Green day and a green week! So green, in fact, that this week’s close is the strongest since the week of October 24th, 2022. 🟢

Today’s Litepaper is full of beautiful technical analysis with levels analysts are looking at. Also, we’ll dive into the ongoing Gemini vs. Genesis vs. SEC debacle.

$SOL.X took over the first spot again, but there are feelings of some exhaustion or a slowdown in the momentum coming into play. That means the weekend could be very, very interesting.

Perhaps the most important event today was the Altcoin Market Cap returning and holding the critical $500 Billion level.

Here’s how the market looked at the end of the trading day:

| Solana (SOL) |

$17.07

|

3.25% |

| Bitcoin (BTC) | $19,339 | 2.02% |

| Avalanche (AVAX) | $15.64 | 1.98% |

| Stellar (XLM) |

$0.083

|

1.58% |

| Shiba Inu (SHIB) |

$0.00000966

|

1.32% |

| TRON (TRX) | $0.058 | 1.31% |

| Ethereum Classic (ETC) | $21.02 | 1.08% |

| Polkadot (DOT) | $5.27 | 0.88% |

| BNB (BNB) | $288.41 | 0.52% |

| Cardano (ADA) |

$0.333

|

0.48% |

| Altcoin Market Cap |

$503 Billion

|

0.65% |

| Total Market Cap | $876 Billion | 1.49% |

If the drama between Genesis (a subsidiary of Barry Silbert’s Digital Currency Group) and Gemini (the Winklevoss twins’ cryptocurrency exchange) could get more dramatic, it just did.

If you’re unfamiliar with the Twitter war between Silbert and the Winklevoss twins, here’s a summary. 🗒️

- Sam “I’m Sorry” Bankman-Fraud’s FTX collapse in November 2022 brought down almost everyone and anything in the crypto leverage/lending path.

- One of those objects in the avalanche of FTX poo was Gemini’s Earn program.

- Genesis then used the loaned crypto in various ways to generate revenue and pay interest to the Gemini Earn lenders.

What is Gemini Earn?

In a nutshell, Gemini offered customers a program called Gemini Earn where customers could deposit crypto into an ‘Earn’ account and receive up to 1-ish to 8-ish % APY on $BTC.X, $ETH.X, $USDC.X, and other various altcoins and stablecoins. Interest rates were/are crypto-specific. 🌰

But then, on November 16, 2022, Genesis tells Gemini Earn customers the legal equivalent of, “uh, ya, we can’t give you your stuffs because we don’t have your stuffs.”

Today Genesis Global Capital, @GenesisTrading's lending business, made the difficult decision to temporarily suspend redemptions and new loan originations.

— Digital Currency Group (@DCGco) November 16, 2022

Gemini Responds:

1/6 We are aware that Genesis Global Capital, LLC (Genesis) — the lending partner of the Earn program — has paused withdrawals and will not be able to meet customer redemptions within the service-level agreement (SLA) of 5 business days. https://t.co/9e48pF3Ymn

— Gemini (@Gemini) November 16, 2022

Fast forward to Jan 2, 2023, Cameron Winklevoss Tweets an open letter to DCG’s Barry Silbert:

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/kouAviTho4

— Cameron Winklevoss (@cameron) January 2, 2023

You can read the replies from Silbert and Winklesvoss in the above Twitter thread.

While Gemini and Genesis duke it out, the SEC also jumps into the fight. 🥊

Yesterday, the SEC issued a press release notifying the public that they’ve charged Genesis and Gemini for the unregistered offer and sales of securities to retail investors through Gemini’s Gemini Earn program.

From the Press Release, SEC Chairman Gensler was quoted saying, “We allege that Genesis and Gemini offered unregistered securities to the public, bypassing disclosure requirements designed to protect investors,” said SEC Chair Gary Gensler.

