The stock market opened higher following weekend reports of a “tentative” debt ceiling deal but faded throughout the day. Let’s see what else you missed. 👀

Today’s issue covers earnings from both halves of HP, Box and U-Haul results, and Nvidia joining the trillion-dollar club. 📰

Check out today’s heat map:

4 of 11 sectors closed green. Consumer discretionary (+0.66%) led, and consumer staples (-1.13%) lagged. 💚

In economic news, the S&P Case-Shiller home price index saw prices rise 0.7% YoY in March as low housing supply keeps upward pressure on prices nationally. The conference board consumer confidence index declined, with the present situation index decline weighing on the overall index. And the Dallas Fed manufacturing index fell further in May, with new orders and growth rate of orders indices hitting their lowest levels since mid-2020. 🔻

Internationally, the European Central Bank warned that the euro zone’s most prominent banks might take a hit if their financial clients run into trouble and have to withdraw deposits. The Turkish lira hit a fresh record low following the re-election of incumbent President Recep Tayyip Erdogan. And France inaugurated the first battery-making gigafactory in the country, with three more to come. 🌍

Over in the Asia-Pacific region, the Reserve Bank of India is raising some red flags at its country’s banks, citing governance gaps and stressed assets misreporting. Meanwhile, Samsung is leading the charge to push Vietnam to compensate them for higher levies they’ll face beginning next year following the recent global overhaul of tax rules. 🌏

Other symbols active on the streams included: $TOP (+59.97%), $TSLA (+4.15%), $PLTR (+7.80%), $AI (+33.42%), $TGT (-3.68%), $AMBA (-7.01%), and $ATTO (+80.82%). 🔥

Here are the closing prices:

| S&P 500 | 4,206 | +0.01% |

| Nasdaq | 13,017 | +0.32% |

| Russell 2000 | 1,767 | -0.32% |

| Dow Jones | 33,043 | -0.15% |

Earnings

Two HPs Walk Into Earnings Season…

Let’s talk about old man Hewlett Packard’s two publicly-traded entities and their earnings from after the bell. 🔔

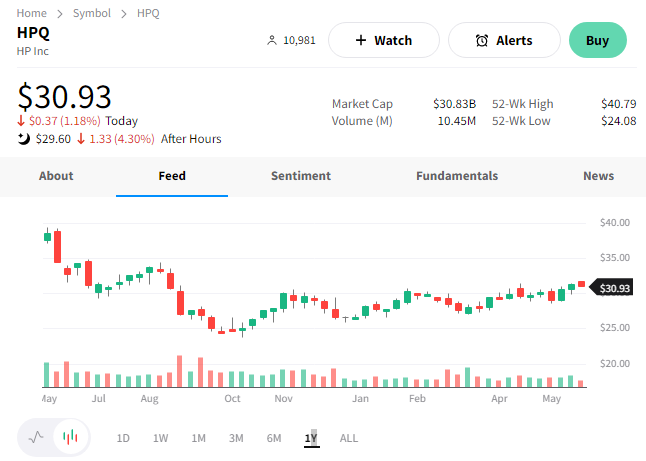

First, we’ll start with HP Inc, which trades under the ticker HPQ. This part of the company comprises three reportable segments: personal systems, printing, and corporate investments. It also retained the company’s original ticker and trading symbol upon the split in 2015. 🖖

It reported second-quarter adjusted earnings per share of $1.07 and revenues of $12.9 billion. That was mixed vs. the consensus estimate for $0.76 per share on $13.07 billion in revenue.

Given the slowdown in the personal computer (PC) market and overall discretionary spending, executives remain focused on cost-cutting efforts. However, like Best Buy and other retailers, they hinted that they expect a rebound in PC sales during the year’s second half and into 2024. 📆

Analysts were encouraged by cost-cutting, increasing bottom-line guidance, and inventory reduction. However, the company did not receive the same artificial intelligence (AI)-fueled boost that others in the market did. Executives tried to spur excitement by saying AI represents a “tremendous refresh opportunity to redefine what PCs can do.”

