It was a mixed day in the markets, with the Nasdaq 100 pulling back during Apple’s WWDC event. Let’s see what else you missed. 👀

Today’s issue covers Apple’s product event, GitLab’s upbeat outlook, and U.S. regulators targeting crypto giant Binance. 📰

Check out today’s heat map:

4 of 11 sectors closed green. Utilities (+0.48%) led, and industrials (-0.69%) lagged. 💚

In economic news, April’s U.S. S&P Global Composite PMI reading of 54.3 showed the fastest expansion in about a year. Likewise, May’s ISM Services PMI of 50.3 remained in expansion territory for 35 of the last 36 months. And strength in transportation equipment helped buoy factory orders to a 0.4% rise in April. 🏭

Meanwhile, the International Monetary Fund (IMF) chief says there hasn’t been a significant slowdown in lending, and therefore the Fed needs to do more tightening. ⚠️

Palo Alto Networks popped 4% on the news it will take Dish Networks’ place in the S&P 500, dropping Dish down into the S&P 400 mid-cap index. The change will go into effect before the bell on Tuesday, June 20th. 🔄

Streaming giant Spotify is laying off 2% of its workforce as it reorganizes its podcast division. This follows 6% cuts and the exit of chief content and advertising business officer Dawn Ostroff earlier in the year. 🎧

Machinery maker Circor jumped 51% after KKR offered to take it private in a deal worth $1.6 billion. Amedisys shares rose 15% after UnitedHealth gave the home health firm a $3.26 billion all-cash acquisition offer. 💰

Other symbols active on the streams included: $TOP (+18.55%), $CJET (+55.26%), $SEV (+76.50%), $FRZA (+133.71%), $TYGO (-22.07%), $CDTX (-0.76%), $TMBR (+26.17%), and $BLPH (-86.64%). 🔥

Here are the closing prices:

| S&P 500 | 4,274 | -0.20% |

| Nasdaq | 13,229 | -0.09% |

| Russell 2000 | 1,807 | -1.32% |

| Dow Jones | 33,563 | -0.59% |

Company News

Apple’s AR/VR Vision Remains Blurry

Today was Apple’s World Wide Developer Conference (WWDC), with a variety of announcements: 📝

Taking the cake, however, was the highly-anticipated Vision Pro headset. Finally, after seven years of development, Apple’s augmented reality (AR) headset was finally released. 🤩

Apple CEO Tim Cook said the device “seamlessly” blends the real and digital world, making it the first Apple product you look through and not at. The device, which looks like a pair of ski goggles, sports a separate battery pack and is controlled by the user’s eyes, hands, and voice. Downward-facing cameras are designed to capture your hands even if they’re in resting form.

While the product is primarily positioned as an augmented reality (AR) device, it can switch between augmented and full virtual (VR) reality with the push of a dial. In addition, it runs on an operating system called visionOS, which allows users to browse rows of app icons by looking at them. And to make it even easier, it supports Bluetooth accessories like a keyboard and trackpad.

Features aside, what ultimately caught investors’ attention was the $3,499 price tag. That’s well beyond the price tag of Meta’s Quest 3, which starts at $500 and comes out this fall. Maybe it’s seven times more expensive because it’s seven times better? There was certainly a lot of skepticism. 💰

What most seem to be focused on is the high price putting mass adoption far out of reach. More optimistic onlookers say Apple has always started with niche products and iterated them to gain mass-market appeal over time. Only time will tell.

Ultimately, we saw a “sell the news” type of situation in the stock. $AAPL shares pushed to new all-time highs intraday but reversed sharply throughout the event to close down nearly 1%. 📉

Earnings

GitLab Grabs AI Gains

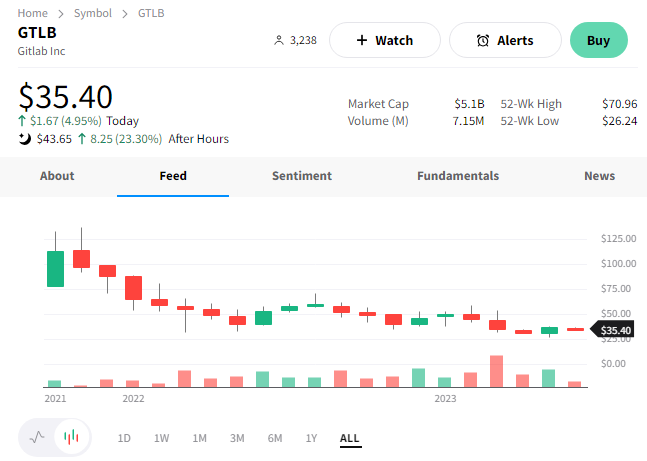

The software development company is surging after hours following its first-quarter results.

