Stocks tried to make it three green days in a row, but a strong dollar and rising yields sent them off course late in the day — here’s what you missed today. 👀

Today’s issue includes OPEC+’s surprise output cut, the U.S. Dollar’s trend, and more news! 📰

Check out today’s heat map:

3 of 11 sectors were green, with energy (+2.13%) leading and utilities (-2.22%) lagging. 💚

In economic news, global PMI and ISM non-manufacturing surveys show that pricing pressures remain elevated in Europe, though they eased slightly in the U.S. during September. Additionally, the ADP employment report showed businesses added 208k jobs in September, with August’s figure increasing to 185k. 📈

Mortgage applications continue to drop along with home affordability and Hurricane Ian disruptions, falling 13% WoW and 37% YoY. 📉

Internationally, the Swiss National Bank is monitoring the Credit Suisse “situation” after a weekend of rumors sparked concern over the bank’s health. Meanwhile, British Prime Minister Liz Truss doubled down on a series of debt-funded economic reforms that sparked the recent turmoil. 💬

Tesla and Twitter shares continue to churn as we await news around Musk’s $44 billion deal to buy the social media company. 📰

In crypto news, the EU finally sealed the text of its landmark crypto law MiCA and fund transfer rules. Meanwhile, countries continue to keep up with the rapidly changing industry. Apparently, Italy hasn’t vetted the 73 crypto firms it approved. ₿

Other symbols active on the streams included: $WTRH (+5.41%), $VEV (+7.48%), $DWAC (+0.29%), $AERC (-19.70%), $MULN (-3.71%), $AVCT (-1.15%), $PEGY (+93.01%), and $TOPS (+81.95%). 🔥

Here are the closing prices:

| S&P 500 | 3,783 | -0.20% |

| Nasdaq | 11,149 | -0.25% |

| Russell 2000 | 1,763 | -0.74% |

| Dow Jones | 30,274 | -0.14% |

Commodities

OPEC+ Cuts Give Crude Renewed Energy

The Peloton instructor is correct. No one can take your energy. However, they can make it more expensive. 🤔

That’s precisely what OPEC+ aims to do by cutting oil production by 2 million barrels per day. Analysts expected a 1 million barrel cut, but the ministry is looking to shore up prices despite calls from the U.S. and other western countries to support the global economy. 🛢️

Oil prices had already been rising in anticipation of the cut but continued their 15% rise in seven trading days. Meanwhile, the energy sector of the stock market rallied alongside oil prices, up 12% over the last five days. It remains this year’s best-performing sector across most timeframes.

Additionally, the European Union countries finally agreed on a controversial plan to place a price cap on Russian oil. The countries moved forward with the plan despite concerns that it would simply drive much-needed energy supplies away from the region. However, diplomats argue it, along with new sanctions, will punish Moscow for illegally annexing four regions in Ukraine.

We’ll have to see how this plays out as Europe prepares for a potentially ice-cold winter season. 🥶

Earnings

Potatoes Are Cool Again

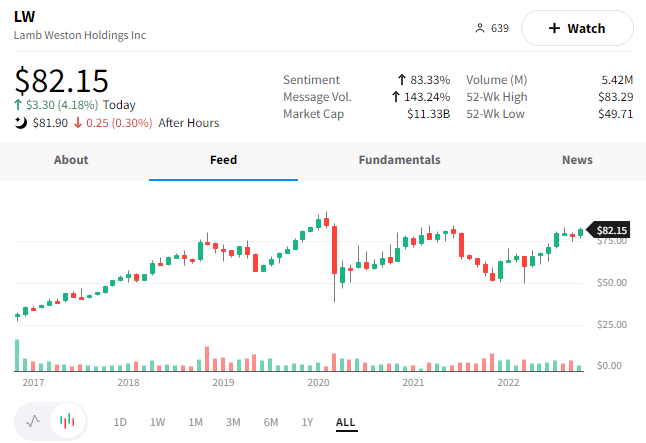

Idaho-based food processing company Lamb Weston is one of the largest producers and processors of frozen french fries, waffle fries, and other frozen potato products. 🥔

Today it reported adjusted earnings per share well above analyst expectations of $0.50, at $0.75. Meanwhile, revenues of $1.13 billion matched consensus expectations.

