Earnings continue to take center stage as the stock market indexes try to keep the sellers at bay — let’s see what you missed. 👀

Today’s issue discusses Amazon incentivizing employee resignations, a mall retailer resurgence, and Chinese internet stocks’ earnings. 📰

Check out today’s heat map:

3 of 11 sectors closed green. Energy (+0.25%) led, and utilities lagged (-1.72%). 💚

U.S. housing starts fell 4.2% in October, driven by single-family projects falling to their lowest level in 2.5 years. Building permits slumped by 2.4%, with single-family permits dropping by 3.6%. Meanwhile, October rent growth was the slowest in 18 months. 🏘️

Palo Alto Networks rallied 6% after announcing it will acquire Cider Security and beating earnings. 📈

Applied Materials rose 3% after forecasting current-quarter revenue above estimates. 👍

In crypto news, FTX’s new CEO says he’s never seen ‘such a complete failure’ of corporate controls. Binance is relaunching a bid for the bankrupt crypto lender Voyager. And someone paid over $500,000 for the ‘DOGE’ username on Telegram. ₿

Other symbols active on the streams included: $STNE (+10.96%), $DWAC (-6.34%), $MMTLP (-9.04%), $ALIT (+2.94%), $DLO (+1.34%), $GLBL (+20.91%), $ARDX (+40.98%), and $SATX (+96.35%). 🔥

Here are the closing prices:

| S&P 500 | 3,947 | -0.31% |

| Nasdaq | 11,145 | -0.35% |

| Russell 2000 | 1,839 | -0.76% |

| Dow Jones | 33,546 | -0.02% |

Company News

Amazon’s “Get Paid To Leave” Program

After laying off 10,000 corporate and technology employees earlier this week, Amazon is stepping up its efforts to reduce headcount further. ✂️

This time they’re using a “voluntary severance” program to incentivize employees to resign by November 29th. And if they change their mind, they’ll have until December 5th to withdraw their application. How about that for an awkward conversation?

The package includes a “lump-sum” payment of three months’ pay plus one week of salary for every six years with the company. Their insurance will continue through the end of December, and they’ll also receive a weekly stipend for twelve weeks to help offset COBRA premiums. 💰

Meanwhile, a memo from CEO Andy Jassy warned that the company will continue to lay off employees in 2023. However, it won’t know the extent of further cuts until after the company completes its annual operating planning process.

What is clear is that Amazon and other tech giants remain in slim-down mode. And how the holiday-focused fourth quarter shakes out will likely inform its decisions about the year ahead. 📆

Sponsored

Hedgeye: The Firm That Called the Crash

Markets have crashed. Millions of investors are staring at 25% (or more) losses. But perhaps not those who listened to former hedge fund manager Keith McCullough on Hedgeye’s The Macro Show.

Keith warned investors to pivot their portfolios before the 2022 market crash (after being bullish throughout 2021).

Some of the world’s largest asset managers have relied on Hedgeye’s risk management process since 2008.

The firm’s hedge fund-quality research, risk management tools, and investing ideas are now available to all investors.

New subscribers can try Hedgeye’s popular daily investing webcasts for 6 months for only $6 with its introductory Cyber November deal.

Investors who subscribe to The Macro Show or The Call @ Hedgeye before midnight on Friday, November 18th will also receive The Hedgeye Elite Pass—a package of 7 Hedgeye investing products.

This Introductory Deal delivers over $843 in value.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

Having A Ball At The Mall

After hearing mixed results from big box retailers Tuesday and Wednesday, several mall retailers presented results that sent shares surging. 😮

Macy’s beat both earnings and revenue expectations. Adjusted earnings per share were $0.52 vs. the $0.19 expected. And revenues of $5.23 billion marginally beat the $5.2 billion expected.

The company trimmed its full-year revenue guidance in August and stood by that today despite the tougher sales backdrop. The company says it has the right inventory mix for the upcoming holiday season and is showing strong luxury sales.

Additionally, its fresher inventory has allowed it to keep its pricing power, leading it to raise its full-year earnings guidance. 🔺

The company’s turnaround plan is still in process, but investors liked what they saw today. $M shares rose 15% to their highest level since June.

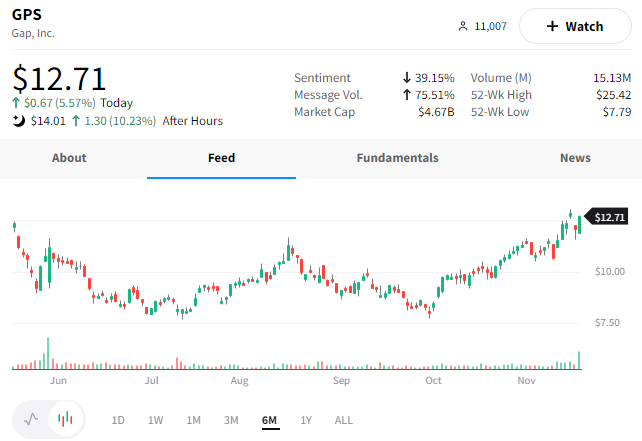

Gap also beat Q3 revenue expectations, coming in at $4.04 billion vs. the $3.8 billion expected. Its adjusted earnings per share of $0.71 showed a dramatic YoY improvement as the company got its inventory and costs under control. 👍

Like Macy’s, the retailer’s luxury brand Banana Republic was the clear standout, with comparable sales rising 10%. Meanwhile, Gap’s namesake brand saw comparable sales rise 4%, while Old Navy was down 1% and Athleta was flat.

