After a week of sideways trading, Jerome Powell’s speech sent stocks and other risk assets blasting off again — let’s recap today’s news-filled session. 👀

Today’s issue covers Jerome Powell’s speech, another Chinese stock update, and more news from the day! 📰

Check out today’s heat map:

Every sector closed green. Technology (+5.02%) led, and energy (+0.50%) lagged. 💚

Oil prices rallied on a larger-than-expected inventory draw as the OPEC+ meeting looms next week. In Europe, Germany has signed a 15-year deal with Qatar to receive liquified natural gas (LNG) from the country through QatarEnergy and ConocoPhillips. 🛢️

Horizon Therapeutics rose 27% as it fields buyout interest from Amgen, J&J, and Sanofi. 💰

Software stock Okta rallied 17% after reporting better-than-expected results. 📈

Salesforce fell 5% after beating earnings and revenue expectations and announcing its Co-CEO Bret Taylor’s departure. 📉

Amazon experienced record sales over the holiday shopping weekend, confirming the third-party data suggesting a better-than-expected turnout. Meanwhile, CEO Andy Jassy says the company’s cost-cutting review revealed the economy is ‘more uncertain’ than previously thought. ⚠️

In crypto news, crypto exchange Kraken is laying off 1,100 employees. The European Central Bank (ECB) says bitcoin is on the ‘road to irrelevance.’ And Sam Bankman-Fried was interviewed by Andrew Ross Sorkin at the DealBook Summit. Our Litepaper writer, Jon Morgan, summarized the talk here and will continue updating it this evening for your reading pleasure. ₿

Other symbols active on the streams included: $CRWD (-14.75%), $DWAC (-3.02%), $MMTLP (-15.16%), $MULN (-4.57%), $APE (-7.45%), $AMC (-2.69%), $CRBP (+60.08%), and $BTC.X (+3.62%) 🔥

🃏 P.S. Our 3rd annual Chips for Charity is this coming Saturday. Secure your seat today to compete for the $5,000 prize and support a great cause! ₿

Here are the closing prices:

| S&P 500 | 4,080 | +3.09% |

| Nasdaq | 11,468 | +4.41% |

| Russell 2000 | 1,887 | +2.72% |

| Dow Jones | 34,590 | +2.18% |

One minute for a chance to win $100. 💰

Answer a short survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the newsletter experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation!

Federal Reserve Chairman Powell’s speech at the Brookings Institution was highly anticipated. And based on today’s price action…he did not disappoint.

There’s a lot to get through, but let’s look at takeaways from his speech and today’s economic data. 🔍

First, let’s recap what we already knew. November’s Fed Minutes told the market three things:

- The terminal rate will be higher than initially expected;

- Rates will stay higher for longer due to their lagging impact on the economy; and

- A slowdown int he pace of rate increases is likely ahead.

That messaging was also reiterated by several Fed members’ press comments and speeches.

Now, let’s get into Powell’s speech and Q&A session at the Brookings Institution. 📝

He started by acknowledging the recent progress in the inflation data. However, he said, “Despite some promising developments, we have a long way to go in restoring price stability.” and “It will take substantially more evidence that inflation is declining and by any standard inflation remains far too high.”

Next, he recognized how poor the Fed and private sector’s inflation forecasting has been over the last year, stating, “…the path for inflation remains highly uncertain.”

As a result, rather than provide more inaccurate forecasts, he outlined what macro conditions the Fed needs to see for inflation to come down meaningfully. They included:

- A sustained period of below-trend growth;

- Goods prices easing due to a drop in demand and supply chains improving (i.e., supply/demand is more balanced); and

- Housing services inflation beginning to fall in the latter half of 2023.

To encourage those economic conditions, the Fed expects to do several things through 2023.

- They will raise interest rates to a level that is sufficiently restrictive (though there’s uncertainty around what rate will be sufficient);

- They will moderate the pace of rate increases to avoid unnecessary risks to the economy; and

- They will hold rates higher for longer due to the lagging effect of policy on the economy.

