It was a big red day across the board as investors fear more rate hikes and higher chances of a recession — let’s see what you missed. 👀

Today’s issue includes a diamond in the rough, Meta’s battle with European regulators, and a recap of several earnings movers. 📰

Check out today’s heat map:

Only one closed sector green. Utilities (+0.66%) led, and energy (-2.65%) lagged. 🟥

In economic news, October’s U.S. trade balance data beat expectations by a hair. On a positive note, oil import prices were down five bucks MoM to $82.05. 💸

Morgan Stanley fell 3% after announcing that it will cut 2% of its global workforce. 🤦♂️

In crypto news, Silvergate Capital’s stock fell another 7% after the CEO tried to address investors’ concerns over its crypto exposure in a public letter. The man behind the iPod, iPhone, and Nest Thermostat is collaborating with crypto wallet firm Ledger to build a new cold wallet. And Goldman Sachs is reportedly looking to invest tens of millions of dollars to buy or invest in crypto companies amid the market turmoil. ₿

Other symbols active on the streams included: $MMTLP (+16.03%), $RMED (+33.63%), $BOIL (-8.65%), $PAFO (+61.12%), $S (-1.62%), $ES (+0.85), $SWBI (-9.36%), $PLAY (-10.89%), $AMC, (-9.40%), $TSLA (-1.55%), and $GME (-8.06%). 🔥

Here are the closing prices:

| S&P 500 | 3,941 | -1.44% |

| Nasdaq | 11,014 | -2.00% |

| Russell 2000 | 1,810 | -1.64% |

| Dow Jones | 33,596 | -1.03% |

Final week to secure your chance to win $100. 💰

Answer a short survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the newsletter experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation!

Earnings

A Diamond In The Rough

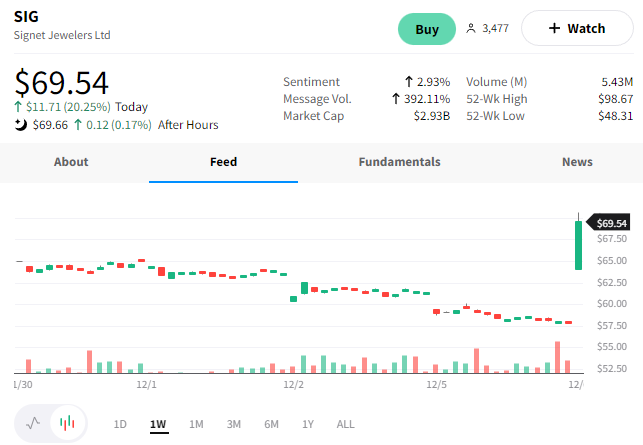

Diamond hands paid off for Signet Jewelers ($SIG) investors today as the company behind Kay Jewelers, Zales, and many expensive decisions reported better-than-expected earnings. 🤩

The company saw sales rise $2.9% YoY to $1.58 billion (vs. the $1.50 billion expected). The company’s North American same-store sales were down 7.6% YoY, but higher prices caused total sales to rise 5.1% YoY. Meanwhile, international sales fell 21.2% YoY to $95.3 million.

The company faced higher costs, with gross margins contracting 250 bps to 34.9% and operating margins shrinking from 7% to 3%. 🔻

Cash and cash equivalents were down roughly $1.2 billion from Q3 of FY22, with a good chunk of that due to the acquisition of Diamonds Direct and Blue Nile – a topic we reviewed in August.

Despite rising costs and the macroeconomy pressuring consumers, the company raised its full-year guidance. It now expects sales of $7.77 to $7.84 billion, higher than its previous view and consensus estimates. Additionally, it raised its earnings guidance to $11.40 to $12.00 per share, above estimates of $10.90.

Signet shares shined in a deeply red tape, rising +20.25% on the day.💎

Company News

EU Delivers Another Blow To Meta

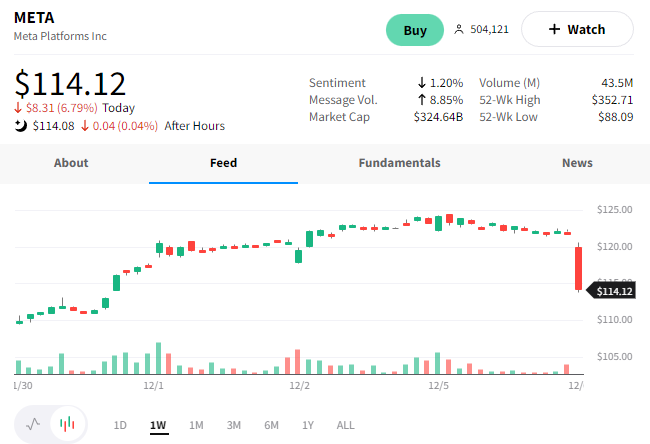

The market continues to pummelMeta ($META), with the most recent hit coming from the European Union (EU). Regulators in the EU, citing EU privacy laws, have allegedly ruled that users don’t have to agree to personalized ads based on their activity. 📝

A public ruling hasn’t been published yet, but the market is trading down based on its potential impact. That’s because analysts and investors fear the EU may create more roadblocks in Meta’s ability to use targeted ads, which are a key part of its business.

