Despite lackluster earnings, stock market bulls managed to reverse the day’s initial losses. Let’s see what else you missed today. 👀

Today’s issue covers what recharged Tesla’s shares, semiconductor and tech earnings, and other major companies reporting today. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Financials (+0.78%) led, and utilities (-1.35%) lagged. 💚

In economic news, Interest rates continue to drift lower ahead of next week’s Fed meeting. Up north, the Bank of Canada raised interest rates by another 0.25%, hinting that it may pause hikes for now. And Australia’s inflation rate hit a new 32-year high of 7.8% in the fourth quarter, reiterating that some countries are still struggling to subdue prices. 🌡️

Internationally, tensions remain high as the U.S. and Germany send tanks to Ukraine in what Russia calls a ‘blatant provocation.’ 😬

Just hours after reporting earnings, a Microsoft cloud outage impacted users around the globe. Shares managed to rebound despite their sharp gap down. ⛈️

Chevron shares pumped 3% after the company announced a $75 billion buyback program and raised its dividend. 🛢️

And Shopify shares rose 12% after announcing increases in its 2023 plan pricing. 🛒

In crypto news, despite the price decline, crypto infrastructure firm Blockstream still raised $125 million for Bitcoin mining. DCG-owned crypto exchange Luno is cutting 35% of its workforce due to the market downturn. And Genesis is seeking $20.9 million from ‘Bitcoin Jesus’ over crypto options trades that never settled. ₿

Other symbols active on the streams included: $GOVX (+58.89%), $SNOA (+40.83%), $INXP (-1.92%), $MULN (+18.66%), $GNS (-9.89%), $HLBZ (-29.76%), $XELA (-6.17%), and $COSM (+7.12%). 🔥

Here are the closing prices:

| S&P 500 | 4,016 | -0.01% |

| Nasdaq | 11,313 | -0.18% |

| Russell 2000 | 1,890 | +0.25% |

| Dow Jones | 33,744 | +0.03% |

Earnings

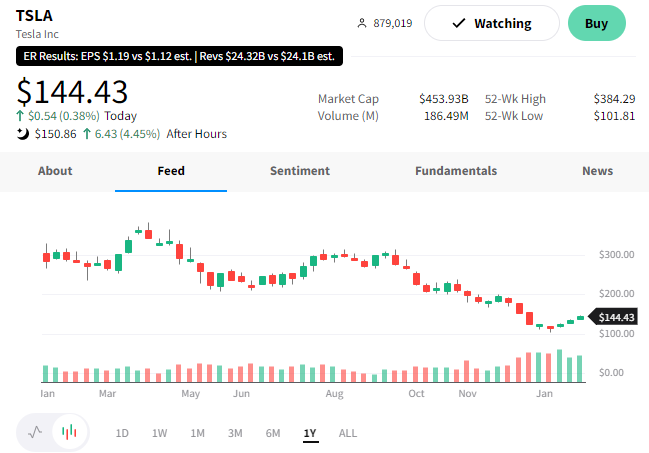

Earnings Renew Tesla Shares’ Charge

Today’s most highly-watched earnings report came from Tesla. But despite all the fanfare, shares didn’t move as much as anticipated. 🤷

Let’s see what the electric vehicle maker told investors.

Adjusted earnings per share of $1.19 beat the $1.13 expected. And revenues of $24.32 billion topped the $24.16 billion estimate.

Automotive revenue of $21.3 billion grew 33% YoY, with $467 million coming from regulatory credits. Margins contracted as expected, with automotive gross margins hitting their lowest level in five quarters at 25.9%. 🔻

Service and other revenue rose to $1.6 billion, and energy generation and storage revenue rose to $1.31 billion. However, rising costs in its energy business left little profit remaining.

