We know you’re suffering from a food coma, and we are too. But let’s recap the shortened holiday week and prep for the week ahead. 👍

What Happened?

💚 The shortened holiday week saw stocks, bonds, and other risk assets rally marginally while the safe-haven U.S. Dollar retested its recent lows.

🤩 This week’s Stocktwits Top 25 report showed moderate outperformance relative to the indexes.

📝 The November Fed Minutes told us what we already knew and a bit of what we didn’t. The Federal Reserve’s base case now includes a U.S. recession in 2023.

🏥 China is struggling with a COVID-19 outbreak, locking down its capital Beijing. Meanwhile, its central bank is attempting to backstop its property market, which accounts for 25% of its economy.

🛍️ Retail stocks continued to surprise to the upside, including Burlington and Abercrombie, Dick’s Sporting Goods, and Best Buy.

🐭 Bob Iger sent Disney shares higher after announcing that he’s returning as CEO less than a year after passing the baton to Bob Chapek.

📉 A few retail investor favorites made fresh lows this week, while earnings losers like Zoom also suffered. Meanwhile, shares of the world’s largest farm equipment maker hit an all-time high.

⚽ The world cup wasn’t the only reason soccer was on investors’ minds. Manchester United shares rallied 60% this week as the club explores a potential sale.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $MMAT, $MMTLP, $MULN, $DWAC, $PSNY, and $SOFI.

🃏 P.S. Our annual Chips for Charity is on Saturday. Have you secured your seat at the table?

Here are the closing prices:

| S&P 500 | 4,026 | +1.53% |

| Nasdaq | 11,226 | +0.72% |

| Russell 2000 | 1,869 | +1.05% |

| Dow Jones | 34,347 | +1.78% |

You scratch our backs. We’ll scratch yours. 😉

Answer a quick 11-question survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation.

Bullets

Bullets From The Weekend

🛒 Black Friday e-commerce sales top $9 billion. Overall online sales for Black Friday were up 2.3% YoY to a record $9.12 billion. Thanksgiving shopping was also strong, with consumers spending an all-time high of $5.29 billion, up 2.9% YoY. This may be a promising indicator of the rest of the holiday shopping season, though we’ll have to see how the rest of the weekend and Cyber Monday sales tally. CNBC has more.

📵 Frontier Airlines ditches telephone customer service entirely. The budget airline is no longer offering phone support to customers, saying customers can now reach them by text, social media channels, or WhatsApp. This comes as the airline looks to reduce labor costs and increase the number of customers it can assist. It joins Breeze Airways and other airlines offering only text, email, or messenger options for customer service. More from CNBC.

🛢️ U.S. allows Chevron to expand Venezuelan oil imports. The U.S. oil giant received an expanded license which allows it to resume production in Venezuela and import that crude into the U.S. This will allow it to revive existing oil projects in the sanctioned country and increase the oil supply to U.S. refiners. With that said, cash payments to Venezuela remain restricted, which will likely limit the amount of oil available to Chevron. CNBC has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

All eyes will be on Thursday’s PCE Price Index and the employment data in the latter half of the week. In addition to the above, check out this week’s complete list of economic releases.