In terms of result drivers, management said that sales volumes fell 5%. This was primarily due to softer casual dining and full-service restaurant traffic. However, its product mix and pricing helped offset that impact and helped reach its revenue estimates.

The company also noted that heat waves would likely result in a total potato crop at the lower end of its historical averages. It expects overall quality to remain good, though. 👍

The stock rose 4.18% today towards the mid-80s, where it failed to break through over the last few years. Traders will be watching to see if the market’s current preference for “consumer staples” companies like $LW can help push its shares to new highs. 💪

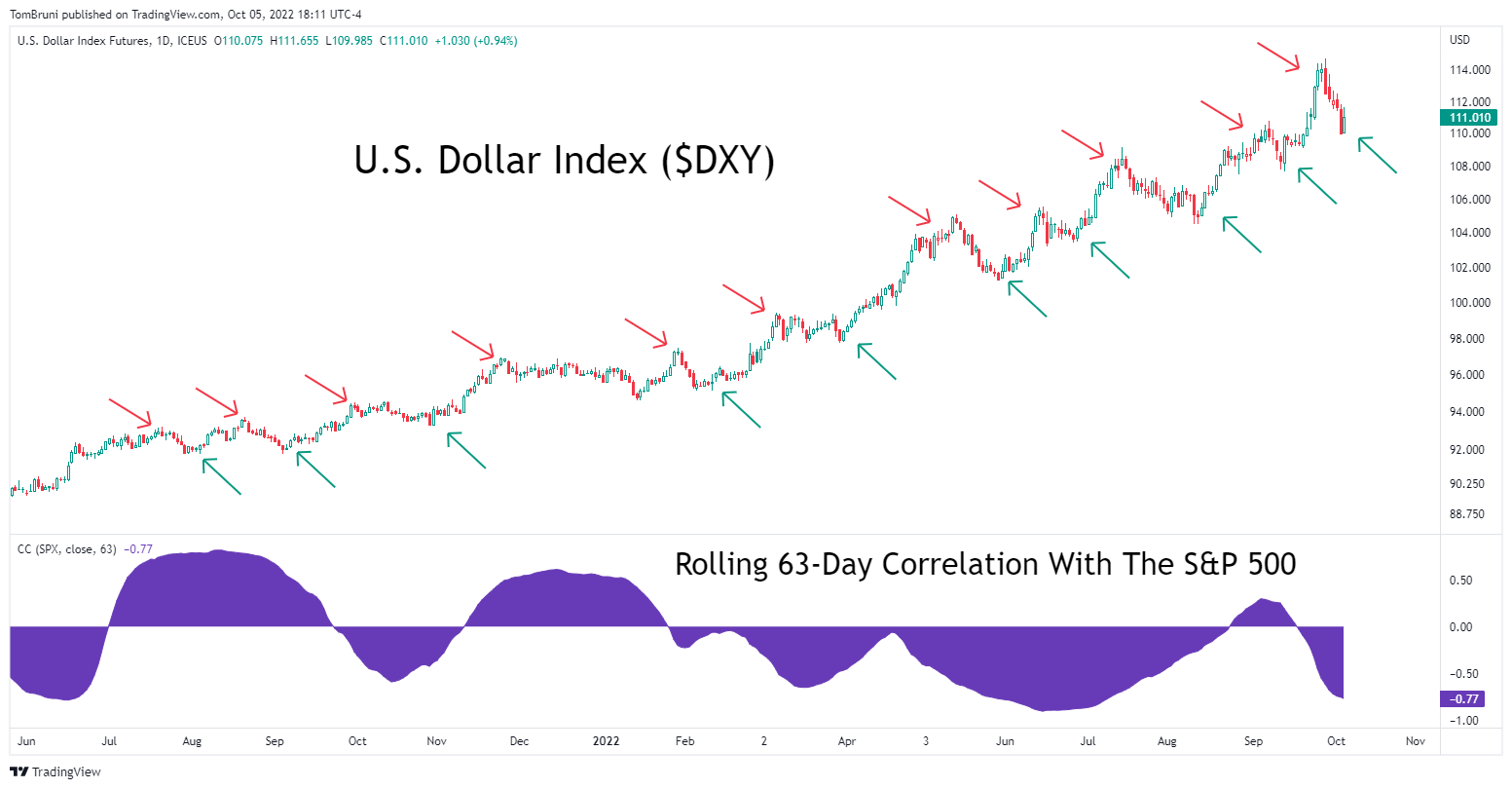

The two-day rally in stock markets around the world has many rushing to call a top in the year’s only safe-haven asset, the U.S. Dollar. In July, we wrote an extensive piece about why the Dollar is getting so much attention lately, which we recommend checking out. 📝