“Today’s charges build on previous actions to make clear to the marketplace and the investing public that crypto lending platforms and other intermediaries need to comply with our time-tested securities laws. Doing so best protects investors. It promotes trust in markets. It’s not optional. It’s the law.”

We’ll keep you updated as this story progresses. 🗞️

Bitcoin

Bitcoin has been on an absolute tear this week – but some conservative, bullish analysts warn that a temporary top might be coming in soon.

Ichimoku traders are likely giddy. Yesterday’s close confirmed an Ideal Bullish Ichimoku Breakout – one of the most sought-after and conservative bullish confirmation patterns within the Ichimoku Kinko Hyo System.

However, there are some warning signs.

The first major gap between the Tenkan-Sen and the body of a candlestick occurred today. That doesn’t mean imminent profit-taking or selling pressure, but it is a warning that if BTC continues to scream higher and more gaps develop, a correction will likely occur within four to five periods.

Bitcoin’s daily RSI and Composite Index levels are also at extremes.

The last time Bitcoin’s daily RSI was this high was two years ago (almost exactly), on January 11, 2021. Similarly, the Composite Index is at its highest since April 3, 2019.

From an oscillator perspective, on the daily chart at least, Bitcoin’s RSI converted into bull market conditions (Oversold 40 and 50, Overbought 80 and 90).

Analysts believe that, given the bullish momentum behind an Ideal Bullish Ichimoku Breakout, a return to the weekly Kijun-Sen at $20,353 is a very probable scenario, and it is there, Bitcoin may face some very real selling pressure.

Update

Here is a quick update on the Ethereum and XRP analysis from Monday:

In Monday’s Technically Speaking (read it here), we looked at several critical price levels analysts saw for $ETH.X and $XRP.X.

