It’s groundhog day, and apparently, Punxsutawney Phil seeing his shadow means they’re six more weeks of buying ahead. Or at least that’s how the market’s behaving. Anyway, let’s recap everything you missed during a busy Thursday session. 👀

Today’s issue covers Google, Apple, and Amazon results, central bank rate hikes, and other ‘movers & shakers’ from the day. 📰

Check out today’s heat map:

7 of 11 sectors closed green. Communication services (+6.57%) led, and energy (-2.28%) lagged. 💚

In economic news, initial jobless claims dropped to a nine-month low of 183,000. A measure of hourly output per worker, nonfarm productivity, rose at a 3% annualized rate in the fourth quarter. The third quarter rates were also revised higher from +0.8% to +1.4%. And U.S. factory orders rose 1.8% in December, buoyed by strong aircraft orders. 🏭

In crypto news, Charlie Munger says the U.S. show ban cryptocurrencies like China has. Crypto hackers reportedly stole $3.8 billion in 2022, with North Korean groups leading the charge. Coinbase shares soared 24% after a federal securities lawsuit against it was dismissed. And Silvergate Capital fell 25% after hours on news that it’s facing a Department of Justice probe over its dealings with FTX and Alameda. ₿

Other symbols active on the streams included: $MSGM (-37.95%), $TENX (+30.77%), $GMBL (-10.16%), $MULN (+8.45%), $EBET (-31.62%), $GNS (+33.77%), and $CETX (-16.10%). 🔥

Here are the closing prices:

| S&P 500 | 4,180 | +1.47% |

| Nasdaq | 12,201 | +3.25% |

| Russell 2000 | 2,001 | +2.06% |

| Dow Jones | 34,054 | -0.11% |

Earnings

An Alphabet Soup Of Earnings

Apple, Amazon, and Google experienced sharp runups ahead of their after-hours earnings reports. Optimism about the economy and Fed had already boosted tech stocks, but Meta’s upside surprise fueled the narrative that these three would also beat.

What ultimately resulted was some lackluster action after the bell. Let’s break it all down. 📝

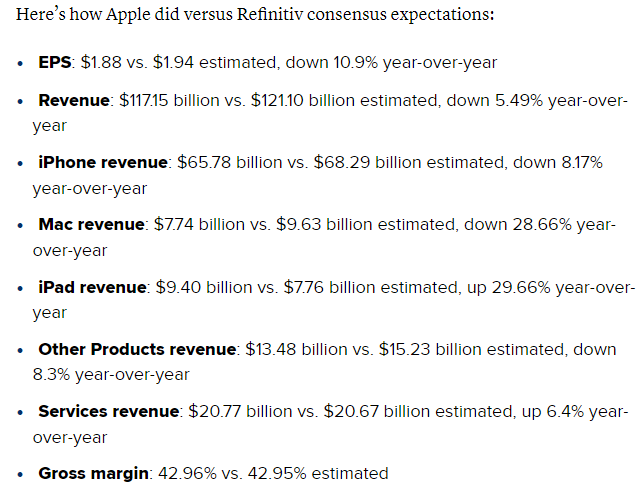

First up is the world’s largest company, Apple. CNBC’s outline below compares its primary metrics vs. expectations.

The company experienced a 5.49% YoY decline in revenue, marking its largest quarterly drop since 2016. CEO Time Cook said three factors drove those results: 1) a strong U.S. Dollar, 2) China’s production issues impacting the iPhone 14 Pro and Pro Max models, and 3) a weakening overall macroeconomic environment. 🔻

Apple did not provide guidance for the current quarter, but its CFO Luca Maestri said revenue would have a similar YoY trend as the December quarter. Services remain a strong component, with the company continuing to invest in new features like “buy-now-pay-later,” which will be launching soon.

Like its peers, the company is cutting costs but has avoided layoffs. Overall, it’s largely been able to sidestep many of the headwinds other businesses were hampered by over the last few years. Whether or not today’s miss was the end of that trend remains to be seen. 🤷

Investors appear to be staying optimistic after hours, as $AAPL shares are only down marginally. 🍎

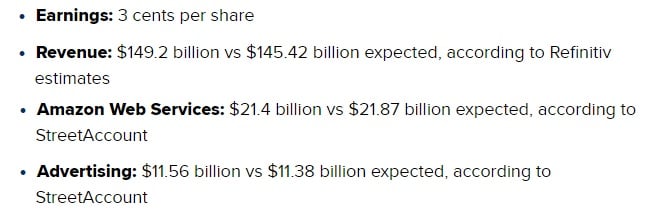

Next is Amazon, which beat current-quarter estimates but provided light first-quarter guidance. Below are their key metrics vs. estimates.

