Stocks were mixed in a news-heavy day — here’s what you missed.

The fight against inflation continues as the Bank of England hikes rates by another 50 bps. We discuss that and other economic updates below. 👇

Plus, many retail favorites reported earnings today, from electric vehicle and space travel companies to movie theatres and delivery services. We recap as many as we can below. 📝

Here’s today’s heat map.

7 of 11 sectors closed green, with technology (+0.46%), communication services (+0.43%), and consumer discretionary (+0.41%) leading. 💚

Energy was again the laggard (-3.71%), as U.S. crude oil prices closed at their lowest level since Russia’s invasion of Ukraine began. 🛢️

In individual company news, Walmart (-3.72%) was sent lower by the news that it’s cutting 200 corporate employees, citing the economic downturn and rising inflation. 📉

Cloudflare is popping 20% following the company’s better-than-expected earnings report. 📈

Twilio is trading down about 10% after its earnings report came in below expectations. 🔻

Block is down about 7% after its operating profit, and Square’s payment volume missed estimates.

As expected, the White House has declared monkeypox a public health emergency, which boosted stocks like SIGA Technologies. 💉

In news that takes you back to 2020, Clubhouse is apparently still around and making some major changes to its app. 🗓️

In crypto news, the biggest story of the day is Coinbase teaming up with BlackRock in a partnership that will allow the world’s largest asset manager’s institutional clients to buy bitcoin. Coinbase surged as the adaption, and totally not centralization, of the decentralized currency continues. ₿

Other symbols active on the streams included: $HKD (-27.27%), $AMTD (-31.20%), $APDN (+40.00%), $GOVX (+30.29%), $BBIG (+3.15%), $QNRX (-28.99%), $XELA (+14.38%), and $MULN (-8.63%). 🔥

Here are the closing prices:

| S&P 500 | 4,152 | -0.08% |

| Nasdaq | 12,721 | +0.41% |

| Russell 2000 | 1,906 | -0.13% |

| Dow Jones | 32,727 | -0.26% |

It was a long day for some of retail’s favorite stocks; let’s quickly recap.

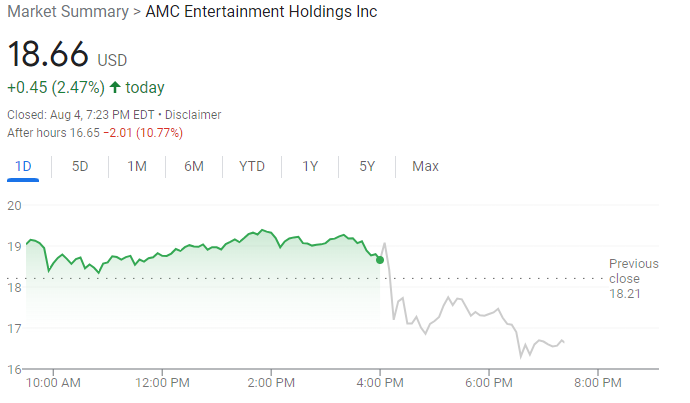

AMC shares fell 11% after reporting another net loss and revenue below analyst expectations. However, the company is making another financial engineering bet, opting to list preferred equity shares on the NYSE under the symbol “APE.”

They picked the appropriate symbol because, quite frankly, this news is BANANAS. 🍌

The new class of shares carries the same voting rights as the existing common shares but is a creative way for the firm to raise funds after investors shot down its proposal to issue more common shares last year. After issuing a preferred dividend of 517 million APE units later this month, it will still have about 4.5 billion units remaining that it could sell to raise funds.

Once again, the company’s rabid fanbase is indirectly giving it more time to stage a turnaround of its struggling underlying business. ⌛

Whether or not it will work remains to be seen, but investors are not cheering the move in the after-hours session. 👎

Beyond Meat shares came under pressure after the company slashed its revenue forecast and cut its workforce by 4%. It’s citing inflation, rising interest rates, and recession concerns – AKA the challenging macroeconomic environment we’ve heard from many other companies, though bears argue that their product is just not that great. 👎

Rocket Companies came crashing back to earth after missing earnings and revenue expectations. The slowing housing market continues to take a toll on the company and its competitors. 📉

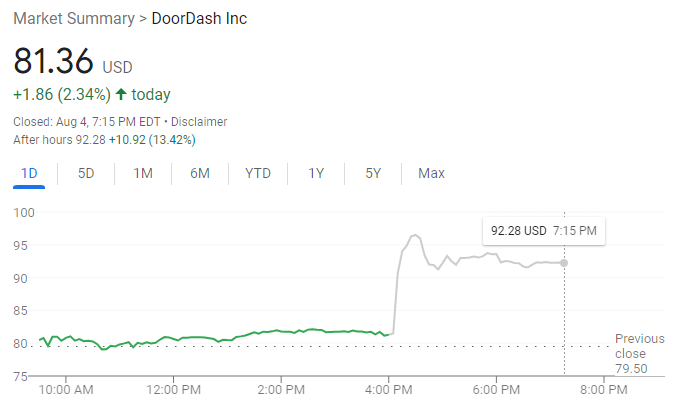

Finally, on a more positive note, DoorDash shares dashed higher after the company delivered better than expected revenue numbers but missed on earnings. It also noted that it expects a softer consumer spending environment through the rest of the year as inflation and other macroeconomic factors weigh on consumers. As a result, those factors could drive results below expectations.

