Markets had a mixed session after strong labor conditions reiterated that the Fed’s fight against inflation would remain difficult. Let’s cap off a busy week and get your weekend started. 🥳

Today’s issue covers November’s nonfarm payrolls, three earnings movers, and more! 📰

Check out today’s heat map:

5 of 11 sectors closed green. Materials (+1.10%) led, and energy (-0.59%) lagged. 💚

The European Union agreed to a $60 Russian oil price cap after the final holdout Poland threw in its support. This will allow formal approval to take place this weekend. On a related note, the pressure seems to be working, as the Kremlin says Putin is open to talks and diplomacy on Ukraine. 🤝

Ford claimed the number 2 sales spot behind Tesla in electric vehicles, though the gap remains wide. Meanwhile, Tesla delivered its first electric Semi truck to Pepsi yesterday after years of delays. ⚡

Boeing rose 4% today on news that it’s nearing a deal with United Airlines for a major 787 order. ✈️

In crypto news, Binance has paused withdrawals after a $5 million Ankr ‘infinite mint’ hack was discovered. Galaxy Digital CEO Mike Novogratz pulled his ‘$500,000 bitcoin in five years’ price target. Sam Bankman-Fried continues his media tour, this time saying he ‘misaccounted’ for around $8 billion in FTX funds. And the Commodity Futures Trading Commission (CFTC) asks for the authority to prevent the next FTX. ₿

Other symbols active on the streams included: $RIGL (+21.84%), $MMAT (+1.09%), $MMTLP (+2.10%), $MULN (-5.85%), $COSM (+34.49%), $FTCH (+8.51%), $AVXL (+35.85%), and $EOSE (+10.58%). 🔥

Here are the closing prices:

| S&P 500 | 4,072 | -0.12% |

| Nasdaq | 11,462 | -0.18% |

| Russell 2000 | 1,893 | +0.59% |

| Dow Jones | 34,430 | +0.10% |

Today’s follow-on to Powell’s speech and yesterday’s economic data dump was today’s nonfarm payrolls report. And unfortunately for the Federal Reserve, the data confirmed the strength shown in the last two days of employment info. 💪

November’s nonfarm payrolls rose 263,000, well above the estimate for 200,000. October’s data was also revised higher to 284,000. The unemployment rate remained flat at 3.7%.

The real problem with today’s numbers was average hourly earnings, which rose 0.6% MoM, double what analysts expected. 😮

The Fed clarified that wage gains are healthy but only when it’s in line with 2% inflation. So the current increases will only further exacerbate the labor supply/demand imbalance and keep inflation high, particularly in the services sector, where wages are a significant cost component. And since services inflation is half of the core personal consumption expenditures index (PCE) that the Fed uses to track inflation, that’s not great.

The TLDR version is: A strong labor market means strong wage growth. Strong wage growth means higher services inflation. And higher services inflation means continued upward pressure on the Fed’s preferred inflation metric. 👎

As a result, good news for the economy remains bad news for the Fed (and markets). That’s why the initial reaction in stocks was a steep selloff. Because if raising rates rapidly to the 3.75% to 4.00% range couldn’t cool the labor market, then the terminal rate may have to go even higher.

The news caused the market to price in rates above 5%, though at a slower pace than previous hikes. And that is ultimately why investors will be watching future employment data like a hawk for any signs of weakness. 👀

Join us for Chips for Charity and Make a Difference!

Tomorrow we host our 3rd Annual Chips for Charity poker tournament. Think you have what it takes to grab a seat at this year’s tournament and walk away with a grand prize of $5,000? Join some of your favorite Fintwit Influencers this Saturday, December 3rd, at 2pm/ET at Chips for Charity! All donations support Wall Street Bound and their efforts to diversify Wall Street.

Sign up now before you miss your chance!

Not around, but still want to donate and listen in on the fun? Join our livestream! You won’t want to miss this.

