I hope everyone’s hangovers from the long July 4th weekend are gone because the – fireworks – (see what I did there?) in the cryptocurrency world are still going. There are few things in the cryptocurrency space at the forefront than the continued fallout from those exposed to the DeFi space.

There’s a bit to go over today: a metric crap-ton of developments have occurred since Friday – where do we even begin? The most important is what’s happening with Celsius ($CEL.X) – maybe things will be ok? Crypto broker and app Voyager Digital ($VGX.X), who recently dicked over its customers in a dick move last Friday, filed for bankruptcy.

From a price action perspective, consolidation near multi-year lows continues with some evidence suggesting that a bounce may be coming in shortly. But before we dive into today’s Litepaper, here’s how the crypto market looked at the end of the trading day – which is mostly green!

| Bitcoin (BTC) |

$20,315.33

|

0.76% |

| Ethereum (ETH) |

$1,153.44

|

2.00% |

| Total Market Cap | $891.15 Billion | 1.24% |

| Altcoin Market Cap |

$503.13 Billion

|

1.54% |

| BNB (BNB) |

$237.5

|

2.95% |

| Shiba Inu (SHIBA) | $0.00001043 | 1.26% |

| Cardano (ADA) |

$0.458

|

0.44% |

| XRP (XRP) |

$0.326

|

0.62% |

| Solana (SOL) |

$36.24

|

2.77% |

| Dogecoin (DOGE) |

$0.068

|

1.64% |

DeFi

DeFi: Who’s Dead?

For those of you new to crypto and the Litepaper, let us get you up to speed with what’s been happening in the DeFi space:

- Back in May, the cryptocurrency Luna ($LUNA.X) collapsed to nearly $0 along with its stablecoin (lol) UST ($UST.X).

- One of the world’s largest and most well-known cryptocurrency hedge funds, Three Arrows Capital, was heavily invested in Luna to the tune of, allegedly, $200 million. They also had exposure to BlockFi ($BLOCKFI.P) and Axie Infinity ($AXS.X), the latter of which was hacked for $700 million last year. As a result, Three Arrows Capital was forced into liquidation last week.

- The resulting fallout from Luna’s collapse caused massive sell-offs in the cryptocurrency markets. So much so that various cryptocurrency services froze customers from withdrawing, selling, or buying – Celsius is one of those services.

- The collapse has been a contagion, exposing which companies and firms were overleveraged, which ones failed GAAP 101, which ones were morons, which are crooks, and which ones were smart – or lucky.

Voyager

In the wee hours of this Wednesday, Voyager announced, “Voyager Digital Commences Financial Restructuring Process to Maximize Value for All Stakeholders.” That’s pompous speak for, “We’re bankrupt d00dz, 4 reelz.”

I just need to say this: nothing pisses an investor more than when a company says, ‘it wasn’t our fault; it was the other guy.’

Do you mean out of billions of dollars, you (Voyager) couldn’t find or hire anyone in your risk department who could have told you, ‘hey, maybe loaning out $350 million in USD Coin ($USD.X) and 15,250 Bitcoin ($BTC.X) to Three Arrows Capital represents what could be just a smidge too much of our liabilities to put into one company?’ /endrant

Customers and depositors are still locked out of making any withdrawals on Celsius and Voyager.

Vauld

You may or may not have heard of this crypto exchange, but it’s backed by Peter Thiel, Pantera Capital, and Coinbase ($COIN) Ventures. The Singapore-based cryptocurrency exchange announced yesterday that it had pulled a Celsius on its customers: no withdrawals, no trading.

Vauld announced they’re cutting 30% of their staff, slow hiring, and chopping executive pay by 50%. Additionally, it’s looking at restructuring.

Restructuring is just another way of saying bankruptcy. However, it’s possible that Vauld get could be lifted to being on life support – more details on later in this Litepaper. 💀