For now, investors appear to be looking past that warning toward the 30% YoY revenue growth, which the company attributed to increased order frequency and more monthly active users. 👍

Economy

Economic Updates

Today’s big story was the Bank of England hiking rates for the sixth time this year, opting for 50 bps, which was its largest single-meeting hike in 27 years. With inflation remaining elevated in the U.K. and around the world, it was expected that the central bank would remain aggressive.

However, what did come as a shock is the weakness in the central bank’s projections. It now forecasts that the country will fall enter a recession in the fourth quarter of 2022 and that it will last five quarters, with real household post-tax income falling sharply and reducing consumption. 📉

Essentially, they’re saying a significant economic downturn is coming, but they’re going to keep hiking rates anyway due to inflation.

Unfortunately, the country is facing the exact *terrible* situation that many economies around the world are doing everything they can to avoid. 🤯

We’ll have to see which other countries face the same fate as the data continues to roll in… 🤷♂️

Meanwhile, in the U.S., initial jobless claims ticked up this week to a 10-month high of 260,000 as the job market continues to soften.

Just this week, private tech company On Deck cut another third of its workforce just three months after laying off a quarter of them, Robinhood cut 23% of its workforce, and giants like Walmart are reducing their corporate staff. Even companies in the business of funding and incubating startups, like YCombinator, are reducing their cohort sizes by 40%. 🔻

The tale of a bifurcated job market continues.

Industries like technology that ramped up hiring during the pandemic are now having to cut back as growth slows. Meanwhile, industries like travel and hospitality that made deep cuts during Covid are struggling to keep pace with demand.

On top of the reversal of those trends, businesses must navigate an uncertain macroeconomic environment riddled with inflation, changing consumer habits, and an overall slowdown in growth.

This week’s JOLTs data showed the most significant decline in the number of job openings since the pandemic began. Given that data and what we’re hearing from both public and private companies, all eyes are on tomorrow’s non-farm payrolls release to see how the labor market is faring at the aggregate level. 👀

Lastly, this week has been chock-full of Fed Governor speeches. 💬

Today we heard from Cleaveland Fed President Loretta Mester, who believes the Fed should raise rates above 4% to help bring inflation down. This view makes her one of the most hawkish members of the rate-setting committee and is less wishy-washy than what we’ve heard from other members.

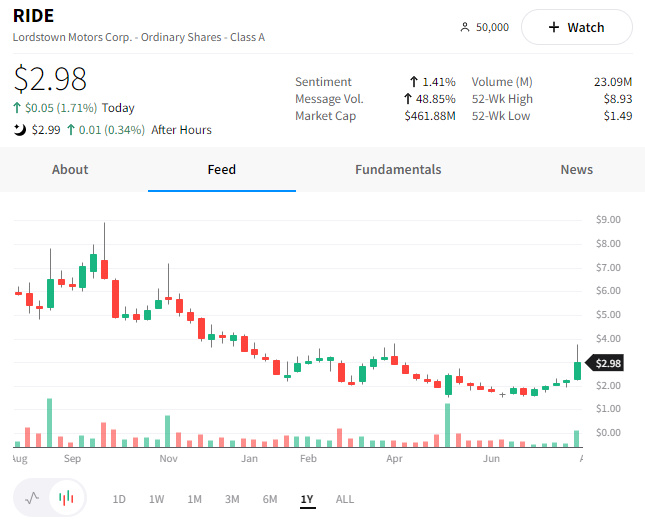

Lordstown Motors had a volatile trading session, ultimately closing up 1.71% after releasing its second-quarter earnings report.

The electric truck startup reaffirmed plans to begin commercial production of its first vehicle this quarter and roll out the first deliveries by the end of the year. However, its CEO Edward Hightower said production would be slow and heavily reliant on capital availability. It expects to produce about 500 vehicles through early 2023, which is very slow by industry standards. 🐌

Despite tepid news on the production front, investors are focusing on the fact that the company said it would need to raise between $50 to $75 million this year, well below its previous expectations of $150 million. For a company that has struggled to raise money effectively/efficiently in the past, an extended cash runway is a welcome sign.

