Interest rates are quietly falling as stocks try to stabilize — let’s see what you missed in today’s volatile session. 👀

Today’s issue covers Carvana’s crash, earnings movers and shakers, and the chart many traders are watching. 📰

Check out today’s heat map:

3 of 11 sectors closed green. Health care (+0.82%) led. Consumer discretionary (-0.60%) lagged. 💚

In economic news, the Bank of Canada hiked 50 bps and hinted at future pauses. A deal was inked for the U.S. to send additional natural gas supplies to Britain. And Q3 productivity was revised higher to +0.8%, and labor costs were revised lower to +2.4%. 📝

Apple was in the news after saying it would use chips built at an Arizona TSMC factory, announcing plans to encrypt iCloud backups, and revamping its App Store pricing for the first time in 14 years. 🍎

Elon Musk is facing criticism from San Francisco for adding staff beds at Twitter HQ, and the company’s janitors are on strike after failing to reach a new contract agreement. Tesla launched its EVs in Thailand at a lower price than local competitors. And finally, Musk briefly lost his “richest person” status to LVMH’s Arnault. 🗫

In crypto news, hedge fund Fir Tree is suing grayscale for details on the Grayscale Bitcoin Trust ETF ($GBTC). The House Ethics Committee has fined Rep. Madison Cawthorn for promoting the “Let’s Go Brandon” cryptocurrency. And Jim Cramer is urging investors to exit crypto, saying ‘it’s never too late to sell.’ ₿

Other symbols active on the streams included: $AMC (-10.37%), $MMAT (+5.13%), $MMTLP (-15.15%), $MULN (+1.22%), $COSM (-4.23%), $SMMT (+33.33%), $RXDX (+165.67%), and $GOSS (-8.47%). 🔥

Here are the closing prices:

| S&P 500 | 3,934 | -0.19% |

| Nasdaq | 10,959 | -0.51% |

| Russell 2000 | 1,807 | -0.31% |

| Dow Jones | 33,598 | +0.00% |

Final week to secure your chance to win $100. 💰

Answer a short survey to be entered into a random drawing to win one of five $100 American Express e-gift cards.

Your response will help improve the newsletter experience. You have until Friday, December 9th, at 11 am ET, to complete the survey. There is only one entry per participant. Good luck, and thank you for your participation!

Company News

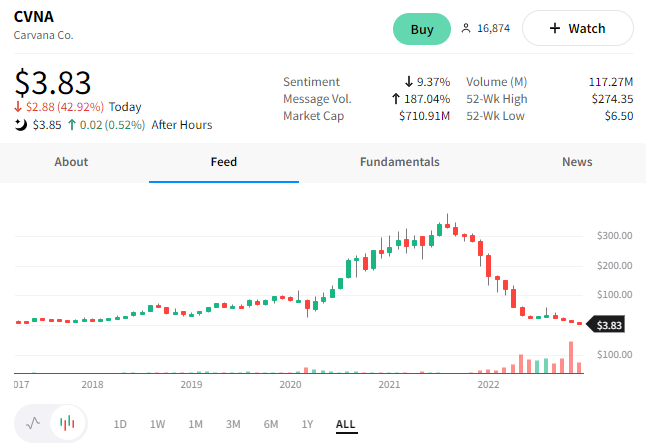

Carvana’s Crash Accelerates

Shares of online car retailer Carvana fell to a fresh all-time low as bankruptcy fears spread. 😱

The company reportedly signed a pact with creditors who hold roughly 70% ($4 billion) of its unsecured debt. The binding deal requires its creditors to act together in negotiations with the company. This could potentially streamline the negotiation process where Carvana can seek to restructure debt or secure new financing.

After the news broke, Wedbush analyst Seth Basham downgraded the stock from neutral to underperform. He also reduced his price target from $9 to $1. He joins the group of other analysts who continue to throw in the towel on the stock. Other analysts, however, downplayed the rumors and said the company has a sufficient short-term cushion to get through the end of 2023.

The bears remain in the driver’s seat for now, with $CVNA shares falling another 43% today… 📉

Stocks

A Line In The Sand

We last talked about the 200-day moving average in October, when traders and investors were looking for the bear market rally to continue. One of the key areas they were watching was the moving average used to track the stock market’s long-term trend.

Flash forward six weeks, and we’re right back there with traders now highlighting it as another important inflection point. 📝

Today’s chart making the rounds is of the S&P 500 ETF ($SPY).

In it, we can see prices recently failing to break above what technical analysts call a “confluence of resistance” comprised of:

- A downtrend line from its January highs; and

- The downward-sloping 200-day moving average

Bearish analysts see this as confirmation that sellers have retaken control. They claim stocks are still in a bear market, and the path of least resistance is lower as long as prices are below their recent highs. Their bullish counterparts say that the current pullback is just a shakeout and that prices will soon break above this resistance level.