Earnings This Week

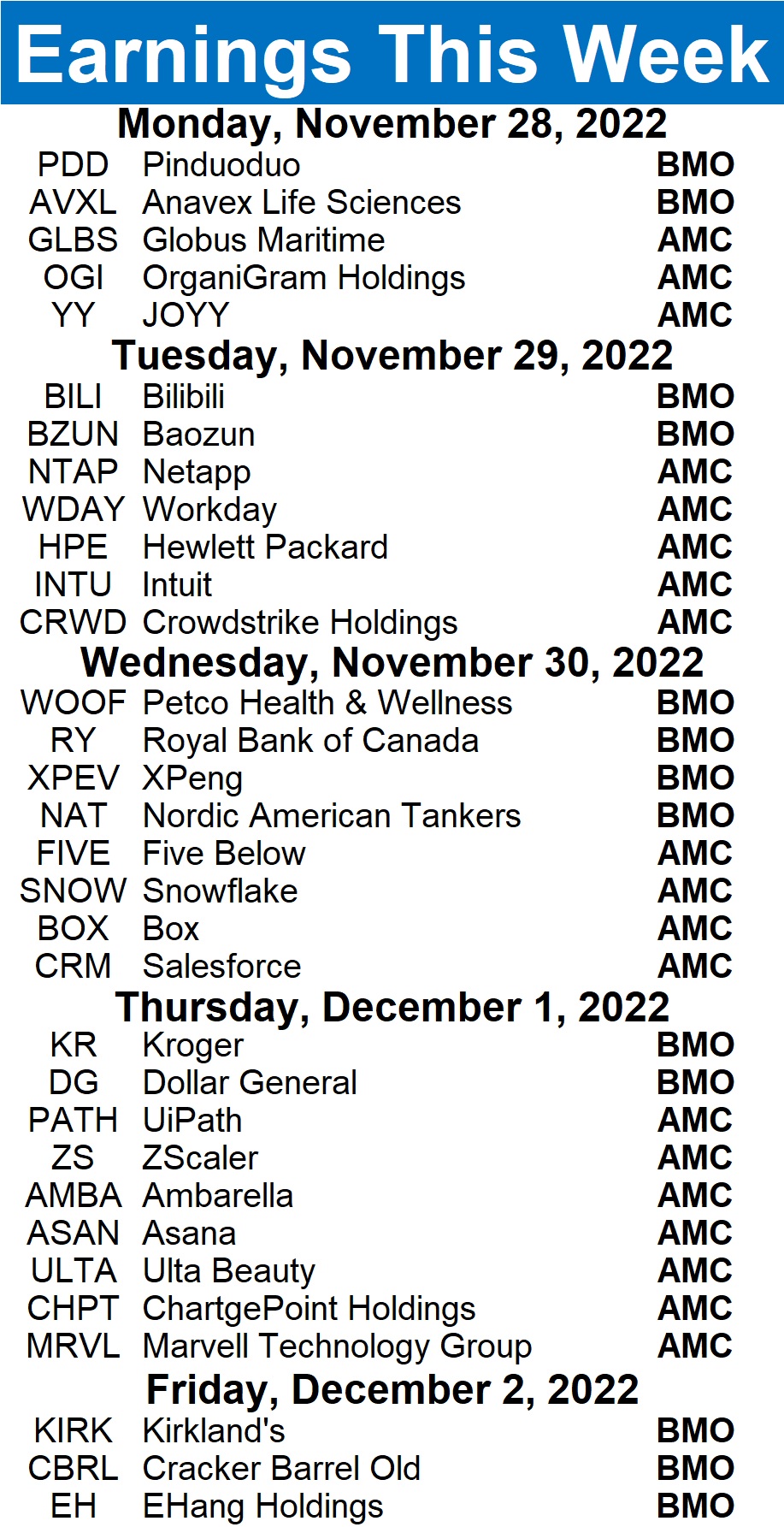

Earnings season is slowing down, with 115 companies reporting this week. Some tickers you may recognize are $CRM, $SNOW, $CRWD, $BILI, $PDD, $CHPT, $DG, $KIRK, and many, many more.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

🥼 Oxford scientists crack case of why ketchup splatters from near-empty bottle

🐖 China’s 26-storey pig skyscraper ready to slaughter 1 million pigs a year

🪨 Man keeps rock for years, hoping it’s gold. It turns out to be far more valuable

🚀 NASA’s Orion spacecraft breaks Apollo 13 flight record

🛏️ United Furniture Industries laid off all 2,700 workers while they were sleeping

🚫 New York is the first state to ban certain types of crypto mining – here’s what to know