Tesla did not issue new guidance but reiterated that it’s planning to grow production as quickly as possible to reach the 50% compound annual growth rate target set in early 2021. Additionally, it reiterated that the Cybertruck pickup is on track to begin production in Texas this year. 📝

Despite the beat, concerns around the demand for the company’s products remain. Some analysts argue that the price cuts signify waning demand and that its 50% growth rate target is unrealistic. The company took steps to quell some of those fears, acknowledging that average sales prices have been trending lower for years. However, it also noted that affordability is a necessary requirement if the company is to sell millions of cars per year.

Additionally, bulls argue that Tesla’s ability to focus only on electric vehicles gives it a meaningful edge over competitors who have to juggle internal combustion engine vehicles and their electric vehicle efforts. That means Tesla can accept a lower automotive margin and still be profitable.

Despite all the noise, the company continues to charge ahead. It plans to invest $3.6 billion to expand its Nevada Gigafactory complex with two new factories. One will mass produce its Semi truck, and the other will make 4680 battery cells. The company’s overall production capacity continues to expand. It can now make 100,000 Model S and X vehicles annually. And about 1.8 million Model Y and Model 3s vehicles. 🚗

$TSLA shares are up about 4% after hours. As always, we’ll have to see if this initial jump holds or if investors reach a different conclusion after reading the report more closely. 🕵️

Earnings

Big Tech’s Big Earnings Day

It’s another big day in tech earnings, so let’s just jump into it.

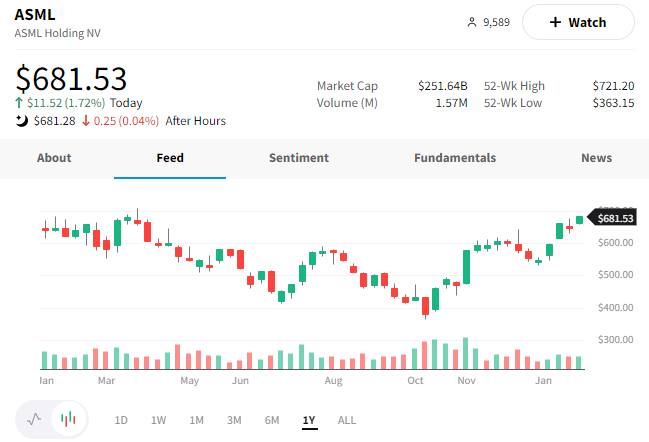

Dutch chip equipment maker ASML beat earnings and announced a lofty forecast for 2023 revenue. 😮

The company’s net sales rose more than 29% in the fourth quarter, with a 13% YoY rise for the full fiscal year. However, its net income for the year declined by roughly 4%.

Since it produces the machines required to make the world’s most advanced chips, ASML’s outlook is an important barometer for the industry. And today, it suggested that its net sales could grow 25% in 2023. 👍

While ASML’s executives recognize their business is not insulated from the macroeconomic environment, their customers believe the recent drop in demand will be “short-lived,” with many expecting a rebound in the second half of 2023. As a result, they’re not canceling orders, especially given the long average lead times for ASML’s tools.

It also noted that it remains in the middle of the U.S. and China’s battle over extreme ultraviolet (EUV) lithography machines, which are required to make the world’s most advanced chips. However, it can still ship its older products to China and expects 2023 sales in the country to account for about the same 15% of its total sales in 2022. 🌏

Overall, investors seemed pleased with the results as $ASML shares rose nearly 2% towards their 1-year high.

ASML’s competitor, Lam Research, did not fare as well. 👎

Despite beating this quarter’s earnings and revenue estimates, The company announced a weaker-than-expected outlook and restructuring efforts. As part of its plan, it’s laying off 7% of its workforce (1,300 employees), with many cuts coming in the U.S. manufacturing sector.

Additionally, it now expects revenue of $3.5 to $4.1 billion in the fiscal third quarter, falling well short of the $4.94 billion analysts expected.

Shares of $LRCX are down roughly 3% on the news. 📉

Next up is Seagate Technology, a major American data storage player.