Who is ultimately right remains to be seen. But rest assured, this is a chart on many people’s radars as we head into year-end. 👀

Earnings

Movers & Shakers – 12/07

Earnings announcements remain sporadic, but there were several big movers of note today. Let’s dive in. 🤿

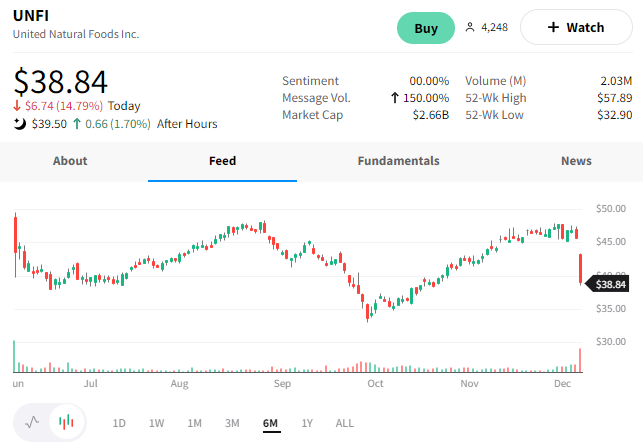

United Natural Foods is the country’s largest organic and natural food wholesaler. Unfortunately, its investors will be able to buy slightly less expensive food after today’s drop.

The company’s revenue rose 7.6% to $7.53 billion, beating the $7.48 expected. However, its gross margin fell 34 bps to 14.55%, causing earnings per share of $1.13 to miss expectations of $1.15. 📉

Wholesaler’s gross margins are the key metric investor’s track. And a declining gross margin shows the company is struggling to pass along costs to its customers. As a result, its guidance for the full year also came in slightly below analyst estimates.

Overall, the lack of earnings growth despite higher food prices caused $UNFI shares to fall 15%. 🤢

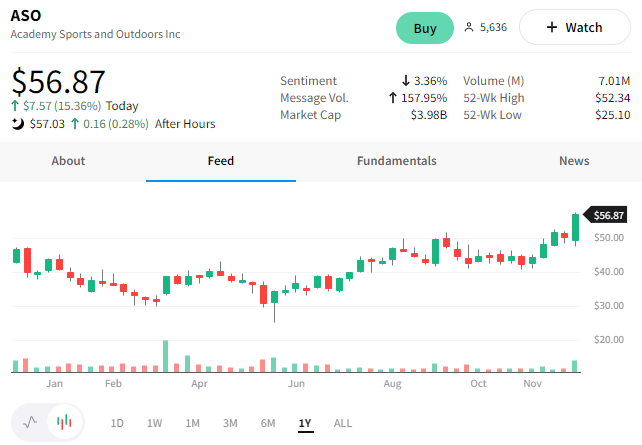

Academy Sports and Outdoors, Inc. rose to a fresh all-time high after it reported better-than-expected Q3 results. 🏀

The company’s earnings per share of $1.69 beat estimates of $1.64. Revenues of $1.49 billion fell by $0.10 billion YoY and missed expectations.

On a positive note, the company updated its fiscal year 2022 earnings guidance above estimates, though revenue guidance was soft.

Overall, investors are assigning more value to the improving earnings picture than the lack of revenue growth. $ASO shares rose 15% to a new all-time high. 📈

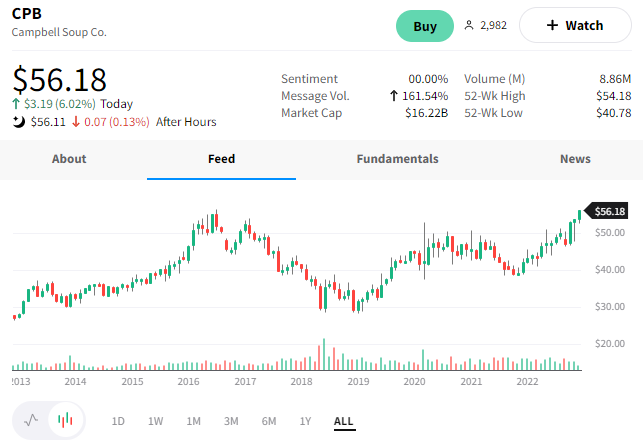

Campbell Soup delivered a better-than-expected earnings report. 😋

The American processed food and snack company saw its sales grow 15% YoY to $2.58 billion, ahead of the $2.45 billion expected. Adjusted earnings per share of $1.02 also beat the $0.88 expected.

The company’s gross margin rose ten bps to 32.4%, with its adjusted earnings before interest and taxes (EBIT) increasing 15% YoY. Net sales in its “meals & beverages” and “snacks” segments both rose 15%. Additionally, the company raised its fiscal-year 2023 sales and earnings outlook.

