Company-specific news took priority today as stocks and bonds continue to churn sideways ahead of Q1’s end. Let’s recap what you missed. 👀

Today’s issue covers Alibaba’s six-way split, Apple’s new “pay later” service, and Lululemon leading today’s earnings movers. 📰

Check out today’s heat map:

5 of 11 sectors closed green. Energy (+1.50%) led, and communication services (-0.80%) lagged. 💚

In U.S. economic news, the S&P Case-Shiller index showed that national home price growth slowed for the seventh straight month, rising just 3.8% YoY. Wholesale and retail inventories both rose more than expected in February. Consumer confidence ticked up slightly in March, with one-year inflation expectations rising by 0.1% to 6.3%. And finally, the Richmond Fed manufacturing index jumped more than expected in March, rising from -16 to -5. 📝

Internationally, Russia says it has successfully redirected all of its crude oil exports impacted by Western sanctions to “friendly” countries. India and China are among the biggest importers of its product. The U.S. and Japan have struck a trade deal for minerals used in clean-energy technologies. And the World Bank warned that the global economy may be entering a “lost decade.” 🌍

The consulting industry continues to trim down as business slows. McKinsey has started its restructuring efforts with 1,400 layoffs. Meanwhile, Facebook parent Meta is planning to assess employee performance more frequently and lower some bonus payouts. ✂️

Virgin Orbit is extending its unpaid pause after its deal with investor Matthew Brown backtracked. Negotiations are ongoing, but shares fell to a fresh all-time low on the uncertainty. 🚀

AMC Shares rose 15% after an article suggested that Amazon is considering buying the distressed theater chain. 🎞️

Oscar Health soared 56% after appointing former Aetna head Mark Bertolini as its new CEO. 🏥

In crypto news, European Union lawmakers voted in favor of payment limits from anonymous crypto wallets. Sam Bankman-Fried is facing new U.S. charges that allege he bribed Chinese officials to the tune of $40 million in order to unfreeze certain accounts. And Disney is scrapping Bob Chapek’s metaverse dream, cutting the team as part of its 7,000 layoffs. ₿

Other symbols active on the streams included: $TRKA (-9.71%), $BRDS (+42.19%), $VKTX (+69.30%), $MYO (+11.29%), $PYXS (+42.59%), $BMEA (+99.03%), and $XRP.X (+10.39%). 🔥

Here are the closing prices:

| S&P 500 | 3,971 | -0.16% |

| Nasdaq | 11,716 | -0.45% |

| Russell 2000 | 1,753 | -0.06% |

| Dow Jones | 32,394 | -0.12% |

Company News

Alibaba Calls It Splits

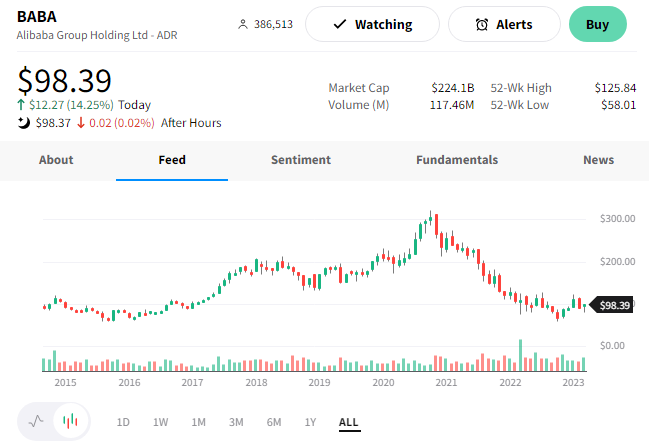

In a post-Jack Ma era of slower growth, Chinese e-commerce giant Alibaba is turning to financial engineering to drive value. 📝

Today the company outlined the most significant reorganization in its history, designed to unlock shareholder value and foster market competitiveness. The business will be split into six separate companies, each led by its own CEO and board of directors. 🧑💼

They each revolve around strategic priorities, including:

- Cloud Intelligence Group – Cloud and artificial intelligence (AI) activities.

- Taobao Tmall Commerce Group – Online shopping platforms, including Taobao and Tmall.

- Local Services Group – Food delivery service Ele.me and mapping.

- Cainiao Smart Logistics – Alibaba’s logistics service.

- Global Digital Commerce Group – International e-commerce businesses, including AliExpress and Lazada.

- Digital Media and Entertainment Group – Streaming and movie business.

