Welcome to the Stocktwits Top 25 Newsletter for Week 38 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 38:

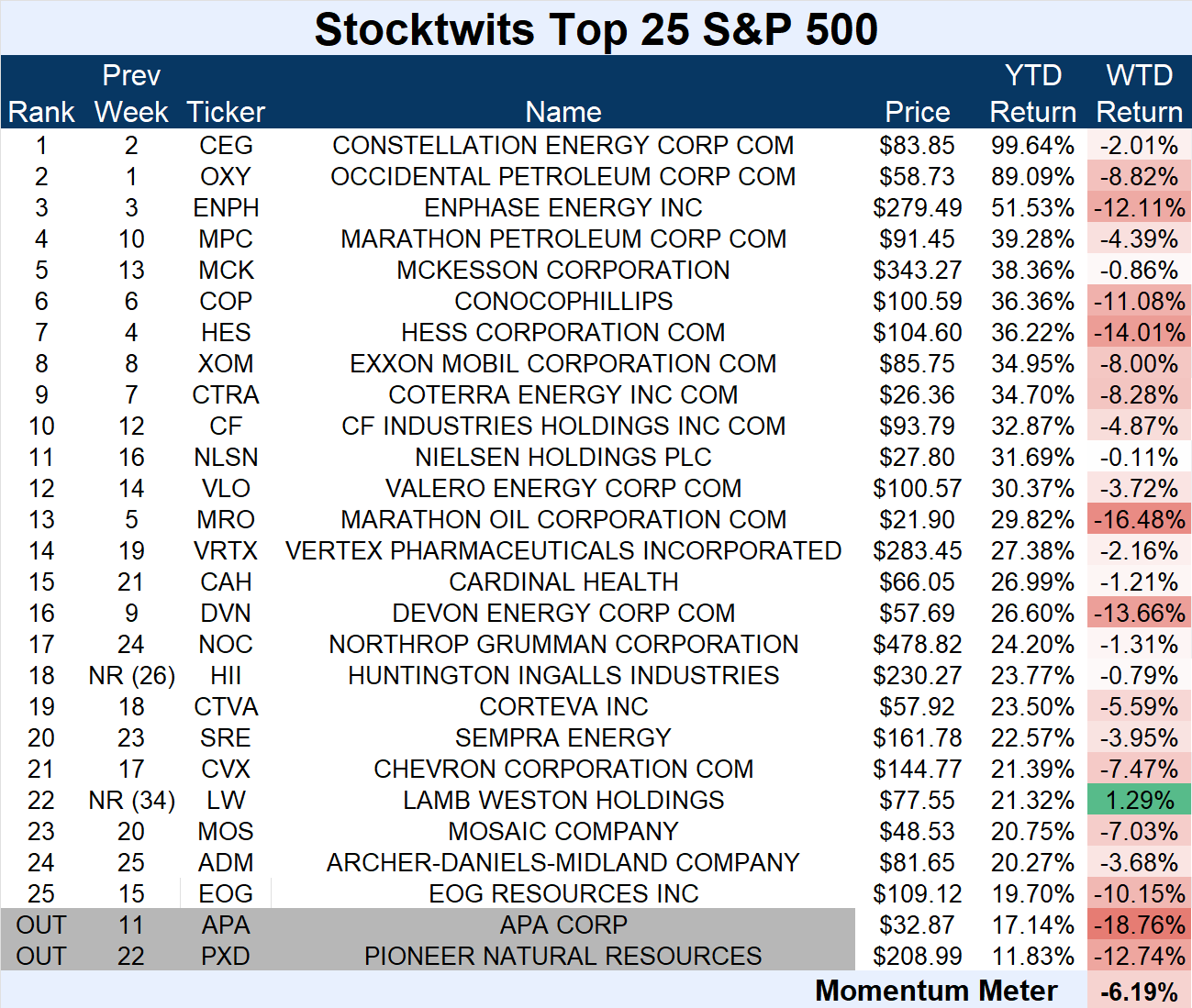

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (-6.19%) underperformed the S&P 500 index (-4.65%).