The overall positive report sent $CPB shares higher by 6%. 🥫

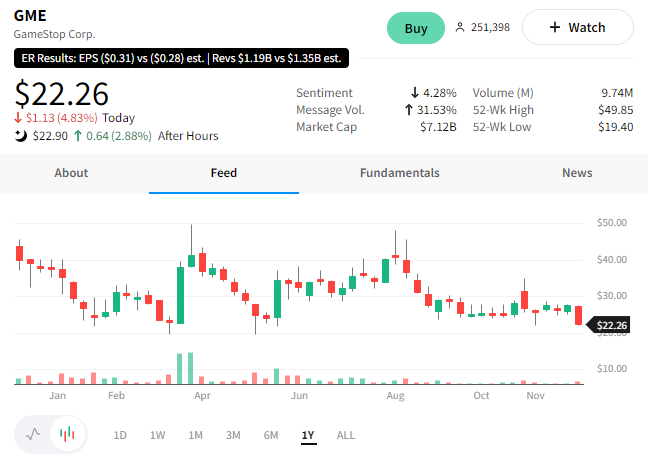

GameStop is erasing its regular session losses after reporting third-quarter results.

The brick-and-mortar retailer saw sales decline from $1.3 billion last year to $1.2 billion. Its net loss of $95 million was slightly less than the $105 million in the same period last year. 📉

Meanwhile, the company continues to burn through its cash, falling from $1.4 billion to $804 million YoY. With that said, it’s working to strengthen its balance sheet by cutting costs, which it hopes will prepare the company to make strategic acquisitions. It’s also struggling with a backlog of inventory, which sits at $1.13 billion.

Regarding the NFT marketplace it launched in July, the company said it continues to progress but did not break out those results for investors. It also said it’s making any of the customers affected by its partnership with FTX whole.

Overall, the company’s turnaround story remains in progress. With that said, $GME shares are hovering near their year-to-date lows as other meme stocks give up much of their gains. 😬

Bullets

Bullets From The Day:

🛒 Online retailer Fanatics’ latest valuation hits $31 billion. The sports platform raised $700 million in new funding, raising its valuation to $31 billion. It plans to use the new money for mergers and acquisition opportunities across its collectibles, betting, and gaming businesses. A new investor, Clearlake Capital, led the round just nine months after it last raised $1.5 billion at a $27 billion valuation. The company expects roughly $8 billion in revenue in 2023 and is weighing an initial public offering. CNBC has more.

❤️🔥 Zantac litigation gives investors heartburn. A West Palm Beach, Florida, U.S. District Judge dismissed 50,000 claims in federal court because they were not backed by sound science. GSK and Sanofi’s shares initially popped on the news. Still, they faded throughout the day to close red as investors fear the broader legal issues around Zantac aren’t going away anytime soon. Lawsuits claim that the heartburn medicine Zantac contains cancer-causing impurities, yet the companies who make and sell it claim the science does not support those claims. More from Reuters.

📆 Netflix CEO gives a peek into its future plans. The streaming giant’s co-CEO Ted Sarandos says its business strategy does not involve sports and will support additional ad tiers. Sports broadcasting has become a popular but expensive endeavor for its peers like Amazon Prime, which pays $1 billion annually to stream the NFL’s Thursday Night Football. On that note, Sarandos said, “We’ve not seen a profit path to renting big sports… We’re not anti-sports, we’re just pro-profit.” Gizmodo has more.

💳 Fintech Plaid lays off 20% of staff after overinvestment. The company is laying off 260 employees, with rumors that its engineering team is likely to see a significant reduction as it’s grown from 20 to 350 people in just four years. Like other tech companies, Plaid expanded rapidly throughout the pandemic but is now pulling back as the broader economic environment slows its business growth. Impacted employees will receive sixteen weeks of base pay in severance, among other things, to help with their career transition. More from TechCrunch.

✈️ Airbus drops output goal as commercial orders soften. The company is abandoning a numerical forecast for jet deliveries and a date for its key production goal but is maintaining its financial targets into year-end. The company says it will fall short of its 700 delivery target for 2022 due to factory disruptions and supply chain issues. Strength in the airline business has buoyed demand, but analysts fear a turn in the global economy could cause new plane orders to fall next year after a strong 2022. Reuters has more.

Links

Links That Don’t Suck:

🧬 Oldest DNA reveals two-million-year-old lost world

🚬 E-cigarette maker Juul reaches settlement with nearly 10,000 plaintiffs

🏘️ 270,000 homebuyers who bought in 2022 are underwater on their mortgage

🛍️ Rising thefts at Walmart could lead to price jumps, store closures, CEO says

🐢 Jonathan, the world’s oldest tortoise, marks his 190th with fanfare and salad cake

👍 Amazon will give your overworked delivery driver $5 if you ask Alexa to say thank you

🦴 100 million-year-old plesiosaur skeleton discovery ‘could hold the key’ to prehistoric research