Clearly, investors remain skeptical about the overall impact AI will have on its business. $HPQ shares traded down about 4% after hours. 🔻

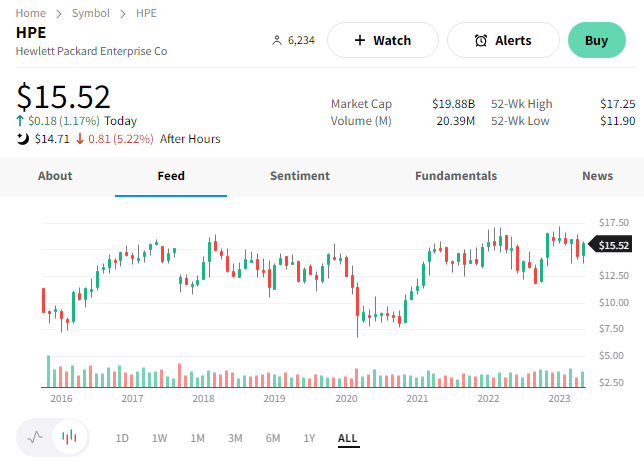

Hewlett Packard Enterprise Co. trades under the ticker symbol HPE and did not fare better. 👎

The global edge-to-edge cloud company reported adjusted earnings per share of $0.52 on revenues of $6.97 billion. That was mixed compared to the $0.49 and $7.3 billion anticipated by analysts. Despite the shortfall, executives focused on the shift towards higher-margin revenue streams like AI (+18% YoY) and its Intelligent Edge segment ($1.3 billion).

Its third-quarter revenue guidance of $6.7 to $7.2 billion was also lighter than the $7.2 billion consensus view. And its earnings per share estimate of $0.44 to $0.48 straddled the $0.46 expected.

$HPE shares traded down about 5% on the news. 📉

Company News

Nvidia Joins The Trillion $ Club

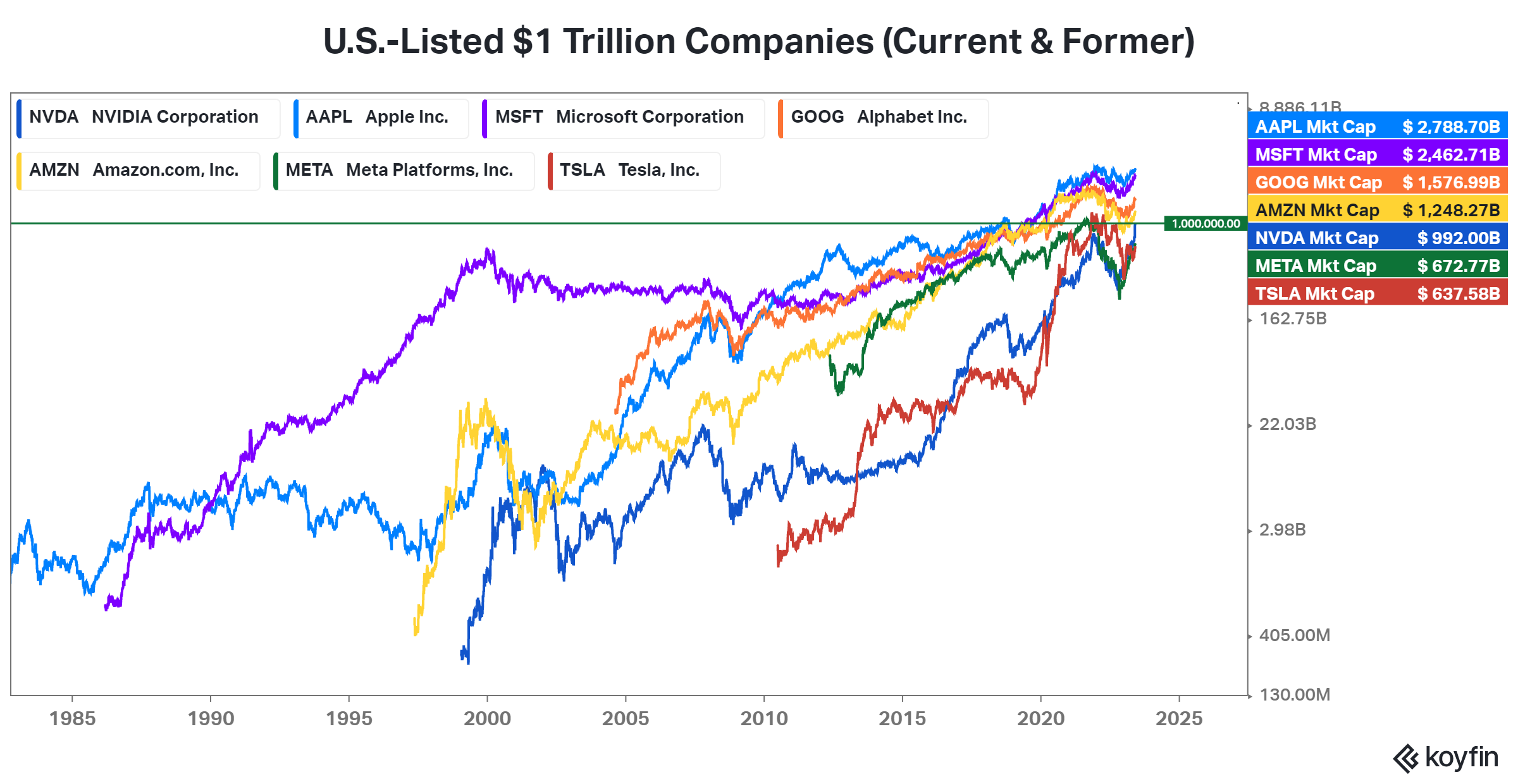

Until today, only six U.S.-listed companies had reached a market capitalization of $1 trillion or more at one point in their history. And one abroad, Saudi Aramco. However, the recent hype over artificial intelligence (AI) helped propel retail investor favorite Nvidia onto that list…at least intraday. 🤩

The chart below shows it is joining the ranks of Apple, Microsoft, Google, and Amazon, which are still above $1 trillion. And Tesla and Meta, which briefly surpassed that mark in 2021 but have since fallen from grace. 👇

Where it goes from here is anyone’s guess. And believe us, people are guessing… But for now, we’re just stopping to smell the roses at this milestone. 🌹

Time will tell what’s (or who) is next. Berkshire Hathaway is closest at $705 billion, followed by TSMC at $530 billion, Visa at $465 billion, United Health at $447 billion, and Exxon Mobil at $421 billion. The race is on… 👀

Earnings

Box And U-Haul On The Move

It’s time to talk storage, both the physical and cloud type, as we recap earnings from the space. 📝

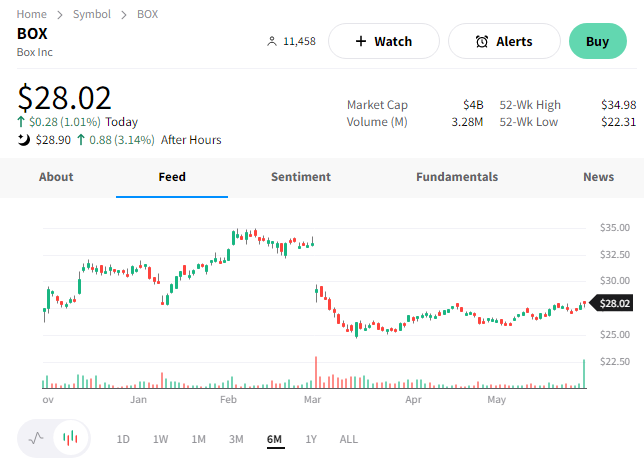

First, we’ll start with cloud storage company Box, which beat Wall Street’s expectations. Its first-quarter adjusted earnings per share of $0.32 on revenue of $251.9 million topped the $0.27 and $250 million anticipated. Billings, which reflects business under contract but not realized, also beat at $191.1 million vs. the $180 million estimate.

Executives focused on their profitable growth strategy, which includes existing improvements to the Box Content Cloud platform and future innovation with Box AI. In addition, they harped on their free cash flow growth of 19% YoY and reiterated their fiscal year 2024 target of revenue growth plus a free cash flow margin of 35%. 🎯

Along with that, they increased their full-year earnings estimate to $1.44-$1.50 per share from $1.42 to $1.45. However, their revenue range fell slightly from $1.05-$1.06 billion to $1.045 to $1.055 billion.

