Optimism reigned supreme headed into the three-day weekend, with technology stocks leading the charge. Let’s see what else you missed. 👀

Today’s issue covers why Pinduoduo is popping, the big drop in Big Lots, and Canaan’s downward continuation. 📰

Check out today’s heat map:

8 of 11 sectors closed green. Technology (+2.85%) led, and energy (-0.43%) lagged. 💚

In economic news, the core personal consumption expenditures price index (PCE) jumped 0.4% MoM and 4.7% YoY. Both were slightly higher than anticipated, as the Fed’s preferred metric shows inflation remains higher and stickier than they’re happy with. 🌡️

Consumer spending rose by 0.8% MoM, with personal income up 0.4%. Consumers dipped into savings to keep up spending, with personal savings rate falling 0.4 percentage points to 4.1%. Meanwhile, Michigan consumer sentiment fell to a six-month low, driven by economic concerns. 🔺

April’s U.S. wholesale inventories fell 0.2% vs. 0.0% expected, while retail inventories rose 0.2%. Durable goods orders were up 1.1% in April vs. an expected decline of 1.1%. 📦

Marvell Technology shares rose 32% following earnings as money continues to pour into artificial intelligence (AI) related stocks. 🤖

Cannabis stock Tilray dropped 21% to new all-time lows after offering new convertible notes to help pay down debt. 🥦

Other symbols active on the streams included: $TOP (+0.91%), $SPCE (-16.54%), $PLTR (+6.31%), $ONFO (+19.66%), $BHG (+45.85%), $IEP (+0.10%), $PDSB (+27.38%), and $ELEV (+66.78%). 🔥

Here are the closing prices:

| S&P 500 | 4,205 | +1.30% |

| Nasdaq | 12,976 | +2.19% |

| Russell 2000 | 1,773 | +1.05% |

| Dow Jones | 33,093 | +1.00% |

Earnings

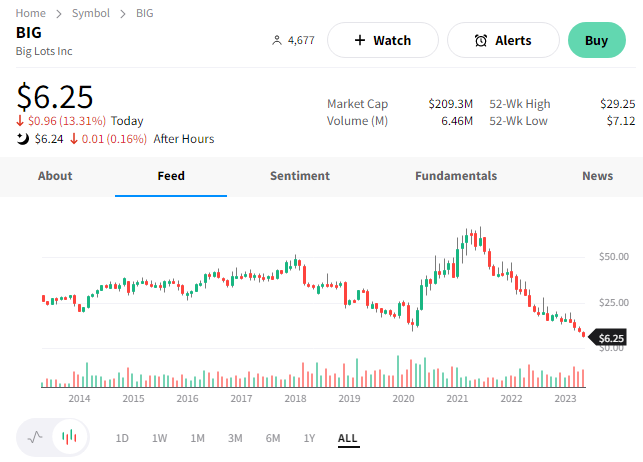

Big Lots’ Big Drop

Big Lots is throwing it back to the 1990s with its share price. The downside move comes after the discount furniture retailer posted losses that nearly doubled analyst estimates. 😮

Here’s how its primary metrics shook out vs. expectations:

- Adjusted loss per share of $3.40 vs. $1.78

- Revenues of $1.12 billion vs. $1.19 billion

- Same-store sales decline of 18.3% vs. 13.2%

The lower-income consumer, which makes up most of the company’s customer base, continues to face several challenges: inflation biting into their discretionary income, receiving lower tax refunds, and higher interest rates on larger purchases. These factors and overall economic uncertainty caused many customers to pull back spending. 🛑

Adding to the issues were furniture product shortages, particularly as the company’s largest vendor abruptly closed in November. Unfavorable weather conditions also hurt seasonal lawn and garden sales, though hopefully, some of that will be made up in the current quarter.

To entice consumers, the company increased promotional activity, which pushed its gross margin from 36.7% last year to 34.9% today. Also, the value of the inventories on its books fell by 18.8%. 🔻

The company’s current situation is dire, and executives are aware of that. So to avoid becoming the next Bed Bath & Beyond story, they’re taking drastic measures to preserve the liquidity they’ll need to get their core business back on track.