The company experienced its slowest year of growth as a public company, with revenue rising just 9%. The challenging macroeconomic environment is pressuring consumers, with Amazon’s online stores’ segment contracting 2% YoY. And its AWS growth halved from 40% to 20% in the current quarter. Advertising revenue was a bright spot at 19% YoY growth, but it remains a smaller business segment. 🛒

Looking ahead, it expects first-quarter revenue between $121 and $126 billion. That’s 4%-8% YoY growth and at the lower end of the $125.1 billion expected by analysts. 🔮

Executives say they’re encouraged by the company’s continued progress. Like its peers, the retail giant has been cutting costs and reprioritizing its focus. Most recently, its announced 18,000 employee layoffs impacting its stores and human resources divisions.

CEO Andy Jassy said, “In the short term, we face an uncertain economy, but we remain quite optimistic about the long-term opportunities for Amazon.”

Meanwhile, Amazon investors are still trying to figure out if they share that optimistic view. $AMZN shares are volatile after hours, currently down 4%. 👎

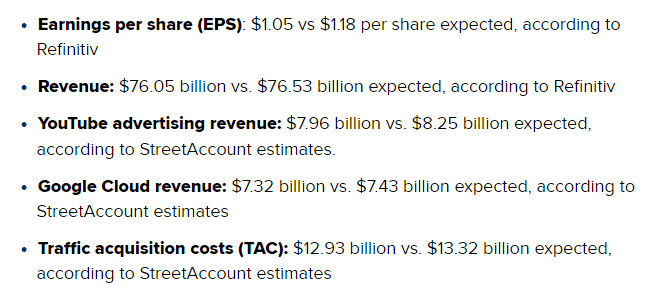

Last but not least is Google’s parent company, Alphabet. The search giant missed top and bottom line estimates this quarter. ❌

Below are its key stats vs. expectations.

Almost every company has telegraphed the slowdown in advertising over the last year. However, it’s apparently impacting Google more than many analysts initially expected. 😨

Within that slowdown is YouTube, which faces increased competition from TikTok and other short-form video platforms. Elsewhere, Google Cloud revenue managed to rise 32% YoY. While that’s less than expected, the company managed to reduce that segment’s loss from $890 million to $480 million YoY.

Operating expenses rose 10% YoY, driven by headcount growth, charges for legal matters, and lower ad spending. With that said, it’s being strategic with costs and reprioritizing to limit spending as tech companies tighten their fiscal belts. 🔺

Despite misses across the board, executives remain optimistic about the future. Addressing the hype around ChatGPT, they noted that the company is investing in Artificial Intelligence (AI) and should release some related products soon.

$GOOGL shares were down roughly 4% after hours, giving back two-thirds of today’s gains. ✂️

Yesterday the U.S. Federal Reserve raised interest rates by 25 bps and set the stage for ongoing rate increases as it continues to battle inflation. 📰

Today, we heard from the European Central Bank (ECB) and Bank of England (BOE), which also continued tightening. Let’s see what they had to say.

The European Central Bank raised rates by 50 bps, moving their key rate to 2.50%. It reiterated that it will“stay the course in raising interest rates significantly at a steady pace.” It also left no room for interpretation around its next meeting, saying it intends to hike another 50 bps in March. 🔺

The bank hiked rates four times in 2022 after leaving rates in negative territory since 2014. However, headline and core inflation hit more than 40-year highs last year. And despite some short-term improvements, prices remain significantly above their 2% long-term target. That leaves the ECB no choice but to continue aggressively tighten financial conditions.

Despite the continued tightening and risk, the Eurozone’s Q4 GDP came in at a positive 0.1% vs. the 0.1% decline expected this week. This led to ECB President Christine Lagarde saying, “The risks to the outlook for economic growth have become more balanced…” as the region secures energy supplies and other measures of the economy improve.

