Whether you’re in stocks, crypto, commodities, currencies, or unicorn futures, no one is having a great week – or 2022, for that matter – and today saw no clear signs of that changing. For crypto investors and traders, the suck is particularly strong. The only people who probably feel worse are Hummer dealerships when gas is near $7 a gallon.

We’re going to take a look at what happened today, along with the good, the bad, and the ugly of the crypto market from this week.

Here’s a quick look at where the leaders in the crypto space are currently sitting:

| Bitcoin (BTC) |

$20,648.4

|

-0.88% |

| Ethereum (ETH) |

$1,093.09

|

-1.38% |

| Tether (USDT) |

$0.9989

|

0.00% |

| USD Coin (USDC) |

$1.00

|

-0.02% |

| BNB (BNB) |

$216.06

|

+0.11% |

| Binance USD (BUSD) |

$1.00

|

+0.03% |

| Cardano (ADA) |

$0.4894

|

-0.46% |

| XRP (XRP) |

$0.32

|

-0.38% |

| Solana (SOL) |

$31.47

|

+0.30% |

| Dogecoin (DOGE) |

$0.05687

|

+0.63% |

Recap

Aside from bears punching bulls in the face, what else happened today?

Cardano ($ADA.X) founder Charles Hoskinson has been invited to speak before the U.S. House of Representatives Committee on Agriculture. Why? No idea. Maybe a congressman/congresswoman heard about Cardano’s upcoming Vasil fork and thought, ‘a fork? That’s something you eat with, and you eat food, and food is part of agriculture, so we need to talk to this man.’ Disagree? We’re open to other reasonable – or un reasonable – potential reasons. Regardless, Hoskinson has proven to be one of the more coherent and professional advocates of the crypto space.

Celsius ($CEL.X) apparently doesn’t have enough liquidity to sell all the staked Ethereum ($ETH.X) in the market, and that brought on some fears that other platforms, such as Crypto.com ($CRO.X), may have some exposure and be affected. Crypto.com CEO Kris Marszalek posted today that they have $0 in exposure to the failure at Celsius and Three Arrows Capital.

$BTC.X made several attempts today to retrace some of yesterday’s nearly -10% flush. Buyers did put up a good fight, getting close to 4.7%, but were handily smacked down.

Artist Dave Krugman’s Drip Drop NFT dropped, viewable on OpenSea. The collection is meant to portray how actions cause ripples like drops of water. Or something like that.

While trading and investing in the crypto market right now may seem about as fun as running barefoot through a field of Legos, the market isn’t without some positive news.

Matt Hougan, chief investment officer at Bitwise, pointed to the approval of several Bitcoin Futures ETFs as progress towards a future spot ETF. Grayscale’s David LaValle’s comments complimented Hougans, saying that it is a matter of when not if a Bitcoin ETF is approved. Look to July 6, 2022, as an important date – the SEC may deny Grayscale’s ETF application.

That, however, shouldn’t be a big deal. Gone are the days when SEC denial of a spot ETF affected the market. And really, except for Bitcoin, the broader crypto market looks like Oberyn Martel after The Mountain smooshed his head into jelly – things could still get messy, but probably not by much.

On the bad and ugly side, the crypto space is still reeling from Do ‘The Con’ Kwon shenanigans with Terra’s LUNA and $UST.X. Rumors are that, allegedly, Con Kwon sold off $80 million thirty-three times over a few months. Check out FatMan’s (of the Luna Research Forum) Twitter thread for a detailed and damning read into Kwon’s actions.

Con Kown is the same dude that thought, ‘oh, $UST.X 1.0 failed. Let’s try this again real quick and see what happens and that will make everything all better!’

Today, another crypto finance company, Babel Finance, just halted all withdrawals and redemptions today. Babel Finance announced:

“Recently, the crypto market has seen major fluctuations, and some institutions in the industry have experienced conductive risk events. Due to the current situation, Babel Finance is facing unusual liquidity pressures.”