The company reported adjusted earnings per share of $0.16 vs. the $0.10 expected. Revenues of $1.89 billion also beat the $1.83 billion expected. And for the fiscal third quarter of 2023, it expects revenue in the range of $1.85 to $2.15 billion and earnings per share of $0.05 to $0.45. 📆

Cash flow from operations was $251 million, and it had free cash flow of $172 million in the quarter. This allowed it to declare a cash dividend of $0.70 per share.

Investors are apparently happy with what the company had in store for them. $STX shares are up 7% on the news. 📈

Lastly, IBM is joining the list of large companies cutting jobs. With that said, its earnings and revenue did manage to top expectations. 🤷

Its adjusted earnings per share of $3.60 were in line with consensus. And revenues of $16.69 billion beat the $16.4 billion expected.

Analysts had expected revenue to decline for the first time in two years, but instead, it was flat. Driving that was strength in its software and infrastructure segments, which saw 3% and 2% growth, respectively. That offset the weakness in consulting, which grew 0.5% but fell short of expectations.

For 2023, it expects constant currency revenue growth to be in the mid-single digit range and a free cash flow of $10.5 billion. 🔮

Like other tech giants, IBM is also taking steps to reduce costs and boost earnings. That includes extending the useful life of its equipment, cutting 1,300 jobs (1.5% of its workforce), and more.

Shares of $IBM were down about 2% on the news. 🔻

Earnings

Earnings Recap – 01/25/23

While we all love talking about tech, there are other industries also reporting earnings today. Let’s recap the most notable ones.

First up is Boeing, which missed earnings and revenue expectations. 👎

The company’s adjusted loss per share was $1.75 vs. the $0.26 profit expected. And revenues of $19.98 billion fell short of the $20.38 billion estimated.

As we’ve heard from other industrial giants, the sharp recovery in air travel has boosted aircraft sales and deliveries. However, the company’s supply chain issues continue to hamper its results and impact its ability to ramp up production to meet demand. 🛫

It generated roughly $3.1 billion in cash flow last quarter and $2.3 billion for the year, its highest since 2018. It reiterated guidance for $3 to $5 billion in free cash flow this year.

After an initial gap down, $BA shares rebounded throughout the day to close marginally positive.

Next up is AT&T, whose shares jumped 6% after its earnings and full-year cash flow topped analyst estimates. 💵

The telecom giant’s adjusted earnings from continuing operations (excludes WarnerMedia spinoff) were $0.61 vs. the $0.57 expected. And revenues from continuing operations were $31.3 billion vs. the $31.4 billion expected.

Investors also focus on the company’s cash flows, which support its dividend. The company reported a full-year free cash flow of $14.1 billion, which beat estimates of $13.78 billion. Next year it expects $16 billion in free cash flow, lower than the $16.2 billion analysts forecasted.

In terms of subscriber numbers, postpaid phone subscribers topped estimates by 11,000. However, its fiber broadband subscribers continue to struggle, coming in at 280,000 vs. the 330,000 expected. 📱

Overall, growing cash flow and slowing capital expenditures in 2024 are seen as welcome signs for shareholders of the beaten-down telecom stock. It’s been a tough environment for competitors like Verizon as well, so we’ll have to see if today’s rally is short-lived or a longer-term turning point.

Copper mining company Freeport-McMoRan reported better-than-expected results. ⛏️

It reported adjusted earnings per share of $0.52 vs. the $0.45 expected. Revenues declined less than expected to $5.76 billion vs. the $5.4 billion consensus estimate.

Falling copper prices and rising operational costs were headwinds for the company. It booked an average copper price of $3.78 per pound in Q4, down about 14% YoY. Recently, copper prices have rebounded on China’s reopening hopes and improving odds that the U.S. and Europe could avoid a steeper recession in 2023. 🔻

Executives expect 2023 copper sales to be flat at 4.2 million pounds, with expected gold sales falling by 100,000 to 1.7 million ounces. Additionally, Unit cash costs are expected to rise to $1.60 per pound of copper in the coming year.