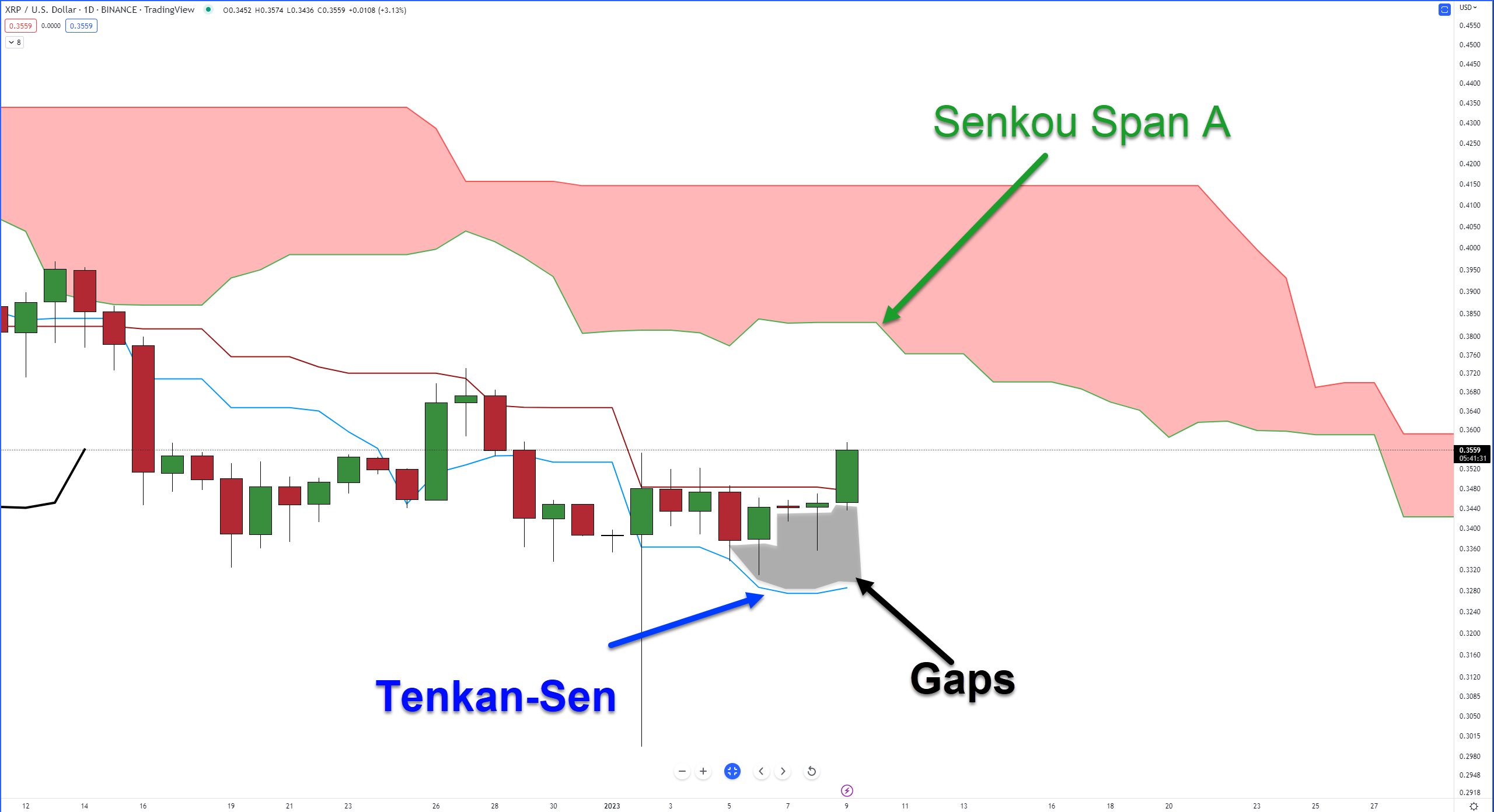

XRP

For XRP, the resistance zone identified on Monday is presently playing out.

Analysts’ fears that a violent pullback could occur may still play out as the gaps between the Tenkan-Sen and the candlestick bodies are, again, present. But given the continued oversold nature of XRP and some recent bullish sentiment in crypto, it may not occur.