The new rules would only allow Meta to run advertising based on personal data with users’ explicit consent. Right now, it’s buried in the terms and conditions, making it difficult for users to opt out if they want to. And since user activity is a key metric used for targeting advertising, losing that data would weaken Meta’s advertising offering in the marketplace. 👎

These are rumors for now, but given the EU’s recent track record against global tech giants…investors are rightfully concerned. 😨

Meta shares gapped down and trended lower throughout the day. They also took other tech companies who rely on advertising lower with them, including Google, Snap, and Pinterest. 📉

Earnings

Earnings Recap – 12/06/22

Earnings season is slow, but that doesn’t mean there aren’t any big movers. So let’s see what today brought. 📝

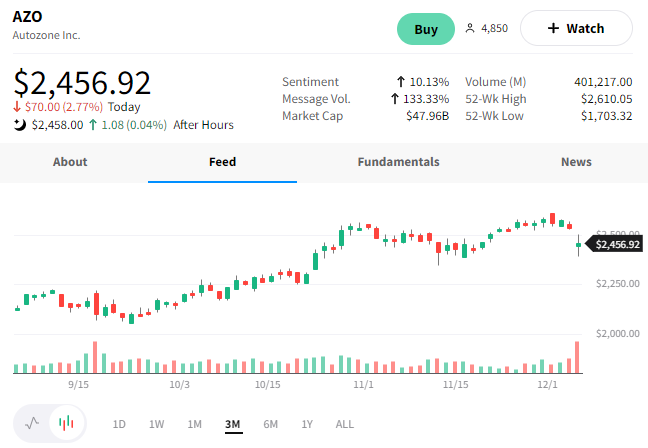

AutoZone reported earnings before the opening bell. The company put the pedal to the metal, posting stronger-than-expected earnings. $3.99 billion in revenue, beating estimates by $130 million. Earnings of $27.45 per share beat estimates of $25.15.

The drop in used automobile prices hasn’t hit the auto parts maker like it has purer plays like Carvana. However, investors feared that the overall trend could impact Autozone as well. However, it seems to be faring well, with domestic sales beating analyst estimates: +5.6% vs. +3.5%. 🚗

Despite the macroeconomic headwinds, CEO Bill Rhodes believes the company’s initiatives leave the company well-positioned for the remainder of the fiscal year.

However, it’s a sell-the-news situation as $AZO shares popped pre-market but faded to close red on the day. 🔻

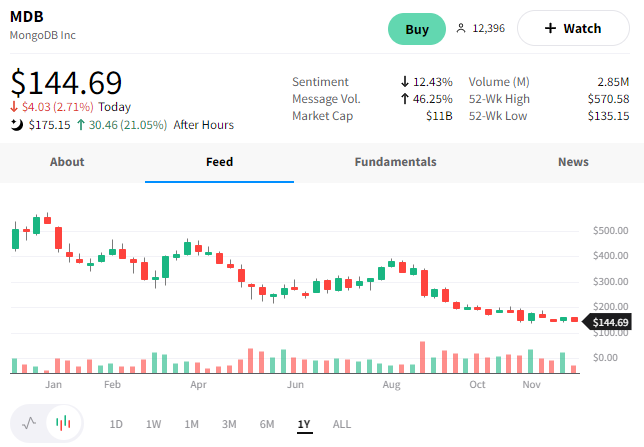

MongoDB is popping after hours following a stronger-than-expected earnings report.

The company’s Q3 revenue was up 47% YoY to $333.6 million, with its customers rising to 39,100. Meanwhile, its fully-managed cloud database, MongoDB Atlas, saw revenues rise 61% YoY, and it now makes up 63% of the company’s total revenue. 💪

Additionally, its Q4 guidance was higher than expected. It now expects Q4 EPS of $0.06 to $0.08 on revenues of $334 to $337 million. The consensus was for a $0.13 per share loss and revenues of $315 million.

