Powell’s commentary sent stocks ping-ponging around, with the major indices ultimately settling near the day’s highs. Let’s recap what you missed. 👀

Today’s issue covers Powell’s sweet nothings, Microsoft’s new way to search, and the day’s biggest earnings movers. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Energy (+3.25%) led, and consumer staples (-0.42%) lagged. 💚

Bed Bath & Beyond gave back more than half of yesterday’s 90% gain on the news that it’s raising $1 billion through a new stock offering. 📉

Zoom rose 10% on news that it’s cutting roughly 15% of its workforce (1,300 employees). Boeing is cutting 2,000 jobs in finance and human resources, shifting some work to contractors in India. And after the bell, eBay announced it was cutting 4% of its workforce. ✂️

Billionaire Tesla bull Ron Baron says Tesla could hit $1,500 per share by 2030. He also said Musk promised him multiples on his $100 million Twitter investment. 🤔

In crypto news, Gemini and Genesis reached a $100 million agreement over the Gemini Earn program. Crypto lender SALT has raised $64.4 million to resume its operations. And crypto will be missing from Fox’s Super Bowl LVII ads because it banned the controversy-laden industry. ₿

Other symbols active on the streams included: $MULN (-1.89%), $KPRX (+38.72%), $AI (-10.96%), $SOUN (-10.67%), $XELA (+6.36%), $GNS (-11.49%), and $VS (+38.54%). 🔥

Here are the closing prices:

| S&P 500 | 4,164 | +1.29% |

| Nasdaq | 12,114 | +1.90% |

| Russell 2000 | 1,973 | +0.76% |

| Dow Jones | 34,157 | +0.78% |

Economy

Powell Whispers Sweet Nothings

Federal Reserve Chairman Jerome Powell spoke in a Q&A session at the Economic Club in Washington, D.C, this afternoon. As expected, the market watched his remarks closely, which led to a bit of afternoon whiplash. 👀

His initial commentary around disinflation helped spark a rally in stocks. He said, “The disinflationary process, the process of getting inflation down, has begun, and it’s begun in the goods sector.” and “…but it has a long way to go. These are the very early stages of disinflation.”

However…stocks quickly reversed their rally and briefly turned negative after Powell suggested the Fed could get more hawkish. “The reality is we’re going to react to the data…So if we continue to get, for example, strong labor market reports or higher inflation reports, it may well be the case that we have to do more and raise rates more than is priced in.”

Outside of that, Powell reiterated much of the same messaging we’ve heard before. After last week’s Fed meeting and rock-solid labor market data, the market is slowly adjusting its rate path expectations. As a result, the stock market was able to shake off that negative comment and close near the day’s highs. 📈

Meanwhile, in economic news, the U.S. trade deficit widened to $67.4 billion in December. The trade balance closed out 2022 with its largest yearly deficit on record ($948 billion), growing 12.2% YoY.

Also, the IBD/TIPP consumer confidence index rose to 45.1 in February. While that marks its highest reading since April 2022, readings below 50 signal an overall pessimistic vibe among consumers. 👎

Want a winter escape without the hassle of plotting the details, planning your travel, and paying for it all? You’re in luck!

Here’s your chance to win an all-inclusive trip to Montego Bay, Jamaica, from Feb 21st to Feb 25th, in just a few clicks!

Open a brokerage account with at least $250 by Feb 10, 2023, to be automatically entered to win a 5-day / 4-night stay for yourself and a guest at the all-inclusive Hyatt Ziva Rose Hall resort.

You’ll also receive roundtrip airfare to Montego Bay and roundtrip transportation between the resort and Montego Bay airport.

The contest is open to US residents only and ends on Feb 10, 2023, so don’t delay! Here are the official rules.

P.S. Want to increase your odds? Receive an additional entry for every $250 deposited into your account during the contest period (maximum 20 additional entries).

