It has been one hell of a week in the cryptocurrency world. The Total Market Cap for crypto regained the $1 trillion level, and unless something dramatic happens over the weekend, we might see this market complete its third consecutive weekly gain.

Today, we’re going to look at Ethereum’s ($ETH.X) massive whale wallet inflows and why analysts believe that’s bullish. Also, Three Arrow Capital’s ‘missing’ founders have resurfaced and did an interview with Bloomberg. For my fellow technical analysis geeks, Basic Attention Token ($BAT.X) and Polkadot ($DOT.X) have some price levels to watch.

Last but not least is a little Crypto 101 on Forks. Not the utensil. But let’s see how the crypto market looked at the end of the regular trading day.

| Cardano (ADA) |

$0.478

|

-4.40% |

| Binance Coin (BNB) |

$261.63

|

-1.47% |

| Bitcoin (BTC) | $22,600 | -2.24% |

| Dogecoin (DOGE) |

$0.067

|

-4.29% |

| Ethereum (ETH) |

$1,524

|

-3.33% |

| Polkadot (DOT) | $7.28 | -3.05% |

| Solana (SOL) |

$40.31

|

-6.42% |

| XRP (XRP) |

$0.35

|

-3.22% |

| Altcoin Market Cap |

$574 Billion

|

-2.22% |

| Total Market Cap |

$1.007 Trillion

|

-2.23% |

Lots of people want to know what Warren Buffet is buying and selling. Unfortunately, if we want to know what Berkshire Hathaway ($BRK.B) is up to, we must wait months. Cryptocurrencies don’t have that problem. Because of blockchain transparency, we get a live view of what big money is doing. That is done through a fancy schmancy method called ‘on-chain analytics’.

On-chain analysis looks at what kind of activity happens over a cryptocurrency’s blockchain. For example, we can monitor large Bitcoin ($BTC.X) wallets and see what leaves (outflows) those wallets and what enters (inflows). Likewise, we can watch cryptocurrency exchange wallets and record what crypto is moving into an exchange (inflow) or out (outflow).

Analysts interpret outflows from cryptocurrency exchanges as bullish because it reduces the supply available and, most importantly, crypto leaving exchanges often means people are hodling for long periods. Conversely, exchange inflows are interpreted as bearish because selling usually follows.

Inflows to non-exchange wallets, however, are considered bullish.