Moreover, her outlook on the economy improved as of late, saying, “Overall, the economy has proved more resilient than expected and should improve over the coming quarters.”

Meanwhile, the Bank of England followed a similar script. The central bank also raised rates by 50 bps and offered a more optimistic economic outlook. 🔺

Its committee voted 7-2 for the second consecutive 50 bps hike, which took its key interest rate to 4%. Unlike the ECB, however, its statement indicated that smaller hikes and an eventual end to the tightening cycle could be ahead. In addition, analysts noted that the bank dropped the word “forcefully” from its statement, as it’s happy with the disinflation progress.

In its forecast, the central bank expects annual CPI inflation to fall towards 4% by the end of the year. It also refined its economic outlook, predicting a shorter and shallower recession than at its November meeting. In that regard, the country may avoid what was previously forecasted to be its most prolonged recession on record. 👍

Meanwhile, the market’s implied path includes rates rising to 4.5% in mid-2023 before falling back to 3.25% over the next three years.

To recap, the Bank of England is on a similar path to the U.S. Federal Reserve. Inflation is coming down at a steady pace, and its economy is holding up better than expected. Europe, however, has seen much of its disinflation come from volatile inputs like energy and food prices. Its core goods and services inflation remains far too high and sticky, which is why the ECB is maintaining its hawkish stance. 📝

Across the board, it appears that economic optimism is improving. Inflation in most countries has begun to come down or at least stop rising. But there’s still a lot of work to be done, and the economic picture remains far from rosy.

Ultimately, whether or not the market is getting ahead of itself remains to be seen. For now, though, it’s rally time. 🤷

Earnings

More Movers & Shakers – 02/02/23

We’re in the heart of earnings season, so there’s a lot to keep on top of. Luckily, we’ve summarized today’s biggest movers and commentary below. 📝

British multinational oil and gas company Shell posted its highest-ever annual profit of $40 billion. Like its peers, it’s returning some cash to shareholders via a $4 billion buyback program and a 15% dividend per share increase. Additionally, the company continues to work towards its net-zero emissions goal by 2050. However, analysts point out that Shell’s fossil fuel investments continue to dwarf its renewables investments. $SHEL shares were down 1% on the day. ⛽

Italian luxury sports car manufacturer Ferrari saw profits rise 13% in 2022. Its earnings per share of 1.21 euros and 1.368 billion euro revenue beat expectations. The company shipped a record 13,221 vehicles, though its profit margin slipped from 22.6% to 21.8%. Its guidance forecasts a strong year ahead, with revenue of 5.7 billion euros and adjusted earnings per share of 6.00 to 6.20 euros. $RACE shares rose 5% following the news. 🏎️

Germany’s Deutsche Bank reported a tenth straight quarter of profit as its 2019 restructuring plan continues to drive results. Its 1.8 billion net profit doubled Wall Street estimates, but revenue figures missed estimates. Investment banking and corporate center weakness were driving those results, which were partially offset by corporate bank strength. It did not announce a share buyback but recommended a 50% dividend increase to 30 cents per share. $DB shares fell 7% today. 🏦

U.S. automaker Ford reported poor fourth-quarter results and a full-year net loss of $2 billion. Its adjusted earnings per share of $0.51 were 11 cents below estimates, while automotive revenue of $41.8 billion outpaced the $40.37 billion expected. The company blamed its ugly results on execution and supply chain management issues. Those issues caused it to miss expected sales by 100,000 units, amounting to roughly $1 billion in missed earnings. The company says its cost structure is not competitive. Executives will be aggressively reducing expenses this year, potentially including more layoffs. $F shares slumped over 6% on the news. 🚗

Starbucks reported earnings and revenue that fell short of expectations. Adjusted earnings per share of $0.75 missed by 2 cents, and revenue of $8.71 billion was $70 million short. Global same-store sales rose 5%, with a 7% increase in average transaction spending. However, international same-store sales dipped 13%, dragged down by China. The U.S. remained a bright spot, with same-store sales growth of 10%, driven by traffic rising 1% and higher average spending. The company is looking for 10-12% revenue growth and adjusted EPS growth of 15-20% for the full-year 2023. $SBUX shares dribbled down 4% on the news. ☕