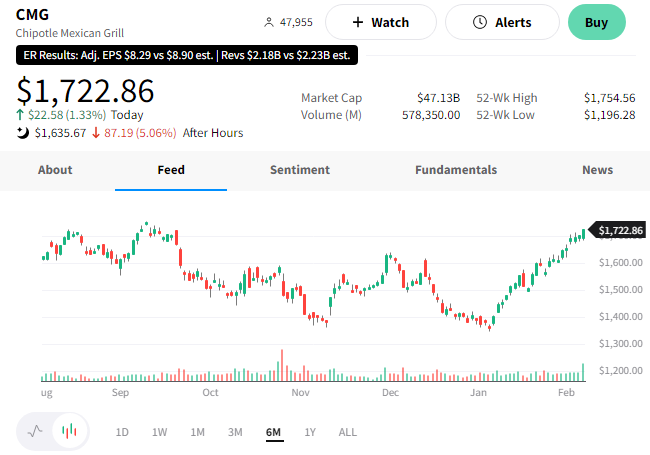

Holy guacamole, there was a lot of earnings today. Let’s start with Chipotle and see what else moved today.

Chipotle Mexican Grill reported worse-than-expected fourth-quarter results. Its adjusted earnings per share of $8.29 were shy of the $8.90 expected, while revenues of $2.18 billion missed the $2.23 consensus estimate. This marks the first time since Q3 2017 that it’s missed both Wall Street estimates. 😟

Net sales rose 11.2% YoY, but same-store sales growth of 5.6% fell short of the $6.9% expected by analysts (and management’s guidance). The company expects same-store sales growth in the high-single digits for Q1 2023. It also plans to open 255 to 285 new locations this year.

Its recent price hikes to keep up with rising costs could be starting to impact customer traffic. Whether or not this miss is a one-off or the start of a new trend remains to be seen. 🤷

For now, however, shares of $CMG are falling 5% on the news. 🔻

British Petroleum (BP) reported a record $28 billion full-year profit in 2022. Like other oil giants, it’s returning some of its profits to shareholders by hiking its dividend by 10% and repurchasing $2.75 billion in shares over the next three months. In addition, the company is scaling back its shorter-term emissions goals but maintains a goal of being net zero by 2050. To get there, the company plans to divide its $18 billion in spending equally between the oil and gas business and its energy transition businesses until 2030. $BP shares rose over 8% on the news. 🛢️

Car rental company Hertz recorded better-than-expected fourth-quarter results. Its adjusted earnings per share of $0.50 topped the $0.46 estimates, while revenues of $2.035 billion beat by $20 million. The company’s efforts to reduce costs and improve technological efficiency helped boost its results. Additionally, travel traffic continues to improve, with corporate business travel up 28% YoY and inbound international travel up 56%. Executives did not provide detailed guidance for 2023 but signaled that further cost improvements would continue and revenue should improve further as it revamps its Dollar and Thrifty rental car brands. The news drove $HTZ shares up by more than 7%. 🚗

Cruise line Royal Caribbean reported a quarterly loss of $1.12 per share, shallower than the consensus estimate. Revenues also rose to $2.6 billion but missed expectations slightly. More importantly, the company’s bookings significantly exceeded pre-pandemic levels during the quarter. Peak cruise-promotion season during the first quarter is going well, with the company experiencing a record-breaking period with bookings approaching previous records and at higher prices. The upbeat outlook helped buoy $RCL by 7%. 🚢

DuPont de Nemours released better-than-expected results. The company expects sales volumes in its division serving consumer electronics and chipmakers to fall in the year’s first half. However, it sees the chip market bottoming out in the back half of the year. As a result, it forecasted full-year EPS of $3.50 to $4.00 per share and revenue of $12.6 billion. Additionally, it raised its dividend by 9% to $0.36 per share. $DD shares jumped more than 7% today. 🏭

French bank BNP Paribas disclosed a record full-year profit of 10.2 billion euros, below the 10.9 billion expected by analysts. Executives say they continue to execute their Growth, Technology & Sustainability 2025 strategic plan. They expect it to drive more than 9% net income growth between 2022 and 2025. Additionally, the company plans to buy back 5 billion euros worth of shares in 2023 and pay a dividend of 3.90 euros. $BNP shares popped more than 3% on the news. 🏦

Company News

Microsoft’s “New Way To Search”

The future is officially here. Or at least that’s what Satya Nadella told CNBC. The Microsoft CEO said he believes that AI-powered search is the biggest thing for the company since the cloud emerged 15 years ago. 😮

The headlines emerge as Microsoft released its new AI-powered Microsoft Bing and Edge software, which they’ve branded as “your copilot for the web.” 🤖

In it, they’ve brought together search, browsing, and chat into one unified experience usable anywhere on the web. The company claims the updates deliver better search, complete answers, a new chat experience, a creative spark, and an overall new Microsoft Edge experience.