There were two major changes to the list this week.

Huntington Ingalls (-0.79%) and Lamb Weston (+1.29%) joined the list.

They replaced APA Corp. (-18.76%) and Pioneer Natural Resources (-12.74%).

Energy stocks were hit hard this week and crude oil fell below $80 as the Fed hike stoked global recession fears.

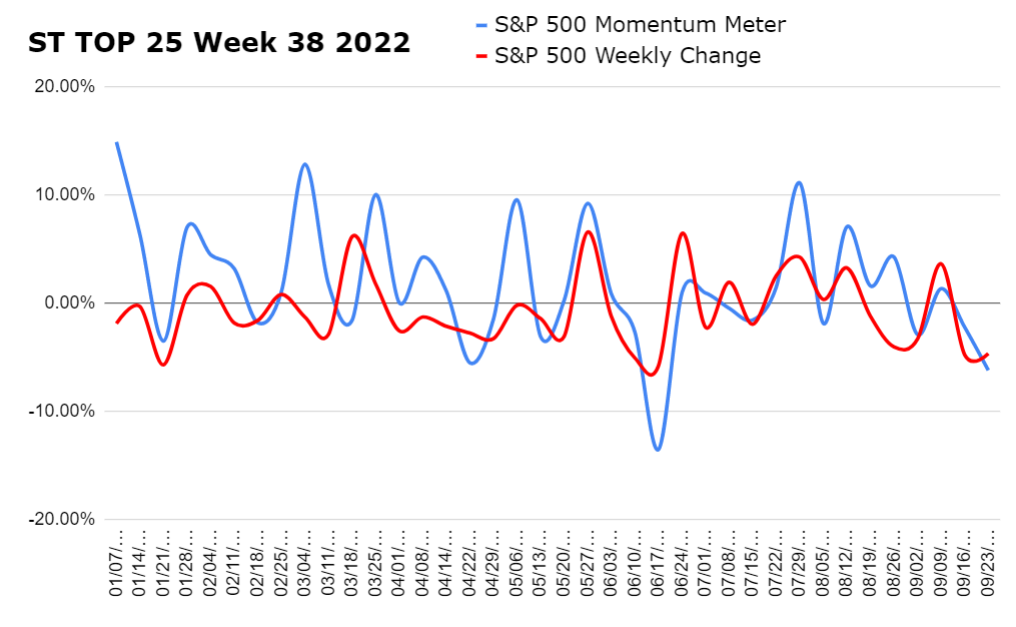

Check out how the momentum meter has performed vs. the S&P 500 index this year:

