The stock market keeps on trucking ahead despite everything the world throws at it. Let’s see what you missed today. 👀

Today’s issue covers more tech and media earnings, confusing economic data, and what payment processor earnings say about the consumer. 📰

Check out today’s heat map:

10 of 11 sectors closed green. Energy (+3.16%) led, and consumer staples (-0.35%) lagged. 💚

Bed Bath & Beyond plummeted 22% after confirming it doesn’t have enough cash to pay down its debts. It’s also already in default on its credit line with JP Morgan. 🏦

Sherwin Williams shares were painted red, falling 9% after its results missed estimates. 🎨

Levi Strauss jumped 7% after beating estimates and offering upbeat full-year guidance. 👖

Tractor Supply also rose 6% after earnings and revenue surpassed consensus estimates. 🚜

Hasbro fell 7% after hours after it warned of a weak fourth quarter and announced new job cuts. 🧸

Southwest Airlines fell 3% on the back of weaker-than-expected results. Meanwhile, American Airlines maintained its altitude after beating earnings but missing revenue expectations. ✈️

Other symbols active on the streams included: $ARDS (-34.96%), $BOIL (-4.70%), $MULN (-8.44%), $GNS (-19.27%), $HLBZ (-0.28%), $TSLA (+10.97%), and $COSM (+3.02%). 🔥

Here are the closing prices:

| S&P 500 | 4,060 | +1.10% |

| Nasdaq | 11,512 | +1.76% |

| Russell 2000 | 1,903 | +0.67% |

| Dow Jones | 33,949 | +0.61% |

Earnings

Tech Earnings Remain Online

Another day, another set of tech earnings. Let’s get into it.

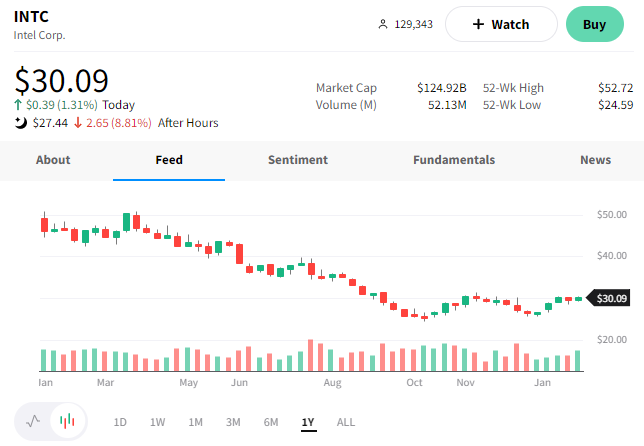

First, let’s start with Intel, whose report left analysts with many questions. 🤔

The company’s adjusted earnings per share of $0.10 missed the $0.19 expected. And revenues of $14.4 billion were also below the $14 billion expected.

Like its peers, data center and AI revenue was the sole bright spot. Despite falling 33% YoY, it managed to come in $0.3 billion above estimates. Client computing revenue was the major issue, falling 36% YoY to $6.6 billion vs. the $7.4 billion expected.

Its Q1 guidance also disappointed…badly. It expects an adjusted loss of $0.15 per share vs. Wall Street’s $0.25 per share profit. Revenues of $10.5 to $11.5 billion vs. Wall Street’s $14 billion. And gross margins of 39% vs. Wall Street’s 45.5%. 📉

In addition to the above, investors have expressed concerns that the company’s dividend could be in danger.

$INTC shares fell 9% on the news, dragging down its peers in the after-hours session. 👎

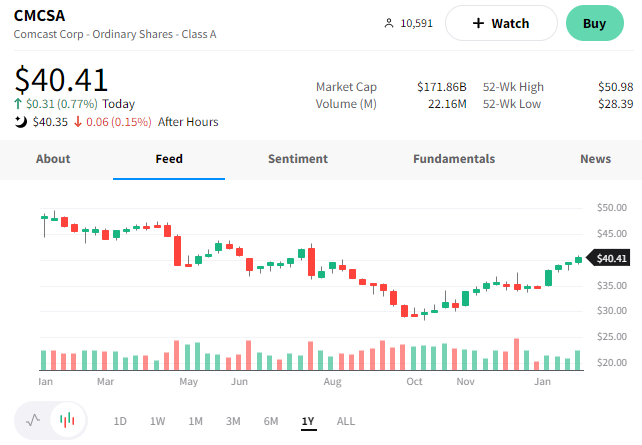

Next up is Comcast, which managed to beat estimates.

Adjusted earnings per share were $0.82 vs. the $0.77 expected. And revenues were $30.55 billion vs. $30.32 billion. 👍

Broadband customers fell due to Hurricane Ian, but excluding that impact, it would have added 4,000 customers. Regardless, its cable broadband subscriber growth continues to slow, much like its competitors. Similarly, its cable TV business lost 440,000 subscribers as cord-cutting continues.