The announcement was pushed via Twitter, where the world chimed in with their thoughts. 💭💭💭

Today we’re reinventing how the world interacts with the web, starting with the tools billions of people use every day — the search engine and the browser. Introducing the new Bing: https://t.co/zkDrBOpi3Y

— Bing (@bing) February 7, 2023

We’ve spoken about artificial intelligence (AI) at length this year. ChatGPT lit the fire, and now companies are pouring fuel on it daily. Yesterday, Google announced its Bard AI, and Chinese search engine Baidu said its ChatGPT-style “Ernie Bot” will be available in March. And there’s likely to be more to come in the months ahead. 📆

That’s at least what retail investors are betting on as they flock to small-cap companies in the space. 🤑

As with anything, the AI revolution is not without its issues. For example, Getty Images is suing Stable Diffusion for $1.8 trillion over copyright and trademark issues. But for now, all we can do is wait and see how these heavily-hyped projects pan out in the real world. 🤷

Bullets

Bullets From The Day:

🤑 Nintendo is raising wages for its Japanese workers by 10%. For the first time in decades, Japan is finally experiencing an uptick in inflation. As a result, employers are responding by raising wages for their employees to help them battle the rising cost of living. Despite a slowdown in growth, Nintendo is investing in its long-term growth by securing its workforce and staying ahead of its competition in the war for talent. Kotaku has more.

🗑️ Could part of the solution to climate change involve mailing your food scraps to this company? Food waste is a massive problem globally, with 1.3 billion tons wasted each year. Most of it ends up in landfills leaking methane, a greenhouse gas 80 times more potent than carbon dioxide. Reusing that food waste to grow more food would help solve the problem, but it’s often hard to do. A new startup, Mill Industries, is trying to solve that problem for consumers. The process starts with members receiving a high-tech bin to collect their leftovers and ends with that product becoming chicken feed. More from The Verge.

⚡ Mercedes-Benz to bring its all-electric eSprinter van to North America. The long-anticipated and updated battery-electric eSprinter is finally making its way to North America. Production is set to begin in the second half of 2023 at the Mercedes-Benz factory in Charleston, South Carolina. The German automaker invested roughly 350 million euros and took a module approach to the design, allowing it optionality to develop and design the van for various uses. TechCrunch has more.

🏥 Primary-care provider Oak Street Health receives a $10.5 billion offer. The primary care center operator’s shares rose 30% after The Wall Street Journal reported that CVS Health Corp is close to buying the company. The current share price discussion is $39, but the $10.5 billion deal also includes debt. A source familiar with the negotiations said it could be announced as early as next week once final terms are reached. More from Reuters.

👎 SoftBank’s Vision Fund posted a fourth straight quarter of losses. The flagship investment arm was hit by the continued weakness in technology valuations, reporting a pre-tax loss of 660 billion yen ($5 billion) in its December quarter. Its loss on investments was about 730 billion yen during the period, with the company marking down its weaker-performing companies. The fund has been raising cash and taking a more defensive approach over the last year, reducing its new and follow-on investments by more than 90% YoY. CNBC has more.

Links

Links That Don’t Suck:

📊 Ranked: America’s 20 biggest tech layoffs since 2020

🎫 One winning ticket sold for $754 million Powerball jackpot, in Washington state

🚫 U.S. judge rejects bail proposal for FTX founder Bankman-Fried

🙁 Leaked document suggests hardly anyone bothered to pay for Twitter Blue

🛒 This fed official grocery shops for his family and knows just how high prices are

📺 What will TV look like in three years? These industry insiders share their predictions

😮 9.3 million more U.S. consumers ended 2022 living paycheck to paycheck than in 2021