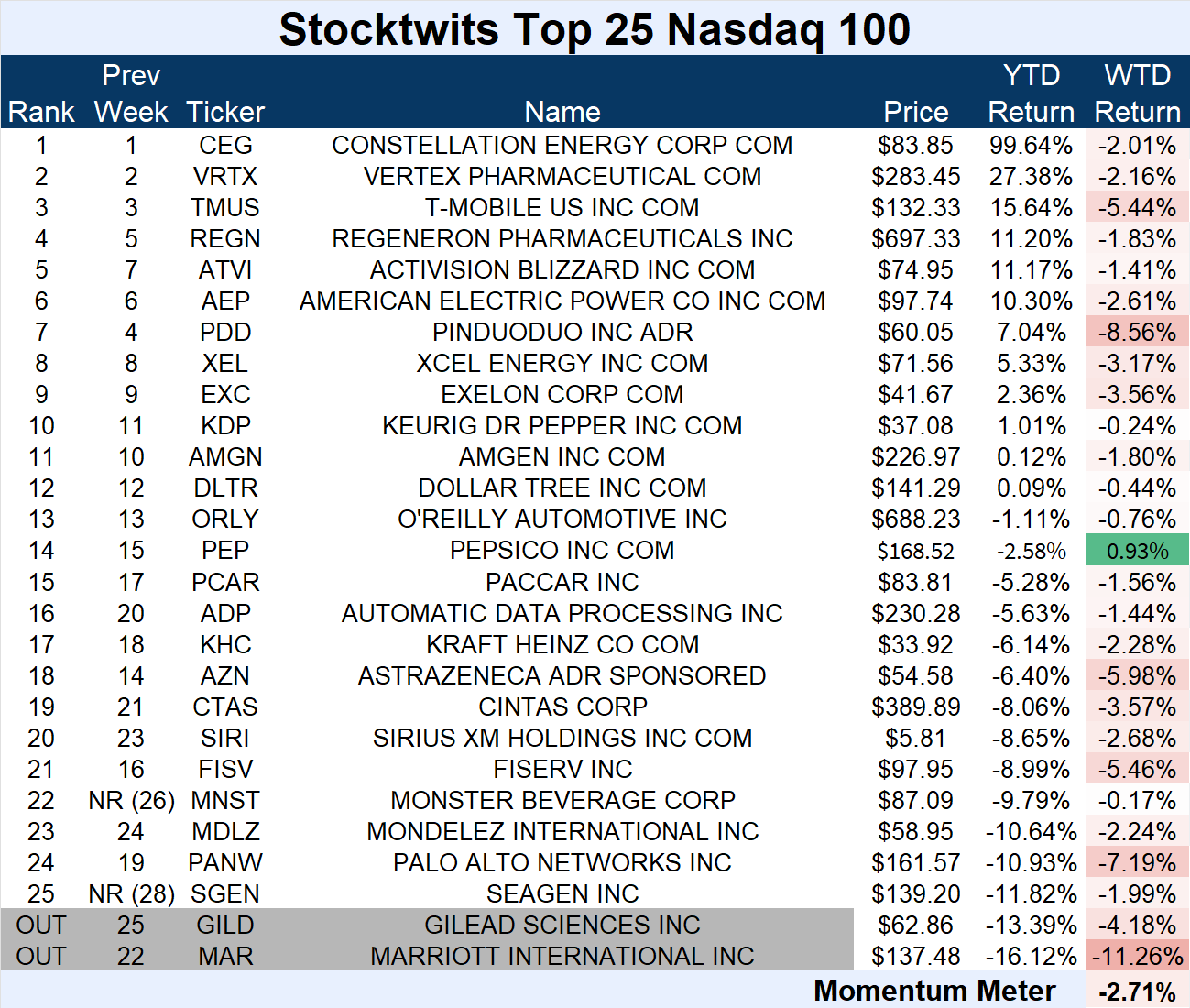

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (-2.71%) outperformed the Nasdaq 100 index (-4.64%).

There were two major changes to the list this week.

Monster Beverage (-0.17%) and Seagen (-1.99%) joined the list.

They replaced Gilead Sciences (-4.18%) and Marriott International (-11.26%).

This list fared slightly better than the others, given it has less energy exposure and more defensive names like Pepsi and Dollar Tree.