The code hosting and collaboration services provider reported an adjusted loss per share of $0.06 on revenues of $126.9 million. That topped the $0.14 loss per share and revenue of $117.8 million anticipated by analysts. 🌤️

Some other highlights included:

- Customers with more than $5,000 of ARR rose 43% YoY to 7,406

- Customers with more than $100,000 of ARR rose 39% YoY to 760

- The dollar-based net retention rate for Q1 was 128%

During the release, executives focused on the company’s artificial intelligence (AI) position. Chief Financial Officer Brian Robins said, “Against a backdrop of macroeconomic uncertainty, customers are looking to our AI-powered DevSecOps platform to drive efficiencies, increase productivity, and accelerate their pace of innovation.”

Looking ahead, executives’ outlook also topped estimates. It now expects a second-quarter adjusted loss per share of $0.02 to $0.03 on revenues of $129 to $130 million. For fiscal 2024, they expect $541 to $543 million in revenue and an adjusted loss of $0.14 to $0.18. 👍

$GTLB shares rose over 23% after hours, rebounding from record lows set two months ago. 🔺

Now that FTX is no longer around, regulators have turned their attention to the world’s largest cryptocurrency exchange Binance. The U.S. Securities and Exchange Commission (SEC) named the company and its founder / controlling shareholder, Changpeng Zhao (CZ), as defendants in the complaint. 📝

Regulators allege the overseas company operated an illegal trading platform in the U.S. and misused its customers’ funds. More specifically, it claims that:

- BAM Trading and BAM Management U.S. Holdings, Inc. misled investors about non-existent trading controls over the Binance.US platform.

- The defendants diverted customers’ funds to a trading entity Zhao controlled called Sigma Chain. That trading firm made Binance’s volume appear larger through manipulative trades.

- Binance concealed its commingling of customer assets with Merit Peak, another entity owned by Zhao, to the tune of billions of dollars.

It also raises the widespread issue of whether many of the tokens traded on the platform are securities and, therefore, subject to U.S. securities laws. 🎯

The suit marks the first federal regulatory suit against Binance’s U.S. but adds to Binance’s global entities mounting challenges with U.S. regulators. For example, the Commodity Futures Trading Commission (CFTC) targeted Binance and Zhao over its derivative offerings in March. And the Justice Department is investigating Binance’s programs to detect money laundering.

Overall, it seems like this will be an uphill battle for Binance. As usual, crypto folks almost make things too easy to get caught. For example, the SEC complaint quoted Binance’s chief compliance officer saying in 2018, “we are operating as a fking unlicensed securities exchange in the USA bro.” If that’s true, then this case likely has some legs. 😵

