Welcome to the Stocktwits Top 25 Newsletter for Week 45 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 45:

Standard and Poor's 500

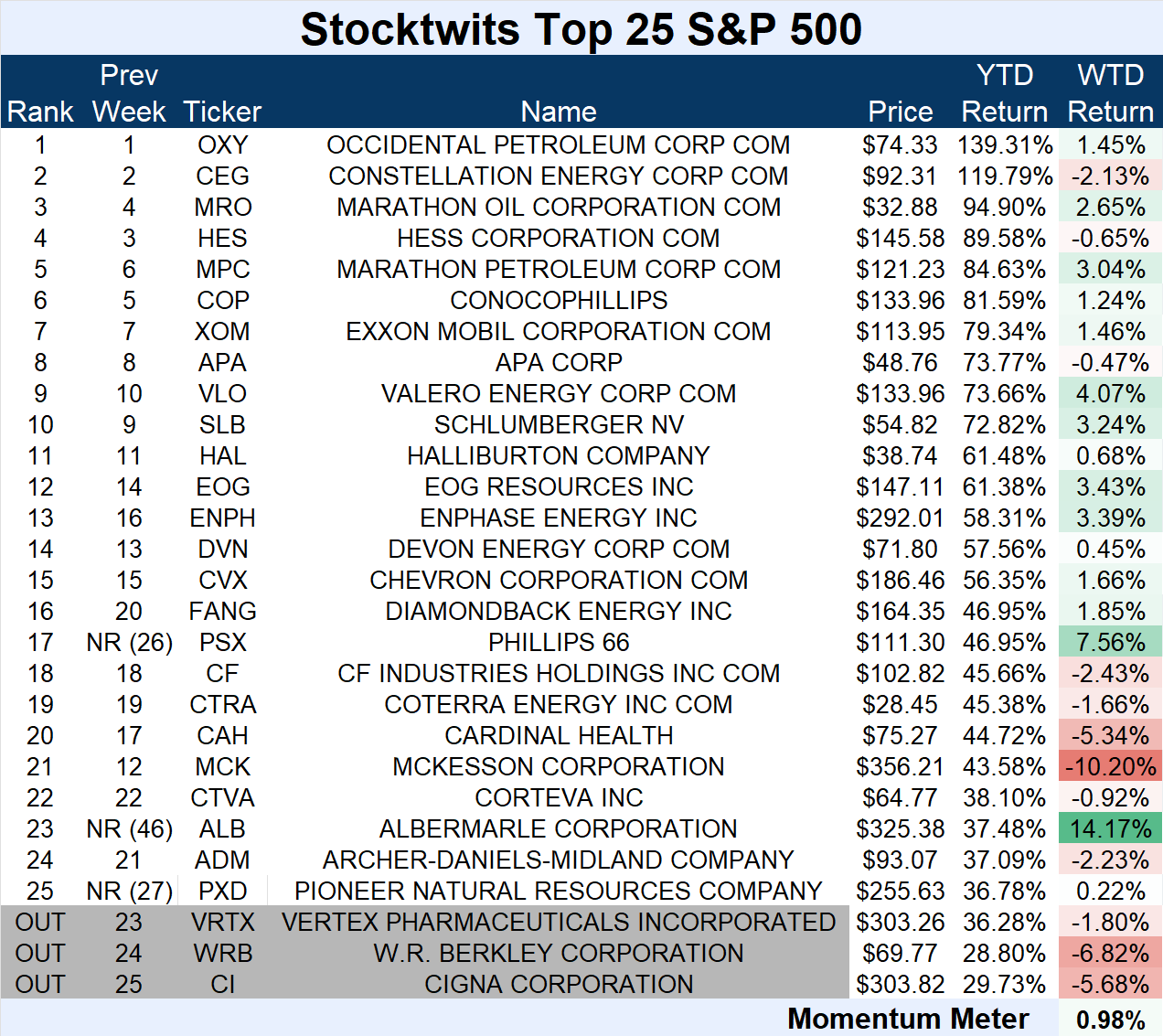

ST Top 25 S&P 500

The S&P 500 Top 25 list (+0.98%) underperformed the S&P 500 index (+5.90%).

There were three major changes to the list this week.

Phillips 66 (+7.56%), Albermarle Corp. (+14.17%), and Pioneer Natural Resources (+0.22%) joined the list.

They replaced Vertex Pharmaceuticals (-1.80%), W.R. Berkley (-6.82%), and Cigna Corp. (-5.68%).

Technology, consumer discretionary, and other sectors that have fallen most year-to-date all rallied heavily this week. That drove the outperformance of the index vs. its year-to-date winners.

Check out how the momentum meter has performed vs. the S&P 500 index this year:

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+2.35%) underperformed the Nasdaq 100 index (+8.84%).

There was one major change to the list this week.

Marriott International (+9.95%) replaced Electronic Arts (+1.13%).

Like the S&P 500 list, the lack of technology and consumer discretionary in the list caused significant underperformance relative to the Nasdaq 100 index.

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+0.69%) underperformed the Russell 2000 index (+4.60%).

There were two major changes to the list this week.

Delek U.S. Holdings (+7.71%) and Universal Logistics (+8.41%) joined the list.

They replaced Golar LNG Ltd. (-8.21%) and Lantheus Holdings (-6.82%).

Energy and health care stocks continue to populate this list’s biggest winners and losers.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Target Hospitality Corp., which rallied 16.45%. 📈

The $1.31 billion specialty rental and hospitality services company reported earnings this week. The company’s earnings came in below expectations, while revenues beat. 📝

Shares rallied after the news and accelerated as the broader market turned higher, currently trading about 15% below all-time highs.

$TH is up 258.62% YTD.

See Y’all Next Week 🤙