Earnings

The Good, The Bad, And The Boring

Today was a slower earnings day, but it still produced some outsized moves. 😮

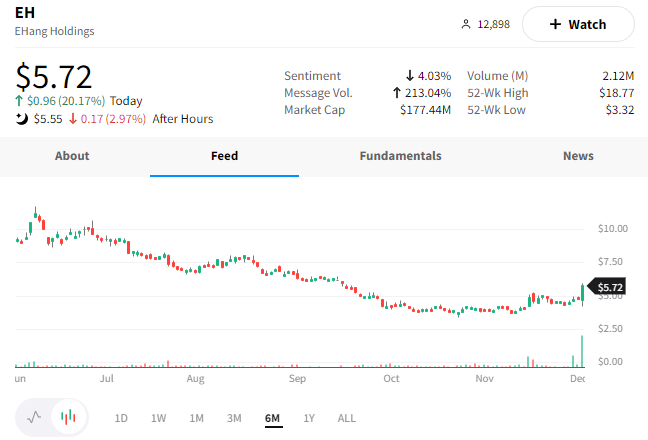

First up was the Chinese autonomous aerial vehicle company, EHang. The company’s loss per share was worse than analysts expected, but its revenue came in significantly above expectations.

The positive news, combined with the general strength of Chinese stocks lately, pushed $EH shares up 20% to a 2-month high. ✈️

Cracks formed in Cracker Barrel Old Country Store’s shares after the retailer reported disappointing earnings and reduced its 2023 outlook. 📆

Its adjusted earnings per share were $0.99 vs. the $1.27 expected. And revenues of $839.52 million met expectations.

The company’s CEO pointed to increased macroeconomic uncertainty and persistent inflationary pressures. However, she noted that the company’s value proposition and strong guest experience should help it navigate the environment. With that said, the company still trimmed its revenue growth outlook for fiscal 2023, which sent $CBRL shares down about 13%. 📉

Lastly, home decor retailer Kirkland’s reported a loss for the third quarter. Additionally, its revenues of $131 million missed expectations of $134 million.

Overall, the stock didn’t react all that much to today’s news. And if we zoom out over the last few months, $KIRK has been trading in a range anyway… 😴

One minute for a chance to win $100. 💰

Answer a short survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the newsletter experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation!

Bullets

Bullets From The Day:

🚀 Astra chief engineer resigns as CEO shakes up management. The struggling rocket builder Benjamin Lyon, its highly touted chief engineer, according to a filing with the Securities & Exchange Commission (SEC). Lyon resigned from his role on Monday, and his last day will be December 27th, as he moves on to pursue another opportunity. The CEO says the move will flatten the organization’s structure and allow it to execute faster, though skeptics say this is a critical loss for the company. CNBC has more.

🚂 Bill signed to avert national rail worker strike. After the U.S. Congress passed a bill making a rail strike illegal, President Joe Biden signed it into law shortly before the December 9th deadline for workers to strike. The administration had tried to avoid getting involved. Still, with a strike estimated to cost the U.S. economy $2 billion a day, it saw little choice but to intervene ahead of the holiday shopping season. The bill signed did not include the paid sick leave provision workers sought after it was voted down in the Senate. More from CNBC.

🤖 OpenAI’s ChatGPT platform makes waves around the globe. Generative AI has been on everyone’s minds this week as they played with OpenAI’s new ChatGPT, which launched as a free research preview. The natural language generation technology allows users to ask various questions, like a search engine, and the program spits out a result. Besides being a fun tool to play around with, investors are watching the space closely as they see the technology as a potential threat to Google and other search engines if it can become advanced enough. TechCrunch has more.

🏭 Tennessee EV battery plant gains additional investment. General Motors and LG Energy Solution are spending an additional $275 million to expand the production capacity of their joint venture battery plant by more than 40%. This new investment is in addition to the $2.3 billion it announced in April 2021 to build its 2.8 million-square-foot facility. The companies expect production at this plant to begin in late 2023, as initially planned. More from CNBC.

☀️ Four Chinese solar panel companies evaded U.S. tariffs. Solar stocks moved higher today after a months-long investigation showed that four Chinese solar panel companies avoided U.S. tariffs by routing their operations through other Southeast Asian countries. Although the findings are preliminary, they will inform how the solar industry will have to move forward in navigating a global supply chain that China’s had a significant hold on for years. CNN has more.

Links

Links That Don’t Suck:

💉 Scientists hopeful about promising results from HIV vaccine

🛰️ FCC allows SpaceX to deploy 7,500 second-gen Starlink satellites

💸 The biggest wall street banks are slashing bonuses by as much as 30%

💩 Wild new hypothesis suggests IBS could be a form of ‘gravity intolerance’

🐀 New York City wants to hire a ‘rat czar’ — and could pay them $170,000 per year

🏥 Hospital patient arrested for allegedly switching off neighbor’s ‘noisy’ oxygen machine

🤣 Lamborghini is getting hammered by the internet for its cringy Huraca Sterrato ad

📝 Tech layoffs send visa holders on frantic search for employment to avoid deportation