Semiconductor and telecom equipment maker Qualcomm is feeling the smartphone slowdown just like its peers. While the company’s adjusted earnings per share of $2.37 beat expectations by a cent, its revenues of $9.46 billion were less impressive. Sales in its handset business fell 18% YoY, down from 40% growth in the previous quarter. Where things got hairy for investors was the company’s first-quarter forecast. It now expects revenue between $8.7 and $9.5 billion, below estimates of $9.55 billion. Additionally, its CEO Cristiano Amon said that inventory clearance would persist in the year’s first half. $QCOM shares gave back an initial 3% gain and are now down 3% after hours. 📱

American entertainment company Penn Entertainment met revenue expectations but missed earnings. The company’s adjusted earnings per share of $0.13 fell short of the $0.33 expected, while revenues of $1.59 billion were in line with estimates. Looking ahead, the company expects full-year revenue of $6.15-$6.58 billion. More notably, it was the first U.S. gambling company to post a profit in its sports betting business during the final three months of a year. Usually, marketing and promotion spending eats into profits, but its interactive business made a $5.2 million profit on $208 million of revenue. $PENN shares were down over 5% on the day. 🎰

Bullets

Bullets From The Day:

⚖️ Federal securities suit against Coinbase dismissed. The complaint claimed the crypto exchange engaged in the unregistered sale and offering of securities and had failed to register as a New York state broker-dealer. However, a Manhattan federal judge dismissed the class-action lawsuit, ruling that the plaintiffs failed to establish their claims and that the company’s marketing efforts did not constitute a solicitation. The claims were dismissed with prejudice, citing the dismissal of another crypto class action against Binance. CNBC has more.

🛒 Livestreamed shopping of trading cards and collectibles is coming to a screen near you. The sports platform company Fanatics is hoping that livestreamed shopping, which is popular in Asia, will also catch fire in the U.S. It’s joining Amazon, eBay, Walmart, and other major retailers by launching a new trading card livestreamed shopping business. The initiative will be led by Snap’s previous global head of content and partnerships, Nick Bell. This represents a big opportunity for the company to establish itself as the hub for the trading card industry, which is projected to reach nearly $100 billion by 2027. More from CNBC.

📝 European Parliament forges new path on platform workers’ rights. A divisive new proposal designed to create a pan-EU set of ‘minimum standards’ for areas like pay, conditions, and social protections when it comes to gig workers. It involves a difficult process of navigating national practices and preferences, vulnerable workers, massive lobbying operations, and other stakeholders all at once. As a result, today’s step is one of many ahead for legislators as they look to establish laws with far-reaching impacts for millions of gig workers across Europe. TechCrunch has more.

🤝 Airbus and Qatar Airways squash their beef. The two companies have been squabbling over grounded A350 jets for the last 18 months but have reached an amicable conclusion moments before a U.K. court trial was supposed to take place. The $2 billion disagreement was over surface damage on the long-haul jets and led to the withdrawal of billions of dollars worth of jet deals by Airbus and caused Qatar Airways to purchase more jets from Boeing. The new deal restores the 23 undelivered A350s and 50 smaller A321neos, while Airbus will pay several hundred million dollars one exchange for being released from future claims. More from Reuters.

🥪 Subway’s sales rise as the sandwich chain explores strategic options. Its same-store sales jumped 9.2% in 2022, reversing years of sales declines for the chain. As a private company, it’s not required to disclose financial results, but it’s begun to share period updates about its turnaround that could entice potential buyers. In 2023, its focus is on improving franchisee profitability and remodeling 3,600 North American locations. Internationally, it’s already received commitments from master franchisees to open 5,300 new locations. Additionally, the company will soon be half-owned by the charity that Subway’s co-founder left his 50% ownership upon his 2021 death. CNBC has more.

Links

Links That Don’t Suck:

🛰️ SpaceX launches 53 more Starlink internet satellites

🎟️ Ticketmaster faces next big test with Beyonce ‘Renaissance’ tour

👨💼 Kohl’s names interim CEO Tom Kingsbury to the post permanently

📦 Amazon’s delivery drones served fewer than 10 houses in their first month

🔻 Venture capital for Black entrepreneurs plummeted 45% in 2022, data shows

🔐 Elon Musk locked his Twitter account to test complaints from right-wing power users

🐭 Trian presses Disney to replace board member Michael Froman with Nelson Peltz