The company did produce an operating profit of $61.3 million, driven solely by gains related to its Ohio factory sale to Foxconn. 💰

The stock’s volatility continues as uncertainty about the company’s ability to keep pace with well-funded competitors General Motors, Rivian Automotive, and Ford remains in question. Whether or not it can meet this quarter’s production goal of producing *one* vehicle will likely be a significant tell as to where its future in the industry lies. 🤷♂️

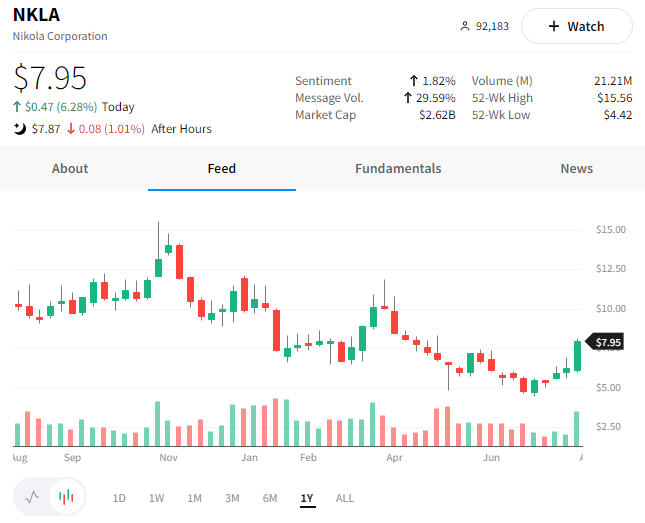

Meanwhile, Nikola shares rallied nearly 7% today after the company reported better-than-expected earnings and revenue. 📈

The company built 50 trucks in the quarter, 48 of which were shipped to dealers, and confirmed that it’s still on track to hit its 2022 deliveries guidance.

Its numbers also confirmed the company had significant cash on hand at the end of the quarter. Its balance sheet had $529 million in cash, with an additional $313 million remaining on its existing equity line of credit. 🤑

The stock is up nearly 28% this week after a string of positive news. On Tuesday, it won shareholder approval to increase its shares outstanding from 600 to 800 million, opening the doors for future financing. Additionally, it announced the acquisition of Romeo Power, giving the company control over a critical part of its supply chain. ⚡

Bullets

Bullets From The Day:

🎮 Tencent is getting aggressive in the global gaming market. To expand its reach in the industry, the company plans to expand its take in ‘Assassin’s Creed’ maker Ubisoft, which it took a 5% stake in roughly four years ago. Ubisoft shares rallied over 20% after the news broke, as public investors own approximately 80% of the French firm’s shares. Therefore, to gain a meaningful stake, it’s expected that Tencent may have to buy some shares in the open market. Reuters has more.

💊 Amgen bets on blockbuster drug in $3.7 billion deal. The company is buying ChemoCentryx Inc. in an all-cash deal that values it at a roughly 116% premium to its last closing price. The deal will give Amgen control of at least two experimental therapies for immune disorders, as well as a potential blockbuster treatment for inflammatory disorders. More from Reuters.

✈️ Private equity firm Apollo scoops up Atlas Air. Just a week after JetBlue and Spirit Airlines agreed to a merger creating the U.S.’s fifth largest airline, Apollo Global Management is buying Atlas Air Worldwide Holdings in a $3.2 billion deal. The company offers air leasing services that can be used to ship perishables, heavy construction equipment, or passengers and has clients ranging from Boeing, FedEx, and MotoGP as clients. CNBC has more.

🌞 Bill Gates-founded VC firm bets big on robot-built solar farms. Breakthrough Energy Ventures, a climate-focused VC firm with ties to some of the world’s wealthiest people, is participating in a $44 million bet on solar startup Terabase Energy. The startup aims to build new solar farms “at the terawatt scale” by using its automated, onsite factory to speed up production. The company also makes software tools to manage the design and construction of solar farms. More from TechCrunch.

😬 Tensions continue as China fires missiles near Taiwan. As Nancy Pelosi visits Taiwan, political tensions remain high, and China continues to flex its muscles in a show of strength. China fired multiple missiles toward waters near Taiwan as part of a live-fire training mission. According to a Chinese military expert on state television channel CCTV, Chinese long-range missiles flew over Taiwan Island for the first time, representing a significant escalation of the country’s military intimidation against Taiwan. CNN has more.

Links

Links That Don’t Suck:

👎 A TikTok rival promised millions to Black creators. Now some are deep in debt.

✌️ The vibes in the economy are weird. Really weird.

🐟 Fish tank PC case tops your computer with 13.5 liters of water

⛵ French sailor survives 16 hours under capsized boat in the Atlantic Ocean

🐠 Parts of Great Barrier Reef show highest coral cover seen in 36 years

🕳️ A massive sinkhole just discovered in Chile has authorities puzzled

💔 Social isolation and loneliness increase the risk of death from heart attack, stroke

🖼️ ‘An engine for the imagination’: the rise of AI image generators

🗑️ Blizzard reportedly cans WoW spinoff MMO that spent three years in development

🐕 A PetSmart dog groomer quit her job. They billed her thousands of dollars for training.