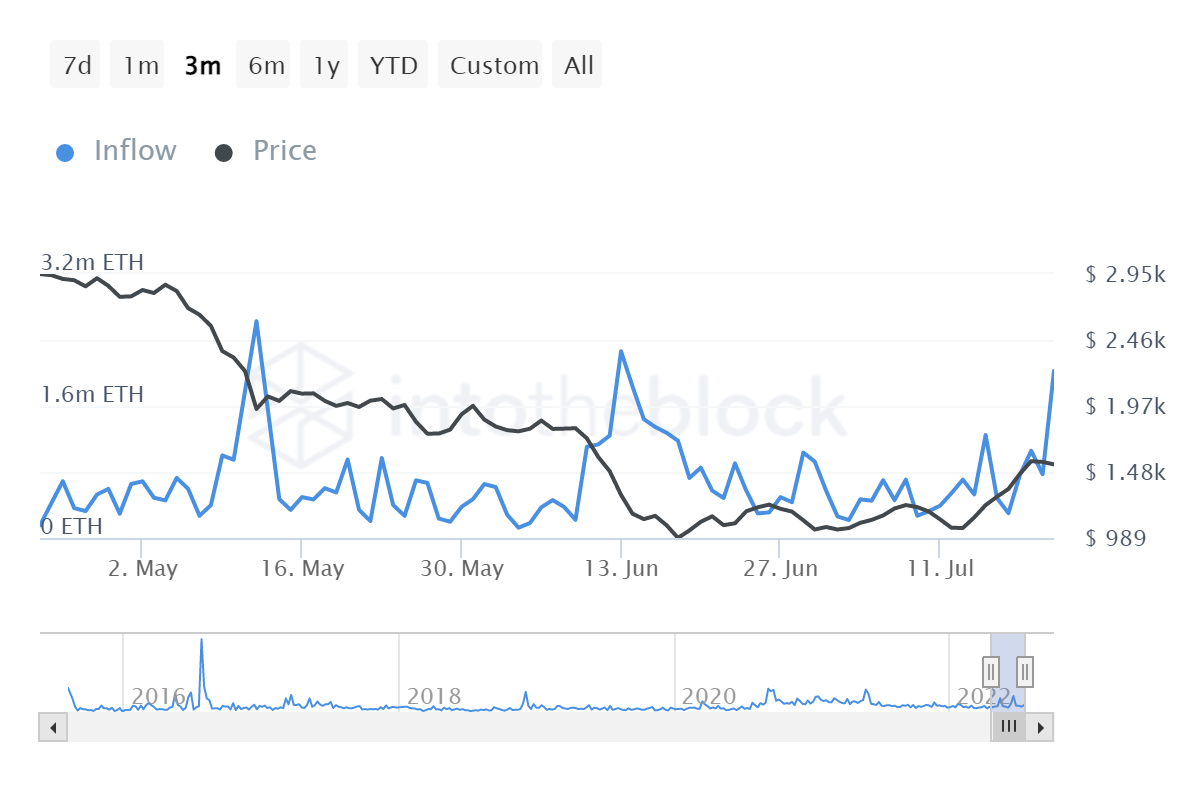

The image above is from the on-chain analytics service intotheblock. The graph displays Large Hodlers Inflows for Ethereum ($ETH.X). intotheblock considers a Large Hodler any wallet with >0.1% of the total ETH supply.

Because Large Hodler wallets hold so much of the available ETH, and those wallets often hold ETH for long periods, analysts interpret inflows to Large Hodler wallets as bullish.

Does this mean Ethereum is set to spike higher? Just hold your rockets moon bois, keep an eye on the market yourself and monitor what happens. 🐳

Crypto

My Big ‘Con’ Founder Guilty

The U.S. Department of Justice (DOJ) convicted My Big Coin founder, Randall Crater, for roughly $6 million in defrauding investors. This story originally popped up in 2018 and has been under the radar until today. So what did the guy do?

He claimed that My Big Coin was backed by $300 million in oil, gold, and other assets. Additionally, he claimed to have a partnership with Mastercard ($MA). Interestingly, the 2018 CFTC (Commodity Futures Trading Commission) lawsuit against My Big Coin was the first time a cryptocurrency was ‘officially’ considered a commodity.

Sentencing is slated for October 27, 2022. 👍

If you’re new to the Litepaper, let’s catch up on what’s happening.

- One of the largest and easily most well-known international crypto hedge funds, 3AC, had a ton of exposure to Luna ($LUNA.X) and TerraUSD ($UST.X).

- TerraUSD collapses, taking Luna with it.

- 3AC’s exposure causes a domino effect to its portfolio, and the broader crypto market collapses.

- 3AC had a metric crap ton of loans from entities such as BlockFi ($BLOCKFI.P), Genesis Trading, Celsius ($CEL.X), and Voyager Digital ($VGX.X). Celsius and Voyager have since filed for bankruptcy.

- The founders of 3AC are rumored to have been incommunicado with their creditors and are silent on social media.

Fast forward to today, and the ‘missing’ founders of 3AC have made their first public comments in weeks. In an interview with Bloomberg, Su Zhu and Kyle Davies deny avoiding their creditors. But, Zhu said, “We have been communicating with them from day one.”

Zhu denied that he and Davies hid money from liquidators or funneled any to secret wallets/accounts. He (Zhu) also addressed rumors he recently bought a yacht. He claimed a yacht was bought last year.

Zhu and Davies blamed the collapse of Luna and UST as the trigger that set off a cascade of liquidations in 3AC’s positions. In addition, an arbitrage of its Grayscale Bitcoin Trust ($GBTC) positions changing from a premium to a discount added further pressure.

Zhu and Davies claim to have received death threats and intend to keep a ‘low profile’ until they can move to Dubai. As always, the Litepaper will keep you updated as this story develops. 🤬

Price Levels To Watch This Weekend For Polkadot And Basic Attention Token

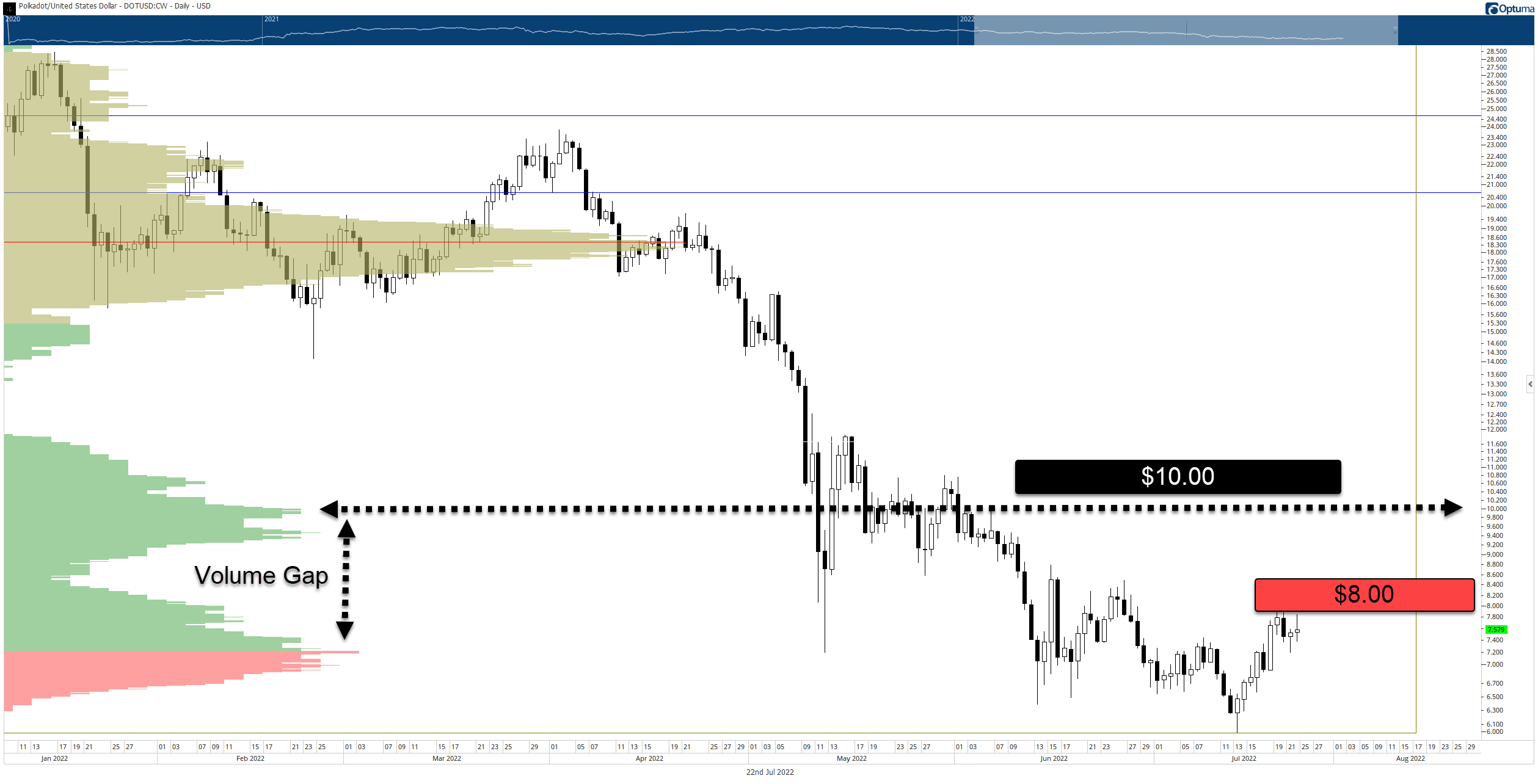

Polkadot ($DOT.X)

Bulls show some difficulty moving above the $8.00 value area. However, if bulls close DOT at or above $8.00, analysts suggest a fast move higher through a gap in the volume profile may occur before finding resistance at the next high volume node and psychologically important $10.00 value area.

Basic Attention Token ($BAT.X)