Despite the improvements, the company offered a cautious view of the holiday shopping season, saying that its overall net sales could be down mid-single digits YoY in Q4.

Like its peers, the company is amidst a long-term turnaround plan and has more work to do. Today’s progress was enough to send $GPS shares higher by 16%. 📈

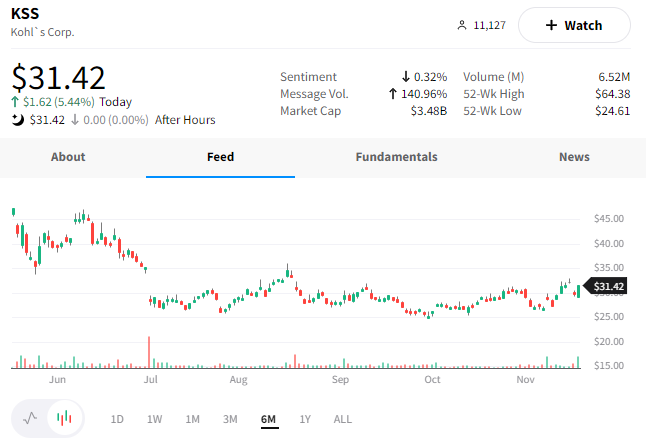

Last up is Kohl’s, which saw results in line with its trimmed guidance earlier in the quarter. 🛍️

Sales fell 7% to $4.28 billion as inflation and the weaker macro environment pressure the company’s core customer base, middle-income consumers. Executives say that segment is buying fewer items and opting for less expensive brands. Though, the coming did see an uptick in sales from its lower-income and higher-income customers.

On that note, the company withdrew its guidance for the year, citing a volatile retail environment and overall economic uncertainty. It says its visibility for the fourth quarter is difficult. However, it expects the holiday shopping season to be highly promotional as shoppers opt to begin purchases later in the quarter than last year.

Additionally, activist investors continue to circle the company. It’s also it looking for a new CEO to replace Michelle Gass, who is departing in December. All while it tries to execute a broader turnaround plan which includes redesigning stores, adding new brands, and offering new e-commerce options. 🏬

Needless to say, the retailer has a lot on its plate. After initially selling off on the news, shares $KSS rallied back to close up 5%.

By no means are these “knock your socks off” results for the struggling retailers, but they’re not as bad as many expected. And in the current environment, sometimes “not that bad” is all it takes to spark a rally in these companies’ shares. 🤷

Earnings

The Climb Continues…

International stocks have been on a run, particularly in China. Well, that run continued today despite mixed results from e-commerce giant Alibaba. 🛒

First up, Alibaba reported adjusted earnings per share of $1.82 vs. the $1.70 expected. However, revenues of $29.12 billion fell short of the $29.60 billion expected as covid lockdowns and regulatory issues hampered the company’s operations.

Investors are used to double-digit revenue growth, but YoY sales increased just 3% in the quarter. With that said, it’s an improvement from the 4% decline last quarter.

Investors appear to be looking ahead despite the macroeconomic uncertainty and covid issues. $BABA shares rallied another 8% today, adding to their strong rally since late October. 💪

Tomorrow morning, we’ll hear from JD.com, who investors think experienced similar headwinds.

Bullets

Bullets From The Day:

⚡ GM expects major EV profits years ahead of schedule. The automaker expects its electric vehicles to be in line with traditional internal combustion engines by 2025. The company’s CEO cited significant federal incentives from the Biden administration’s Inflation Reduction Act as the driver of increased profit factors. It also boosted its 2022 cash flow guidance to between $10-$11 billion and tightened its adjusted earnings range to $13.5-$14.5 billion. CNBC has more.

⚾ Liberty Media will split off Atlanta Braves. It will create a new Liberty Live Group tracking stock, which will house the company’s 31% stake in Live Nation Entertainment, the Atlanta Braves, and other things. The company cited investors’ strong appetite for professional sports teams, sharing that it will be able to unlock more value from the Braves and its related real estate development if it’s a separate entity. Executives expect the split-off and tracking stock reclassification to happen in the first half of 2023. More from The Hollywood Reporter.

🧑⚖️ Biden administration petitions Supreme Court on student loan relief. Three days after a St. Louis federal appeals court issued a nationwide injunction on the program, the Biden admin is asking the Supreme Court to overturn the ruling. Meanwhile, the back and forth is causing mass confusion among borrowers who are set to see their interest and payments resume on their loans in January. CNBC has more.

🔻 Market volatility takes a bite out of 401(k) balances. Fidelity’s analysis showed the average 401(k) balance fell 23% YoY due to the decline in stocks, bonds, and other traditional financial assets. On a positive note, the study also showed that most savers kept their contribution rate steady during the volatility, allowing them to accumulate assets at lower prices. We’ll have to wait and see whether recessionary conditions cause a change in their behavior going forward. More from CNBC.

💳 Plaid nabs former Meta exec to lead its payments push. The company has tapped John Anderson to serve as its new head of payments as it looks to evolve beyond its core product of account linking. With it expanding into identity and income verification earlier this year, payments are a natural next step for its business. The company says there’s been much innovation in point of sale in the last decade, but only on the digital side. As a result, the company will focus on innovating the physical interaction aspect of the payment experience. TechCrunch has more.

Links

Links That Don’t Suck:

🐢 Fossils of car-sized dinosaur-era sea turtle unearthed in Spain

🛢️ U.K. to raise $65 billion from windfall tax on energy companies

⚠️ This common problem with tenant background checks is costing renters

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.