That starts with suspending the company’s dividend and monetizing assets worth roughly $340 million. Additionally, they’ve raised their 2023 cost-cutting target from $70 million to over $100 million and identified opportunities to cut more than $200 million over the next eighteen months. ❌

Executives opted not to provide full-year guidance, citing the “significant macroeconomic uncertainty,” but said they expect sales and gross margins to improve in the year’s second half. That’s similar to comments from other retailers like Best Buy. However, they forecasted a same-store sales decline in the “high-teens” percentage range for the second quarter. That was well beyond the analyst consensus view of an 8.6% decline. 🔮

In the face of all these issues, executives say they’re “highly encouraged by the green shots we are seeing.” Moreover, they reiterated that the steps being taken today would position them well for when the macroeconomic environment ultimately turns more favorable.

However, much like the company’s customers, investors aren’t quite buying what they’re selling. The only shoots they see are the parachutes they’re jumping out of the stock with. 🪂

Bad jokes aside, $BIG shares fell 13% to their lowest level since 1991. 👎

Earnings

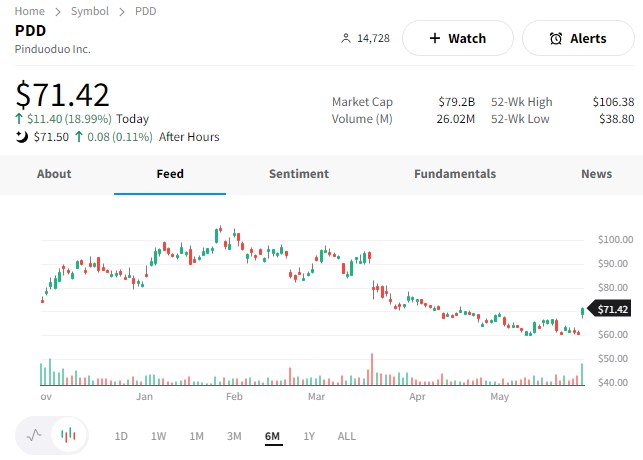

Pinduoduo Pops While Canaan Drops

Pinduoduo, now known as PDD Holdings, is rebounding from nearly seven-month lows following better-than-expected results. 👍

The company’s adjusted earnings per American depository share (ADS) of RMB6.92 was well above the RMB4.46 expected. Its gross margin also improved from 69.9% to 70.4%.

Meanwhile, revenues grew 58.1% YOY to RMB37.64 billion, topping the consensus view of RMB32.18 billion. That’s broken down into online marketing services of RMB27.24 billion (+50% YoY) and transaction services of RMB5.59 billion (+86% YoY). 💰

Executives say their cost-cutting efforts and operational prioritization have been paying dividends. Additionally, recovery trends among consumers continue to improve, with online retail picking up steam and users showing a higher willingness to shop. Overall, these early trends should lay a “solid foundation” for steady consumption growth throughout the year. 🛒

To position itself to benefit from this improvement, it’s investing heavily in promoting ecosystem vibrancy and sustainability. Its dedicated ’10 Billion Ecosystem Initiative’ is designed to facilitate an environment where quality merchants can flourish. In addition, improving cash flows and operating profitability should also extend the company’s runway for investing in its growth goals.

Despite today’s 19% rally, $PDD shares are roughly 65% off their 2021 highs. Nonetheless, investors seem hopeful that the company’s efforts will continue to push the stock in the right direction. 🔺

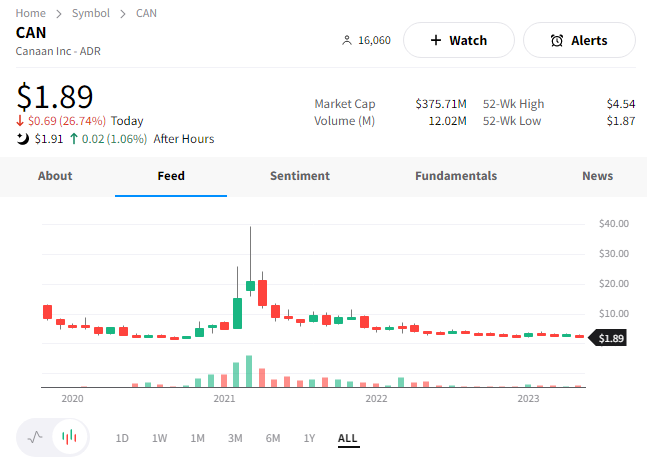

While discussing Chinese stocks, it’s worth mentioning Canaan Inc. The China-based computer hardware manufacturer is plunging after reporting weak results. 😮