What really got markets going was Powell’s comment about the Fed’s December meeting. He suggested that the Fed could “Reduce the pace of rate increases as early as the December meeting…”

He also peppered in some hope for a “soft landing” during his Q&A, where he stated, “…I do believe there is a path to a soft-ish landing.” When asked to clarify that, he said, “Unemployment goes up, but without a severe recession.” 🛬

With that said, he did say that history warns against reversing policy too soon. And that “…cutting rates is not something we want to do soon.” ⚠️

His final remarks were that the Fed would “Stay the course until the job is done.”

Powell didn’t say much that we haven’t heard before. However, strongly hinting at a slowdown in the pace of hikes this December was enough to spark a rally in risk assets. 📈

There were some other great points, so we encourage you to watch the entire thing. But for now, let’s quickly review today’s economic data.

First up, the ADP Report showed that 127,000 jobs were added in November, well below the 190,000 estimated. It was also down from 239,000 in October. 🔻

Most of the gains came from the leisure and hospitality sector, which added 224,000 jobs. Meanwhile, there were major losses in manufacturing (-100,000), professional and business services (-77,000), financial activities (-34,000), and information services (-25,000).

Overall, goods-producing industries experienced 86,000 job losses, while services industries added 213,000. Wage growth rose 7.6% YoY, down slightly from the 7.7% October rate. 🔺

Next, the Job Openings and Labor Turnover Survey (JOLTs) showed 10.33 million job openings in September. This left 1.7 job openings per available worker, which is down from a 2 to 1 ratio peak.

The labor market remains tight but continues to show signs of softening at the aggregate layoff. Today we saw layoff announcements from CNN, H&M, DoorDash, Kraken, and NPR.

Manufacturing activity fell off a cliff, with October’s Chicago PMI reading falling for the third straight month to 37.2. That jives with the manufacturing job losses shown in the ADP report. 🏭

Housing continues to soften, with pending home sales falling 4.6% MoM and 37% YoY in October. 🏘️

Lastly, the U.S. economy’s Q3 GDP estimate was revised up to 2.9% after two-quarters of contraction.

We’ll leave it there, but note that tomorrow’s PCE Price Index and Friday’s Non-Farm Payroll data will be watched closely. 👀

Earnings

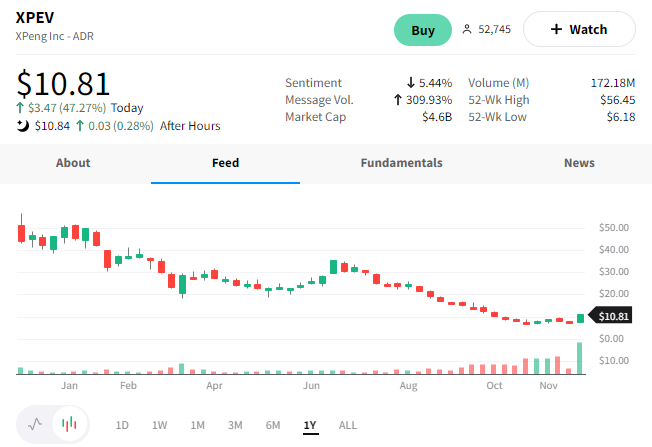

Chinese Stocks XPeng Their Rally

China and its markets remain in focus this week. We covered news on Friday, Monday, and Tuesday and will add to that today. So let’s dive in.

The first update is that China’s factory activity hit its lowest level since April, as lockdowns and protests weigh on business activity. As a result of the last few weeks, China’s Zhengzhou, which is home to the world’s largest iPhone factory, ended its Covid lockdown. Others, including the financial hub of Shanghai, are following suit as the country tries to curtail unrest and reboot its economy. 🏭

That news helped lift China’s stock market broadly, but several stocks moved heavily on earnings. 📝

Chinese EV maker XPeng Inc. posted a larger-than-expected loss, with revenue falling short.

Revenues rose 19.3% YoY, but at 6.82 billion Chinese yuan, it missed the 7.26 billion expected. Meanwhile, it reported a net loss of 2.38 billion yuan this quarter. While this beat the 2.09 billion yuan expected, it was up 1.59 billion yuan reported in the same quarter last year. 🚗

The company delivered 29,570 electric vehicles, up 15% YoY but a 14% decline from the second quarter. Looking forward, it expects to deliver 20,000-21,000 cars in the fourth quarter, representing a YoY decline of around 50%.