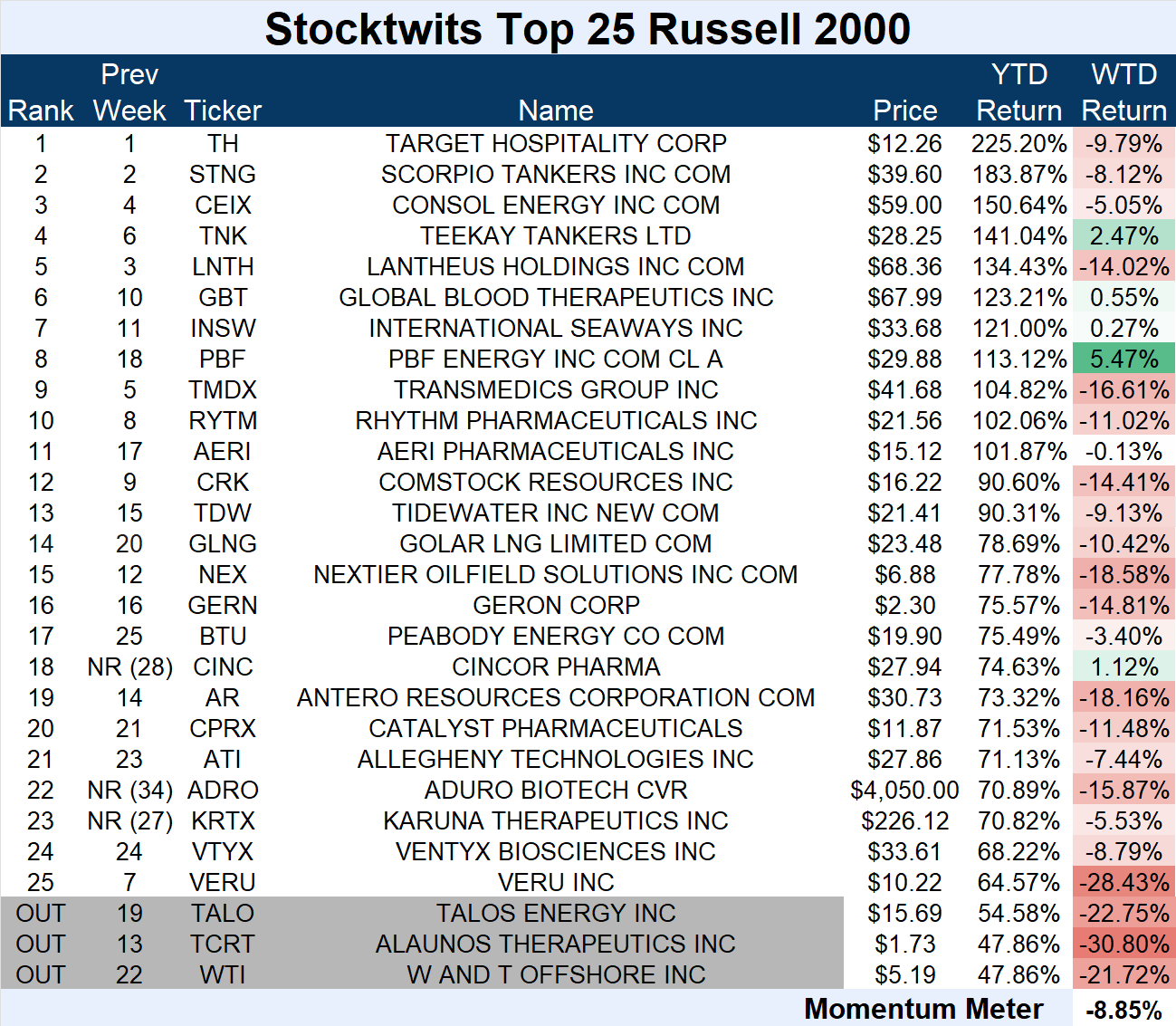

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (-8.85%) underperformed the Russell 2000 index (-6.65%).

There were three major changes to the list this week.

Cincor Pharma (+1.12%), Aduro Biotech (-15.87%), and Karuna Therapeutics (-5.53%) joined the list.

They replaced Talos Energy (-22.75%), Alaunos Therapeutics (-30.80%), and W&T Offshore (-21.72%).

Volatility among biotech and energy stocks continues, with many of them taking significant spills. 📉

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was PBF Energy, which rallied 5.47%. 📈

The mid-cap refining and logistics company received several analyst upgrades this week on news that it may start paying a dividend and buy back shares. Record refining margins in the U.S. have increased the company’s cash flow, which is why analysts are expecting them to begin returning some cash to shareholders. 💰

This week, the stock stood out in a rough tape by being one of the few green names on people’s screens. With that said, market participants are watching it closely as prices are at levels they’ve topped out at several times over the last decade. 👀

$PBF is up 113.12% YTD.

See Y’all Next Week 🤙