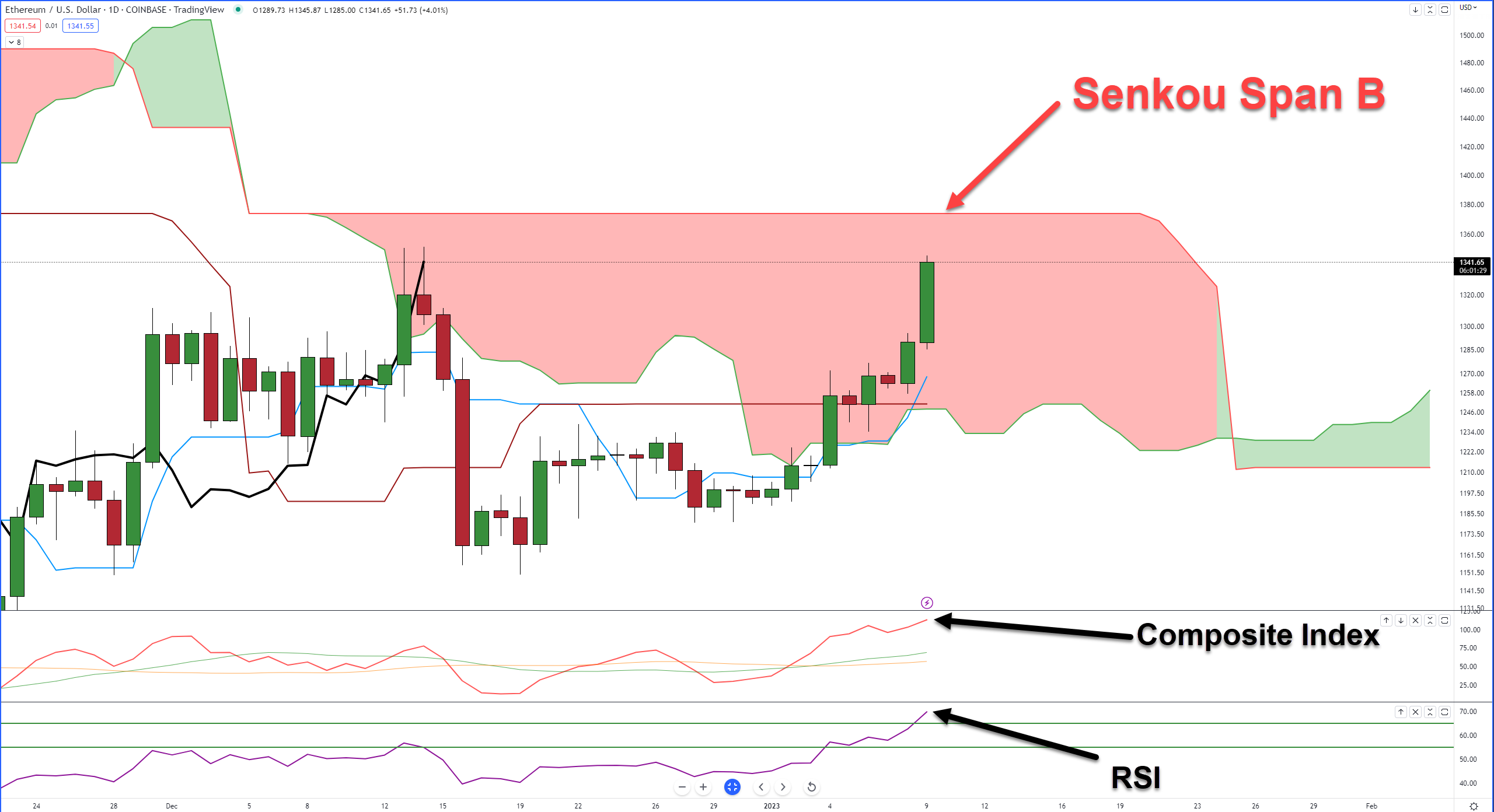

Ethereum

Monday’s analysis looked at Senkou Span B ($1,375) as a probable resistance zone that analysts carefully watched.

The resistance zone at Senkou Span B ($1,375) certainly looked like it was going to hold as resistance based on Tuesday’s and Wednesday’s close, but bears were unable or unwilling to stop the bulls.