In this post, we’re simply going to point out that the trend in the U.S. Dollar Index, which most people use to track the Dollar’s performance, remains up. In technical analysis, an upward trend involves a data point making higher lows and higher highs, i.e., moving from the bottom left to the upper right of the chart.

And so far, the U.S. Dollar Index remains in a textbook uptrend. Below we obnoxiously use arrows to point out each successive higher high (red arrow) and higher low (green arrow) over the last fifteen months. Until prices break below their previous low of around 107.50 and fail to make a new high above 114, then many technical analysts say it’s hard to call a top.

So why does this all matter? Well, the U.S. Dollar’s 63-day (or quarterly) correlation with the S&P 500 has been strongly negative for most of the year. In other words, when the U.S. Dollar is rising, it reflects market participants’ preference for a safe asset over “riskier” assets like stocks. 🦺

As a result, many Wall Street Technicians suggest that a break in the U.S. Dollar Index’s uptrend would signal improving risk appetite and be a positive sign for the stock market. Correlations are always changing, but as it stands right now, the data looks supportive of their theory.

Friday’s nonfarm employment data is expected to cause an uptick in volatility. Rest assured, many will be watching this chart during that volatility to see if the Dollar’s trend is impacted. 👀

Bullets

Bullets From The Day:

🖥️ Demand for inflation protection strains the 20-year-old government platform. If you’ve ever used a government website, you know how bad it can be. After TreasuryDirect sold more than $27 billion in Series I bonds since last November, it’s finally ready for an upgrade. The significant uptick in demand has strained its clunky infrastructure and pushed customer support wait times to over an hour, highlighting a clear need for an improved user experience. Although Tuesday’s revamp to the website is a start, the Treasury Department says there are many more system upgrades to come. CNBC has more.

📱 Amazon discontinues its video-calling device for kids. The company’s Amazon Glow enabled kids and family members to chat remotely and play games using a touchscreen projected by the device. However, as Amazon cuts expenses amid slowing growth and a weaker economy, it is discontinuing some of its less-popular releases. More from CNBC.

🛒 U.S. e-commerce site Poshmark sells for $1.2 billion. Naver is buying Poshmark, the online retail site that lets people shop from other users’ closets, for $17.90 per share in an all-cash deal. Naver operates a search engine, e-commerce platform, and other services in South Korea. The company says the deal will expand its reach in online retail and allow Poshmark to enter international markets. Consolidation in the secondhand clothing market continues, as Etsy acquired fashion resale app Depop for $1.62 billion last year. CNBC has more.

🛍️ Retail giants come out swinging for the holiday shopping season. Amazon Prime’s early access sale on October 11-12 has a new competitor…Walmart. The retailer is holding a “Rollbacks and More” sale event from October 10-13, marking the start of what’s likely to be a very competitive holiday shopping season. Many retailers are sitting on excess inventory while consumer demand drops for many discretionary items, forcing companies to increase their promotional activity to lure in customers. More from TechCrunch.

⚡ Ford tripled EV sales despite a dip in total deliveries. The company maintained its place as America’s second best-selling EV marker after a surge in sales last quarter. The company’s total third-quarter sales rose 16% YoY, while EV sales were up 197.3%. While it’s important to note that EVs remain only a small part of Ford’s total sales at 3.3%, investors are focused on the forward progress the company continues to make in the space. JALOPNIK has more.

Links

Links That Don’t Suck:

❌ REI dumps Black Friday – Permanently

👋 Tyson Foods next big company leaving Chicago during rampant crime

🚀 SpaceX launches Crew-5 mission for NASA, carrying astronauts to space station

😋 When you eat may dictate how hungry you are, study says

💊 These LSD-based drugs seem to help mice with anxiety and depression – without the trip

⚖️ Holmes gets new hearing after disheveled gov’t witness shows up at her house