Each unit will be able to pursue independent fundraising and public listings if/when ready. However, Taobao Tmall Commerce Group will remain a wholly-owned subsidiary of Alibaba. 🛒

With growth slowing across the business, the move should give each unit the flexibility to win in its competitive markets. It should also reduce the regulatory headwinds Alibaba dealt with as a massive conglomerate.

$BABA shares rallied 15% on the news. However, they’re still trading at their late-2014 IPO levels. 🔻

Company News

Apple Unveils Its “Pay Later” Service

Apple is continuing its push into the services business, this time targeting the popular “buy now pay later” (BNPL) space. Today the consumer tech giant introduced its “Apple Pay Later” feature, allowing consumers to pay for purchases over time. 💳

Soon, Apple Pay users can split purchases into four payments at no cost. The four payments will be spread over six weeks without interest, fees, or immediate impact on their credit score. Users can apply for loans ranging from $50 to $1,000, which can be used for online and in-app purchases and at merchants that accept Apple Pay.

Apple says there’s no one-size-fits-all approach to how people manage their finances. And as more people look for flexible payment options, the company wants to help fill that need…with some guardrails. 🦺

The company will use a “soft credit pull” to judge the borrower’s creditworthiness before approving the requested loan. And since users will view and manage their loans straight within Apple Wallet, Apple says they’ll have all the information they need to make responsible borrowing decisions. They’ll also be required to link a debit card to ensure timely payments and prevent them from paying back the debt with other forms of debt. 🏦

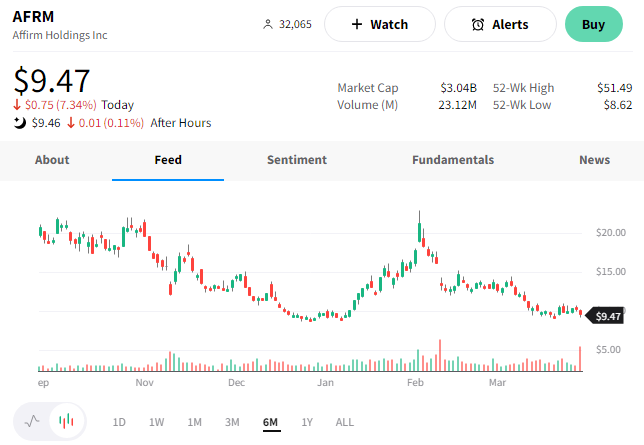

As for consumers, the six-week “free” loan is an alternative to longer-term offerings from Affirm and other BNPL competitors that are often higher cost. Apple plans to begin reporting the loans to the three major credit bureaus in the fall. That means consumers who don’t pay what they owe will see an impact on their credit score, as they would with most other credit products. 📝

The Mastercard Installments program enables Apple Pay Later, with Goldman Sachs acting as the issuer of that program. That means merchants who already accept Apple Pay will not need to make any changes to participate in the new service offering. 📱

With consumers demanding more payment flexibility, it makes sense that Apple would offer it. Of course, they already have the Apple credit card, but this could be an attractive alternative for those that don’t qualify or would prefer not to open another account.

Apple shares barely budged after the announcement. However, BNPL stock Affirm saw its shares fall more than 7% as investors weighed the impact of further competition. 🔻

Earnings

Lulu Leads The Earnings Movers

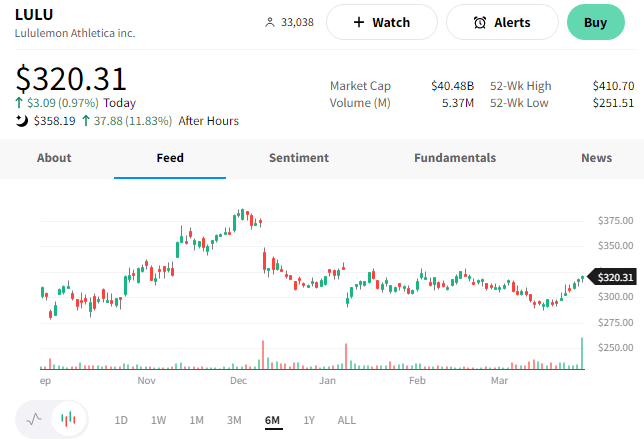

Athletic-wear retailer Lululemon’s stock is going for a run after reporting better-than-expected holiday-quarter sales.