Offsetting that weakness was its Xfinity Mobile business, which saw 365,000 net additions in the quarter. 📱

Investors also remain concerned about the Peacock streaming service, which continues to lose money. However, it added 5 million net paying subscribers in Q4, the best since its launch in 2020. That brings it to more than 20 million paying customers and revenue of $2.1 billion. Driving the strength was the increased demand for live sports programming, where we’ve seen other media giants investing heavily. 📺

With that said, 2022 losses of $2.5 billion were in line with expectations, and executives reiterated that the losses should peak at around $3 billion in 2023.

$CMCSA shares were up marginally on the news. 🦚

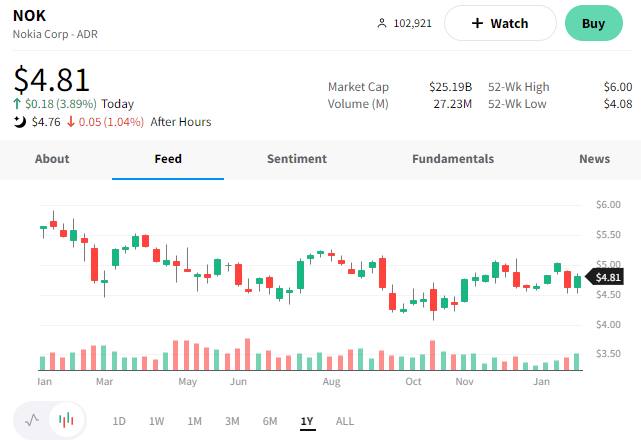

Lastly, Finnish telecom equipment maker Nokia issued an upbeat outlook for 2023.

While many have forgotten about the company, executives say it’s been able to gain market share by taking advantage of the 5G roll-out internationally, specifically in India. 🛰️

Executives’ demand outlook remains robust despite the macroeconomic uncertainty. They forecasted full-year net sales of 24.9 to 26.5 billion euros, while analysts expect 25.5 billion euros.

Its main competitor Ericsson did not fare as well. It reported weaker-than-expected earnings and expects its margin decline to continue into the first half of 2023.

$NOK shares were up about 4% on the day. 📈

Economy

Today’s “Mushy” Economic Data

U.S. GDP grew by 2.9% in the fourth quarter, beating expectations slightly but still down from Q3’s 3.2% print. 🔻

Analysts watch consumer spending closely, as it accounts for roughly 68% of GDP. It increased by 2.1% in Q4, down from 2.3% in Q3. Inventory also rose significantly, adding 1.5% to GDP. Government spending also buoyed the headline number, adding 0.64%.

Meanwhile, residential fixed investment continues to decline, with housing subtracting about 1.3% from GDP. Exports also fell by 1.3%.

The areas keeping the GDP number afloat remain vulnerable to the lagging impact of interest rate hikes. Additionally, there are signs consumers are using debt to keep their lifestyle amid rising prices. And bank earnings tell us that credit losses are beginning to rise. 💳

As a result, some analysts say today’s report shows that the U.S. economy remains vulnerable to more serious weakness in the second half of 2023.

Moving into the labor market, initial jobless claims fell to their lowest since April 2022 at 186,000. Continuing claims ticked up marginally but remained below their December highs. 🧑💼

Layoffs continue to spread, with chemical company Dow cutting 2,000 and software company SAP cutting 3,000 workers. IBM also cut 3,900 jobs yesterday as part of its planned asset sales. Meanwhile, Chipotle is gearing up to hire 15,000 restaurant workers ahead of its busy spring months.

At the aggregate level, the labor market remains historically strong. Below the surface remains the two distinct sides of the labor market that we’ve been writing about for months.

And sooner or later, ChatGPT will take all of our jobs anyway…right? That’s at least what BuzzFeed is partially betting on. 🤖

As for manufacturing activity, durable goods orders rose more than expected in December. The 5.6% jump came in well above the 2.4% forecast, but some concerns remain. Driving the strength was a 116% increase in aircraft orders. Meanwhile, demand for new cars and trucks rose by under 1%. 🏭

Excluding transportation, new orders fell for the third time since 2021. And business investment also dropped by 0.2%.

Signs of weakness in the manufacturing sector abound, with many suggesting that U.S. manufacturers are already in recession territory. The slowdown in new orders has caused them to reduce production. And if the economy continues to weaken then further cuts are on the way.

Lastly, new home sales indicated the housing market saw an uptick in activity for the third month in a row. New home sales rose 2.3% MoM in December, though it’s still down 26.6% YoY. The median house price was $442,100, up 7.8% YoY. 🏘️

Overall, the market took these headline numbers in stride despite concerns under the surface.