$FCX shares rose about 4.6% on the news, nearing a 9-month high. 📈

Casino operator Las Vegas Sands losses jumped and missed estimates. Revenues of $1.12 billion rose 10.9% YoY.

Despite the miss, shares of $LVS are up about 4% after hours. 🤷

Investors appear to be reading between the lines here. Bulls say that its Macau operations are still not back to normal and that China’s reopening will help fuel further growth. Essentially, if these results were okay without Macau performing well, then earnings/revenue should beat estimates in the future once it is.

Whether or not that *gamble* will pay off for bulls remains to be seen. But for now, they’re placing their chips on green. 🎰

Bullets

Bullets From The Day:

💽 Justin Bieber sells music catalog for $200 million. Justin joins the long list of stars cashing out by selling their music catalog to Hipgnosis Songs Capital, a $1 billion venture between Blackstone and British Hipgnosis Song Management. The 290-song catalog will fetch Bieber $200 million for his ownership stake and more for the rest of the owners. The investment thesis is based on the idea that hit songs can be more valuable than gold or oil due to the royalties they generate over their lifetime. And that’s also why some question why a 27-year-old artist would sell his catalog this early rather than wait for further appreciation. BBC News has more.

🙅♂️ Rupert Murdoch abandons Fox-News Corp merger push. The media mogul has officially withdrawn his proposal to re-combine the two companies after determining that a combination is not currently optimal for the shareholders of either company. Instead, News Corp is now looking to sell its stake in Realtor.com parent company Move Inc. to CoStar Group in a deal worth potentially $3 billion. Murdoch, who split up the companies in 2013, still controls roughly 40% of the companies’ voting rights through the Murdoch family trust. More from CNBC.

🗳️ Familiar faces among candidates for top Biden economist position. The White House is considering several senior officials to replace top economist Brian Deese, including Federal Reserve Vice Chair Lael Brainard and deputy Treasury Secretary Wally Adeyemo. Brainard taking on the national economic committee role would allow Biden to fill in the Fed’s second highest position with a candidate that Democrats ‘like.’ CNN Business has more.

🖼️ Shutterstock will now be able to create images from text prompts. The company recently announced a partnership with OpenAI to help develop the Dall-E2 artificial intelligence image-generating platform by using its image libraries to train the algorithm. However, it also indicated that it could soon release its own generative AI tools that create ‘ready for licensing’ images based on text prompts. Unlike its competitor Getty Images, which is currently suing Stability AI, Shutterstock is taking a more proactive approach in allowing its libraries to train and feed various companies’ AI tools. More from TechCrunch.

🎯 Hindenburg selects its next target, Indian conglomerate Adani. The activist short-selling investment research firm announced that it shorted Adani Group through U.S.-traded bonds and non-Indian-traded derivative instruments. It claims that the world’s third-richest man is ‘pulling the largest con in corporate history.’ And in its report, it accuses Adani of improperly using offshore tax havens and taking on debt that puts the group on ‘precarious financial footing.’ The company has responded, saying the claims are baseless and only meant to disrupt the company’s $2.5 billion share offering, which took place on the same day. Reuters has more.

Links

Links That Don’t Suck:

🪹 Ad spending on Twitter falls by over 70% in Dec – data

⏱️ Amazon strikes: Workers claim their toilet breaks are timed

🏘️ These 4 cities will suffer a 2008 crash in home values: Goldman Sachs

🍼 New FDA guidance calls for lower lead concentration in baby food and cereals

🌠 Stargazers Alert! Rare exotic green comet to shoot past earth after 50,000 years

🥱 America, we have a problem. People aren’t feeling engaged with their work

🏠 Someone finally bought Bernie Madoff’s Hamptons home years after forced sale

🤑 Here’s how much money you need to earn to be in the top 1% in every U.S. state

💆 Google job cuts hit 1,800 employees in California, including 27 massage therapists

🍪 Oreo’s newest filling is … more Oreo: Cookie company releases new Oreo-stuffed Oreos

🍟 Californians will vote on whether to overturn controversial fast-food law affecting 550,000 workers