Look familiar? It should. The fancy-schmancy speak is very similar to Celsius’s announcement on June 12:

“Due to extreme market conditions, today we are announcing that Celsius is pausing all withdrawals, Swap, and transfers between accounts. We are taking this action today to put Celsius in a better position to honor, over time, its withdrawal obligations.”

Nothing shouts confidence more than telling your depositors and customers that it’s better for them if they can’t get their money.

It seems like crypto firms that have been speculating with excessive leverage are falling like dominos this week. The hedge fund, a big player in the crypto space, Three Arrows Capital failed to meet a margin call with BlockFi. BlockFi confirmed that they, “… fully accelerated the loan and fully liquidated or hedged all the associated collateral.”

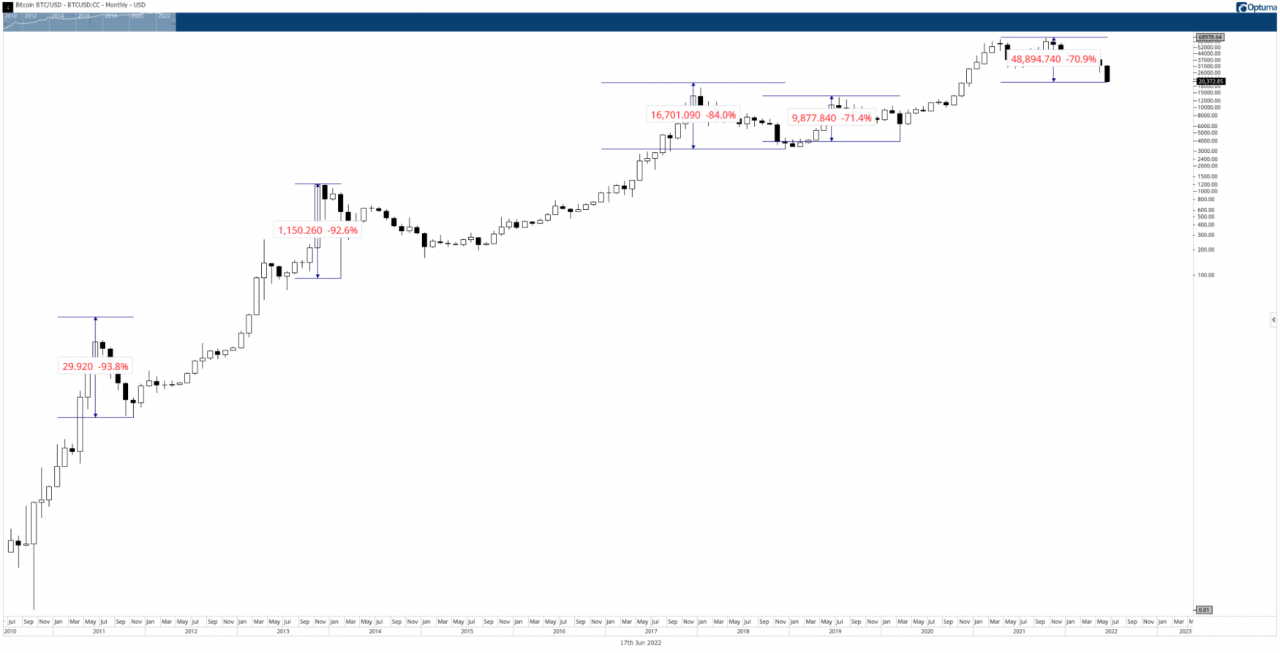

The chart image above is Bitcoin’s monthly chart. The five largest drops in Bitcoin’s history are:

June 2011 – November 2011: -94%

November 2013 – February 2014: -93%

December 2017 – January 2018: -84%

June 2019 – March 2020: -71% (Covid Crash)

Oct 2021 – present (June 2022): -71%

A collection of time cycles and other indicators point to extreme oversold conditions and a highly probable bounce soon. If history repeats itself, then Bitcoin and the broader crypto market may experience a mean reversion higher or the beginning of a wider trend change. Either way, the move higher will likely be crazy.