It pointed to supply chain issues, rising competition, and a more challenging macroeconomic environment as the driver of its results. However, the company hinted at a potential bottom in deliveries soon. It also noted the completion of its internal restructuring and believes it has a strong strategy for the future.

Shares of $XPEV still rallied nearly 50% as investors look ahead to a hopefully stronger future. 🤷

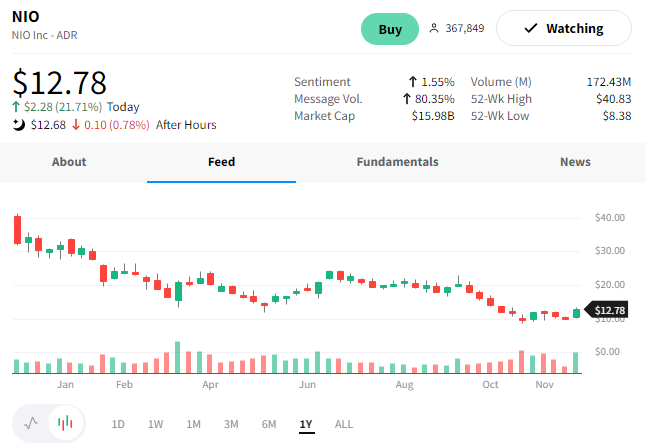

That strength in XPeng and the broader market spilled into other electric vehicle makers like Nio, which rose 22%. ⚡

Bullets

Bullets From The Day:

👍 House approves tentative railroad labor deal. With a nationwide railroad strike looming, the House of Representatives looks to force a tentative rail labor agreement between unions and railroad operators. The Biden administration has been reluctant to intervene further but sees little choice as a rail shutdown would devastate the economy during the busy holiday shopping season. The House vote added seven days of paid sick leave to the agreement instead of the one currently in the contract. With this being the main disagreement, hopes are this will help bring the two sides closer. CNBC has more.

⛔ Delta is curbing access after travelers flood their airport lounges. What was once an exclusive club has become an everyday luxury for many travelers, leading to long lines and unsatisfactory visits for flyers. As a result, Delta is increasing the price and requirements to enter its Sky Club airport lounges, which offer amenities like complimentary food and drinks, workspaces, and sometimes even showers, among other things. The company’s senior vice president of customer engagement and loyalty says it, “Wants to invest in our customers who invest in us.” More from CNBC.

🧠 A breakthrough in Alzheimer’s treatment. After decades of failure, a new drug called lecanemab, is offering hope to treat the most common form of dementia – Alzheimer’s. The treatment’s data suggests it slows the destruction of the brain, but it only works in the early stages, which is a challenge given early detection of the disease remains a major issue. The drug, developed by Eisai and Biogen, is already being assessed by U.S. regulators and the companies plan to begin the approval process in other countries next year. BBC News has more.

🗳️ House Democrats elect Hakeem Jeffries to succeed Nancy Pelosi. Rep. Hakeem Jeffries will be the first Black American to head a major political party in Congress, replacing Nancy Pelosi, who is stepping down next year. The Democratic party showed unity in choosing their new leader, with the closed-door vote ending in a unanimous decision. Many see the party’s quick transition and unity in the face of losing the midterm elections and House control as a sign of progress. More from AP News.

🏠 Airbnb’s new features assists renters in hosting apartments. The company’s new site page will list so-called Airbnb-friendly buildings allowing tenants to host their apartments the same way homeowners do. Generally, rental buildings prohibit tenants from subletting their space for short stays. However, many people already do this as a way to supplement their income amid rising home and rental prices. The new tool can help offer a new source of demand for Airbnb’s services and help those renting their space do so legally. CNBC has more.

Links

Links That Don’t Suck:

📈 Upgrade your stock research this Cyber Monday and save over $140 on MarketSmith*

🥖 French baguette gets Unesco heritage status

🎶 Christine McVie, Fleetwood Mac singer-songwriter, dies aged 79

⚽ Cristiano Ronaldo mulling Saudi soccer offer for $207 million a year

💸EU proposal would send proceeds of frozen Russian funds to Ukraine

📝 IRS gives Trump tax returns to House committee after 3-year legal battle

💊 Drug overdose deaths among seniors have more than tripled in two decades

🕳️ Super-distant black hole is eating half a sun a year and blasting its leftovers at Earth

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.