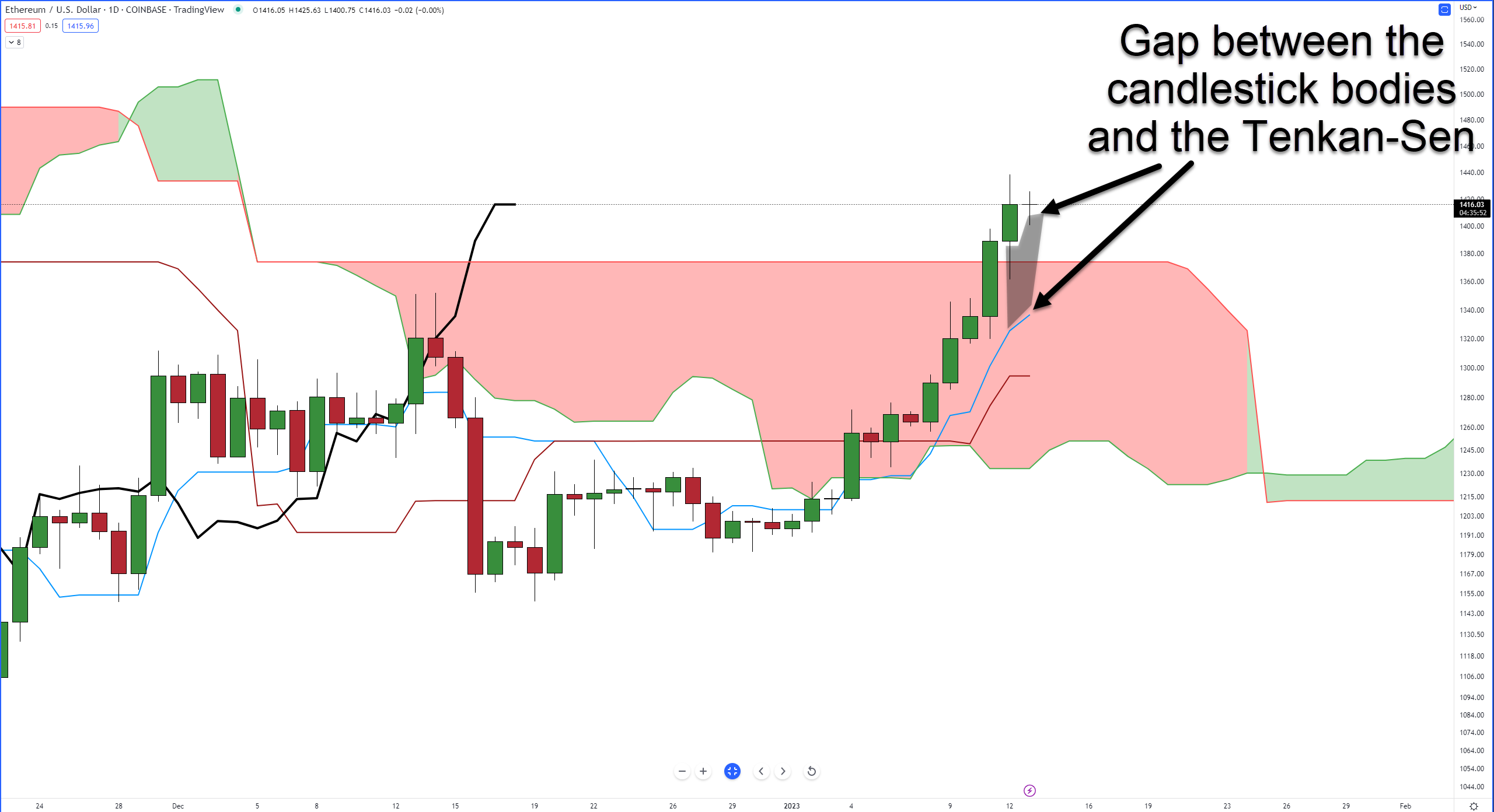

Ethereum has just completed an Ideal Bullish Ichimoku Breakout – the same as on Bitcoin’s chart.

However, there are currently some sizable gaps between the Tenkan-Sen and the candlestick bodies, so a return to test Senkou Span B as support becomes increasingly likely.

The table below is the current (January 13, 2022) staking yield rates of the top ten Proof-Of-Stake cryptocurrencies by market cap.

Staked % is what percent of the total supply of that cryptocurrency is currently used to earn staking rewards – sometimes called ‘Lock-Up.’

The Lock-Up Period is how long crypto must stay staked before you can withdraw it and/or any rewards earned.

Nominal Yields are the rewards listed, whereas Real Yield is the expected return when factoring in other costs, factors, or changes like inflation rates (not listed).

It should also be noted that calculations and factors for Real Yields can vary substantially from one week to the next. Additionally, the Nominal Yield may have an expected range but is not guaranteed. For example, Polkadot’s ($DOT.X) Nominal Yield is advertised/listed between 8% to 14%.

Another factor to consider is that the rewards are not in US Dollars but in token/crypto your stake. Staking Cardano ($ADA.X) rewards you in ADA and so forth.