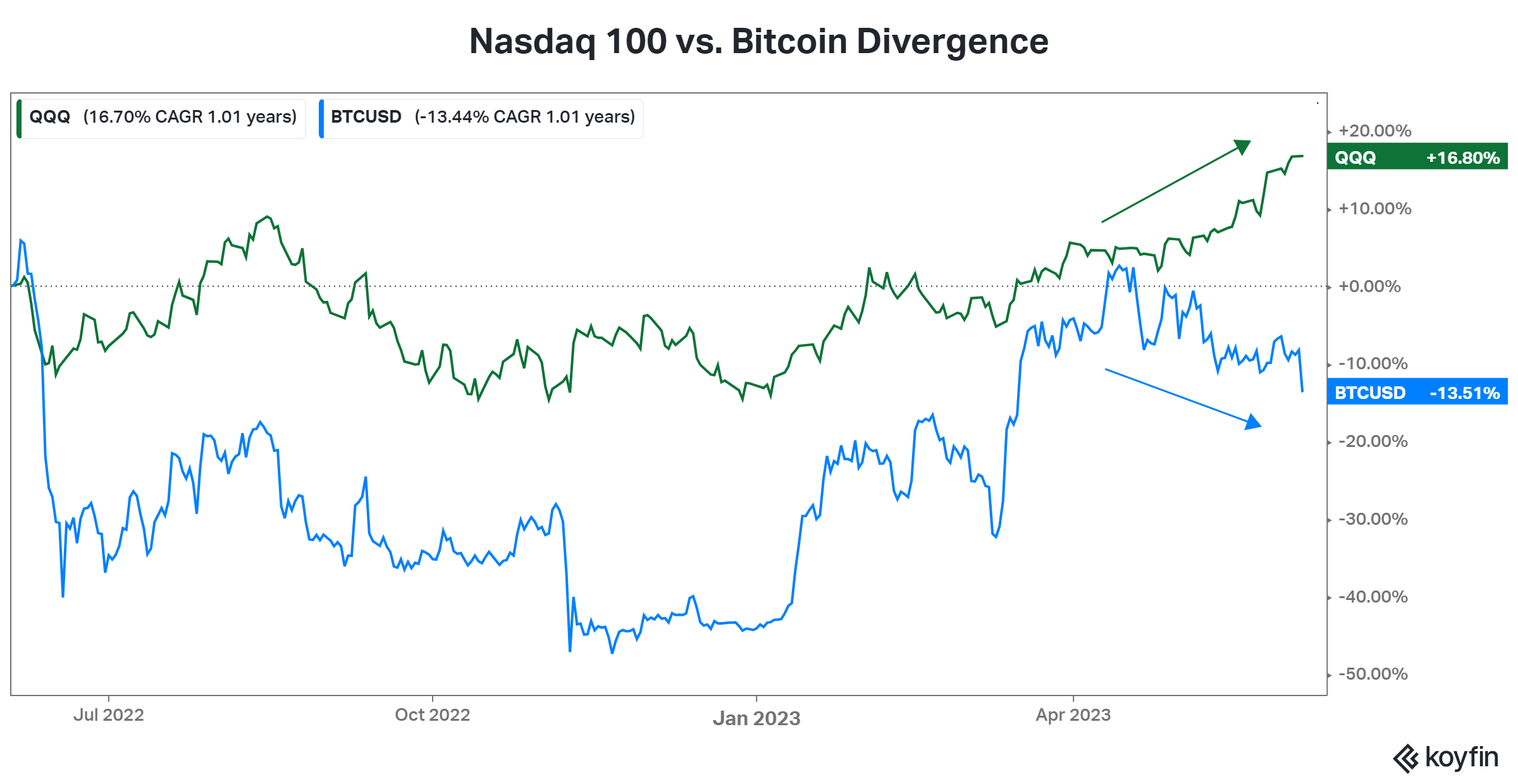

Today’s news obviously put some price pressure on the entire crypto space and related equities. With that said Bitcoin’s positive correlation with the U.S. stock market has been weakening for the last two months. The chart below shows Bitcoin prices falling as the Nasdaq 100 rises. We’ll have to wait and see if that trend continues. But clearly, the pressure on crypto companies operating in the U.S. remains high. 🕵️

Bullets

Bullets From The Day:

🛻 General Motors bets big on heavy-duty pickups. The automaker is investing $1 billion in two Michigan plants to produce next-generation heavy-duty trucks as demand surges. The investment includes $788 million to prepare its Flint Assembly plant to build the gas and diesel trucks and another $233 million in its Flint Metal Center to support production. Despite its commitment to exclusively offer all-electric vehicles (EV) by 2035, it continues to invest in its profitable traditional vehicles to fund its long-term investments in EV operations. CNBC has more.

🔺 New global rules could raise U.S. banks’ capital requirements. U.S. regulators, led by the Federal Reserve, are anticipated to unveil the stricter standards by the end of the month. The proposal looks to roll out the final batch of global bank capital rules created by the Basel Committee of banking regulators that will take effect at the beginning of 2025. Regulators have warned since 2021 that the remaining regulations could increase capital requirements by up to 20% for the largest banks. We’ll know by the end of the month how big the actual impact is. More from Yahoo Finance.

👎 Internal documents show Twitter’s U.S. ad sales have fallen 59%. Former NBCUniversal advertising chief Linda Yaccarino is taking over Twitter earlier than anticipated as internal documents paint a bleak picture of the company’s ad operations. The leaked documents indicated that U.S. ad revenue for the five weeks between April 1 and the first week of May totaled $88 million, down 59% from a year earlier. That contrasts Elon Musk’s comments in an April BBC interview that almost all advertisers had returned or said they would. Ars Technica has more.

🤯 Elon Musk’s Neuralink commands a $5 billion valuation despite the long road ahead. The brain impact startup was last valued at roughly $2 billion two years ago, but privately executed stock sales now indicate it trades at a $5 billion valuation. Experts say it could take several years for Neuralink to secure commercial use clearance, but the FDA’s recent approval of a human trial caused some investors to bid up the stock in the private market. Following the trial’s approval, shares were reportedly marketed privately at a $7 billion valuation. As usual, the company and its executives declined to comment on the events. More from Reuters.

🪧 Major Reddit communities plan a mass protest over new API pricing. Some of the largest communities on the platform plan to set themselves to private on June 12 over new pricing for third-party app developers to access the site’s APIs. The practice is known as “going dark” and means that communities will be inaccessible to the public during the 48-hour protest. Developers of third-party Reddit apps said the company’s new pricing threatens their existence. However, some Reddit employees have argued that the new API charges should be affordable if third-party apps are efficient with their API calls. Nonetheless, the battle between them continues. The Verge has more.

Links

Links That Don’t Suck:

🍕 Robot pizza startup shuts down after cheese kept sliding off

👿 Airlines are dealing with a sharp uptick in unruly passengers

🏦 UBS expects to seal Credit Suisse takeover as early as June 12

⚠️ Google and Facebook urged by EU to label AI-generated content

🥗 Restaurant chain Cava set IPO terms, could be valued at $2 billion

🔥 Allstate no longer offering new policies in California due to wildfires, other costs

💉 Moderna and Merck cancer vaccine used with Keytruda reduces risk of deadly skin cancer spreading