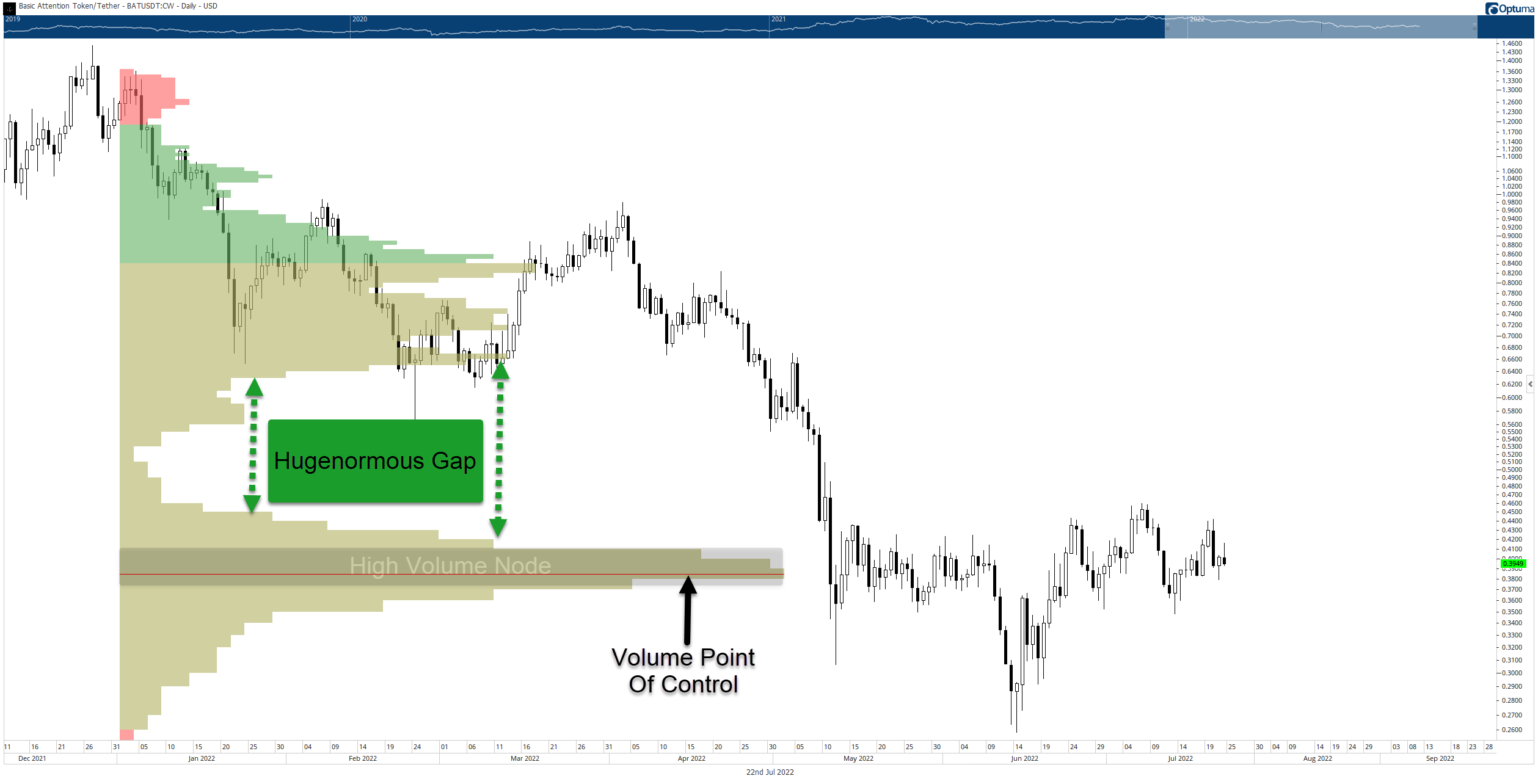

The very thin red horizontal line in the volume profile is known as the Volume Point Of Control (VPOC). The VPOC represents the price level where the most buying and selling has occurred and is interpreted by analysts as one of the most important support/resistance levels on a chart.

BAT is trading slightly above the VPOC but inside a high volume node (the long horizontal blob of yellow). Analysts are watching for any daily close below $0.34 because there is no volume profile support below that price level, indicating a fast move lower may occur.

Conversely, analysts are watching for any daily close above $0.45. The volume profile is extremely thin above $0.45. Analysts interpret large gaps in the volume profile as areas of easy movement.

When price moves above or below a high volume node into a gap, it gets sucked towards the next high volume node like a vacuum. For Basic Attention Token, analysts warn that BAT could spike towards the $0.55 to $0.60 value area. 🪙

Crypto

Crypto 101 – What Are Forks?

Welcome to the Litepaper’s Crypto 101! Here, we will dispel, explain, and simplify (if possible) the insane amount of technology, jargon, words, and information in cryptocurrency.

A word of warning, though – it’s difficult to summarize some topics, but we will where we can.

Bullets From The Day

⛑ FTX is sure turning into the savior of the cryptocurrency space. The massive exchange is reportedly looking at acquiring the South Korean exchange, Bithumb. Full story on blockworks

📲 According to research released today, JPMorgan ($JPM) analysts suggest that retail demand for cryptocurrencies is increasing. The research report indicates that major crypto lenders’ deleveraging is likely to end soon – or may have finished already. Get more from bitcoinist

📩 Cryptocurrency exchange Zipmex has resumed withdrawals from its Trade Wallets, but withdrawals from the Z Wallet are still disabled. Read the full story from TheBlock

🧱 SEC Chairman Gensler says crypto lending firms fall under the dominion of the regulatory agency. Gensler cited firms like BlockFi as an example. Find out more from TheDailyHodl

Links That Don't Suck

👎🏽 Taiwan Bans Crypto Purchases Using Credit Cards

🤺 Coinbase is ready to fight the SEC

⚽️ FIFA applies for metaverse trademark ahead of World Cup

🎟 Crypto.com ($CRO.X) integrates GooglePay

🥊 Crypto adoption Grows, likely to reach 1 billion users by 2030

🚧 Blockchain.com cuts 25% of staff, citing harsh market conditions

🏛 Abra CEO reveals how his lending firm weather the 3AC storm and why others failed