The positive news was a breath of fresh air for the struggling stock, sending $MDB shares up 21% after hours. 👍

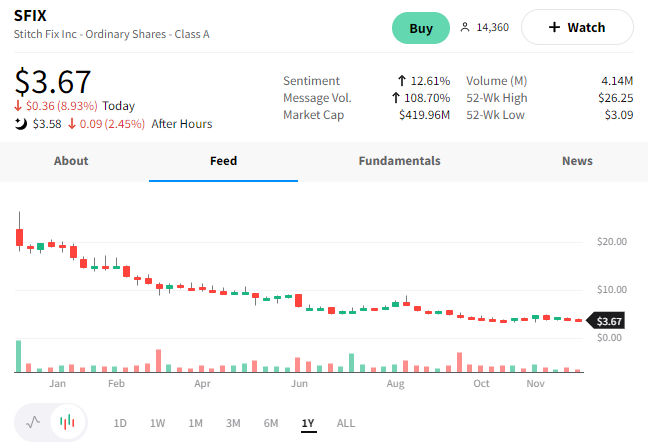

Stitch Fix continues its “death by a thousand cuts” journey after missing earnings expectations. 😬

The online fashion company saw a 22% YoY decline in revenue, with active clients falling 11%. Its loss per share of $0.50 was higher than the $0.46 analysts expected.

The company’s executives harped on its turnaround story, saying that cost savings have enhanced its EBITDA guidance for the 2023 fiscal year. They also noted that their initiatives should allow the company to achieve near-term profitability and drive longer-term growth.

With that said, investors remain skeptical as the company reduced its full-year revenue guidance once again. Analysts expected $1.8 billion in sales, but its guidance is for $1.6 to $1.7 billion. 👎

$SFIX shares fell more than 10% to a fresh all-time low today. 📉

Bullets

Bullets From The Day:

⚒️ Fears that there may not be enough copper are increasing. Metal investors have sounded the alarm on the massive silver premiums and a lack of supply (the U.S. Mint has several times over the past three years), but now “King Copper” is taking center stage. Glencore CEO Gary Nagle estimates a gap between projected demand and supply of 50 million tonnes. Analysts expect a large deficit to begin in the mid-2020s, with copper rising to an estimated $8.5k/tonne. Driving the rise in demand is copper’s importance in electric vehicles, renewable energy, and more high-growth industries! More from Business Live.

✈️ The end of an aviation era. The last Boeing 747 rolled off the assembly line today, 54 years after the first 747 – and it happened in the same city, plant, and building. It’s hard to believe this mammoth of aviation’s time has come to an end. The first 747 flew just a few months before Apollo 11 landed on the moon in 1969 – many reading this probably weren’t even developing eyelids yet. 3.5 billion people flew under her wings for over half a decade, but now her time is done. /salute. AVweb has more.

💰 Robinhood looks to retirement accounts to bolster its business. The fintech company has seen its share price and business metrics fall significantly from the height of the pandemic, but it’s hoping that its foray into retirement products could help get it back on track. The company is targeting workers who fall outside of the traditional 9-to-5 setting and therefore don’t have access to employer-sponsored plans like 401ks. And it’s making a big bet as the “first and only” individual retirement account (IRA) to offer a 1% match on every eligible dollar contributed. More from TechCrunch.

⚡ 65% of U.S. dealers agree to Ford’s EV investment program. The U.S. automaker offered its dealers the option to become “EV-certified” under one of two programs, costing the dealers either $500,000 or $1.2 million. Unlike General Motors, Ford allows dealers to continue selling the company’s cars, even if they opt out of selling electric vehicles. The company’s CEO said this week that roughly two-thirds of its dealers have agreed to sell its electric vehicles. CNBC has more.

💊 Opioid overdose drug gets priority review from U.S. FDA. Emergent Biosolutions is seeking the Food & Drug Administration’s approval for a prescription-free sale of its nasal spray, Narcan, which is used to treat suspected opioid overdoses. The agency granted it priority review and said it would decide by March 29th, putting it on track to become the first naloxone-based drug to be sold over the counter. With that said, some states have legal barriers, and the overall industry remains competitive as drugmakers look to capitalize on the Biden administration’s push to address the opioid epidemic. More from Reuters.

Links That Don’t Suck:

📈 Get IBD’s Online Investing Courses for the holidays and score the lowest prices of the year*

😬 ‘Not how you treat friends.’ Biden’s climate plan strains trade ties with Europe

🔋 The world will gain enough renewable energy in 5 years to power China says IEA

🐭 Disney’s Christine McCarthy emerges as top CEO contender to succeed Bob Iger

🐑 Nativity scene display at Iowa bank could break two Guinness World Records

🐒 Exclusive: Musk’s Neuralink faces federal probe, employee backlash over animal tests

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.