The company’s adjusted earnings per share of $4.40 on revenues of $2.77 topped the expected $3.26 and $2.7 billion. 👍

Other important stats included:

- Comparable store sales rose 15% YoY (17% constant dollar basis)

- Direct-to-consumer net revenue rose 37% YoY (39% constant dollar basis)

- Direct-to-consumer net revenue as a percentage of total revenue rose 3% YoY to 52%

- Adjusted operating margin rose 50 bps YoY to 28.3%

- Inventories grew 50% YoY to $1.4 billion (down from +85% YoY growth in Q3)

The company took a significant write-down on its acquisition of MIRROR, now rebranded as Lululemon Studio. Executives say they will build on the two-tier membership program launched in October 2022, expanding features to guests at a lower price point. They hope this will drive digital app-based services in the future.

Looking ahead, executives expect fiscal 2023 revenue of $9.3 to $9.41 billion and earnings per share of $11.50 to $11.72. Both forecasts topped consensus estimates of $9.14 billion and $11.26 per share. They continue to focus on delivering sustained growth and long-term value. 💪

There was not much mention of the macroeconomic environment or a consumer slowdown. Maybe the company’s focus on middle to higher-income consumers has isolated it from much of the slowdown other retailers are experiencing. Nevertheless, changes in the company’s outlook are something investors will likely watch for in the coming quarters.

$LULU shares rallied 13% after hours. 📈

Bullets

Bullets From The Day:

🏦 French prosecutors raid banks over alleged dividend stripping. Authorities searched the Paris offices of five banks, including Societe Generale, BNP Paribas, and HSBC, on suspicion of fiscal fraud. It’s part of a broad European probe into the dodging of dividend tax payments, following similar investigations in Germany and other countries in the region. The practice in question is “cum-ex” dividend stripping, which aims to blur stock ownership and allow multiple parties to illegally claim tax rebates on dividends by swiftly trading shares around the dividend payout day. Reuters has more.

💻 Zoom fights to stay relevant amid heavy competition with new features. With its stock sitting near historic lows and the company laying off 15% of its staff weeks ago, Zoom is introducing a new suite of features to compete with competitors, including Slack, Calendly, Google, and Microsoft. The new features include AI-powered meeting summaries, prompt-based email responses, whiteboard generation, video “huddles,” and a meeting scheduler. Its latest move comes as Zoom looks to shift more of its customers’ work tasks to its tools, specifically targeting the crowded enterprise market. More from TechCrunch.

🎮 This game looks to bring back “The Sims” without all the constraints. Former EA and Linden Lab executive Rod Humble’s new studio, Paradox Tectonic, is taking its shot at reinventing life simulator games. Its first release, Life By You, was officially unveiled last week and looks a lot like The Sims but with a few key differences. First, it uses a procedurally generated real-language system for dialogue and includes much more in-depth simulation. Every character in the game’s fictional city is fully simulated in real-time, making it more immersive. And that’s just the start. The Verge has more.

💰 Study shows China spent $240 billion to bail out ‘Belt and Road’ countries. A new report suggests that China has financially supported 22 developing countries between 2008 and 2021, with the extent of its support soaring in recent years. Almost 80% of the lending was made between 2016 and 2021, mainly to middle-income countries. However, lending has slowed significantly since then as many of these infrastructure development projects failed to create the expected returns. This all matters now because regulators are looking to mitigate risks to the country’s banking sector by understanding and potentially backstopping their international lending. More from the Reuters.

🛢️ Energy Transfer LP expands its Permian market share via a new acquisition. It’s acquiring pipeline operator Lotus Midstream in a $1.45 billion cash-and-stock deal. The acquisition will help Energy Transfer solidify itself as one of the top midstream companies in the Permian region and provide greater access to these crucial markets through more than 1,000 miles of pipelines and related infrastructure in West Texas. It’s also agreed to acquire a 50% interest in certain NGL processing assets, including fractionation plants located near Odessa, Texas, which process up to 40,000 barrels per day (bpd) of NGLs into various products. Yahoo Finance has more.

Links

Links That Don’t Suck:

🛢️ A look back at Pepsi’s history as it unveils a new logo

🦣 Cultured meat firm resurrects woolly mammoth in lab-grown meatball

⚡ U.S. electricity from renewables surpassed coal for the first time in 2022

👍 Employees need positive feedback from bosses. Without it, people quit.

👩💼 The company behind Johnnie Walker and Guinness appoints first female CEO

😓 With 62% of Americans living paycheck to paycheck amid inflation, more people have a side job

🤖 Goldman Sachs report says AI systems like ChatGPT could impact 300 million full-time jobs worldwide