$BOX shares were up 3% after hours as they continued to claw back their post-earnings decline from March. ⛅

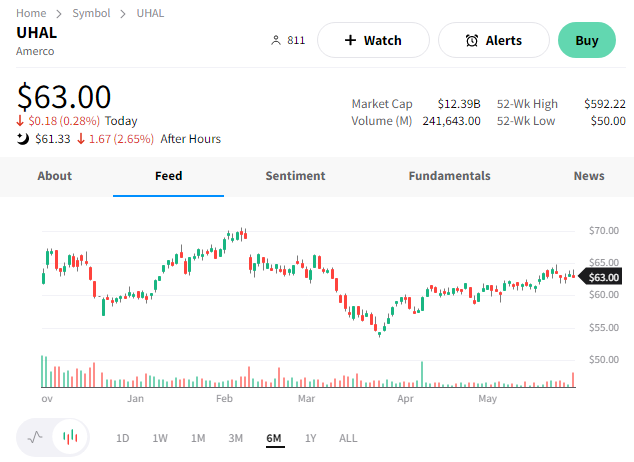

Moving to physical storage (no pun intended), U-Haul Holding Company also reported today. 📦

The company reported net earnings available to shareholders of $37.7 million, down from $86.7 million a year earlier. 🔻

Self-moving equipment rental revenues fell 6% YoY to $32.5 million, with revenue and average miles driven per transaction falling. Those declines were more prominent in one-way markets. Meanwhile, self-storage revenues rose 17% YoY to $28.4 million. Occupancy for all locations declined by 1.4% to 81.2%, with the company adding 6 million net rentable square feet (+12% YoY).

Fleet maintenance and repair costs rose $32.4 million YoY. Higher activity levels in prior years combined with a slower replacement of new equipment into its fleet caused the increase. 🛠️

Executives say that overall moving activity has returned to more historical trends. Self-storage has cooled over the last two years, but the company is still building and filling new units. Overall, the company is focused on building its long-term competitive position.

$UHAL shares fell 3% after hours as investors consider whether the company can weather a slowdown as well as executives hope it will. 🤔

Bullets

Bullets From The Day:

💸 New paper says rising wages will keep inflation high. A paper by former Fed chair Ben Bernanke and former IMF chief economist Olivier Blanchard suggests the Fed might need to do more to cool down the labor market if it hopes to get prices under control. Their model found that supply shocks initially pushed up prices during the pandemic. Then consumer demand took over and has since been playing a more significant role, fueled by government stimulus and a strong labor market. Axios has more.

🚗 Elon Musk visits China, with Tesla investors eyeing expansion plans. The electric vehicle giant’s CEO started a high-stakes visit by meeting China’s foreign minister in Beijing for the first time in three years. The trip comes as many U.S. and global CEOs revisit China following the reopening of its borders and economy. The minister told Musk that China is committed to improving the business environment for investors, particularly as the country’s growth stalls and companies diversify their supply chains away from it. More from Reuters.

🎰 Gamblers are spending more and winning less in Vegas. Casinos on the Las Vegas Strip are changing things up to attract higher-value customers. This comes at a time when losses for blackjack players reached their highest since 2007, at nearly $1 billion in 2022, according to data from the Nevada Gaming Control Board. As for the reason why? A former pro player says data he compiled suggests over two-thirds of blackjack tables on the Strip have shifted from 3:2 payouts to 6:5. It’s just one example of casinos pushing the scales further in their favor. Business Insider has more.

🔥 State Farm pulls out of California due to wildfire risk. The insurer says it will no longer accept homeowner insurance applications in the state due to “historic increases in construction costs outpacing inflation” and “rapidly growing catastrophe exposure” to extreme weather events. This is big news because State Farm is the top home insurance firm in the state, with AIG also pulling policies last year. And it’s not just happening in California; some insurers pulled out of Louisiana and Florida last year due to hurricanes and other severe weather. More from Axios.

👎 Cathie Wood’s unending optimism doesn’t extend to Nvidia. After selling shares of Nvidia before its recent run, the founder of Ark Invest says that the AI darling is now overpriced. She tweeted that while the firm has believed that Nvidia saw the AI future before most, at 25 times the expected revenue for this year, the stock is priced ahead of the curve. Wood argues that at six times its revenue, Tesla is far cheaper than Nvidia. But, she added, the electric vehicle company is the most obvious beneficiary of the recent AI breakthroughs. Yahoo Finance has more.

Links

Links That Don’t Suck:

🍿 Summer movie season could heat up box office

✂️ Goldman Sachs prepares another round of layoffs – WSJ

🛻 Toyota, Daimler in deal to combine Japan truck operations

✈️ Memorial Day weekend air travel surges past pre-pandemic levels

🛑 Air New Zealand to weigh passengers before they board the airplane

📰 William O’Neil + Company Announces The Passing of William J. O’Neil

🔒 Theranos fraudster Elizabeth Holmes to start 11-year prison sentence today