The computing solutions provider reported an adjusted net loss of $3.37 per share. Last year it reported a $2.52 per share profit. Revenues also dropped from $201.8 million to $55.2 million, missing the consensus view of $62.4 million.

Executives blamed an industry-wide reduction in selling prices. They also noted unforeseen delays in payments and shipments following U.S. regional bank failures. However, investors remain skeptical of that reasoning given the company’s many quarters of underperformance. They want fewer excuses and more results. 😑

$CAN shares were down another 27% today, approaching their all-time lows.

Bullets

Bullets From The Day:

💊 Pharmacy giant cuts corporate jobs by 10% amid stock rout. The struggling pharmacy chain Walgreens Boots Alliance said it’s further streaming its operations and focusing on consumer-facing healthcare businesses. None of the 504 job cuts are based at its stores, micro-fulfillment outlets, or call centers. It comes at a time when the chain has lost significant market share to its rivals and is trying to reverse those trends and its stock price. CNBC has more.

❌ More insurers desert net-zero alliance (NZIA). Lloyd’s of London became the sixth organization within 36 hours to quit the partnership after a U.N.-backed coalition of financial groups warned about the fallout of political attacks on U.S. insurers. The NZIA has lost a fifth of its members in a week, raising questions about the viability of the coalition, which was formed in 2021 and requires insurers to reduce greenhouse gas emissions in their underwriting portfolios to a net-zero level by 2050. More from Reuters.

🧠 Elon Musk’s brain chip firm wins U.S. approval for human study. The U.S. Food and Drug Administration (FDA) approved the billionaire’s brain-chip firm, Neuralink, to conduct its first tests on humans. Its earlier bid was rejected on safety grounds, so it’s unclear what has changed since then. However, Neuralink hopes to use its microchips to treat conditions such as paralysis while also aiming to help disabled people use technology to improve their quality of life. The tech has been tested in Monkeys and now has permission to enter the big leagues, though the company said it has no immediate plans to begin recruiting participants. BBC News has more.

🎰 China’s gambling hub opens $2 billion resort. The Las Vegas of Asia, Macao, has added another luxury casino resort to the Cotai Strip. “The Londoner Macao” is a British-themed casino with Big Ben, the prime minister’s residence, and everything else needed to transport visitors straight into London. Las Vegas Sands owns the new venture and continues to invest in Macao, which has expanded beyond gambling over the last two decades to include retail stores, restaurants, spas, conventions, and more. More from CNBC.

🏭 LG and Hyundai partner in a $4.3 billion U.S. factory. The Korean companies are teaming up to build a new electric vehicle (EV) battery cell manufacturing plant in the U.S., signing a memorandum of understanding that gives each company a 50% stake in the venture. The new plant will be located in Georgia, where Hyundai is also building its first all-EV factory in the U.S. Construction is expected to begin in the second half of 2023 and be operational by 2025 at the earliest. At full capacity, it will produce enough batteries every year to support 300,000 EVs. Engadget has more.

Links

Links That Don’t Suck:

🔒 Netflix might ruin password sharing for everyone

📝 What the credit rating agencies are saying about the U.S.

😡 OpenAI CEO’s threat to quit EU draws lawmaker backlash

🌞 Investment in solar power to outstrip oil for first time, says IEA

✈️ What is ‘skiplagging’ and why airlines hate the booking practice

💰 Credit Suisse ordered to pay $926 million to Georgia’s former prime minister

❌ Tech layoffs ravage the teams that fight online misinformation and hate speech