We’ll have to see what Friday’s PCE index and personal income/spending data say ahead of next week’s Fed meeting. 👀

Earnings

Payment Processors’ Economic Outlook

Consumer spending is a big focus as investors assess the economy’s health. While we’ve heard a lot from banks this earnings season, today, we received additional color from payment processors Visa and Mastercard. 💳

First up, Visa reported earnings per share of $2.18, which topped estimates for $2.01. Revenue rose 12% to $7.9 billion, its slowest growth in seven quarters. Total payment volumes rose 7%, with total cross-border volumes increasing 22% on a constant dollar basis.

Driving that strength is the travel sector, where demand remained robust. However, executives noted that a stronger U.S. Dollar and overall macroeconomic worries could slow that growth. 💵

Meanwhile, Mastercard earned $2.65 per share vs. the $2.58 analysts expected. And net revenues rose 12% to $5.8 billion.

Like Visa, its total cross-border volumes remained strong. However, growth came in well off its recent highs and is unlikely to accelerate, given the company said travel to most regions is back to pre-pandemic levels.

As a result, it now expects first-quarter revenue growth at the high end of a high single digits range. Analysts had expected 10.7% growth. 🔻

Overall, it appears both companies were humming the same tune. Travel demand is waning, and a weaker macroeconomic picture will likely weigh on their 2023 results. That jives with the increased allowances for credit losses and default rates banks have reported.

As a result, both $MA and $V shares were down marginally on the day. 👎

While we’re on the subject, it’s worth mentioning that Stripe is headed for the exits. The payments platform has set a one-year deadline to either go public or pursue a private market transaction. 📆

Bullets

Bullets From The Day:

🧾 This startup wants to bring more repayment functionality to fintech apps. Method is raising $16 million to bring loan repayment, balance transfers, and bill pay automation into other fintech apps. The company launched in 2021 after the co-founders experienced the difficulties of embedding debt repayment into their previous company, Gradjoy. They note that there’s no standard or easy way to access a person’s financial liabilities and pay them in one place. That’s the problem the company ultimately hopes to address in the marketplace. TechCrunch has more.

🍸 Diageo investors may need a shot of Johnnie Walker. The world’s largest spirits maker announced net sales growth of 9.4% in the first six months of its fiscal year. Executives say they beat forecasts by raising prices and benefitting from the tailwind of higher demand for premium spirits. In addition to its positive outlook, the company also announced an additional buyback program and raised its dividend. Yet despite the seemingly good news, Diageo shares fell more than 5% today. More from CNBC.

📝 An AI just passed law, medical, and business school exams. ChatGPT is smart enough to pass prestigious level exams, although not with very high marks. After completing exams at various universities, results confirmed that the program could perform at the level of a C+ student. However, the tests show that the magnitude of the program’s mistakes is still considerable and that there’s still much work ahead to improve the technology and its applications. CNN Business has more.

💰 Canva competitor Kittl raises $11.6 million Series A round. Canva is already a massive platform, but that doesn’t mean new startups aren’t trying to get a slice of the design platform pie. Kittl’s design platform allows people to easily turn ideas into graphic products, hopefully eliminating the tough learning curve of other professional-grade design tools. While the new round is a vote of confidence in their business, the founder says he plans to double down on existing A.I. and machine learning efforts which will continue to disrupt the industry. More from TechCrunch.

⚡ Toyota CEO and President is stepping down to make way for the company’s EV push. Akio Toyoda is stepping down on April 1st, becoming the board’s new chairman, as he supports the new President through the industry’s structural change. Chief Branding Officer Koji Sato will take over as President, and the current chairman Takeshi Uchiyamada will remain on the board. CNBC has more.

Links

Links That Don’t Suck:

🤔 How do active managers invest their own money?

⚖️ A robot was scheduled to argue in court, then came the jail threats

🐦 Elon Musk reportedly strives to raise $3 billion to save Twitter

🤭 NYSE says stock-trading chaos caused by staffer’s ‘manual error’

🛻 Audi’s latest concept car is a luxury coupe that transforms into a truck

❌ Merck scraps Keytruda trial for prostate cancer after dismal interim data

☄️ Earth will have ‘a very close encounter’ with an asteroid tonight, NASA says

📰 Meet Gautam Adani: Accused by Hindenburg of ‘largest con in corporate history’

🔬 Autism rates have tripled. Is it now more common or are we just better at diagnosis?

🚉 Grand Central Madison brings LIRR service to the East Side, realizing decades-old dream

🥸 Scammers posed as tech support to hack employees at two US agencies last year, officials say