line with expectations, the market has been taking any new data in stride.

The CBO’s optimistic estimates for the U.S. economy also helped brighten the mood yesterday. ☀️

And today, April’s Personal Consumption Expenditures headline price index (PCE) showed inflation rose 6.3% YoY, slowing from the March reading.

This week’s broad-based rally, led by offensive sectors like consumer discretionary, energy, financials, and technology, may be the start of investor sentiment turning more positive.

What’s clear is that stabilization in the bond market is helping risk appetite.

Remember, the market’s mess began when bonds started pricing in rapid inflation growth about a year ago. So the fact that Treasuries were able to notch their third week of gains in the face of elevated inflation readings suggests that maybe we’ve priced in enough pain for a while. 🤔

Lastly, one market that didn’t participate in this week’s rally was crypto. The space, which has recently traded along with stocks and other risk assets, bucked the trend and was down across the board. Ethereum is testing a significant long-term support level that many folks will have their eyes on this weekend. 👀

So is this a dead-cat bounce or the start of a summer rally for the market? Hop on to the streams and share your thoughts!

Sponsored

Providing Quality Pet Food and Shareholder Value

Bullets

Bullets From The Day:

📰 Substack ditches Series C plans amid tougher fundraising market. The popular newsletter platform was looking to raise between $75-$100 million for a 10% stake. Its Series B round, raised in March 2021, valued the company at $650 million and was used to help diversify the platform by adding support for podcasts, among other things. However, the company struggles with churn and monetization, generating just $9 million in revenue last year as competition for writers/content creators heats up. TechCrunch has more.

👩🎓 Biden admin is leaning towards forgiving $10,000 in student loans per borrower. Student loan forgiveness remains a hot-button issue, with $1.7 trillion in outstanding debt and an average debt balance of over $30,000 per borrower. Today’s news that Biden is leaning towards forgiving $10,000 per borrower, with income caps of $150,000 (or $300,000 for married people), drew criticism from both sides of the aisle. Proponents of the idea say Biden isn’t going far enough and that red tape will make it harder for borrowers to access relief. Read more via CNBC.

📒 Accounting giant EY is considering a business shakeup. Conflicts of interest remain a significant concern for accounting industry regulators, especially for firms that provide audit, tax, and advisory services all under one roof. To address this, big four accounting firm EY is considering a worldwide split of its audit and advisory businesses, which would be the largest accounting industry shakeup in decades. The move is far from finalized but will likely put pressure on its competitors — Deloitte, KPMG, and PWC — to explore this option as well. The WSJ has more.

⛽ G7 struggles to tackle energy crunch while sticking to its environmental goals. The G7 called on OPEC to help ease global energy supplies during their meeting in Berlin this week. The group also walked back their commitments to phase-out coal usage by 2030 as the worldwide energy heats up. While the group’s leaders stressed they would not let the recent crisis derail its efforts to fight climate change, it’s clear that juggling those two priorities is not going to be a walk in the park. Read more from Reuters.

Links

Links That Don’t Suck:

🏠 Redfin reports nearly 1 in 5 sellers is dropping their price

🏦 FlexID gets Algorand funding to offer self-sovereign IDs to Africa’s unbanked

♻️ We never got good at recycling plastic. Some states are trying a new approach

💰 Indian fintech Jar eyes $50 million investment

🛍️ U.S. retailers’ ballooning inventories set stage for deep discounts

💰 Joywell Foods raises $25m to bring sweet proteins to market

📁 Trump-linked SPAC files for resale of up to 100 million shares

👂 Piercing-mania takes the retail world by storm

🎫 Blockchain lottery sells NFTs for legal defense in suit that cuts to the core of DeFi