As we head into the Fed’s December 13-14th meeting, the market is on edge. 😬

Let’s recap and prep for the week ahead. 👍

What Happened?

💚 Stocks had their worst week in a couple of months as bond yields started to rise. Traders are watching this “line in the sand” for clues regarding the market’s next move.

🤩 This week’s Stocktwits Top 25 report showed underperformance relative to the indexes.

⚠️ A global regulator warned of an “$80 trillion blind spot” for the financial markets and global economy. Meanwhile, the U.S. SEC is responding to the recent FTX turmoil by requiring additional disclosures for public companies.

🍅 November’s producer price index (PPI) showed that inflation remains elevated, this time driven by rising food costs.

📝 Investors are watching continuing jobless claims closely for signs of a softening labor market. The metric hit 10-month highs, though the data is generally volatile this time of year.

🏭 iPhone maker Foxconn is struggling with China’s lockdown measures. With that said, some relief on that front may be coming as China takes steps towards easing.

🛍️ Earnings were packed this week with Signet Jewelers, Carvana, VF Corp., Express, Li Auto, and many more movers and shakers.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $MMAT, $MMTLP, $MULN, $COSM, $SMMT, and $TSLA.

Here are the closing prices:

| S&P 500 | 3,934 | -3.37% |

| Nasdaq | 11,005 | -3.99% |

| Russell 2000 | 1,797 | -5.08% |

| Dow Jones | 33,476 | -2.77% |

Bullets

Bullets From The Weekend

⚡ Stellantis idles Jeep plant to cut costs for EVs. The plant, which currently produces the Jeep Cherokee SUV, will stop production at the end of February. The roughly 1,200 workers will be placed on indefinite layoffs as the company takes ‘difficult but necessary action.’ CNBC has more.

📈 Costco membership price hike ‘a question of when not if.’ As gas prices come down and costs of retail items rise, Costco is looking elsewhere to raise its profits. On its recent earnings call, its CFO signaled that a new membership hike might be coming since the last one was in June 2017. With that said, the company is committed to providing additional value to its consumers to justify the price. More from Fox Business.

🛒 Getir acquires Gorillas as instant grocery app consolidation continues. After rapid growth during the covid-19 pandemic, the industry is seeing its weaker players go out of business or get acquired as they struggle to grow or become profitable. The combined firms will be worth roughly $10 billion, down about 40% from their peak valuations during the hight of the instant grocery craze. TechCrunch has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

All eyes will be on Tuesday’s consumer price index (CPI) and Wednesday’s Federal Reserve interest rate decision and press conference. In addition to the above, check out this week’s complete list of economic releases.

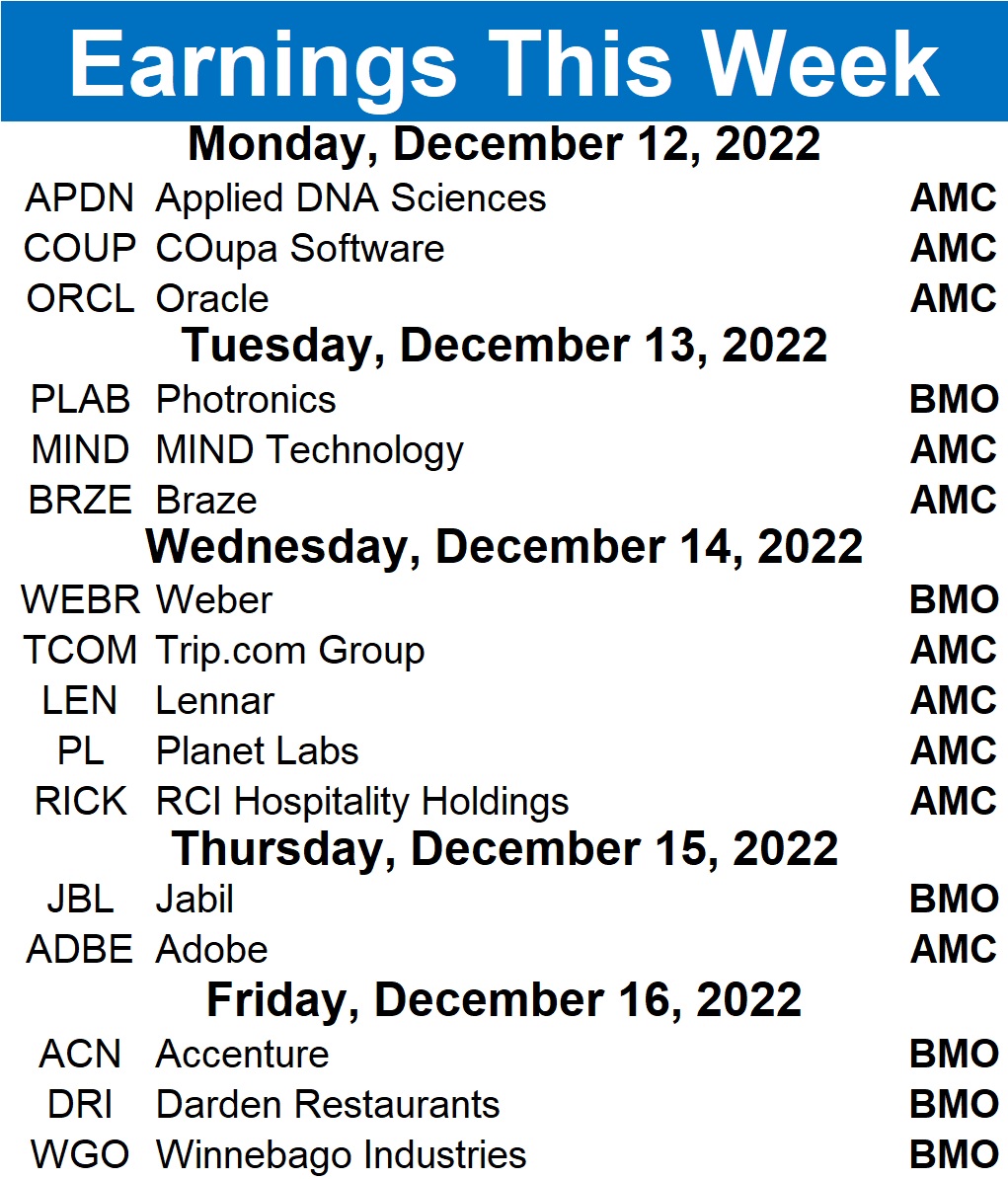

Earnings This Week

Earnings season remains slow, with 42 companies reporting this week. Some tickers you may recognize are $ADBE, $COUP, $ORCL, $JBL, $RICK, $WEBR, $LEN, and many, many more.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

🏭 Hyundai partners to build $4b plant in Georgia

💵 Yellen, Malerba become 1st female pair to sign U.S. currency

🏘️ U.S. home prices will post first year-over-year decline in decade in 2023: experts

🔌 Microsoft acquires startup developing high-speed cables for transmitting data

☕ Starbucks opens up its web3 loyalty program and NFT community to first beta testers

🛢️ Oil removal effort for Keystone pipeline spill to extend to next week, U.S. EPA says