Celsius

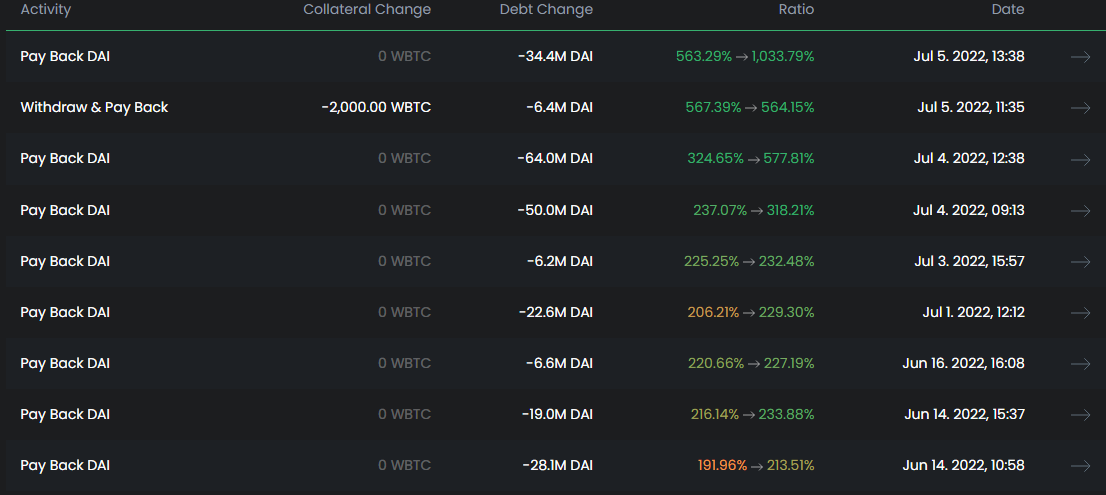

Thought Celsius would be included in the ‘Who’s dead?’ category? Celsius might be refilling the hole they dug themselves in. This month, Celsius paid Maker DAO ($MKR.X) back over $177 million in DAI ($DAI.X).

The image above is a snapshot of Celsius’s BTC collateral and debt in DAI.

The result of these debt payments is a massive reduction in the liquidation level Celsius would face with its outstanding debt to Maker. What is the current liquidation price? It’s currently at $2,722. If Bitcoin gets that low, crypto has bigger issues than the DeFi space’s solvency. 🏥

Nexo

If you want a breath of fresh air and hope that there is one crypto in the DeFi space doing things right – or at least not anything stupid (that we know of) – then Nexo ($NEXO.X) could be the winner in this current kerfuffle. While a part of the DeFi space, Nexo is really more of a centralized TradFi (traditional finance) than DeFi. Nexo is another of the myriad of services that allows you to borrow and stake/lend for a return with various cryptocurrencies and stablecoins.

Nexo is doing so well that they previously offered to buy Celsius – but that was rejected. However, they did secure a 60-day exclusive to negotiate a buy out of Vauld. Nexo’s CEO, Antoni Trenchev’s recent talks with CNBC gave me some good vibes.

When asked how much Nexo would pay, Trenchev said they are starting their due diligence. A notable quote those in the DeFi space should take note of: “…60-day window of exclusivity where they will open up the books. You will see everything. Is there a hole? How big is the hole? Where are the assets? Who are the counterparties?”

Those questions are, I don’t know, questions that some other entities probably should have been asking. We’ll dive into this more as it develops. 💸

The chart above is the Total Market Cap for cryptocurrencies. The horizontal bars on the image above measure volume at price – in other words, it measures how much of something was traded at a particular price level.

When a whole lotta trading occurs at a certain level, the bars get longer. The longest chunks of the volume profile are called ‘high volume nodes.’ Now, notice the big gap between the green arrow.

Volume profile traders loooooove gaps. Why? Because gaps act like a vacuum. For volume profile traders, this chart and that gap excite them in all the right places. In theory, if the Total Market Cap moves and closes a daily or weekly candlestick above $975 billion, we should expect a violent push higher towards the next high volume node near $1.17 trillion.

It’s going to be exciting to watch what happens at these levels. And the Litepaper will keep you updated when the move happens. 🚀

Bullets

Bullets From The Day:

🤣 Crypto-lovers are giving crypt-hater Peter Schiff a shellacking on social media over reports that the latter’s bank in Puerto Rico is being probed for tax evasion and money laundering. Coincidentally, Bitcoin would have been a safer store of value for him than his bank – irony at its best. Read more at CoinDesk.

😭 Cryptocurrency continues to face an uphill battle in India. A recent 1% tax on every transaction and the 30% crypto income tax have killed volume. The three largest exchanges have reported a nearly 75% drop in volume since India stepped-up enforcement. Check out the full story at newbtc.com.

⭐️ Crypto exchange Bullish has laid over roughly 7% of its workforce. Bullish join firms like Coinbase ($COIN), BlockFi, Crypto.com ($CRO.X), and Gemini in eliminating positions or reducing hiring altogether. Plans for Bullish to be listed on the NYSE via a SPAC are still in limbo. More details at blockworks.