This table is updated weekly.

| Crypto | Nominal Yield % | Real Yield % | Staked % | Lock-Up Period |

|---|---|---|---|---|

| Ethereum (ETH) | 3.88% | 3.9% | 13.82% | 12+ Months |

| BNB (BNB) | 2.33% | 7.35% | 97.54% | 7 Days |

|

Cardano (ADA)

|

3.42%

|

-0.17% |

71.98%

|

None

|

|

Polygon (MATIC)

|

5.42%

|

2.87%

|

39.48%

|

21 Days

|

| Polkadot (DOT) | 14.58% | 7.09% | 44.95% | 28 Days |

|

Solana (SOL)

|

4.2%

|

-0.13%

|

71.49%

|

5 Days

|

|

TRON (TRX)

|

3.59% |

1.55%

|

44.84%

|

3 Days

|

|

Avalanche (AVAX)

|

8.1%

|

2.58% |

62.51%

|

14 Days

|

|

Cosmos (ATOM)

|

9.84%

|

7.63% | 62.81% | 21 Days |

|

Near Protocol (NEAR)

|

9.62%

|

4.45%

|

43.50% |

1 Day

|

Source: www.stakingrewards.com

$DOT.X, $ATOM.X, and $BNB.X offer the highest Real Yields.

$ADA.X and $SOL.X show negative Real Yields – but this may change if the current crypto momentum remains bullish.

Bullets

Bullets From The Day:

😱 $NEXO.X is facing some similar woes to Gemini and Genesis. Nexo’s offices in Bulgaria were raided as part of an investigation from Bulgaria’s attorney general. They are accused of violating tax regulations, money laundering, and bypassing international sanctions against Russia. Nexo denies any wrongdoing, but that hasn’t stopped the FUD from hitting. Roughly 8,300 Bitcoin have so far been withdrawn from the lending platform. According to Nexo’s Real-Time Attestation of customer liabilities, their Bitcoin holdings have fallen from 133k to 125k. Bitcoin.com has more.

⚖️ Grayscale filed a reply brief with the court concerning the SEC’s denial of converting $GBTC into an ETF. Grayscale’s attorney’s hammered the SEC for their “illogical” denial: “The commission’s brief never comes to terms with the order’s arbitrary premise and the discriminatory result it has produced. Instead, the commission goes on for page after obfuscatory page pointing out differences between the spot bitcoin and bitcoin futures markets that have no bearing on the issue before this court.” The brief also highlights a historical chart of Bitcoin’s spot price with the CME futures price, showing a 99.9% correlation and a reminder to the court and SEC that the futures contract follows the underlying spot price. Briefs are due on February 3, 2023. Chief Legal Officer for Grayscale, Craig Smith, believes a decision by the court may be complete in Fall 2023. More from Grayscale’s blog.

💲 A-wasasasasup BitConeeeeeeeeeeect?! The U.S. Department of Justice issued a press release that said approximately 800 people would get a portion of $17 million in restitution. The ruling yesterday said BitConnect was a ‘textbook Ponzi scheme,’ taking money from later investors to pay earlier investors. The primary U.S. promoter, Glenn Arcoro, was given a 38-month sentence in September 2021, with the DOJ selling $56 million in crypto seized from Arcoro. The founder, Satish Kumbhani, is still wanted. DeCrypt has more.

Links

Links That Don’t Suck:

🤑 Aptos price pumps 86% to $7 – how much higher can it go?

📉 Peter L. Brandt claims Bitcoin is putting in its cycle low now

📹 HBO Max gets big discount ahead of The Last Of Us premiere

🖥️ Intel breaks the 6GHz barrier with $699 Core i9-13900KS processor

🕵 Scaramucci changes tone on FTX, says it’s clear there was fraud now

👨🚀 Samsung’s asset management subsidiary launches Bitcoin Futures ETF in Asia

🚔 Multimillion Euro crypto fraud operation in Bulgaria, Cyprus, and Serbia busted

🏦 Crypto execs agree lending needs to mature, outgrow its cliquish nature to thrive

Credits & Feedback

Today’s Litepaper was written by Jon Morgan. Let him know how he did: